[ad_1]

This week, Jaclyn, the Chief Engagement Editor on our Alpha team asked…

“Charles — I know you say your approach is simple. But after editing your articles, listening to every one of your updates…it’s anything but!

You make it sound simple because it’s second nature to you. It’s like a pro golfer saying the perfect stroke isn’t that hard.

Once again, it’s not simple. But thousands of hours of experience and practice make it seem so.”

Well, I guess Jaclyn has a point.

Since I’ve been doing this for so long — 40 years — I take a lot of what I do for granted.

It’s become second nature to me.

So, I asked her to tell me one thing she’d like to know more about — that she thought was a lot harder than it looked.

Without missing a beat, Jaclyn said: “how to figure out the underlying worth of a business.”

It just so happens that’s the same question many of you have written to me about.

How do I value a business? Is there one number I look at? Is there a formula?

So, I’m going to give you a simple overview on how I come up with a valuation for a business.

Because if I couldn’t come up with a valuation of a business, I wouldn’t want to invest in it.

My Approach to Evaluating the Worth of a Business

First off, there are two things I want to share with you.

No. 1 There’s no exact number that tells you the worth of a business down to the penny. Instead, it’s a wide estimate.

For instance, your house doesn’t have a ticker displaying its price throughout the day…

But you have a pretty good idea of its value. And that’s because you are familiar with your neighborhood, and have some insight on what it would cost to replace your home.

No. 2: Valuation is a range.

Back in the day, when businesses were heavily industrial, investors used book value.

Book value is the assets — what they own — minus the liabilities — what they owe. And the balance is the worth of the business.

Now, that doesn’t work with most businesses.

Technology, biotech and the like don’t have much in the way of plants and equipment. The book value doesn’t accurately reflect the intellectual property of the business or good will.

In the case of Coca-Cola, that goodwill — its brand name — is worth a lot. So, using the book value would give you a false sense of the stock being overvalued — which it wouldn’t be.

So, in today’s day and age, book value has its place with certain companies and industries. You just have to know when to use it.

Instead, one of the ways I value a business is by the amount of money the business will generate over the next five years or longer.

For example, ABC Inc. has a market cap of $1 million and generates $150,000 in earnings per year.

If we bought the whole business for $1 million, we would get $150,000 — or 15% — back on our investment. That’s pretty good considering a five-year treasury bill is yielding close to 4%. Our risk premium, the excess return we’d get over the Treasury bill, would be 11%.

But if we bought that same business for a higher price of $2 million, and it generates the same $150,000 in earnings, our return would be $150,000 on a $2 million investment — or 7.5%… a premium over five-year Treasury bills of only 4%.

And if we paid an even higher price, such as $3 million, the business would still generate the same $150,000.

But now, since we paid a higher price, our return would be $150,000 on a $3 million investment — or a 5% return, a risk premium of only 1%.

Gee, that’s not much higher than a treasury bill. Why buy the business when we can make a return pretty close to it without taking a risk?

It’s the same business in all three examples. The only difference is the price we paid. The higher the price, the lower our return.

Lower Price = Higher Reward

The lower the price you pay, the higher your return.

The stock price represents a fractional ownership of the business — ABC Inc.

The $1 million market cap is nothing more than the current stock price times shares outstanding. So, if we would buy one share of ABC Inc., we’re buying a small piece of the business.

If the company has 100 thousand shares outstanding and is trading for $10 per share, the business has a market cap of $1 million. That would be 100 thousand shares times $10 per share.

If the stock price moves up to $20 per share, the business has a market cap of $2 million. See? It’s not so hard, right?

In both cases, the business in our example still generates the same $150,000 in earnings.

As owners, we’re entitled to a fraction of those earnings.

So, Wall Street makes it easy for us to figure out. Instead of saying the business generated $100 million, they break it down by earnings per share.

So, in our example, $150,000 in profit works out to $1.50 per share.

That’s all there is to it.

Research & Discipline

If we know something about the business — and it’s trading in an industry with a tailwind and run by a rock-star CEO — we can make an intelligent projection of future earnings.

So let’s say that revenue is growing, the company is repurchasing shares, and profit margins are rising. And we project earnings to grow by 15% per year over the next few years.

If the current earnings per share is $10 and ABC hits our projections and grows 15% per year, earnings per share at the end of year five should be around $20 per share.

I then use my experience, and research to say: “In a fast-growing business like this, Mr. Market would price this business at around 20X its earnings.”

Using those two assumptions, what I project the business to earn over the next five years and a conservative estimate of how many times earnings Mr. Market would give the company — in this case, 20X — I come up with a stock price in five years of $20 per share times Mr. Market’s multiplier of 20 to equal $400 per share.

Now, this isn’t physics where there are exact formulas and precise answers. Valuation is part art and part science.

Coming up with a growth rate for earnings — in this case, 15% — and a multiplier for how many times earnings Mr. Market would put on it — 20X — is an estimate.

