[ad_1]

TW Farlow

Stating electric vehicle deSPACs have had a torrid year would be an understatement. It’s been a total disaster with at least two Chapter 11 bankruptcy filings from Proterra (OTC:PTRAQ) and Lordstown Motors (OTC:RIDEQ). A few other EV deSPACs are also hanging on to solvency by a thread. Lion Electric (NYSE:LEV) comes from the 2020 class of deSPACs and forms one of the tickers still trading above the standard $1 minimum listing requirement. Whilst the Fed’s battle with inflation and the subsequent flight of capital away from somewhat speculative loss-making stocks has formed a core part of this collapse, valuations across the EV sector in early 2021 were constructed around hype, euphoria, and FOMO. LEV is down 18% year-to-date, is it a buy?

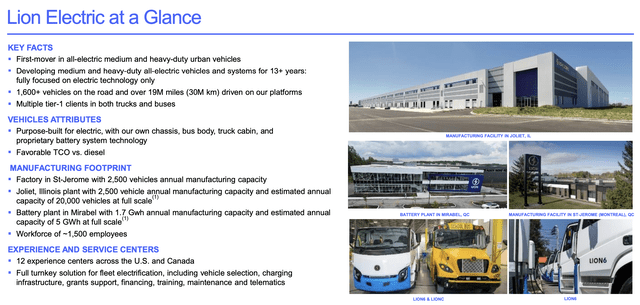

Lion Electric Fiscal 2023 Third Quarter Presentation

LEV is building all-electric medium and heavy-duty vehicles and owns three manufacturing facilities across North America; a factory in Quebec with an annual capacity to manufacture 2,500 vehicles, a larger 20,000-vehicle factory in Illinois, and a battery plant with an estimated annual capacity of 5 GWh at full scale. I last covered the ticker over a year ago when it was scaling operations, performance since then has reflected a stock market where the Fed funds rate has been hiked to a 22-year high of 5.25% to 5.50%. Liquidity is key is this post-ZIRP world as LEV chases the decarbonization wave that’s sweeping across the US and Canada.

Ramping Operations, Sales, And Liquidity

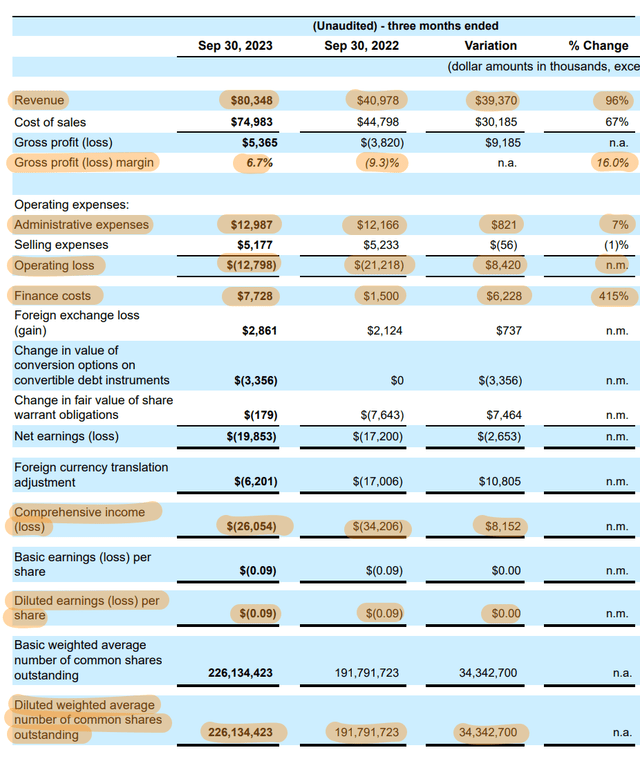

Lion Electric Fiscal 2023 Third Quarter Form 6-K

LEV opened its Illinois facility in the summer and is targeting eventually expanding production to 20,000 buses and trucks from 2,500 school buses currently. The company recorded fiscal 2023 third-quarter revenue of $80.3 million, up 96% over its year-ago comp and a beat by $2.57 million on consensus estimates. The rapid ramp in revenue meant LEV recorded positive gross profit margins of 6.7% versus its year-ago quarter which was negative at 9.3%. LEV also delivered 245 vehicles during the quarter, an increase of 89 vehicles over its year-ago comp.

