[ad_1]

Published on March 27th, 2023 by Nathan Parsh

Companies that provide monthly dividend payments can help investors secure consistent cash flows, helping to provide income on a more regluar basis compared to those that pay quarterly or annual payments.

That said, there are just 86 companies that currently offer a monthly dividend payment, which can severely limit the investor’s options. You can see all 86 monthly dividend paying names here.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter, like dividend yield and payout ratio) by clicking on the link below:

One name that we have not yet reviewed is Savaria Corporation (SISXF), a Canadian-based company that operates in the accessibility industry. Shares currently yield more than 3%, which is roughly twice the average yield of the S&P 500 Index.

This article will evaluate the company, its business model, and its dividend to see if Savaria Corporation could be a good candidate for purchase.

Business Overview

Savaria Corporation is a specialty industrial machinery company that provides accessibility solutions for the elderly and disabled. Though the company has a market capitalization of just $734 million, Savaria Corporation has a solid footprint around the world.

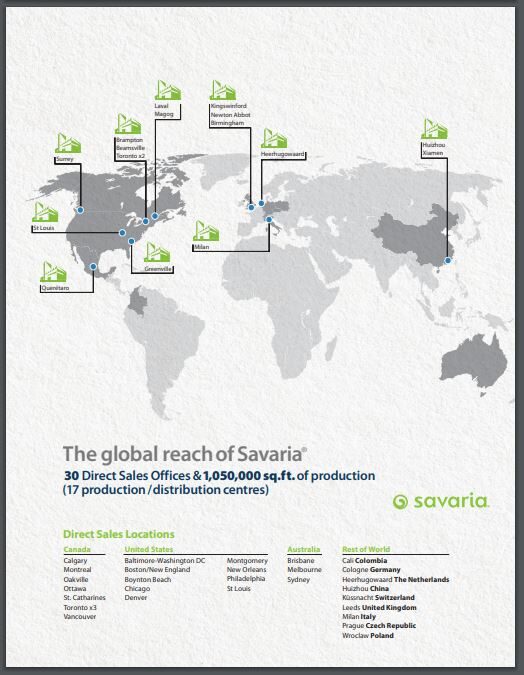

Source: 2022 Annual Report

The company has operations in Canada, the U.S., the U.K., Germany, China, and Italy, among others. In total, Savaria Corporation has more than 1 million square feet of production space, 30 direct sales offices, and 17 product and distribution centers.

Savaria Corporation is comprised of several business segments, including Accessibility, Patient Care, and Adapted Vehicles.

Accessibility manufactures products such as stairlifts for straight and curved staircases and wheelchair platform lifts. This segment contributes ~70% of revenue. Patient Care, which accounts for 21% of revenue, manufactures and markets therapeutic support surfaces for medical beds and other medical equipment. Adapted Vehicles produces vehicles for use by patients with mobility difficulty. This segment is the smallest within the company, making up less than 10% of total revenue. The company was founded in 1979 and is based in Laval, Quebec, Canada.

Savaria Corporation reported fourth quarter and full year results on March 15th, 2023.

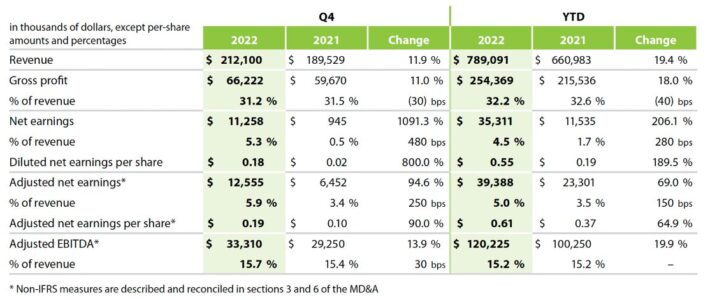

Source: Fourth Quarter Results

Results for both the quarter and year demonstrated strong growth rates. For the quarter, revenue was up nearly 12% while adjusted earnings-per-share almost doubled from the prior year. Full year revenue grew more than 19% while adjusted earnings-per-share of CAD$0.61 compared very favorably to CAD$0.37 in 2021.

Organic growth for the year was very high at 12.7% and acquisitions added 8.9% to results, which were offset by a small headwind from currency exchange rates. Organic growth for both Accessibility and Patient Care was 8.7% in the fourth quarter while Adapted Vehicles improved 62.1%.

One area of concern is that Savaria Corporation carries a substantial amount of debt for a company of its size. Net debt stood at $369.4 million as of the end of the most recent quarter, equating to more than 50% of its market capitalization. However, the company’s operating cash flow is solid, including nearly $91 million last year, that can be used to pay down debt. Savaria Corporation’s ratio of net debt to adjusted EBITDA was high at 3.07 last year, but this was down from 3.73 as of December 31st, 2021.

Growth Prospects

Savaria Corporation has a number of tailwinds that should help the company continue to grow into the future. First, the company’s main markets are seeing elderly people make up a higher percentage of the total population. In the U.S. alone, those over 65 years old are projected to make up 21% percent of the population by 2030. People in this age group tend to require more assistance with mobility.

Next, the vast majority of older people wish to remain in their homes. According to AARP, nearly 80% of people over 50 want to stay in their homes as they age. More than two-thirds say that their properties have accessibility issues inside and outside of the home.

Savaria Corporation estimates that the global long-term market will grow at 6% annually through 2030, which is a solid, if not spectacular, growth rate. The U.S. is forecasted to have 24 million people require long-term care by the end of this decade.

Given that people are living longer, want to remain in their homes, and have accessibility challenges, a company like Savaria Corporation is poised to benefit from the demand for products.

The company offers a variety of products, from chair lifts to vehicles to beds, that can greatly improve the quality of life for customers. This can also help people remain in their homes as opposed to having to enter into an adult care center, which can be much more expensive than the products that Savaria Corporation markets. People wishing to remain in their home could very well be willing to purchase a product if it means that they can continue to live as they have.

Dividend Analysis

Savaria Corporation began paying an annual dividend before switching to a quarterly dividend in 2013. By late 2017, the company converted to its current monthly payment schedule.

Payments have fluctuated for U.S. investors due to currency exchange, but the size of the dividend has gradually increased over the years. U.S. investors received $0.3888 in annual dividends last year compared to $0.3872 in 2021. As you can see, dividend growth has typically been very low. We do not anticipate that this will change.

The reason that the dividend hasn’t increased materially in the past and is not forecasted to so in the near future is due to the high payout ratio. Last year, Savaria Corporation’s payout ratio was 85%. With results showing signs of growth, the dividend is likely safe. A downturn in the business could call that into question, especially considering the debt on the company’s balance sheet.

The annualized rate of $0.38 for U.S. investors results in a 3.3% yield.

Final Thoughts

Savaria Corporation is a small monthly dividend paying company that is well-positioned to take advantage of people living longer. With most people wanting to remain in their homes, the need to tackle accessibility and mobility challenges will likely be a major industry in the coming decade.

This positions the company in an advantageous spot. A growing business should help to defend the dividend and provide the capital needed to pay down debt to a much more manageable level. Lower debt would also help to protect the dividend. Investors looking for monthly income and access to a growing population might find Savaria Corporation an attractive investment option.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.

[ad_2]