[ad_1]

Sakorn Sukkasemsakorn

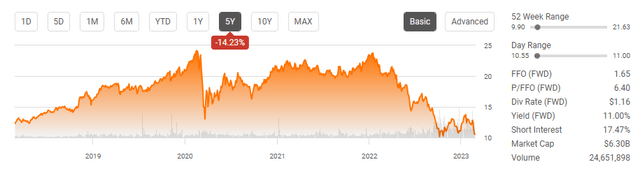

Medical Properties Trust (NYSE:MPW) has arguably been a disaster as shareholder value has been eradicated. Shares of MPW have retraced to the point where they are currently residing below the pandemic lows. Since topping out around $23.74 on 1/12/22, shares have declined -55.56%, and over the past year, they have fallen -47.30%. MPW has been ridden with repeated short calls from Hedgeye and fears that negative implications from Prospect and Steward would lead to a slashed dividend. MPW just released their Q4 2022 and full year 2022 earnings and did not reduce the upcoming quarterly dividend of $0.29, which goes ex-dividend on 3/15/23 and is payable on 4/13/23. After reading through the earnings call transcript, and digesting the results, I feel the bearishness surrounding MPW is overdone, and I am adding to my position. I could be incorrect, but I don’t believe the dividend will be lowered, and I feel shares are trading at an extremely low valuation. I will take this opportunity to lower my cost per share at a price point where MPW is yielding 11%.

Seeking Alpha

The important updates from the 2022 fiscal year and Q4 earnings call

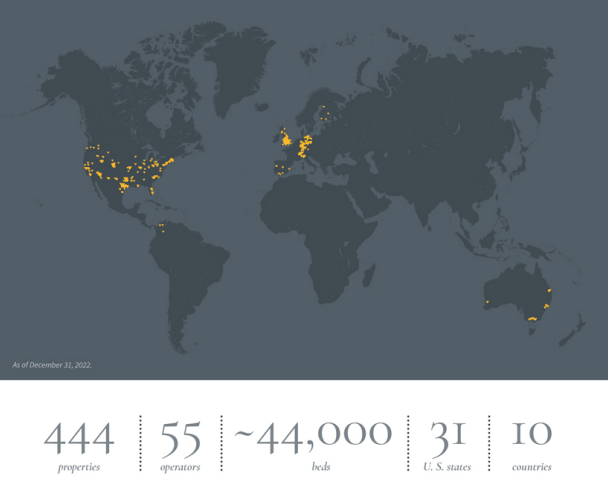

For the 2022 fiscal year, MPW generated $1.54 billion in revenue, and $902.6 million in net income attributable to shareholders, which breaks down to $1.50 per share. MPW generated $934.31 million in funds from operations (FFO) which is $1.56 of FFO per share. On a normalized basis, MPW generated $1.82 in normalized FFO (NFFO) after impairment charges, write-offs, and other items were factored in. At the end of 2022, MPW had roughly $19.7 billion in total assets, which included $13.4 billion of general acute care hospitals, $2.7 billion of behavioral health facilities, $1.4 billion of inpatient rehabilitation facilities, $0.3 billion of long-term acute care hospitals, and $0.2 billion of freestanding emergency room and urgent care properties. MPW manages a portfolio consisting of 444 properties and approximately 45,000 licensed beds across the United States as well as in the United Kingdom, Switzerland, Germany, Australia, Spain, Finland, Colombia, Italy, and Portugal.

Medical Properties Trust

In December of 2022, MPW acquired 6 priority hospitals for roughly $230 million euro, which will be added to their master lease with Priority. MPW recently completed the Springstone transaction with Apollo, which will be added to the LifePoint portfolio. Prospect continues to make progress with its East Coast divestitures in Rhode Island and Connecticut. The transaction in Connecticut with Yale, New Haven Health Systems is still tracking for a mid-2023 close. Prospect management is focused on an aggressive cost-cutting measure that should enable them to return the Pennsylvania market to profitability in approximately 12-18 months. Steward and CommonSpirit have announced a definitive agreement for Steward to sell the operations of their Utah facilities to Catholic Health Initiative, a CommonSpirit subsidiary. The purchase price will be used by Steward to pay down debt obligations, including the loan MPW made to Steward.

