[ad_1]

JPMorgan’s Marko Kolanovic is abstaining from the early 2023 rally.

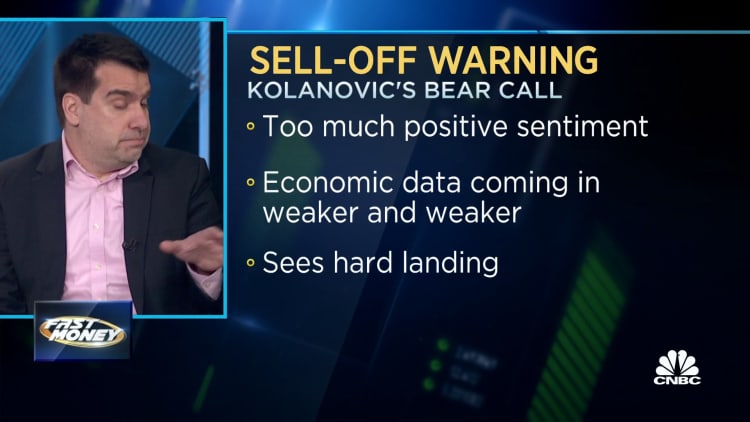

Instead, the Institutional Investor hall-of-famer is bracing for a 10% or more correction in the first half of this year, telling investors he’s “outright negative” on the market.

“Fundamentals are deteriorating. And, the market has been moving up. So, that has to clash at some point,” the firm’s chief market strategist and global research co-head told CNBC’s “Fast Money” on Tuesday.

Kolanovic slashed his firm’s exposure to stocks last week to underweight. In a recent note, he warned the market is not currently pricing in a recession. His base case is a hard landing.

“Short-term interest rates moved a lot in the last six months, and they’ll probably still go a bit higher and stay there,” he said. “The consumer took a lot of debt. Interest rates went up. The consumer was resilient, and that was sort of our thesis last year… But as time progresses, they’re less and less resilient.”

Kolanovic, who is ranked as the number one equity strategist by Institutional Investor for the twelfth time, cites troublesome trends in recent key economic data — including ISM services, retail sales and the Philadelphia Fed Survey as reasons to turn bearish.

“We think things first turn south, get much worse,” said Kolanovic.

Yet, the tech-heavy Nasdaq is up more than 8% so far this year, and the S&P 500 is up almost 5%. It closed on Tuesday at 4,016.95.

He lists positive developments including China’s reopening from Covid-19 lockdowns and a weaker dollar for market enthusiasm. Kolanovic believes they helped create a narrative the worse is behind us and a recession “somehow magically ” happened last year.

“I just don’t think that at 5% rates we can have this economy functioning,” said Kolanovic, who noted private equity and venture capitalists can’t exist in this kind of environment. “Something will have to give, and the Fed will need to flinch.”

And, it could happen this year as a rate cut.

“At some point, they’ll [the Fed] backstop it. So, the big question is where. Is it [the S&P at] 3,600? 3,400? 3,200? We don’t have a very strong conviction. But we do think lower is the direction,” he said. “There is usually some contagion or something that happens unexpected.”

Kolanovic lists Treasury bonds and cash as viable places to hide out for now.

Disclaimer

[ad_2]