[ad_1]

Bulgac

Investment thesis

Our current investment thesis is:

LEG has a market-leading position across various manufacturing industries, built on strong innovation, customer recognition for quality, and large scale. The business has seen mild growth for an extended period, as it has struggled to gain market share and has been conservative with allocating capital to growth. LEG’s dividends have been great for investors but we question its sustainability. Debt is reaching a healthy maximum and the need for M&A-led growth is high. LEG underwhelms relative to its peers yet is trading at a premium, implying no upside.

Company description

Leggett & Platt (NYSE:LEG) is a diversified manufacturing company headquartered in Carthage, Missouri. It operates through various segments, including Residential Products, Industrial Products, Furniture Products, and Specialized Products. The company designs and produces a wide range of engineered components and products for various industries.

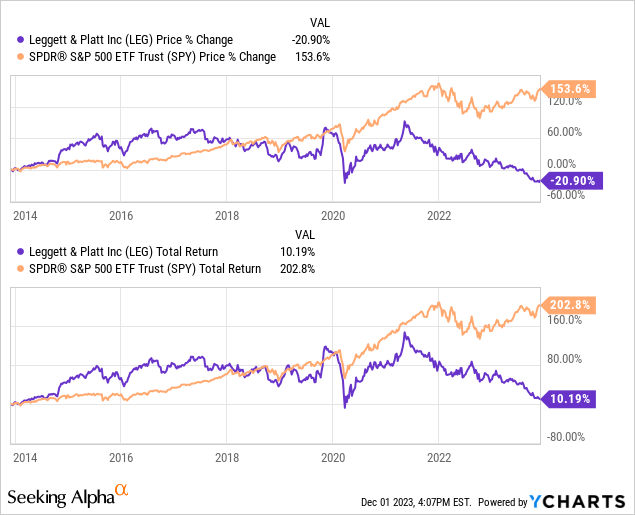

Share price

LEG’s share price returns have been poor in the last decade, losing value while the wider S&P 500 has performed exceptionally well. This is due to a period of modest financial returns and a degree of financial pressure.

Financial analysis

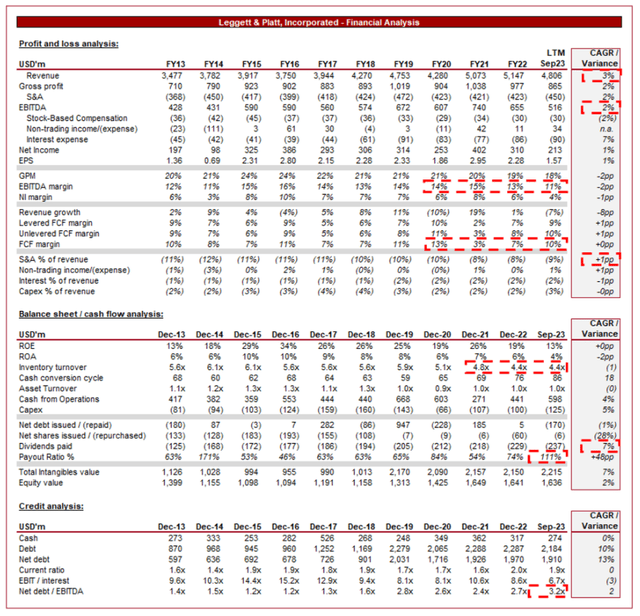

Leggett & Platt Financial analysis (Capital IQ)

Presented above is LEG’s financial performance in the last decade.

Revenue & Commercial Factors

LEG’s revenue has grown at a CAGR of 3%, with generally consistent growth across the historical period. Excluding the pandemic-hit fiscal year, the business has only experienced a decline in revenue once.

Business Model

LEG’s business model revolves around designing and manufacturing innovative products and components for its customers. LEG operates through numerous business segments, each offering a diverse range of products and solutions.

