[ad_1]

Published on April 1st, 2023 by Nikolaos Sismanis

A&W Revenue Royalties Income Fund (AWRRF) has two appealing investment characteristics:

#1: It is a high-yield stock based on its 5.3% dividend yield.Related: List of 5%+ yielding stocks.#2: It pays dividends monthly instead of quarterly.Related: List of monthly dividend stocks

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter, like dividend yield and payout ratio) by clicking on the link below:

The combination of a high dividend yield and a monthly dividend render A&W Revenue Royalties Income Fund appealing to income-oriented investors.

But there’s more to the company than just these factors. Keep reading this article to learn more about A&W Revenue Royalties Income Fund.

Business Overview

A&W Revenue Royalties Income Fund is a limited-purpose trust that owns the A&W trademarks used in the A&W quick service restaurant business in Canada. The trademarks comprise some of the best-known brand names in the Canadian food service industry. Specifically, the trust’s powerful lineup of great food and beverages and established brands include A&W Root Beer, The Burger Family, and Chubby Chicken.

The trust licenses these trademarks to A&W Food Services of Canada. In exchange, these restaurants enter a royalty pool and are required to pay a royalty of 3% of their sales.

The A&W Revenue Royalties Income Fund stands out as a “top-line” fund, as its revenue is solely derived from the sales of A&W restaurants, with only minimal operating expenses, interest on Trade Marks’ term debt, and income taxes subtracted to get to net income.

This unique structure shields the Fund from the fluctuating earnings and expenses associated with actually running the restaurants. As a result, the Fund enjoys protection from inflation and a dependable stream of profits, among other benefits.

Growth Prospects

Similar to other royalty trusts of its type that we have analyzed, like Boston Pizza Royalty Income Fund, the trust’s growth prospects and overall performance hinge on just two key factors. The first is the number of franchised restaurants in its royalty pool, while the second is the rate of growth in same-restaurant sales.

