[ad_1]

JodiJacobson/E+ via Getty Images

National Storage Affiliates (NYSE:NSA) owns and operates self-storage properties predominantly located within the top 100 metropolitan statistical areas (“MSAs”) throughout the United States.

In total, the company has an interest in over 1,100 properties, 72% of which are managed by the NSA corporate platform. NSA also has a differentiated operating model that utilizes participating regional operators (“PROs”) in the management of their properties. As of December 31, 2022, PROs managed 385 of their properties.

Through the PRO model, participants exchange their self-storage properties to NSA in exchange for a combination of OP units and subordinated performance units. This enables the PRO to serve as regional property managers for their managed portfolios, while also directly participating in the upside of those properties.

This model also provides NSA with a large captive acquisition pipeline, which is especially important in uncertain transactional markets.

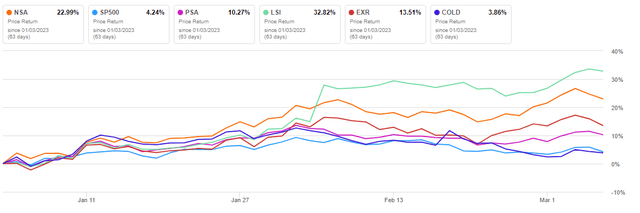

YTD, shares in NSA are performing strongly in relation to both the broader markets and related peers, up over 20% during this period. Life Storage (LSI) is up over 30%, but gains there are due primarily to recent M&A-related activity.

Seeking Alpha – YTD Returns Of NSA Compared To Related Peers And The Broader Market

The stock is, however, still down nearly 30% over the past one year. And they are up just over 4.5% since a prior update on the stock. This trails a gain of over 5% by the broader markets (SPY) over the same period.

In addition to upside potential, shares come paired with an attractive dividend payout that is backed by a strong track record of continuous growth. At current trading levels, NSA remains a quality add to the portfolio of any investor in real estate investment trusts (“REITs”).

Recent Performance and Current Portfolio Metrics

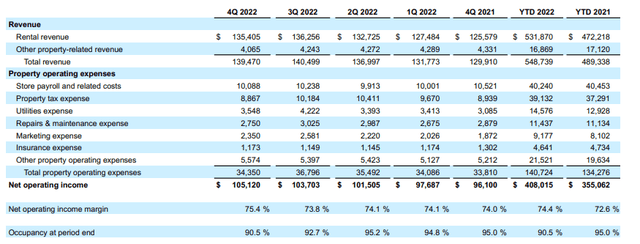

For the full 2022 fiscal year, NSA reported core funds from operations (“FFO”) of $2.81/share. This was up 24% from the prior year, driven in part by a YOY increase in same-store net operating income (“NOI”) of 14.9%. The same-store strength was attributable to 12.1% growth in revenues, which more than offset a 4.8% increase in operating expenses.

For the quarter, core FFO was up 10.9% on same-store NOI growth of 9.4%, largely due to a 7.4% increase in total revenues.

While increases in average annualized rental revenue per occupied square foot of 12.4% and 13.4% for the quarter and YTD, respectively, contributed to the increase in total same-store revenues, occupancy declines partially offset these tailwinds. Total year end same-store occupancy, for example, was down 450 basis points (“bps”) compared to last year.

Though occupancy was down significantly from last year, NSA still generated margins of just over 75%. This is higher than what they posted in the trailing four quarters and for all of 2021.

Q4FY22 Investor Supplement – Summary Of NOI Margin And Occupancy For The Trailing 5 Quarters

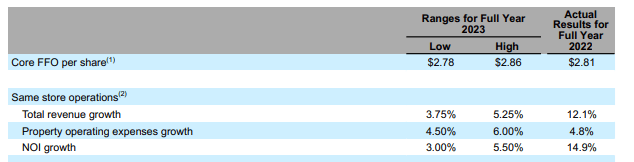

Looking ahead to 2023, management is expecting same-store growth to return to long-term averages. This would be about 4.5% and 4.25% at the midpoints of their stated range for total revenue and NOI growth, respectively.

Q4FY22 Investor Supplement – Partial Summary Of 2023 Guidance

All things considered, core FFO/share is expected to land at a midpoint of $2.82/share. This would be just a penny higher per share than their 2022 results. Weighing on expected results is expectations of higher interest expense, which is forecasted to be +$150M for the year.

Liquidity and Debt Profile

At year end, total leverage stood at 6x, as measured as a multiple of net debt to EBITDA. This stands at the midpoint of their targeted range of 5.5x to 6.5x.