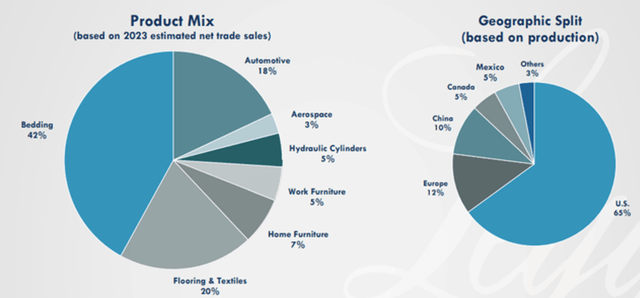

These segments include Bedding, Specialized Products, and Furniture, Flooring, & Textile Products. “Bedding” focuses on Mattresses and Beds, “Specialized Products” create Auto seats and Aerospace products, and “FFTP” creates home/work furniture and flooring. These industries leverage similar technologies and technical capabilities, allowing the business to benefit from shared competencies.

This diversified profile creates a higher quality revenue profile, as it reduces the company’s exposure to any single industry. Manufacturing has cyclical qualities, as investment in capital is tied to economic improvement.

As the following illustrates, the company is both geographically diverse and has a broad product mix, although clearly specializes.

Revenue (LEG)

The industries within which LEG operates are mature and so Management’s strategy for growth is a combination of broadening its product offering and continued product development to maintain and grow market share.

In conjunction with achieving organic development, LEG has pursued strategic acquisitions and partnerships. Through these relationships, the company is able to expand its product offerings and develop its expertise within its existing industries. In the last decade, the business has spent almost $2bn in cash on acquisitions.

The company’s acquisition strategy is:

Strong strategic fit – Acquiring businesses within attractive markets with a strong competitive advantage. Further, businesses that develop their current capabilities, or those that provide meaningful synergies. Disciplined financial screen – Accretive on an EPS basis and a return above WACC. Cultural alignment – Strong leadership, customer focus, and a strategy of continuous improvement.

On paper, this strategy sounds perfect for supporting the growth trajectory of the business, reducing the risk of missteps and value destruction. Clearly defining its investable universe allows investors and analysts to critique each transaction, adding a layer of protection to shareholder value.

Although we believe the business benefits from diversification, there is still additional improvement to be made, as LEG has a glaring reliance on the US and Bedding.

If we look at recent acquisitions, Management looks to be following the strategy:

Hydraulic Cylinders. Expansion into this manufacturing segment that looks to be on a strong growth trajectory, supported by the trend toward automation and autonomous equipment. Geo Components. Leveraging its existing infrastructure and expertise to expand its geographical reach and product offering to deepen exposure to the industry. Fabric Converting. Increasing existing capacity for its furniture and bedding businesses.

Competitive Positioning

LEG operates within highly competitive industries. The company faces competition from both domestic and international manufacturers, which can exert pressure on pricing and limit growth opportunities. In recent years, we have seen a rise in producers based in the far east, particularly in the bedding, furniture, and flooring, utilizing low-cost production techniques to undercut existing brands to take market share.

The company’s business model emphasizes manufacturing excellence and the branding of superiority. LEG’s primary competitive advantage is the quality of its products, with strong marketing of its proprietary technology and a track record of durability.

LEG places significant emphasis on innovation and R&D. As with all manufacturing industries, the requirement to continually develop is paramount to long-term success. The company invests in developing new products, materials, and manufacturing processes to stay ahead of market trends and offer cutting-edge solutions to its customers. Given the company’s scale, it is able to outspend its peers.

The U.S. bedding industry has a total addressable market of $11bn, with the global automotive seating industry at $20bn, according to Management. At an LTM revenue of $4.8bn, this gives LEG sufficient runway to grow further, predicated on its ability to grow market share relative to peers. The historical period suggests LEG is unable to achieve growth materially in excess of inflation, despite being positioned well to take market share. This likely means a continuation of its mild trajectory.