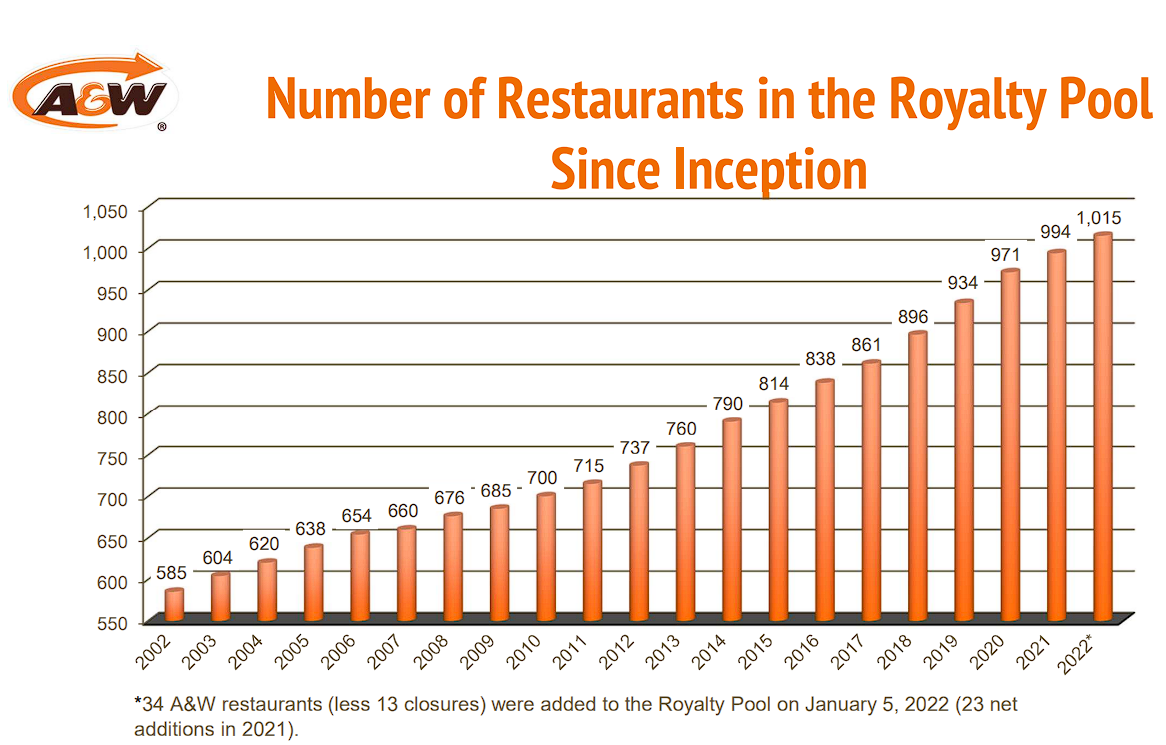

Since its inception in 2002, the number of franchised restaurants in the trust’s royalty pool has increased every single year. This is an excellent indicator of the trust’s success, as it suggests that there is a high demand among franchisees for A&W’s brands, indicating that the restaurants are likely performing exceptionally well.

The underlying success of A&W’s brands is also reflected in the fact that over 70% of new A&W restaurants opened over the past three years were opened by existing A&W franchisees, while more than 600 A&W restaurants are owned by franchisees who own at least five restaurants. In 2022, the number of restaurants in the Royalty Pool rose by 21 locations to $1,015.

Source: Investor Presentation

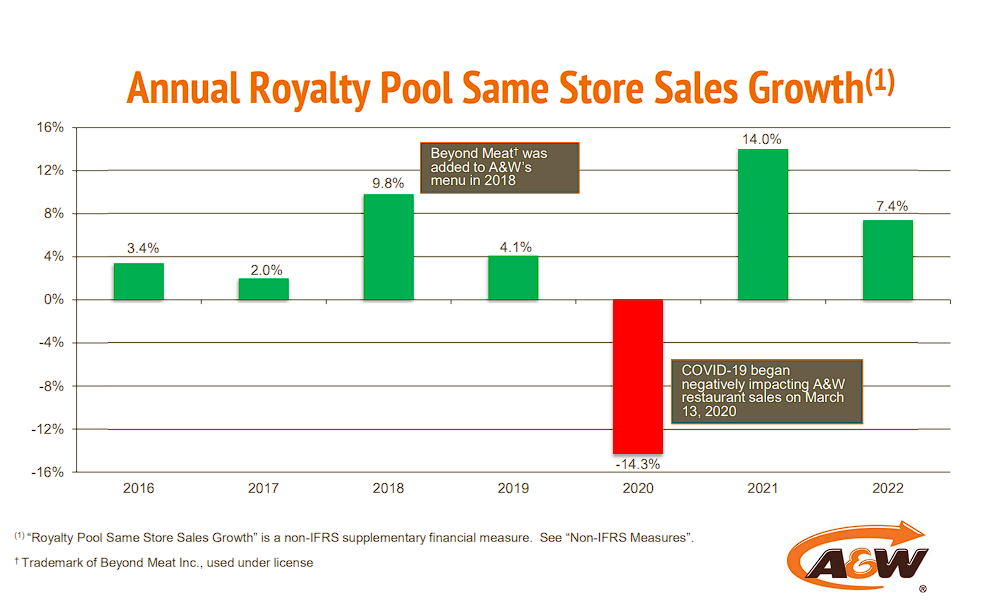

A&W restaurants have a notable record of increasing revenues through menu optimizations and operational efficiencies, which has resulted in rising same-store sales. Although the COVID-19 pandemic had a negative impact on sales due to strict lockdowns, they rebounded quickly once reopened.

