[ad_1]

Alex Potemkin/iStock via Getty Images

Thesis

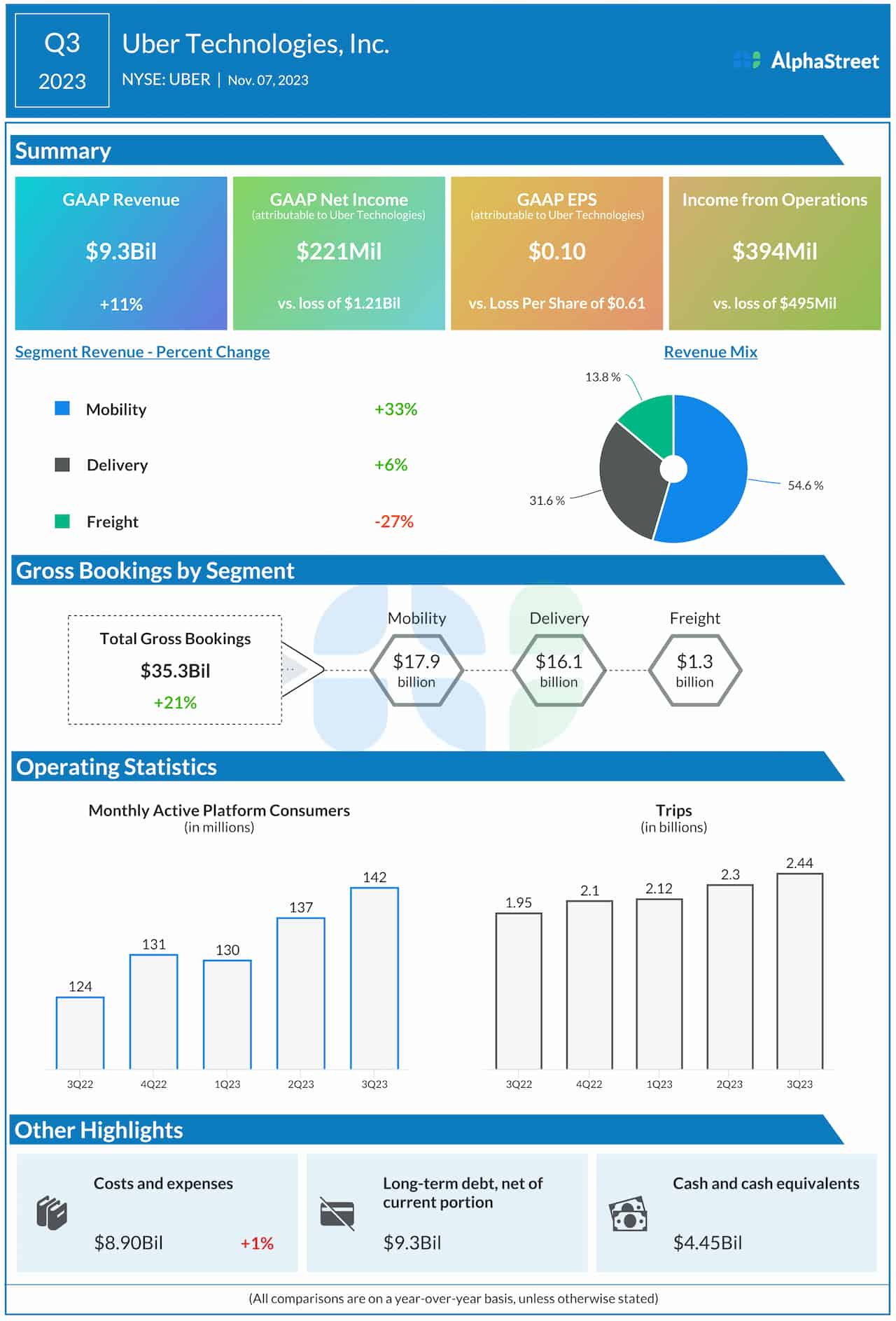

I began covering Hudson Technologies (NASDAQ:HDSN) back in July and plan on continuing to watching their progress. They are blessed with a business model which faces multiple positive long-term growth factors.

This is an update to my last article, where I went into much further detail into the longer timeframe trends affecting the company and the nature of their cyclical industry. Although their share price has increased by about 40% since the last time I covered Hudson, they still appear quite undervalued. After looking over their financials and valuation, I presently rate Hudson as a Buy.

