[ad_1]

Frank dongyang/iStock via Getty Images

Introduction

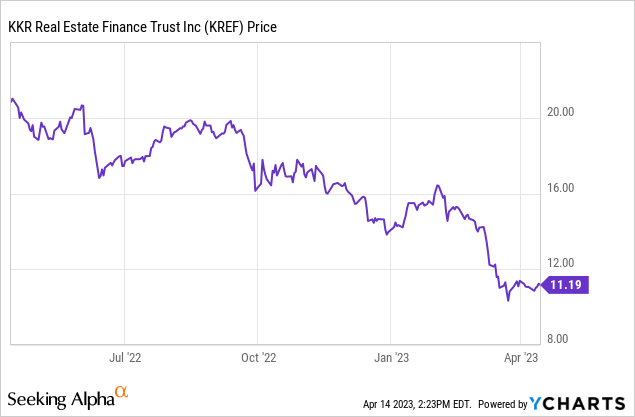

KKR Real Estate Finance Trust (NYSE:KREF) should report its Q1 results later this month but I’m not particularly optimistic about how this year will shape up for the mortgage investor. While the majority of the loans are senior loans with a floating interest rate, KREF had to focus on damage control lately as several of the loans in its loan book defaulted and required attention. This obviously weighed on the results in 2022, and given the further increase of the interest rates on the market in 2023, KREF likely isn’t out of the woods yet.

More write-offs make the LTV ratios questionable

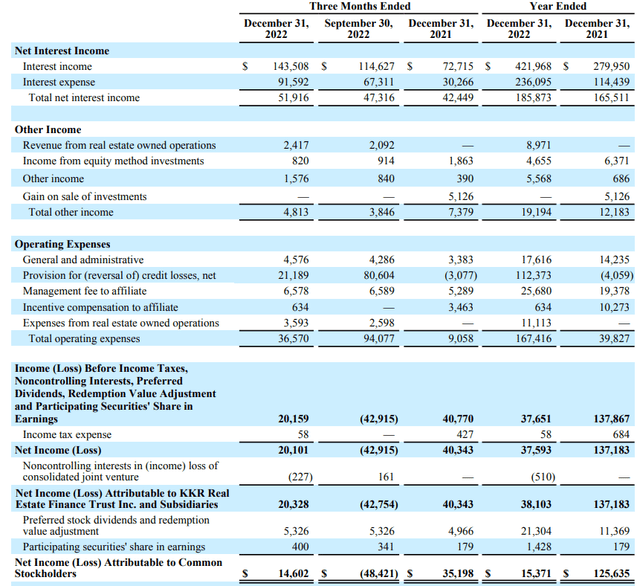

Although I’m more interested in seeing the distributable cash flow calculation, we should really start with the income statement as the net income is the starting point for the DCF calculation.

In the fourth quarter, KKR reported a total net interest income of $52M. That’s very encouraging as it shows the floating rate investments are paying off. While the REIT’s interest expenses increased by more than a third, the interest income increased as well and the net interest income increased by approximately 10% on a QoQ basis. So far, so good.

KREF Investor Relations

The main issue here is that the loan loss provisions remain high. Much lower than in Q3 2022, that’s definitely true, but seeing a $21.2M loan loss provision obviously still weighs on the underlying results. The net income came in at $20.1M and after deducting the preferred dividends and the $0.4M payable to securities that participate in the net income, the bottom line showed a net income of $14.6M for an EPS of $0.21.

While that’s not dramatic considering the need to record a loan loss provision of in excess of $21M, it’s clear the earnings don’t cover the current quarterly dividend of $0.43 per share. And the fourth quarter wasn’t a fluke. The FY 2022 net income was approximately $0.23/share due to a $112M+ loan loss provision.

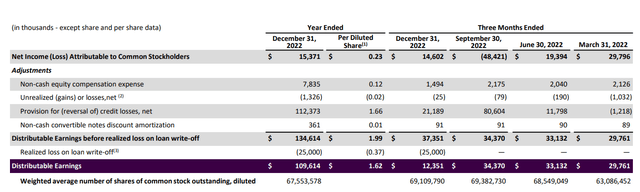

Of course the REIT refers to the distributable cash flow as the loan loss provisions are a non-cash element. The distributable earnings add back the total loan loss provisions and only deduct the actual write-offs. As you can see below, this had a negative impact on the Q4 result as the distributable earnings were just $12.4M or $0.18/share but the $25M write-off in Q4 was the only write-off during the year.

KREF Investor Relations

This means the distributable earnings for FY 2022 were still a very respectable $109.6M or $1.62 per share using the weighted average share count (and approximately $1.59/share using the effective share count).