Bottom line: If all my projections come to pass, ABC Inc. should be trading around $400 per share.

If we buy it today at around $200 per share, we should make a 100% return on our investment. The stock would trade from $200 per share to $400 per share.

If we buy the stock today for $100 per share … boy, oh boy — would that be even better!

If our projections come to pass — and the stock price is at $400 per share — then our return would be 300%!

But if I got excited, didn’t have discipline, paid too high a price for the stock today — let’s say $300 per share — and my projections come to pass, my return would now be only 33%.

See how important paying the right price for a stock is?

It’s the same stock and same projections. The only difference is that I paid different prices for the stock. And that made all the difference in my returns.

I bought at $100 per share, and it came out to a 300% return.

Then, I bought at $200 per share, and it came out to a 100% return.

Last, I bought at $300 per share, and it came out to a 33% return.

Next Up?

Now, when I project the earnings growth of a business, I need to know a lot about it.

I need to know the industry, the company’s track record of growing earnings, how well the CEO allocates capital and what competitors are doing.

If I don’t know that, my projections of 15% earnings growth is nothing more than a guess.

So, we do an inordinate amount of research to understand the business, how it plans on growing, how big its market is and about 10 other things.

Once we’re confident in our research, we put in a range of scenarios.

Say something happens and earnings only grow by 8%. Or say something else happens and the business grows by 5%. Will we still make a decent return on our money in five years?

The less certain we are, the higher the margin of safety we want.

So, for a business with stable earnings, in an outstanding business, it doesn’t take a leap of faith to make projections.

In that case, we would require a lower margin of safety. We wouldn’t mind paying a higher price for the business due to its stability and certainty.

In a business with changing economics, no tailwinds or mediocre management, we would want a high margin of safety.

We’d want to buy the business at a very low price because of our uncertainty.

Ben Graham, Warren Buffett’s teacher, said: “You don’t need to know the exact weight of someone to know if they are overweight … or the exact age of someone to know if they are old.”

If our projections of earnings on a great business with a lot of certainty are off — say it grows by 13% instead of 15% — we’d still see a good return over five years.

We look for situations where a business with a high degree of certainty is trading at a lower price because of something that has nothing to do with the business.

Those are the times when it’s like shooting fish in a barrel with the water drained out.

Alpha Recommendations

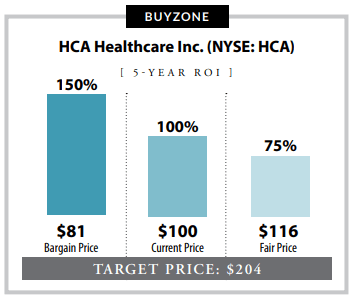

That’s what happened when we added HCA Healthcare Inc. (NYSE: HCA) to the portfolio.

We added it during the COVID-19 bear market in 2020. And a great business with high certainty was seeing its stock price trade sharply lower because of fear and panic.

In the Alpha Investor newsletter each month, at the end of every recommendation, I tell you what our projections are and spell them out for you.

That way, you know exactly what I’m thinking and how I’m valuing the business.

In the July 2020 issue, here’s what I said about HCA.

After sharing the industry, the CEO, the growth drivers of the business and the company’s financial position, I wrote:

If the company can grow its earnings per share by just 6% a year over the next five years, total earnings per share should be around $14.05.

So, if you bought the stock at around $100 per share — our price target is $204 per share — and everything happened the way we projected, you would make 100% return on your money in four years.

Keep in mind one thing: I err on the side of underestimating the future.

So, what happened to HCA?

We added it to the portfolio on June 22, 2020 at $98.32 per share — an even better price because stock prices were falling.

Now, we’re sitting on an open gain of 168%.

But, every time I recommend a stock, I always share how I came up with the projections and what I anticipate the stock would sell for in four to five years.

The fundamentals of the business don’t change much year over year.

But you wouldn’t know that by looking at the stock price. Many times, it rises and falls by very wide margins over 52 weeks! That’s the nature of investing.

If you watch the stock price drop, you might wonder: “What’s wrong with the company?”

And the answer is: nothing.

That’s just Mr. Market giving smart investors who know the underlying worth of the business a great entry point.

See, simple right?

The good news is, I do all the heavy lifting for you when you’re in the Alpha “A-team” family.

If you want specific stock recommendations with all of this analysis and more behind it, click here to see how you can join us today.

Do you feel like you have a better understanding of valuation now? Let me know at BanyanEdge@BanyanHill.com. I’d love to hear from you!

Regards,

Charles Mizrahi

Founder, Alpha Investor

I’m never going to tell you not to trade.

Even Warren Buffett – a man most people would associate with buy-and-hold-forever investing – has made his share of shorter-term trades and likely will continue doing so as long as he’s in the game.

In our world, you should seek opportunities wherever you can find them.