Source: Investor Presentation

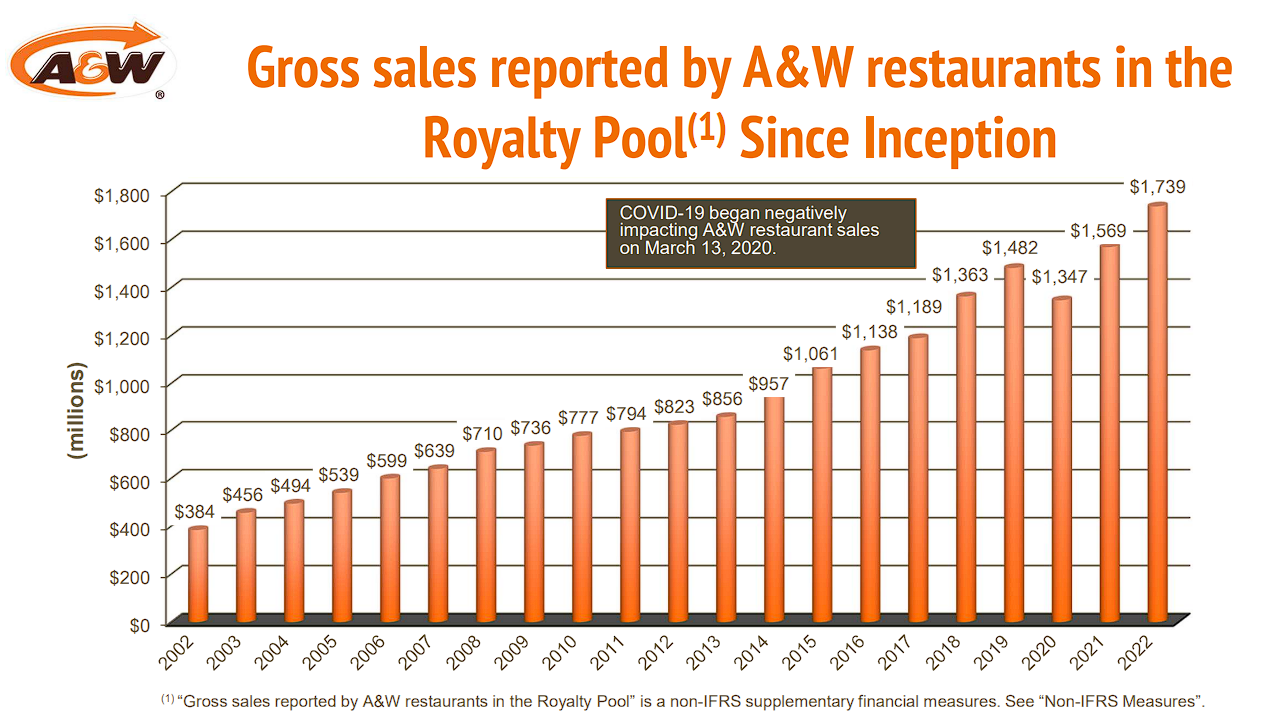

The combination of a rapidly growing number of restaurants along with gradually higher same-store sales has resulted in remarkable gross sales growth in the trust’s royalty pool. Even though gross sales temporarily declined in 2022 as a result of the pandemic, new restaurant openings and rebounding same-store sales resulted in record royalty-eligible gross sales of C$1.74 billion in 2022.

Source: Investor Presentation

The above bar chart effectively showcases the trust’s recession-resistant royalty model, as affordable fast-food chains like A&W typically experience resilient sales during market downturns. As a result, the trust’s royalty-eligible gross sales continued to grow all the way through the Great Financial Crisis.

The trust’s decoupling from each restaurant’s individual operating expenses is also apparent in the steady growth of its gross sales, which is the sole factor that determines the trust’s royalty revenue.

Looking ahead, we anticipate that the trust’s growth potential will remain strong, given the sustained interest among franchisees in opening new A&W restaurants and the organic growth in same-store sales at A&W-licensed locations over time.

