[ad_1]

Abu Hanifah

I initially wrote about HireQuest (NASDAQ:HQI) in an article SeekingAlpha published on April 14th of last year. I encourage you to read that article before this one as it details what HQI does generally, whereas this article will focus more on recent developments.

The stock was trading around $19 at that time, and my recommendation was to wait until it went below $18 before establishing a position. That opportunity quickly presented itself as the stock dropped precipitously and stayed down between $12 and $15 per share through October of 2022. From a low of $12.18 in mid-June 2022 through today where it trades nearing $23, I am thrilled with how quickly the investment thesis has played out. What may have caused the surge? Is the stock worth holding on to? These are questions I hope to answer with today’s article.

Recent Developments

The reason I outlined in my initial article for NOT buying at that time when it was trading at $19 and requiring a larger margin of safety was because I saw some indications of capital constraints that would slow acquisitions and therefore affect the velocity of revenue growth. Management clearly didn’t share my concern, as they announced a few months later in November the acquisition of MRINetwork for $13.5 million, their second largest acquisition ever. MRINetwork (“MRI”) is an executive recruiting company, the third largest in the world in fact. TTM data for MRI at the time of the announcement was $283 million in system wide sales and $1.9 million of adjusted EBITDA. While I am always weary of “adjusted EBITDA” numbers, at a multiple of just over 7, even backing out adjustments would still likely show HQI not over-paying.

It is this acquisition that may be a prominent factor in why HQI stock has performed so well. Of particular note is that this acquisition nearly doubles the geographic footprint of HQI, where the 232 MRI franchises will be added to the 225 HQI already had. The 225 they already had were present in 38 states. The 232 from MRI include many offices in the US of course but also a couple dozen in both developed and developing international markets such as England, Germany, Malaysia, and Brazil. These executive search locales could serve as bases from which to also expand into temporary staffing in the same regions. There is tremendous potential here. With how generous HQI is in providing their franchisees with inexpensive capital where-with to grow and otherwise supporting them, this could turn into a massive growth driver looking forward.

Financial Performance and Valuation

Perhaps the main reason HQI stock has done so well is because they have showcased on a consistent basis that what they are doing is working. HQI only took their present form operating under the franchise model in 2019. All fundamental since then are stellar:

(millions) 2020 TTM Revenue $13.8 $33.6 Operating Profit $6.6 $17.2 Net Income $5.4 $11.7 Click to enlarge

They have more than doubled every metric in just a couple years. With the recent add of MRINetwork, adjusted EBITDA alone is going to go up almost 10%. Lest you think these numbers are fudged because 2020 was the pandemic year and easy to look good against, their financial performance in 2019 wasn’t much better, and isn’t directly comparable because HQI didn’t take their current form until half-way through 2019.

An interesting conversation between an analyst and the CEO in the most recent conference call underscores just how remarkable their growth has been. In responding to a question about what they are going to do with the cash they are generating, Rick Hermanns made the following point:

…. right now we have less debt than what we did at the end of September 2019. We had more debt than we do right now, and yet, we have obviously made numerous acquisitions. And to the extent that our adjusted EBITDA this year, if it just continues at the same rate, we’ll literally exceed our total revenues for 2021, which is pretty amazing.

This is what happens when strong revenue growth meets margin expansion. And all the cash being generated will allow them to continue to execute their strategy.

HQI ended September with $0.72 in EPS for the 9-months of 2022. The third quarter of 2022 was up $0.07 worth of EPS over Q3 2021. If the same happened for Q4, they will have $0.22 worth of EPS in that quarter and $0.94 for the year. That puts them at a multiple of ~24, which may seem a bit expensive, especially with the S&P at a multiple of about 22 currently. However, it is plain that HQI is growing at a much faster rate than the S&P so this higher multiple makes sense.

Risks

The biggest risk facing HQI is that of a potential recession. There are many folks of the opinion that an economic contraction is impending. One indicator called the Architectural Billings Index, which measures increases and decreases in billings at architectural firms nationwide, has been flashing negative for several months. Any such downturn will be particularly harmful to HQI. After all, their bread and butter is providing personnel to fill vacancies in the labor market. A weak economic environment means less demand for workers and lower wages.

The topic of recession came up in the most recent conference call and the CEO had some interesting things to say about how HQI is positioned:

…. a recession is bad for our business, it’s bad for our franchisees, it’s bad for our clients, and thus, it’s bad for us.

I personally have led my company through four different recessions. Frankly, each one is a little bit different. And I think that for the longer term, whether we’re in a recession a year from now, six months from now, or five years from now, is that I think that the country is undergoing a fundamental shift in demographics that will significantly impact the staffing industry overall. And by that I mean that when you look at labor participation rates, they’ve dropped significantly, which is part of the reason I believe we’ve maintained such a low unemployment rate is simply the number of people who are just no longer working. People took early retirement.

And there’s an abnormally high number of 20 to 35 year old young men who aren’t working at all. They’re living with their parents and they’re not working. And so that will create probably a bit of an environment that we’re not used to in a recession. I just know that there is a real shortage still out there of quality workers. And I think that therefore demand for our services will remain higher than what they otherwise were back in the 1980s or the 1990s when there were huge numbers of baby boomers that were in their prime working years. Things have changed. The world is a different world.

For the staffing industry, I think so long as we retain our focus on candidate quality is that we will be able to do better than maybe historically what the performance of the economy is.

I share his view that while a recession is of course a risk and would send the stock down, and justifiably so, HQI has weathered those types of storms before and is set up to do so again, and perhaps even expand market share by acquiring other staffing firms at a discount when distressed.

Conclusion

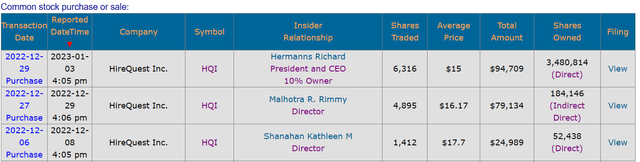

As a deep value investor, I am satisfied with my current position and cost basis where I got a lot of shares with a substantial margin of safety. The margin of safety is no longer present, so I am not buying now. However, I don’t think HQI is outrageously priced. Those who prefer momentum strategies or growth at a reasonable price may find an opportunity with HQI. The final thing to outline is that the CEO and other insiders are obviously bullish about their company, both in what they say and what they do. A series of insider buys in December show great confidence in the company and in Q4 2022 performance:

secform4.com

All told, I will certainly be holding on to HQI for the foreseeable future. They are executing well, are still small and therefore have a long runway of growth ahead of them, have good leadership and a powerful business model.

[ad_2]