Company Background

Hudson Technologies is a provider of sustainable refrigerant products and services. The company was formed in 1991 and is currently headquartered in Woodcliff Lake, New Jersey. They are the single largest refrigerant reclaimer in the United States and are capable of recovering a wide variety of refrigerants for restoration to AHRI standard for later reuse as certified EMERALD Refrigerants™.

HDSN “Our Mission” (Hudsontech.com)

Long-Term Trends

I was able to find two projections for the global refrigerant market. One is estimating a CAGR of 7.4% until 2030, the other a CAGR of 7.98%. The global refrigerant recycling market is projected to witness a CAGR of 10.5% through 2028.

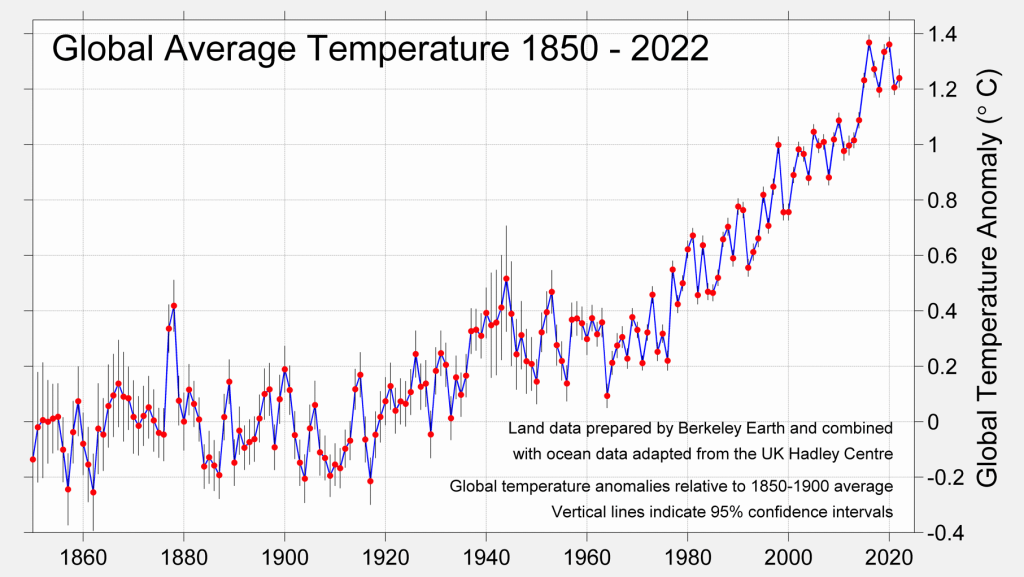

As the global equilibrium temperature shifts, I expect for the HVACR industry to witness elevating demand for decades to come. When examining positive feedback loops, changes in output lag their underlying causes. So even if greenhouse gas production were immediately halted, our mean temperature will continue rising until our climate finds itself at a new equilibrium point. Presently, median expectations are for a 1.5-2.0°C (2.7-3.6°F) rise by 2050.

Global Average Temperature 1850 – 2022 (Berkleyearth.org)

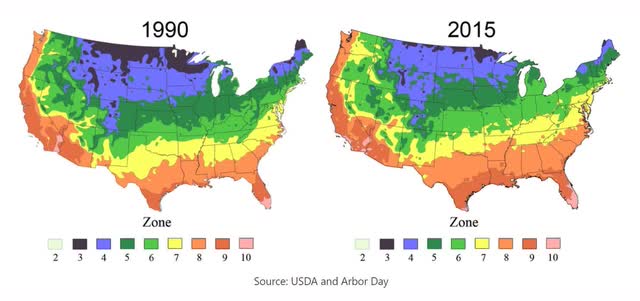

This shift can be visualized by reviewing planting zone maps.

Plant Zone Shift 1990 – 2015 (USDA and The Arbor Day Foundation)

The company also benefits from the AIM act. The EPA is forcing industries to phase out the use of certain HFCs.

Guidance

Their recent Q3 earnings call transcript covered a huge number of details. I am only going to cover the highlights, so I encourage you to read it. Hudson revealed that although they experienced a drop in revenue, they still maintained attractive margins.