That’s still pretty decent but the main question is how far KKR is kicking the can further down the road. Perhaps we should have a look at why and how the $25M write-off was realized. The press release provides an excellent explanation:

In January 2023, the Company completed the modification of a senior office loan located in Philadelphia, PA, that was risk-rated 4 at September 30, 2022, with an outstanding principal balance of $161.0 million, of which $25.0 million was deemed uncollectible and written off, as of December 31, 2022. The terms of the modification included, among others, a $25.0 million principal repayment and a restructure of the Company’s $136.0 million senior loan (after the $25.0 million repayment) into a $116.5 million committed senior mortgage loan (including future funding of $5.5 million) and a $25.0 million junior mezzanine note

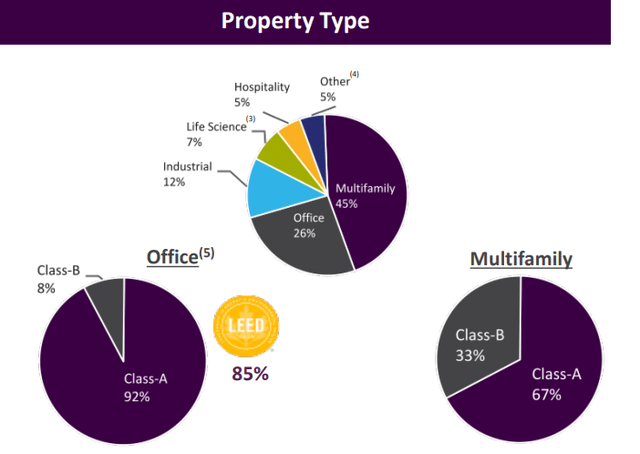

While it’s positive to see the REIT has been able to come to an agreement rather than being handed the keys, it does raise some question marks here. Based on the Q3 2022 corporate presentation, the $161M loan had an official LTV ratio of 72%. While that’s not ideal, it means the fair value of the collateral was estimated at about $220M. In theory that’s fine. But seeing how KREF has to take a haircut on a senior loan makes me a bit nervous about its exposure to the office portfolio as this definitely wasn’t the first fire KREF had to put out. In my previous article, I discussed there are more loans maturing this year that may require a long-term solution.

Fortunately I have the impression KREF understands this risk. First of all, the office portfolio represents just 26% of the asset base (but creates close to 100% of the headaches) so as long as the portfolio of multifamily assets performs well, the fallout from a deteriorating climate in the office segment should and could be covered.

KREF Investor Relations

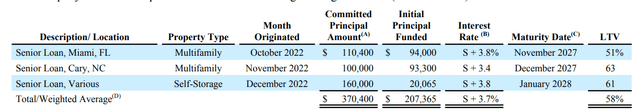

Secondly, the new loans KREF has funded during the fourth quarter appear to have a much lower risk profile. The average LTV ratio is just 58% and all three loans are non-office loans. There are two multifamily loans and a self-storage loan and the average cash coupon is currently approximately 8% (based on the year-end situation and the average markup of 370 basis points on the SOFR benchmark rate).

KREF Investor Relations

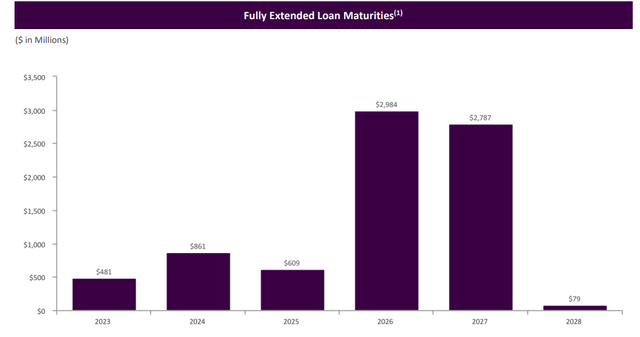

Additionally, KREF expects $1B in repayments this year, mainly weighted towards the second half of this year. That would be excellent news as it will allow KREF to continue its more conservative underwriting policy.

KREF Investor Relations

It’s also important to know that the assets used as collateral for two other troubled loans which are maturing this year are currently in the sales process. From the Q4 conference call:

Regarding our other two risk-rated 5 loans, there are sponsor-led sale processes in progress, and we are maintaining an active dialogue with these sponsors. With the Minneapolis loan, we executed a short-term extension to facilitate the sale process. And for the other Philadelphia loan, we have an initial maturity date in May of this year.

Investment thesis

There will likely be more hits to the distributable earnings in the current financial year. In 2022, KREF recorded in excess of $112M in loan loss provisions but this does not impact the distributable earnings calculation until those losses materialize. In FY 2022 only $25M of those losses effectively materialized. I hope to see more details in the Q1 update later this month and fortunately the higher net interest income will be helpful to absorb additional write-offs.

In my previous articles I mainly focused on the preferred shares (trading with (KREF.PA) as ticker symbol) and I will update my view on the preferred shares after the Q1 results. The preferred dividends are still well covered, the common share dividends definitely weren’t in 2022 and it remains to be seen if the $0.43 quarterly dividend on the common shares will be covered this year. From a longer-term perspective, KKR is likely in a better shape as it can now lend cash at more advantageous terms than before.

[ad_2]