The market didn’t respond well to MPW’s 2023 guidance as it took into account the range of rent and interest that may not be paid throughout the year. Management didn’t sugarcoat anything and came out with a conservative scenario. MPW guided for $1.50 – $1.65 of normalized FFO on a calendar basis. There are several potential scenarios for 2023, which depend on companies getting clear of their previous financial obligations to MPW. The estimates of $1.50 – $1.65 take into consideration a worst-case scenario where MPW would recognize no rent or interest to an expected likely outcome that MPW recognizes most of its California and Connecticut rent, but nothing from the Pennsylvania investment. At the high end of the range, it doesn’t take into consideration incremental FFO that would be created by the recycling of MPW’s current investment in Prospect East Coast. Currently, it’s too early to tell where on the spectrum MPW will fall, but even if the lower estimates occur, $1.50 of normalized FFO in 2023 is still significantly above the $1.16 dividend that MPW is currently paying. MPW didn’t discuss a dividend cut on the earnings call, and I am not seeing a reason to worry about a potential cut after reading through the Q4 and fiscal year 2022 information.

MPW still looks attractively valued compared to its peers

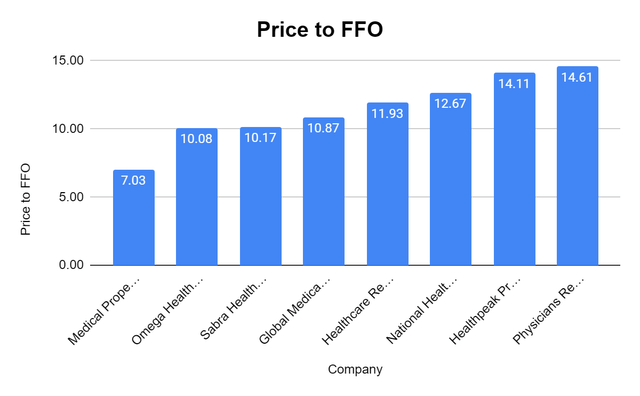

I used Seeking Alpha’s peer group as the base for this analysis. I am comparing MPW to:

Healthpeak Properties (PEAK) Healthcare Realty Trust (HR) Physicians Realty Trust (DOC) National Health Investors (NHI) Sabra Health Care REIT (SBRA) Omega Healthcare Investors (OHI) Global Medical REIT (GMRE)

I also used MPW’s low end of the FFO projection of $1.50 for the forward FFO to be conservative.

When I compare REITs, I look at the price to FFO I am paying and how a REIT trades compared to its respective peers. MPW is still trading at a discounted valuation, as its price to FFO is 7.03x compared to its peer group average of 11.43x. I used the low end for MPW’s FFO, and paying 7.03x FFO is very attractive to me.

Steven Fiorillo, Seeking Alpha

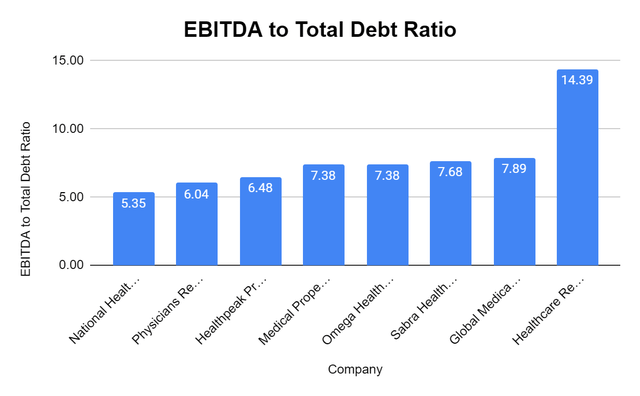

MPW has $10.27 billion in total debt. MPW’s 7.38x EBITDA to total debt ratio is just under the peer group average of 7.82x. Compared to its peers, MPW looks to be in good shape, and I am not concerned about the balance sheet or MPW’s debt.