HDSN Guidance 1 (Q3 Earnings Call Transcript)

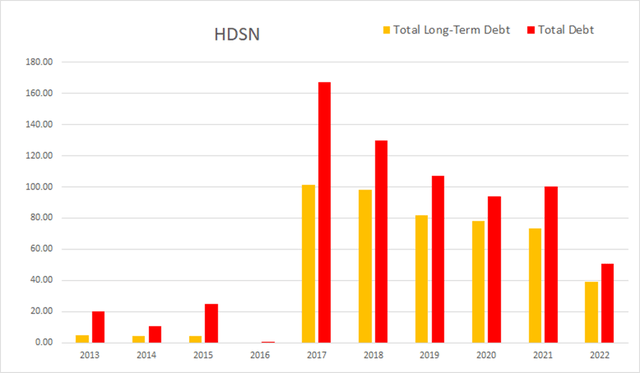

This will become more clear when we get to looking at their financials; they have been paying their long-term debt down over the last several years and have managed to pay the last of it off.

HDSN Guidance 2 (Q3 Earnings Call Transcript)

They believe they are currently well positioned to meet potential increases in demand.

HDSN Guidance 3 (Q3 Earnings Call Transcript)

Their projections for eventual future demand fall in a range between 6 and 10 times current demand.

HDSN Guidance 4 (Q3 Earnings Call Transcript)

Annual Financials

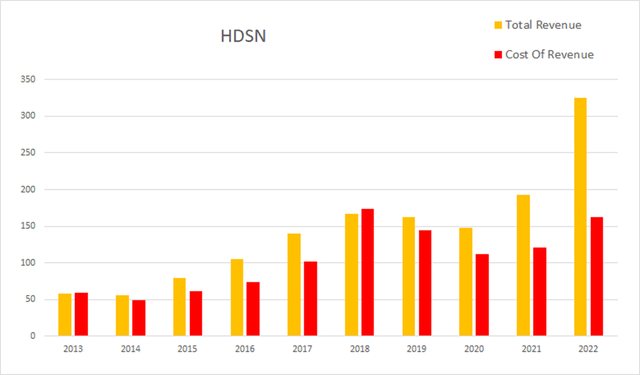

The company has achieved significant growth over the last decade. In 2013 they had an annual revenue of $58.6M. By 2022 that had grown to $325.2M. This represents a total increase of 454.95% at an average annual rate of 50.55%.

HDSN Annual Revenue (By Author)

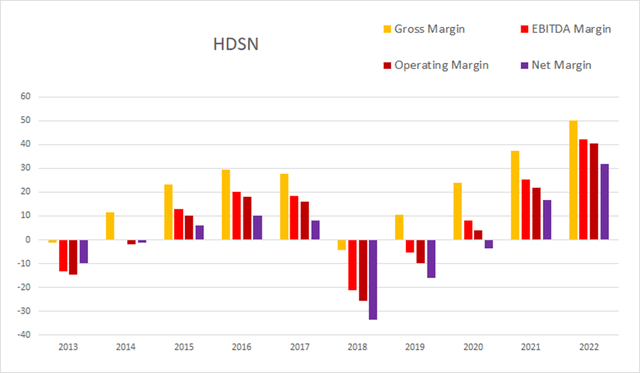

Their annual margins clearly show the cyclicality the company suffers from. In 2018 they experienced a dramatic margin contraction. Their old earnings call transcripts revealed that this was because Chinese refrigerants found their way into the market in 2017, causing a drop in the value of the refrigerants in Hudson’s inventory. As of the most recent annual report, gross margins were 50.09%, EBITDA margins were 42.28%, operating margins were 40.44%, and net margins were 31.92%.

HDSN Annual Margins (By Author)

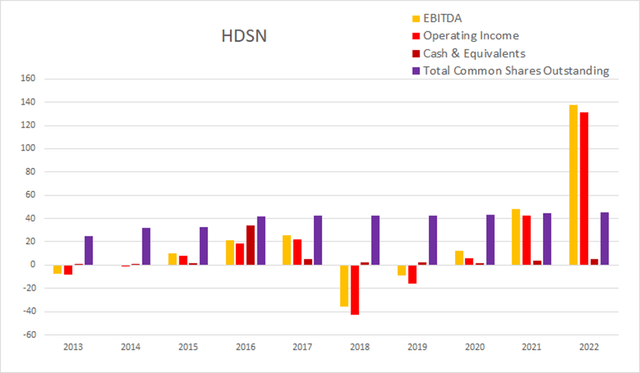

They were diluting fairly heavily up until 2016. Total common shares outstanding was at 25.1M in 2013; by the end of 2022 that rose to 45.3M. This represents an 80.48% increase in share count, which comes out to an average annual rate of 8.94%. Over that same time period operating income rose from -$8.5M to $131.5M.