Dividend Analysis

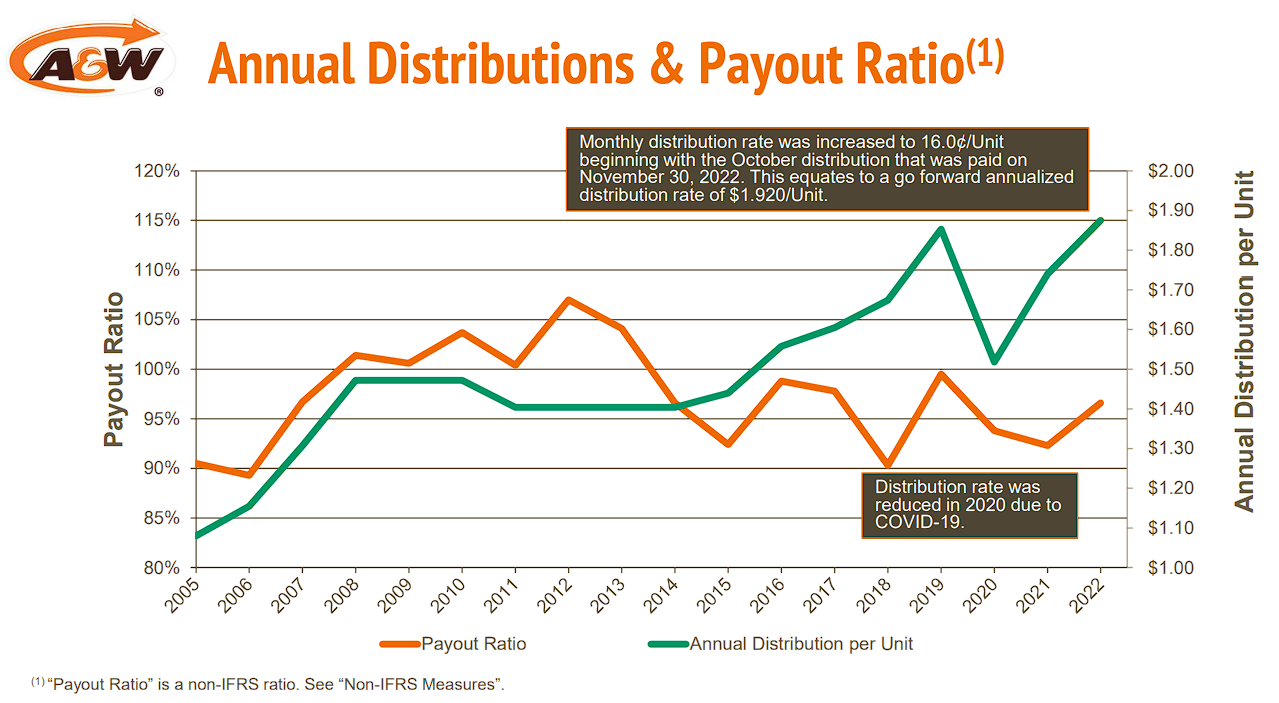

Consistent with the trust’s objective of distributing all of its earnings to unitholders, its payout ratio has consistently remained near 100%. As demonstrated earlier by the upward trend in the company’s royalty-eligible gross sales, the trust’s distributions have also increased over time. Management may slightly adjust the payout ratio to ensure a more predictable monthly income for unitholders, smoothing out the rate of monthly distributions over time.

In 2022, the trust’s payout ratio was 96.6%, paying out a record C$1.875 in distributions per unit out of the C$1.941 in distributable cash per unit.

Source: Investor Presentation

Investors should not expect distribution increases or distribution “cuts” but instead expect that each year’s total distributions per unit will vary based on the underlying gross sales of A&W-licensed restaurants.

That said, we believe that over time, the trust will continue to pay out larger distributions, following our aforementioned rationale regarding robust franchise interest and higher same-store sales.

The current monthly distribution of C$0.16 translates to an annualized rate of C$1.92 (or $1.42), implying a yield of 5.3%. It may not be an enormous yield, but the dividend’s potential for growth is significant and adds to its overall appeal.

Final Thoughts

A&W Revenue Royalties Income Fund’s investment case is rather compelling. Its frictionless revenue model and purpose of distributing the entirety of its earnings, along with the highly attractive frequency of its monthly payouts, make it a highly enticing pick for income-oriented investors.

The trust’s yield of 5.3% is especially attractive, and it is expected to grow in line with the established trend of increased franchised locations and same-store sales growth. While extreme events like the COVID-19 pandemic may temporarily impact distributions, we are confident that they will continue to rise over time. Despite the pandemic’s strict lockdowns in 2020 and 2021, the trust’s earnings and distributions hit record levels in 2022, highlighting the resilience of its brands and royalty model.

In conclusion, we believe that A&W Revenue Royalties Income Fund could be a fitting choice for income investors seeking a notable yield with the potential for dividend growth in a robust and resilient investment vehicle.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.

[ad_2]