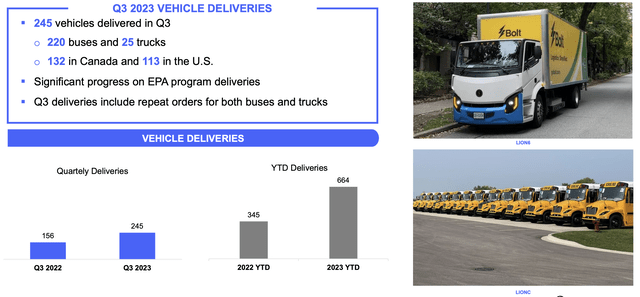

Lion Electric Fiscal 2023 Third Quarter Presentation

LEV’s order book at the end of the third quarter stood at 2,232 vehicles. This was 268 trucks and 1,964 buses with an aggregate value of $525 million. Critically, this continues to be bolstered post-period end with the company recently announcing that it had received a conditional purchase order for 50 electric school buses. LEV has been able to fully tap into the EPA’s Clean School Bus program, an offshoot of the 2021 Bipartisan Infrastructure Law, which seeks to provide $5 billion over five years to replace existing school buses with zero-emission alternatives.

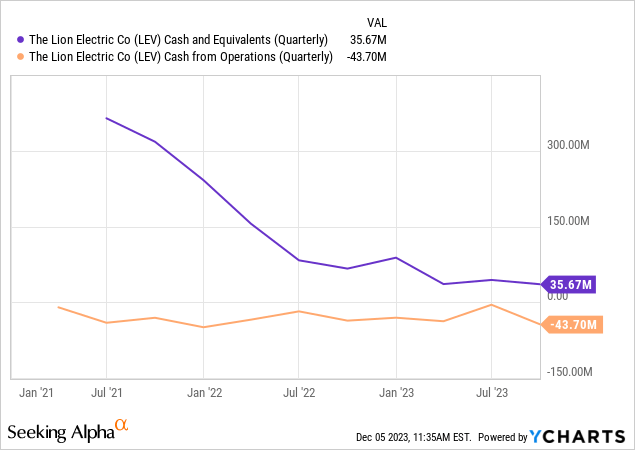

Net loss for the quarter at $26.05 million was an improvement from a loss of $34 million in the year-ago period with finance costs that jumped 415% year-over-year forming the biggest component of LEV’s losses during the third quarter. LEV held a total long-term debt balance of $172.1 million with higher base interest rates driving the finance cost increase. The company’s end-of-quarter cash balance at $35.7 million was a decline from $88.3 million at the start of 2023 with a free cash burn of $66.1 million driving a substantial decline in liquidity. Hence, whilst LEV needs to slash capital expenditure to save cost, cash loss from operations is so deeply negative at $43.7 million that any such cost reduction would have to be extremely material. Cash loss from operations was also a deterioration from $36.4 million in the year-ago period.

Cash Runway Shrinks Materially

LEV has access to $96 million in borrowing capacity from its revolver for a near-term liquidity position of $132 million. The company is also chasing cost cuts and announced its intention to lay off 10% of its employees a few weeks ago. This should shave off roughly $1.2 million in expenses a quarter, simply not enough to move the needle in terms of a material expansion of its current liquidity position. LEV’s current cash balance would be fully exhausted if its fourth quarter cash burn from operations is reflective of the third quarter. Assuming a free cash burn of roughly $50 million for the next few quarters would see the current liquidity balance exhausted by the end of the second quarter of 2024.

It’s difficult to recommend an EV ticker as a buy when they’re losing money, facing higher interest expenses, and with a liquidity position that’s under sustained sequential pressure. There are no easy solutions for LEV to solve this liquidity bottleneck with dilution at the current level a ticket towards a stock price falling below the minimum listing requirement. Further, by tapping into its remaining revolver, quarterly interest expenses will rise to somewhat dampen the effort to cut costs. The ticker has also not participated in the broad market recovery seen since interest rate cut bets for 2024 were ramped up in recent weeks because of the specter of dilution. Selling more shares would form the only way to sustainably expand the runway but any future issuance would have to be significant. Diluted weighted average shares outstanding at the end of the third quarter was up 18% year-over-year with further dilution likely. The company might survive the carnage but is a sell.

[ad_2]

Source link