[ad_1]

A decade ago, then-Netflix chief content officer — and now co-CEO — Ted Sarandos told GQ, “‘The goal is to become HBO faster than HBO can become us.”

But, to quote HBO’s “The Wire,” “The thing about the old days: they the old days.”

Today, the apparent goal for both companies is to avoid becoming one another.

The past two weeks have crystalized the media giants’ diverging priorities. Parent company Warner Bros. Discovery decided to remove HBO from the name of its flagship Max streaming service to protect the HBO brand from becoming … Netflix. Rather than risk diluting HBO’s prestige brand with oodles of reality TV programming from Discovery+, Warner executives want HBO to stay pristine.

“HBO is HBO. It needs to stay that way,” Warner Bros. Discovery head of streaming JB Perrette said at an April 12 event unveiling the new Max brand. “We will not push it to the breaking point by forcing it to take on the full breadth of this new content proposition had we kept the name in the service brand.”

In a not-so-subtle shot at Netflix, HBO CEO Casey Bloys touted Max by highlighting its brand strength.

“We’re not a giant undifferentiated blob of programming,” he said at the event.

Protecting HBO, rather than expanding it, hasn’t always been the priority. Under the ownership of AT&T, then-WarnerMedia CEO (and now AT&T CEO) John Stankey appeared comfortable leaning on the HBO brand to challenge Netflix. This was the driving force behind making HBO Max — combining HBO’s programming with other original content and library programming from the WarnerMedia catalog. Stankey believed HBO couldn’t compete against Netflix on its own because it was too limited in scope.

John Stankey, AT&T CEO speaks at the Boston College Chief Executives Club luncheon in Boston, Massachusetts, March 24, 2023.

Brian Snyder | Reuters

“We need hours a day,” Stankey said at an internal town hall in 2018 after AT&T closed its acquisition of Time Warner, HBO’s parent company. “It’s not hours a week, and it’s not hours a month. We need hours a day. You are competing with devices that sit in people’s hands that capture their attention every 15 minutes.”

That sentiment didn’t sit well with HBO chief Richard Plepler, who would leave the company just months after the town hall. Plepler’s mantra, which he often repeated, was: “More is not better. Only better is better.”

AT&T would merge WarnerMedia with Discovery in a transaction that closed last year. Warner Bros. Discovery CEO David Zaslav will still chase Netflix, but he won’t be doing it by expanding HBO or its brand.

Netflix’s shift from HBO

Meanwhile, Netflix seems distinctly focused on delivering content that has as wide of an audience as possible. This is far from becoming HBO, which was Netflix’s goal in and around 2013. At the time, Netflix was just beginning to dabble in original content, bidding against HBO for shows such as the Kevin Spacey-led drama “House of Cards.” When Netflix hit again with the drama “Orange Is the New Black,” Sarandos seemed on his way to making Netflix the new HBO.

But as the years went by, Netflix’s ambitions grew. Investors cheered on more spending. Simply buying prestige shows seemed like small potatoes. HBO’s U.S. audience was typically about 35 million subscribers, and Netflix quickly blew past that mark as it built a global streaming service whose target became the entire traditional pay-TV ecosystem rather than simply HBO.

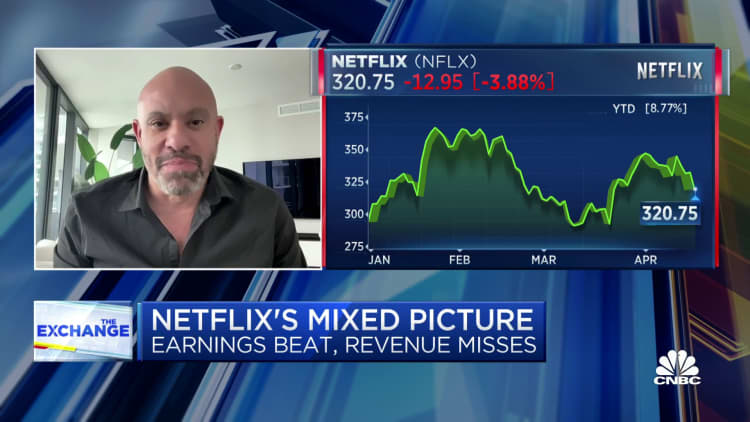

Netflix said this week it ended the first quarter with more than 232 million global subscribers.

But the importance of making prestige shows to compete with HBO appears to be less and less essential to Netflix with every year. It’s also fair to argue Netflix hasn’t had the same hit rate as HBO when it comes to making prestige TV shows. From 2013 on, HBO has won dozens more major Emmys than Netflix.

Ted Sarandos attends the 94th Oscars at the Dolby Theatre in Hollywood, California on March 27, 2022.

Angela Weiss | AFP | Getty Images

“When we talk about our content, it sometimes sounds like a laundry list,” Sarandos said this week during Netflix’s earnings conference call. “Everyone has remarkably varied taste that you have to have very different things for different fans, and that’s what we are good at doing at scale.”

Netflix has decided its competitive advantage is its breadth of programming. Sarandos told The New Yorker earlier this year that Netflix’s new strategy is to function as “equal parts HBO and FX and AMC and Lifetime and Bravo and E! and Comedy Central.”

Ten years after Sarandos’ quote to GQ, it’s clear HBO won’t become Netflix, and Netflix won’t become HBO. And that’s fine with both of them.

WATCH: Netflix’s password sharing is just a form of price increasing, says MMTN’s Mark Douglas

[ad_2]