[ad_1]

Intel Company (NASDAQ: INTC) has remained a market-leading tech agency regardless of going through a number of challenges within the latest previous and dropping market share to rivals. Falling PC and smartphone gross sales are the semiconductor big’s important considerations, given its sturdy presence within the CPU market. The administration appears to be like to deal with the present slowdown by means of efficient price administration and capability enlargement.

After struggling continued losses since early 2021, Intel’s inventory stabilized in the previous few months, in an indication it has most likely bottomed out. The low valuation and long-term restoration prospects ought to encourage these trying to make investments, however the difficult market atmosphere makes the inventory a dangerous guess proper now. As the corporate prepares for its fourth-quarter earnings launch, the inventory languishes on the lowest degree in about eight years. Contemplating the sharp inventory actions usually related to earnings bulletins, it’s advisable to maintain an in depth watch on INTC within the coming days and assess the corporate’s earnings efficiency earlier than investing.

Headwinds

After a weak yr, enterprise circumstances are unlikely to enhance in 2023, on account of financial uncertainties and the post-pandemic shift in demand circumstances. On the identical time, the corporate usually fails to maintain tempo with fabless chipmaker Superior Micro Units, Inc. (NASDAQ: AMD) with regards to offering superior compact chips, with the latter having fun with the pliability of outsourcing manufacturing to third-party foundries. The dearth of innovation resulted in Intel dropping a significant buyer like Apple, Inc. (NASDAQ: AAPL), which has stopped utilizing Intel chips in most merchandise.

Learn administration/analysts’ feedback on Intel’s Q3 2022 earnings report

In the meantime, Intel is revisiting its enterprise technique to beat competitors and has adopted what it calls Inner Foundry Mannequin for establishing constant processes and enhancing general effectivity. The corporate additionally made a re-entry into the discrete GPU market final yr after a protracted hole, giving competitors to rivals like AMD and Nvidia Company (NASDAQ: NVDA). This week, Intel unveiled its Thirteenth-generation cellular processors. These initiatives, supported by the corporate’s upcoming new-gen 10nm chips, ought to allow it to realize the objective of returning to processor management by 2025.

Intel delivered stronger-than-expected earnings repeatedly for greater than seven years, besides within the second quarter of 2022. The development has been virtually related for the highest line, although there have been extra misses. Consultants are of the view that the ultimate three months of the fiscal yr had been difficult for the corporate, with consensus estimates exhibiting a 25% fall in revenues to $14.5 billion within the fourth quarter. Internet revenue, excluding one-off objects, is seen falling sharply to an unimpressive $0.2 per share. The report is slated to be revealed on January 26, after common buying and selling hours.

Key Numbers

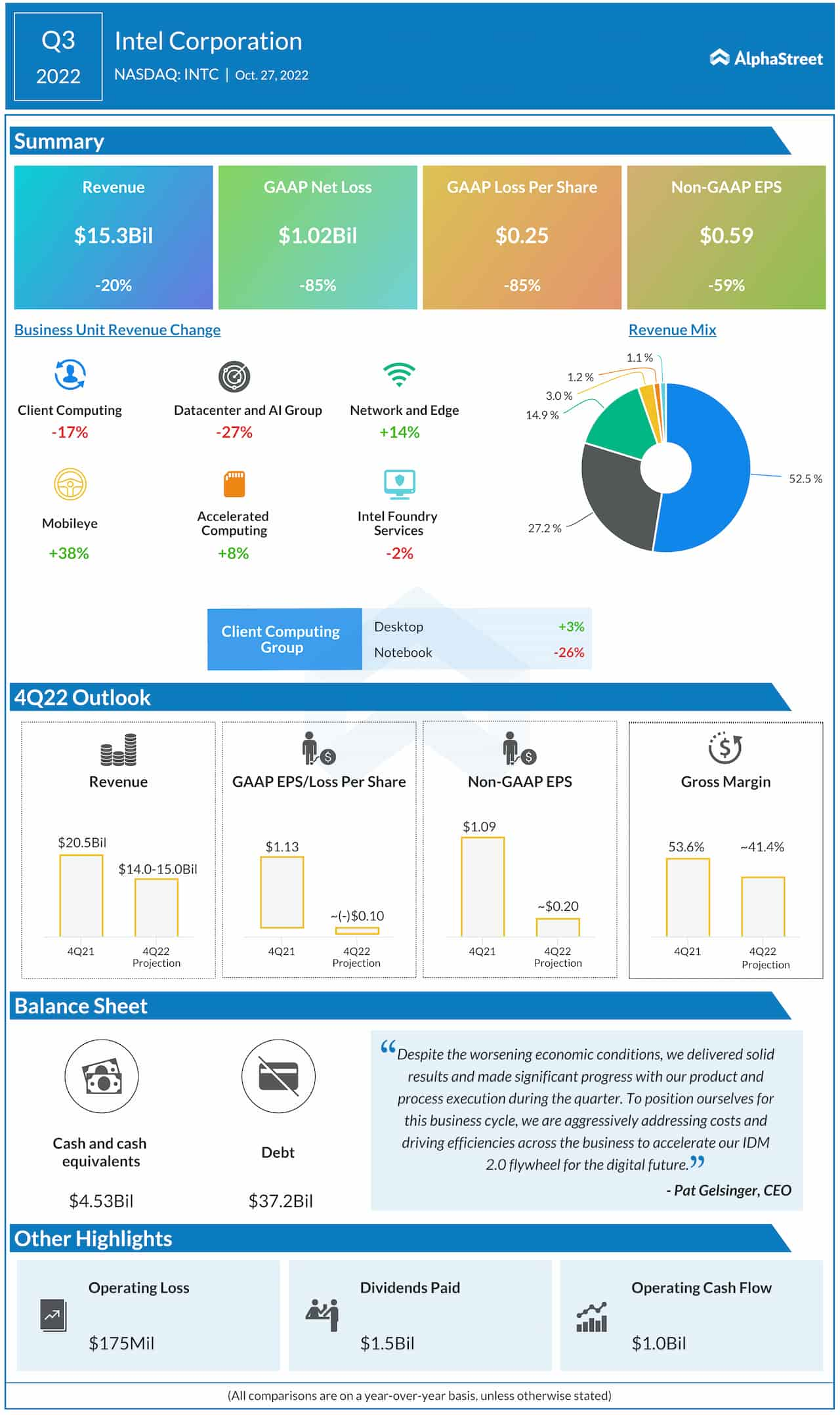

The efficiency was equally disappointing within the third quarter when the principle working segments of shopper computing and data-center contracted sharply, greater than offsetting income progress in different divisions. That translated right into a 60% plunge in adjusted earnings. Taking a cue from the weak end result – although the important thing numbers topped expectations — the administration has set its fourth-quarter earnings and income targets sharply under the prior-year ranges.

From Intel’s Q3 2022 earnings convention name:

“We’re responding to the present atmosphere by taking aggressive actions to cut back prices throughout COGS and OPEX whereas mindfully defending the investments wanted to speed up our transformation and guarantee we’re well-positioned for long-term market progress. Along with lowering near-term prices, we now have additionally recognized structural price reductions and effectivity drivers… In mixture, our efforts ought to drive $3 billion in annual financial savings within the near-term and $8 billion to $10 billion by the top of 2025.”

Why buyers ought to add Nvidia inventory to their watchlist

Intel’s market worth has almost halved prior to now twelve months because the inventory remained caught in a dropping streak. Nevertheless it had a constructive begin to 2023 and traded increased all through Wednesday’s session.

[ad_2]