Economic & External Consideration

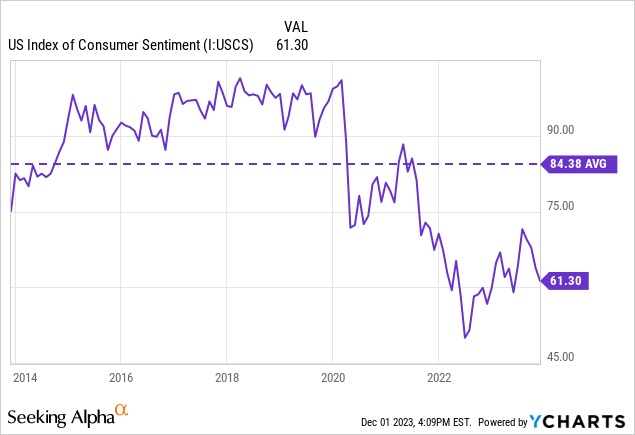

Economic fluctuations and slower growth periods can impact demand for the industries in which LEG services. Many of its purchases are large ticket, or associated with large ticket spending, a segment that is generally hard hit when deferrable. With high inflation and elevated rates, consumers are cutting back on spending where possible.

As the following illustrates, consumer sentiment remains noticeably lower than the 10Y average, implying a greater propensity to defer larger purchases in the near-term, until the outlook improves.

Further, many bedding products are purchased with new home sales, as consumers are less likely to keep their current mattresses and this serves as a good time to upgrade.

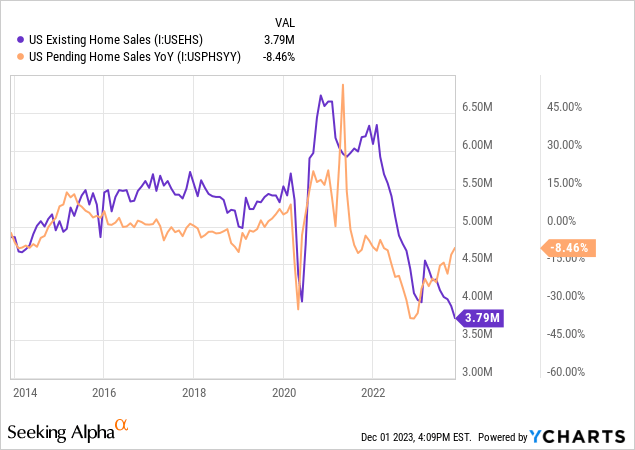

As the following data illustrates, new home sales have fallen dramatically, as high interest rates discourage home purchases and an increasing number of people are priced out of purchasing due to affordability.

These factors have contributed to a rapid decline in LEG’s growth rate, with 5 consecutive quarters of negative YoY growth. In the most recent quarter, Bedding (down HSD) and FFTP (down LDD), in particular, experienced large negative growth, illustrating the negative impact of exposure to consumer sales.

Our expectation is for this to continue in the coming quarters, as inflation remains stubborn in its decline. This said, the decline will likely slow, as the business approaches a “bottom”.

Margins

LEG’s margins have remained relatively flat over the historical period, with an EBITDA-M of 11% and a NIM of 4%. Margins had been on an upward trajectory, peaking at 15/16% (EBITDA level) but the subsequent decline in demand has contributed to a rapid erosion.

In conjunction with the lack of demand, increased material costs, transportation expenses, and labor costs are putting pressure on the company’s GPM.

Management is seeking to make operational improvements but we remain skeptical as S&A spending has already declined 2% as a % of revenue and GPM improvements will only come with a decline in inflation and an improvement in revenue.

Balance sheet & Cash Flows

LEG’s inventory turnover remains below its historical level of 5-6x, implying a drag on cash flows as demand has underwhelmed. We would like to see Management ease production to unwind this level, allowing for an improvement in cash flow margins even if demand remains low.

