[ad_1]

Quick Take

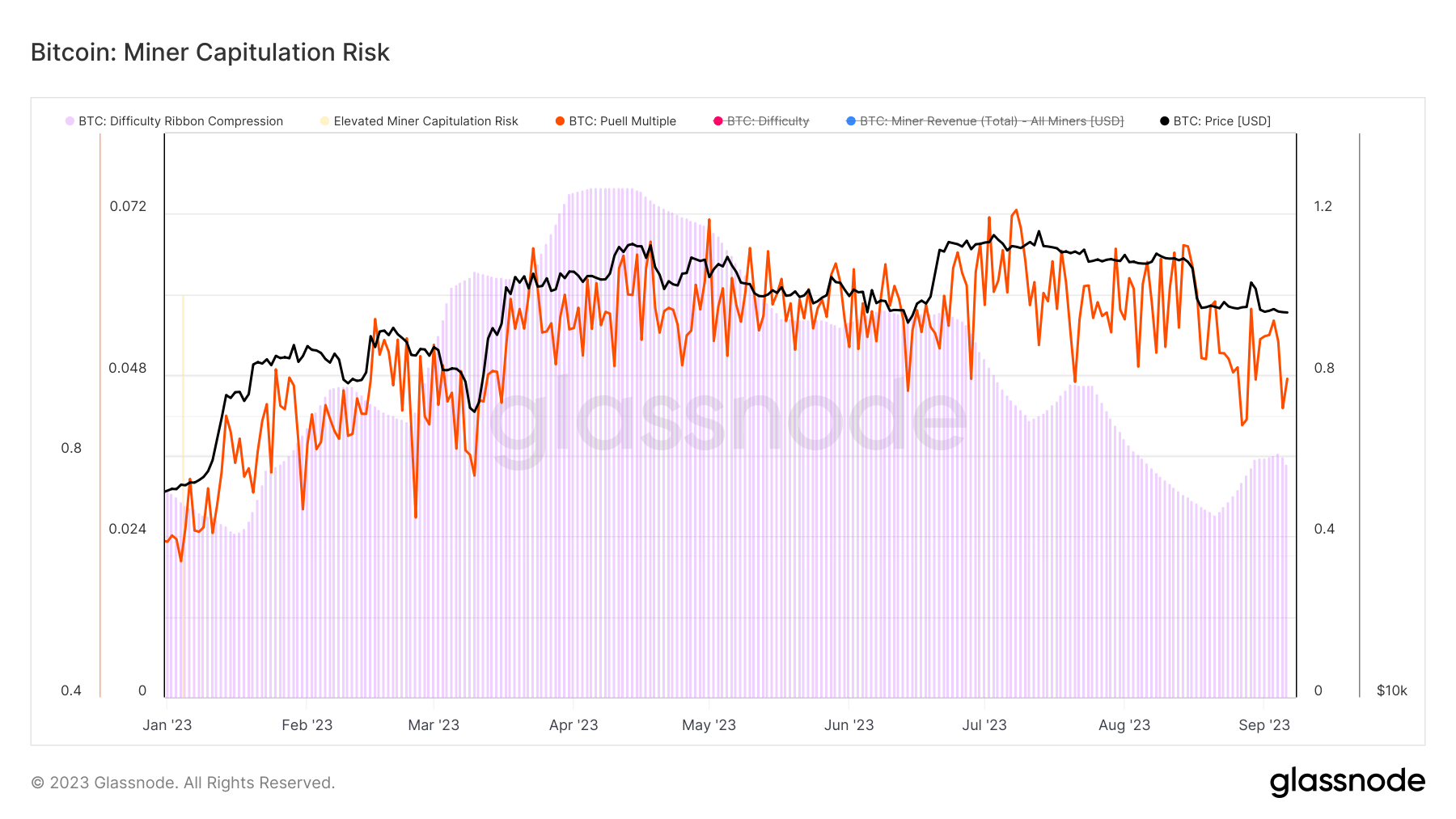

Miner capitulation risk represents the potential for miners to cease operations due to unprofitability, leading to a significant reduction in hash rate. A drop in hash rate can further exacerbate selling pressure as miners liquidate their holdings to cover operational costs.

This risk is assessed through two metrics — the Puell Multiple and the difficulty ribbon compression (DRC). The Puell Multiple represents an implied stress model, with low values signaling a higher probability of miner income stress. DRC is an explicit stress model, showing how much of the hash rate is coming offline.

As of Sep. 6, data from Glassnode has shown no elevated risk of miner capitulation. The Puell Multiple dropped below the 1 mark on Sep. 3, but it’s still standing well above the 0.6 level where the inherent risk of capitulation sets in. Despite seeing sharp drops caused by Bitcoin’s slump, neither the Puell Multiple nor the Difficulty Ribbon Compression (DRC) are signaling meaningful lows.

While miners might be feeling the financial strain, they aren’t in danger of capitulation. Despite price volatility, this stability in the mining sector shows that the market isn’t facing an immediate threat from increased sell-offs by miners.

The post Miner capitulation risk still not elevated despite Bitcoin’s price drop appeared first on CryptoSlate.

[ad_2]