HDSN Annual Share Count vs. Cash vs. Income (By Author)

As of the 2022 annual report, they only had -$14.3M in net interest expense, total debt was $50.7M, and long-term debt was $39M.

HDSN Annual Debt (By Author)

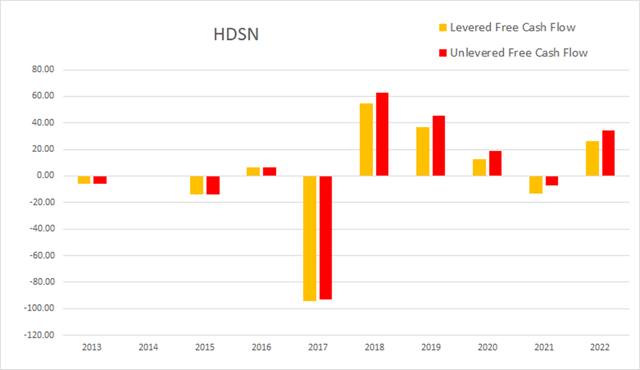

As of this most recent annual report, cash and equivalents was $5.3M, operating income was $131.5M, EBITDA was $137.5M, net income was $103.8M, unlevered free cash flow was $34.2M, and levered free cash flow was $26.4M.

HDSN Annual Cash Flow (By Author)

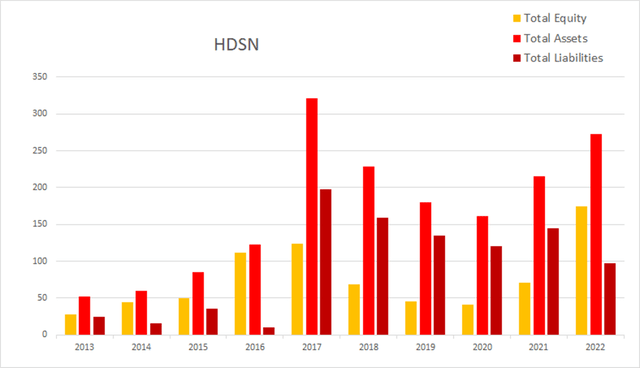

Their total equity has been on a bit of a roller coaster ride. It was rising up until 2017, before falling into a new low in 2019 and 2020. Their equity has been rising since then and is now above its old 2017 high.

HDSN Annual Total Equity (By Author)

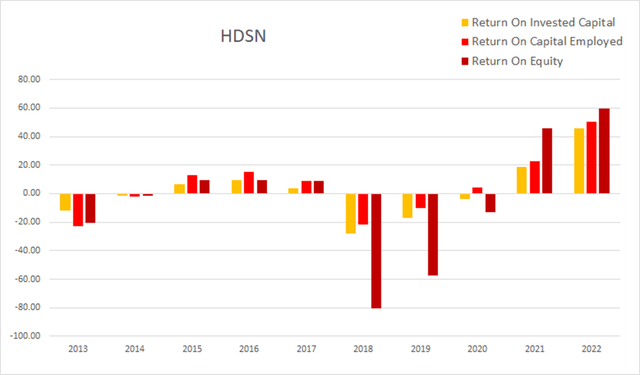

Their returns are showing the same cyclicality that showed up their margins. Since 2017 their returns have shifted from being absolutely terrifying to extremely attractive. As of the most recent annual report ROIC was 46.01%, ROCE was 50.42%, and ROE was at 59.35%.

HDSN Annual Returns (By Author)