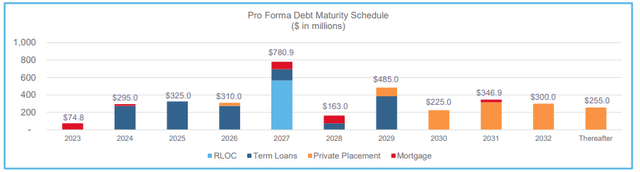

In early January 2023, NSA expanded their total borrowing capacity to +$950M via the recasting of their credit facility. And in connection with this recast, NSA satisfied two large maturities totaling +$300M that would have been due in 2023. This was accomplished via +$230M in incremental borrowings on existing term loans, as well as by drawdowns on their revolver.

Following their activities in the capital markets, their weighted average effective interest rate ticked higher by about 5bps. But this was offset by an increase in their weighted average maturity to 5.7 years from 5.1 years previously.

March 2023 Investor Presentation – Debt Maturity Schedule

Additionally, their variable rate exposure pulled down to about 17% of their total stack. This is notably improved from 24% at the end of Q3.

Aside from the repayment of debt, NSA’s principal long-term liquidity needs consists of property acquisitions and capital expenditures. In 2022, their transaction volume was the third largest year since their IPO, at +$569M.

Looking ahead, however, management is seeing fewer deals come to the market. And for those that do, price discovery challenges reign supreme. As such, they expect to acquire just +$300M in 2023 at the midpoint of their guidance.

But it is worth noting that in February of 2023, NSA entered into an agreement with one of their PROs to acquire a portfolio of properties located in Florida for approximately +$145M. This is expected to close in Q1 of fiscal 2023.

Dividend Safety

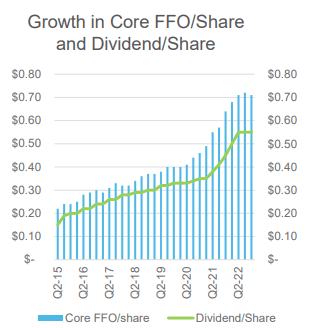

NSA’s full year dividend payout in 2022 was 35% higher than in 2021. This came as the payout was first increased in Q1 by 11% and then another 10% shortly thereafter.

It’s also notable that the Q4 dividend payout was 22% higher on a YOY basis and 189% higher than the payout provided at the time of their IPO in 2015.

March 2023 Investor Presentation – Dividend Growth History

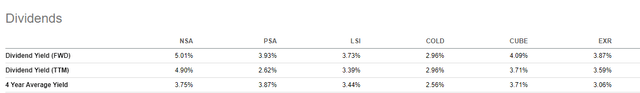

In addition to a strong track record of growth, the current payout is yielding about 5% at current trading levels. This compares favorably to their peers within the sector, whose payouts typically average in the mid 3s to the low 4s.

Seeking Alpha – Dividend Yield Of NSA In Relation To Peers

Compared to the midpoint of their 2023 FFO range, which currently stands at $2.82/share, the payout ratio is about 78%. To stress the payout even further, one can reduce the midpoint by about $0.20/share to account for their reoccurring and value enhancing capital expenditures. Even at this reduced value, the payout ratio would still be just 83%, which is in-line with sector averages.

For investors, the outlook for further increases ahead appears promising based on current earnings results.

Final Thoughts

In 2022, NSA delivered their second highest growth in core FFO since their IPO in 2015. In addition, following nearly 15% growth in their same-store portfolio, NOI and FFO/share are now more than 40% and 80% higher, respectively, than pre-pandemic levels in 2019.

The strength came even as they logged significant YOY declines in occupancy. These declines came as rates were continuously pushed higher throughout the year. Despite the declines, however, margins remained intact, even higher, in fact.

While some would express concern at the occupancy decline, it’s worth nothing that in January of 2023, same-store occupancy was over 250bps higher than in the same period in 2019. So, while the company is experiencing pushback from their current customers, they are still operating well-above pre-pandemic levels.

NSA’s unique PRO structure also provides them with a competitive advantage in relation to their peers, most notably in the acquisition market. While total targets have been scaled back for 2023, NSA has a sizeable captive pipeline that affords them the ability to acquire properties directly from their PROs.

Since there is an existing relationship, the bid/ask spread is unlikely to be as much of an issue than if they were shopping in the broader markets. This should keep their outlet for external growth open, regardless of current conditions in the overall transactional market.

At just 15.3x forward FFO, shares trade at an attractive valuation for new initiation. In addition, the stock comes with a dividend payout that is more competitive than that offered by their peer set. The quarterly rate is also likely to increase in future periods.

Consistent with a prior analysis, a 17x multiple isn’t unreasonable, given their current market positioning and outlook. At this valuation, shares would have upside of about 10%, excluding considerations for dividend growth. For investors, this would represent modest risk-adjusted potential in a challenging market environment.

[ad_2]