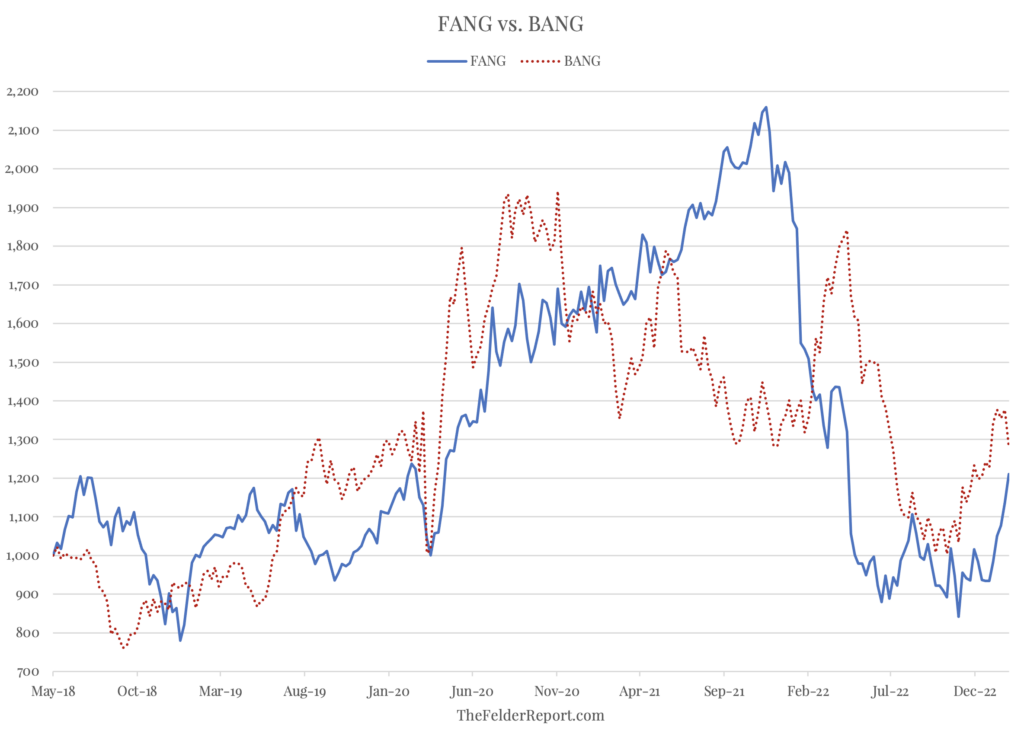

That said… I see a lot of really stupid trades right now.

As a case in point, consider Bed Bath & Beyond (BBBY). The retailer, which has really struggled in recent years and has been flirting with bankruptcy, saw its shares pop 92% on Monday.

That’s not 92% over the past year or even the past month. That’s 92% in one day.

Remember, this is a company that was preparing to file for bankruptcy last month and – barring some last-minute buyer coming out of the woodwork – will likely file within weeks.

And this isn’t an isolated incident. Carvana Co (CVNA), the stock that Charles Mizrahi referred to as “the worst stock to own in 2023” and as a “Pez dispenser for cars,” is up 180% in 2023. Just a couple days ago, it was up over 200% on the year.

To understand why we’re seeing this, you have to dig into the mechanics of the market. In the Banyan Edge Podcast, Adam O’Dell explained how short covering creates massive rallies in low-quality stocks.

Every share sold short is a share that must be bought back in order to close out the trade. So, exceptionally high short interest creates a massive potential buying catalyst. Think of it as a giant pool of gasoline just waiting for a lit match.

Adam knows a thing or two about short covering and its cousin – the short squeeze. Back in late 2000, Adam recommended the shares of National Beverage (FIZZ), the maker of the popular sparkling water brand La Croix. I remember it well, as I helped with the research.

We had high hopes for National Beverage, as it met Adam’s quality criteria and it fit into the larger trend of healthier living that we saw during the pandemic. But there was also an X-factor that we had identified… the massive short interest in the stock.

We didn’t necessarily predict a short squeeze. But given the massive size of the short interest, we figured that short covering could spark a rally.

Well, it did. We closed out half the position at a gain of over 100% in less than a month. But here’s the difference between our National Beverage trade and the action we see today in Carvana or Bed Bath & Beyond. National Beverage was a healthy company we actually wanted to own. Had the short squeeze never happened, we would have been happy owning it for months or even years, assuming it continued to meet our criteria.

Can you really say the same for Carvana or Bed Bath & Beyond? I don’t think so.

The conversation about short-selling continues next Monday with Adam O’Dell and Mike Carr. But until then, what highly shorted stocks are on your watchlist?

Yahoo Finance publishes a list of stocks with the highest short interest in the markets.

Do you hold any in your portfolio?

Let us know at BanyanEdge@BanyanHill.com, and we’ll feature your comments on next week’s show!

Regards,

Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge

[ad_2]