A slightly concerning development is the company’s debt position. With an interest coverage of 7x (2% of revenue) and a ND/EBITDA ratio of 3.2x, the business is quickly approaching a healthy maximum. This will restrict its ability to conduct M&A, especially when the business remains committed to shareholder distributions.

Dividends have grown well for an extended period, with many referring to this stock as a “Dividend King”. We are concerned that the current capital allocation strategy is unsustainable. The company is paying out the majority of its FCF as dividends, while still having an M&A focus and rapidly bloating balance sheet.

This could mean M&A slows, dividends decline or debt becomes unsustainable. Worse, we could see a combination of these. These will inevitably not go down well with investors, causing negative price action.

The only escape is achieving an improvement in growth, which although we believe is possible in the medium term, the business has shown in reality an inability to do this.

Industry analysis

Home Furnishings Stocks (Seeking Alpha)

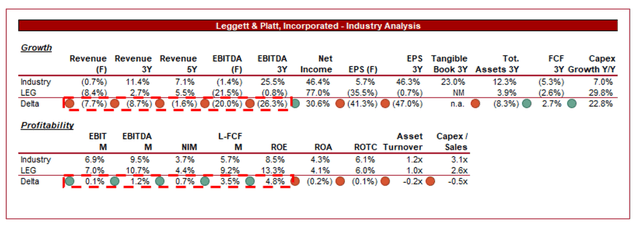

Presented above is a comparison of LEG’s growth and profitability to the average of its industry, as defined by Seeking Alpha (10 companies).

LEG is underwhelming when compared to its peer group. The company’s growth rate is noticeably below the industry average across various periods, with a disappointing decline forecast when factoring in the industry is expected to grow. The reason for this is likely the difference in products sold, with LEG’s exposure to large ticket items leaving the business cyclical tied to a large extent.

The company’s margins, however, are comparable. The business is slightly more profitable, enhanced by the potential for outsized improvement in the medium term once economic conditions improve.

Based on this, we believe LEG should be trading at a discount to its peer group, reflecting the lack of growth but appreciating its strong margins.

Valuation

Valuation (Capital IQ)

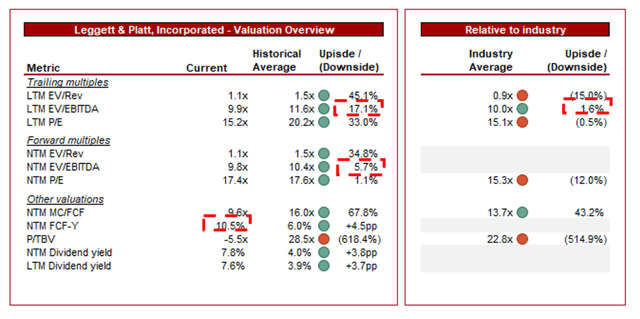

LEG is currently trading at 10x LTM EBITDA and 10x NTM EBITDA. This is a premium to its peer group, with mixed messages based on its historical average.

Our view is that a discount to its historical average is warranted, pricing in the current margin weakness, headwinds faced, capital allocation concerns, and lack of growth improvement. We do not believe there has been sufficient improvement to the business to offset these factors. Compared to its peers, we also believe a discount is warranted, for the financial weakness previously discussed.

Based on this, the stock appears overvalued, with no material discount on a historical level and an unjustifiable premium to its peers. Analysts are aligned with this view, with a target downside of ~(8)%.

Final thoughts

LEG has been a winner for many years, owing to its reliable growth and healthy distributions to shareholders. The business, however, looks to be approaching a crossroads. Growth in distributions and debt has outstripped revenue, and now the business must adjust accordingly. It needs M&A to support its organic growth rate but this may already be unfeasible on a large scale, further softening its future trajectory.

With near-term headwinds continuing to hurt the business, we suggest patience with this business until an improvement in outlook is observed.

[ad_2]

Source link