Steven Fiorillo, Seeking Alpha

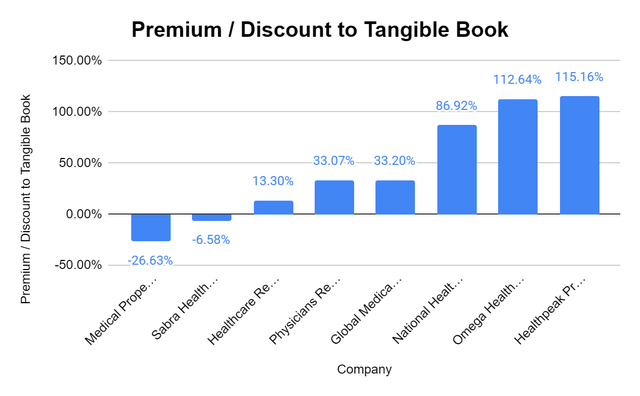

I used tangible book value instead of book value because it strips away intangible assets such as goodwill. Tangible book value is a stricter valuation metric, and today MPW’s tangible book value is $14.38. MPW is currently trading at a -26.63% discount to its tangible book value. The only other company that is trading at a discount is SBRA. The peer group average is a 45.13% premium on tangible book. It’s rare that you find a company that trades at a discount to tangible book, as most companies are provided with a multiple on this metric. MPW looks very attractive from this valuation metric.

Steven Fiorillo, Seeking Alpha

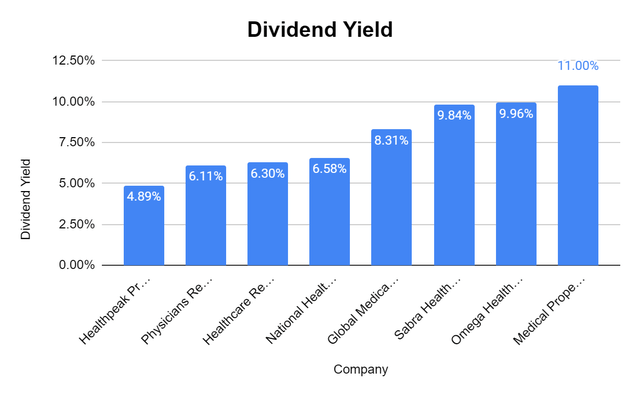

MPW once again has the largest yield in the group at 11%. The peer group average is a 7.87% yield, and MPW has fallen so low that it’s exceeding a double-digit yield. Looking at its tangible book value, and FFO, this is a yield that’s hard to pass up.

Steven Fiorillo, Seeking Alpha

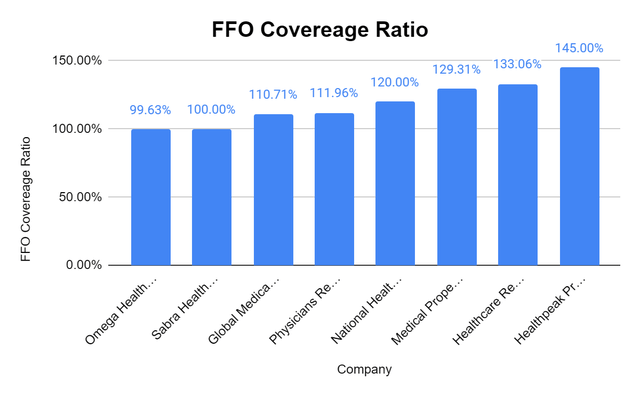

The peer group has an average FFO coverage ratio on their dividends of 118.71%. Using the low end of 2023’s FFO of $1.50, MPW has a coverage ratio of 129.31% which is significantly larger than its peer group. The dividend is fully covered, and I am not worried about a reduction.

Steven Fiorillo, Seeking Alpha

Conclusion

I plan on adding more shares of MPW as I am not seeing anything that is making me change my long-term investment thesis. I think there is too much bearish sentiment around a dividend cut that may or may not occur. Today, MPW has a tangible book value of $14.38 and trades at a -26.63% discount. MPW is yielding 11%, and management didn’t provide any reasons why a cut would be on the table. At the low end of 2023’s FFO, MPW still has a 129.31% dividend coverage ratio. I am taking the sell-off as an opportunity to dollar cost average as the risks are within my tolerance level. Unless something drastically changes, I will continue adding into weakness and reinvesting the large dividends.

[ad_2]