[ad_1]

Published on April 6th, 2023 by Aristofanis Papadatos

Extendicare (EXETF) has two appealing investment characteristics:

#1: It is a high-yield stock based on its 7.6% dividend yield.Related: List of 5%+ yielding stocks.#2: It pays dividends monthly instead of quarterly.Related: List of monthly dividend stocks

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yield and payout ratio) by clicking on the link below:

The combination of a high dividend yield and a monthly dividend render Extendicare appealing to income-oriented investors. In addition, the company is ideally positioned to benefit from the secular growth of demand for health care services. In this article, we will discuss the prospects of Extendicare.

Table of Contents

You can instantly jump to any specific section of the article by using the links below:

Business Overview

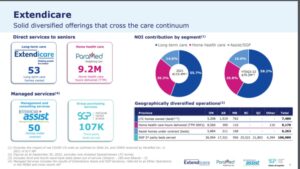

Through its subsidiaries, Extendicare provides care and services for seniors in Canada. The company offers long-term care (LTC) services, home health care services, such as nursing care, occupational, physical, and speech therapy, assistance with daily activities, and contract and consulting services to third parties. It operates LTC homes, retirement communities, and home healthcare operations under the Extendicare, ParaMed, Extendicare Assist, and SGP Partner Network brands. The company was incorporated in 1968 and is based in Markham, Canada.

Extendicare operates or provides contract services to a network of 103 long-term care homes and retirement communities (53 owned/50 contract services), providing approximately 9.2 million hours of home health care services per year.

Source: Investor Presentation

The company employs about 19,000 highly trained employees.

Extendicare has been hurt by the coronavirus crisis, which has caused many problems in the daily operations of the company. COVID-19, influenza, and other viruses have resulted in abnormally high absenteeism of employees, thus exacerbating an already tight labor market. As a result, Extendicare has seen its operating costs increase significantly since the onset of the coronavirus crisis.

In the fourth quarter of 2022, Extendicare improved its long-term care occupancy from 93.5% to 94.5% and sequentially grew its home care volumes by 2%. However, due to unfunded COVID-19 costs of $13.4 million, the company saw its adjusted EBITDA slump from $24.5 million to $9.2 million.

On the bright side, thanks to the massive distribution of vaccines, the pandemic has subsided this year. As a result, the company expects the effect of the pandemic on its business to attenuate in the upcoming months.

Moreover, thanks to the essential nature of its business, Extendicare is likely to prove resilient in the event of a potential recession. Even under the most adverse economic conditions, people hardly reduce their healthcare expenses. The defensive business model of Extendicare is paramount in the current investing environment, given the global economic slowdown caused by the aggressive interest rate hikes of central banks.

Overall, Extendicare is facing a downturn due to the impact of the coronavirus and other viruses on its personnel but it is likely to recover strongly from this downturn in the upcoming quarters.

Growth Prospects

Extendicare is ideally positioned to benefit from a strong secular trend, namely the growing demand for healthcare services. The demand for health care from seniors who are above 85 years old is growing at a 4% average annual rate.

Source: Investor Presentation

Moreover, there is an immense backlog of demand for long-term care beds, with more than 39,000 seniors waiting for a bed in Ontario alone. According to official estimates, there will be a need for more than 200,000 new long-term care beds in Canada by 2035. Thanks to its 55-year experience in this business, Extendicare is ideally poisoned to benefit from the secular growth in the demand for health care services.

On the other hand, investors should be aware that Extendicare has exhibited a volatile performance record. Due to the aforementioned impact of the pandemic on its business, the company has not grown its earnings per share over the last decade. Therefore, the stock is suitable only for patient investors, who can endure extended periods of poor business performance and stock price volatility and remain focused in the long run. Given the low comparison base formed this year, we expect the company to grow its earnings per share by about 5.0% per year on average over the next five years.

Dividend & Valuation Analysis

Extendicare is currently offering a 7.6% dividend yield. It is thus an interesting candidate for income-oriented investors but the latter should be aware that the dividend may fluctuate significantly over time due to the fluctuation of the exchange rates between the Canadian dollar and the USD.

The company has a decent payout ratio of 61%, but its interest expense currently consumes 79% of its operating income. On the bright side, its net debt is standing at $330 million, which is 81% of its market capitalization, and hence it is manageable. To cut a long story short, the 7.6% dividend is not likely to be cut in the near future, but it is not entirely safe in the long run, given the material interest expense of the company.

Moreover, Extendicare has not grown its dividend (in USD) over the last nine years, partly due to the devaluation of the Canadian dollar vs. the USD. Therefore, it is prudent for investors not to expect material dividend growth going forward.

In reference to the valuation, Extendicare is currently trading for 8.3 times its earnings per share in the last 12 months. Given the expected recovery of the company, we assume a fair price-to-earnings ratio of 10.0 for the stock. Therefore, the current earnings multiple is lower than our assumed fair price-to-earnings ratio. If the stock trades at its fair valuation level in five years, it will enjoy a 3.8% annualized gain in its returns.

Taking into account the 5% annual growth of earnings per share, the 7.6% dividend, and a 3.8% annualized expansion of valuation level, Extendicare could offer a 13.7% average annual total return over the next five years. This is certainly an attractive expected return. Nevertheless, the stock is suitable only for patient investors who are comfortable with the volatile business performance and the stock price of Extendicare.

Final Thoughts

Extendicare has a solid business model in place and greatly benefits from the growing demand for healthcare services. The stock offers an attractive dividend yield of 7.6% with a healthy payout ratio of 61% and hence it is an attractive candidate for the portfolios of income-oriented investors, particularly given that the stock has an attractive expected return of 13.7% per year over the next five years.

On the other hand, investors should be aware of the risk resulting from the company’s somewhat weak balance sheet and its choppy business performance. Therefore, the stock is suitable only for patient investors, who can ignore stock price volatility and remain focused in the long run.

Moreover, Extendicare is characterized by exceptionally low trading volume. This means that it is hard to establish or sell a large position in this stock.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.

[ad_2]