Quarterly Financials

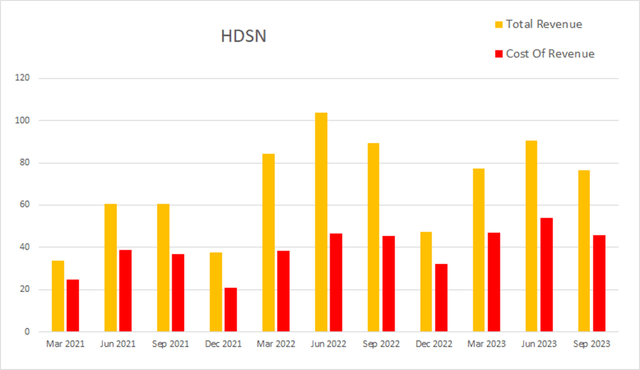

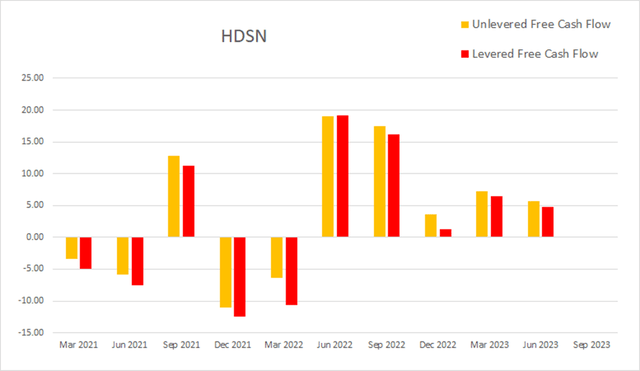

Their quarterly financials are showing clear seasonality. They typically experience lower revenue in colder months and higher revenue in warmer months. Eight quarters ago Hudson had a quarterly revenue of $60.6M. Four quarters ago that had risen to $89.5M. By this most recent quarter that had further risen to $76.5M. This represents a total two-year rise of 26.24% at an average quarterly rate of 3.28%.

HDSN Quarterly Revenue (By Author)

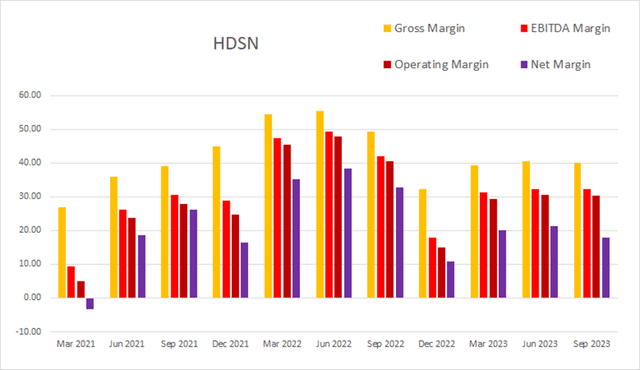

This same seasonality also affects their margins. As of the most recent quarter gross margins were 40.0%, EBITDA margins were 32.16%, operating margins were 30.2%, and net margins were at 17.8%.

HDSN Quarterly Margins (By Author)

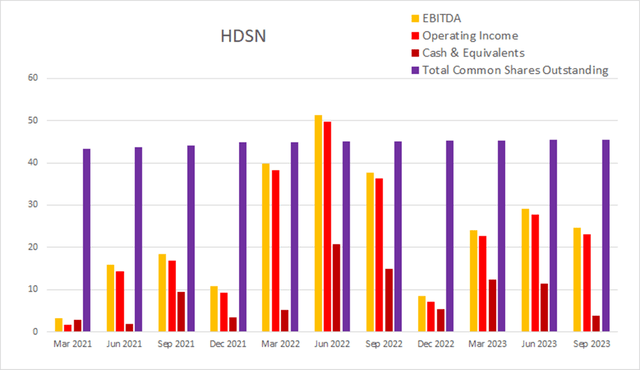

Their dilution rate appears to have dropped over the last year. The sum of their last eight quarters of dilution comes to 3.37%; over the last four quarters this has risen/dropped to 0.88%.

HDSN Quarterly Share Count vs. Cash vs. Income (By Author)

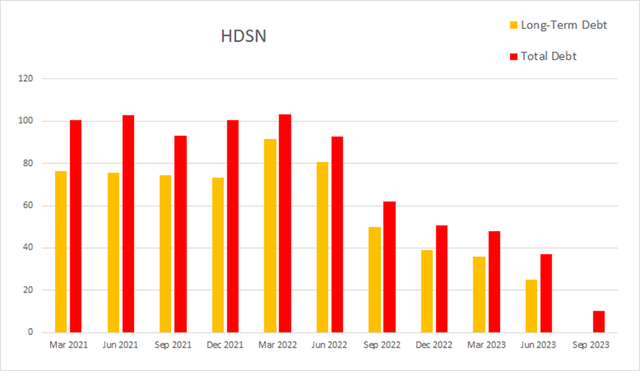

As noted in the guidance section, they have paid off the last of their long-term debt. The most recent quarter, Hudson had -$4.4M in net interest expense, total debt was at $10.2M, and long-term debt fell to $0.

HDSN Quarterly Debt (By Author)

As of the most recent earnings report, cash and equivalents were $3.8M, quarterly operating income was $23.1M, EBITDA was $24.6M, and net income was $13.6M. The company has not released their 10-Q yet, so values for their unlevered free cash flow and levered free cash flow are not showing up in Seeking Alpha. They typically release their 10-Q about a week after their quarterly report, so these values should be available to investors within a few more days.

