[ad_1]

KanawatTH

One of the worst performing stocks so far this year has been Lumen Technologies (NYSE:LUMN). Shares of the communication services company have lost more than half of their value so far, as investors worry about the cash flow picture and growth situation. After being an income investment dream for some time in a low interest rate environment, the dividend elimination may have been the last straw for many. Today, I want to look at where things currently stand, and discuss what is needed for this stock to truly bottom.

The latest major leg down came after the company’s Q4 report, in which management issued a very disappointing forecast for this year. Free cash flow is expected to be in the range of $0 million to $200 million for the full year, which is a lot less than investors and analysts were hoping for. As I discussed previously, the two major divestitures that the company made last year reduced the company’s revenue and cash flow profile in exchange for eliminating a good chunk of debt from the balance sheet.

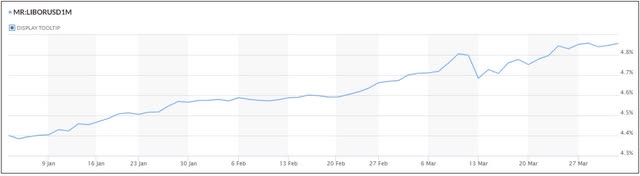

However, the overall interest rate situation looks a lot different now than it did when management originally announced those asset sales. As the chart below shows, 1-Month LIBOR rates have continued to rise this year, after being at near zero back when 2022 started. A good portion of the company’s debt is variable rate, based on LIBOR, and just as this key rate was starting to surge, Lumen’s major interest rate hedges expired.

1-Month LIBOR (Marketwatch)

Since the Q4 report alone, this key rate has risen by another nearly 28 basis points. On nearly $8 billion in variable rate debt for Lumen, that’s another roughly $22 million in annual interest expense. Additionally, as the company’s results have weakened, management expects its leverage ratio to increase. Should that figure jump a bit in the near term, it could trigger another 25 basis point spread above LIBOR in the rates it is paying on certain borrowings. An extra $40 million or so in interest may not seem like much, but that’s a decent percentage when you consider the midpoint of this year’s free cash flow forecast was only $100 million.

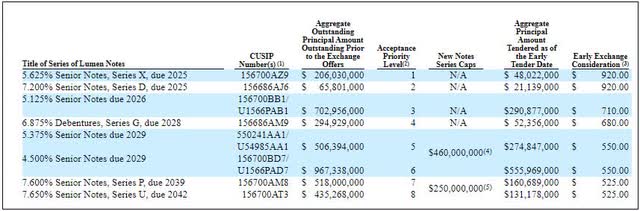

Recently, Lumen did announce a debt swap that will push out the maturity profile of some company borrowings and reduce total debt. Based on the early tender results seen in the graphic below, the company will see its total debt come down by more than $600 million. However, the new borrowing features a 10.5% coupon, meaning the current exchange will result in an extra $11 million of annual interest. Again, that’s not a tremendous amount on its own, but every little bit starts to add up in the end.

Lumen Debt Exchange (Company Press Release)

Unless the Federal Reserve starts cutting rates rather soon, I don’t think the interest rate situation for Lumen will improve in the near term. With Sunday’s news of OPEC+ oil production cuts, a rise in energy prices could spark inflation fears yet again, pushing rates even higher. For a while, part of the bull case for Lumen was based on low interest rates, as the previous management team was able to cut a lot of debt and refinance a number of borrowings to lower rates. Now we’re on the opposite side of that spectrum, with the potential for 1-Month LIBOR to top 5% soon if current trends continues.

Because of the two major asset sales, reported results this year are expected to show significant declines for both revenues and adjusted earnings. Of course, management will provide a set of numbers that’s comparable on an apples to apples basis so everyone can see how things are truly looking. Management does expect revenues and EBITDA to stabilize as we progress through 2024 with growth thereafter, but there is one more asset sale expected to close this year that will also impact the overall numbers.

For sentiment in the stock to truly improve, I think management needs to provide a better 2023 forecast at the Q1 report. We’ve seen a lot of names in the technology space rally recently when announcing job cuts or pullbacks in their capital spending plans. I’m not saying here that Lumen has to go out and fire a ton of people today or significantly pull back on its long term growth plans. However, finding some operating expense efficiencies or perhaps reducing some discretionary capital expenditures could go a long way in changing the narrative. Ideally, you want to see this year’s free cash flow forecast increase, although just holding it steady might be a win here given the added interest pressures I detailed above.

Lumen shares closed Friday at $2.65, just a stone’s throw from their multi-year low and down more than $10 from their 52-week high. The average price target on the street implies that the stock will double from here, although that average valuation has been more than halved in the past year. I just don’t see how the stock soars like that without some dramatic short term improvement in results or perhaps the company unexpectedly being bought out for a significant premium. In the short term, there may also be some upside resistance on the technical side from the falling 50-day moving average, the purple line seen in the chart below.

LUMN Last 6 Months (Yahoo! Finance)

In the end, Lumen needs to show some much better results in the coming quarters if it wants its stock price to bottom. Higher interest rates are starting to dent the bottom line again, which isn’t great considering the company’s large debt pile and the fact that almost no free cash flow generation was expected this year. Management stated that results are likely to be pressured until sometime next year, so it’s hard to justify buying this name until we can see the light at the end of the tunnel.

[ad_2]