HDSN Quarterly Cash Flow (By Author)

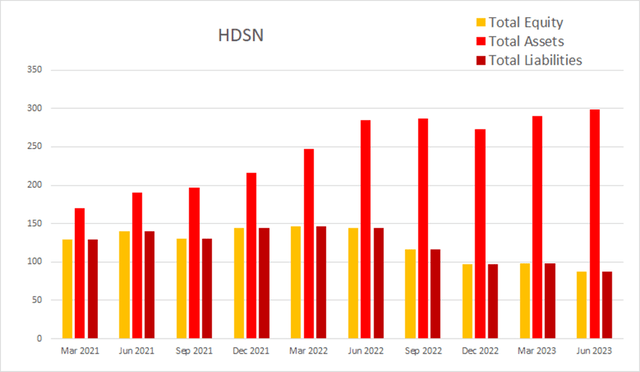

Both their debt and their cash reserves are lower than they were last quarter. Total equity dropped while the value for assets rose.

HDSN Quarterly Equity (By Author)

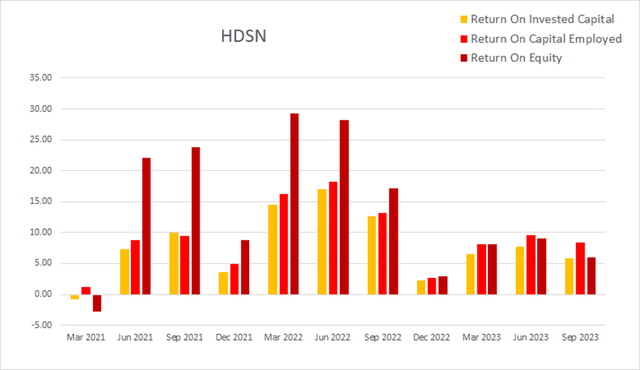

Their returns for 2023 are not as attractive as they were in 2022, but they are still quite attractive. As of the most recent earnings report ROIC was 5.79%, ROCE was 8.35%, and ROE was 6.06%.

HDSN Quarterly Returns (By Author)

Valuation

As of November 3rd, 2023, Hudson had a market capitalization of $559.91M and traded for $12.37 per share. They don’t offer a dividend, so using their forward P/E of 10.89x and their EPS Long-Term CAGR of 27.5%, produces a PEGY of 0.396x and an Inverted PEGY of 2.525x. With a PEGY value this far below 1, I consider the company quite undervalued. This PEGY estimate implies intrinsic value is around $31.23 per share.

Risks

Hudson has recently paid the last of its long-term debt off so this risk has lowered, but is it certainly possible that at some point in the future, Hudson takes on debt immediately before the price of refrigerants begins falling.

The HVACR industry may experience a similar situation to what occurred in 2017 and 2018. Whenever the refrigerants market finds itself in oversupply, Hudson will incur financial losses as the value of the refrigerants in their inventory falls.

Hudson has several competitors including American Refrigerants, Inc., C&L Refrigeration, CoolSys, Inc., and others. As with all businesses, competition always has the potential to undermine their ability to find profit.

Catalysts

In 2016, the company entered into an agreement with the Department of Defense. In 2021 the DoD extended the contract to 2026. Customers which are happy with recurring services are more likely to view switching to another provider as a potential risk, so Hudson may be able maintain their relationship with the DoD beyond 2026.

The company can expect growing demand provided by the AIM act. They also stand to benefit from the ongoing effects of global climate change, and continued changes in public sentiment pertaining to environmental management.

Conclusions

I regularly hunt for potential long-term compounders. This company has already proven it is capable of achieving extremely attractive returns when conditions allow for it. They stand to benefit from multiple long-term trends. Yet because their industry is cyclical, companies such as this one do not make for good investments for the average investor.

I believe HDSN has the potential to be a viable investment for those who are willing to keep track of the everchanging price of refrigerants. Those who are already involved in the refrigerants industry or are interested in taking the extra time to stay up to date on their prices, will be able remove most of the cyclicality risk from this potential investment. Being able to maintain situational awareness about the state of the refrigerant market may provide investors with an elevated ability to correctly time entries and exits and may produce considerable alpha.

Because this company produces extremely attractive returns when conditions are correct, and is blessed with multidecade tailwinds, I consider this to be an attractive investment. Even though their share price has climbed by roughly 40% since my last article, I still consider them very undervalued and have no reservations about placing another Buy rating on this company.

[ad_2]