[ad_1]

Andreas Rentz

My Coverage History

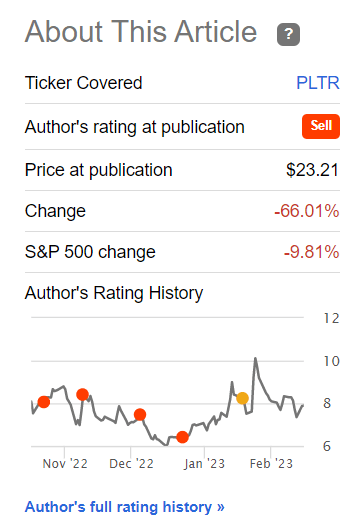

I have been covering Palantir Technologies (NYSE:PLTR) stock since early October 2021. Since then, 11 articles have been published, of which only the last one was Neutral. The other 10 were rated Sell – unsurprisingly, as a cycle of interest rate hikes ensued, investors began to demand higher equity returns [equity capital, expected returns] and overvalued companies – like PLTR – lost their momentum completely. This was due to a variety of factors – incessant competition, a dysfunction in the business models of some companies leading to a lack of cost control [COGS, OPEX], and the need to resort more and more to stock-based compensation [SBC], the unwillingness of counterparties and customers to make concessions, etc. But most important are the consequences that followed these causes: Palantir Technologies, like many other technology companies, experienced strong multiple contractions and downward earnings revisions, as a result of which its shares fell as if off a cliff:

My very first article on Palantir (Seeking Alpha)

I am not bragging – the consequences that occurred could have been more or less easily predicted in mid-2021 (if not earlier). Unlike many bears, I am aware that stocks can move back and forth during their bear-market rallies. Sometimes there is so much negativity that it is difficult to stay on the side of the bears. Such was the case in early February this year – I published an article called “Palantir: It May Get Better Before Getting Ugly” arguing that PLTR would most likely beat revenue and EPS expectations, based on actual data from peers’ reports at the time. That is why I changed my Sell rating to Neutral then. As history has shown, my call has aged extremely well:

Seeking Alpha News

Instead, however, as I warned, PLTR stock has returned below my call price and has since traded 0.76% below the S&P 500 Index (SPX). That’s not a huge difference, but given the post-release high, it’s a drawdown of more than 23% [off the local high on Feb. 16, 2023].

In today’s article, you will find out why I am reiterating my Neutral rating – in the thesis, I can say that the old issues have softened for the company, but the current earnings estimates do not give me the right to recommend PLTR even for very long-term investors. Let’s dive in.

Palantir’s Earnings Estimates: There’s A Problem

On February 13, 2023, Palantir Technologies released its Q4 earnings report, which showed the company beating the Street’s estimates in terms of non-GAAP EPS and revenue [surprises of 49.5% and 0.72%, respectively]. The company’s commercial revenue grew 11% year-over-year to $215 million, while government revenue grew 23% year-over-year to $293 million. Customer count grew 55% year-over-year and 9% quarter-over-quarter.

Although Palantir’s sales forecast for the first quarter of 2023 was below analysts’ expectations, investors seemed optimistic about the company’s profitability outlook. The company expects its Q1 sales to be between $503-507 million, compared to analysts’ initial forecast of $520.3 million. For the whole of FY2023, Palantir estimates its revenue to be in the range of $2.18-2.23 billion, which is less than analysts’ initial forecast of $2.29 billion. At the same time PLTR’s management guide for adjusted EBTI of $481-531 million – that’s a margin of 22.95% of sales, which is a bit better than the last reported quarter. For example, for Q4 2022 Palantir made $114 million in adjusted EBIT on total sales of $508.62 million – that’s a margin of 22.41%

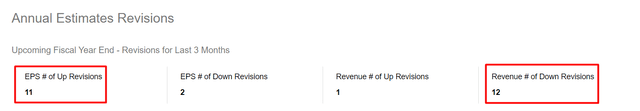

That is, management sees a slight margin expansion in FY 2023 – only 53 basis points. At the same time, Wall Street analysts rushed to raise their EPS growth forecasts and lower their revenue forecasts:

Seeking Alpha, PLTR’s earnings forecasts, author’s notes

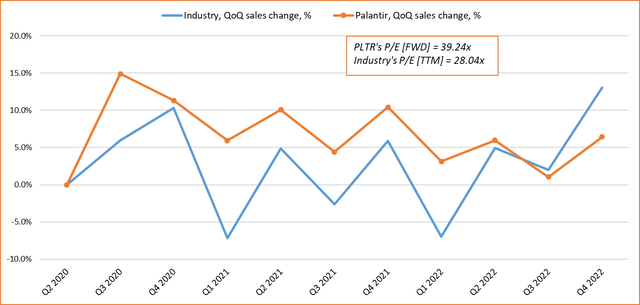

Many of my old readers will recall that in the last article, I compared the sales growth of the entire defense and aerospace industry [Bank of America’s Coverage List, 38 companies] with Palantir’s sales growth over the same period [the last 11 quarters]. I compiled this data manually from Seeking Alpha Premium sources.

Of all 38 companies, only 3 did not report for Q4 2022 – they had to be removed from the sample this time. I also removed all companies whose quarterly revenue was less than $200 million – as a result, my sample shrunk to just 31 companies. Here’s a look back at how PLTR’s revenue growth compares to its industry:

Author’s calculations [based on Seeking Alpha and Google Finance]

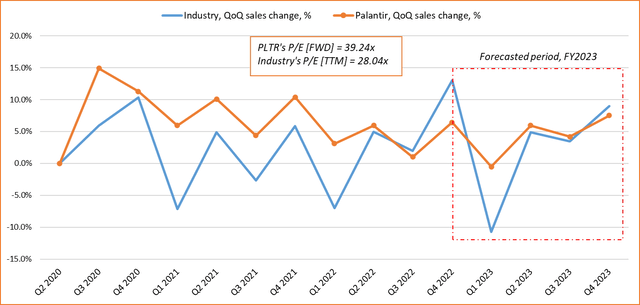

And here’s how forwarding revenue growth rates look, taking into account analysts’ consensus forecasts for calendar 2023:

Author’s calculations [based on Seeking Alpha and Google Finance]

Industry data is the sum of all sales figures, so Bombardier (OTCQX:BDRBF), Boeing (BA), and Raytheon Technologies (RTX) revenue drops of 47.27%, 10.7%, and 6.43%, respectively [QoQ], are dragging the entire sector down in Q1 FY2023. Therefore, I assume that the projected seasonal sales decline from PLTR will still not be that deep. In the coming quarters, things should take a turn for the better for the company. But again, we see that PLTR’s revenue growth is expected to narrow its spread with that of the industry. The company is forecasted to report revenue growth of 15.5% versus the industry’s 7.7% for the year, according to consensus data.

In contrast to revenue, I think the company’s EPS is in a very precarious state. That is the main problem I was referring to in the title, addressing Huston.

Palantir had an effective tax rate of 11.5% [data from Seeking Alpha, presumably non-GAAP] in Q4 2022, which is very low and likely to be higher in future periods. Yes, the company has no debt issues – interest income exceeds interest expense. But the increase in shares is still happening and will continue – at a much more moderate pace, but you cannot rule that out. From all this, a logical question arises: how sustainable is the $0.04 EPS forecast in the 1st quarter of FY2023 in light of the company’s projected revenue decline of -0.52% QoQ [industry revenue is expected to decline by -10.7%, QoQ]? In my opinion, even if the 53 additional basis points in the adjusted EBIT margin mentioned above – if they happen immediately in Q1 2023 – are not enough to offset the effect of the revenue decline, especially given the increase in shares outstanding.

We are still a couple of months away from the company’s next report [May 9, 2023], but at the moment it seems to me that Mr. Market has raised its expectations for Palantir’s profitability too high too quickly. The likelihood of the company significantly exceeding those expectations – as it did with Q4 FY2022 results – is less than the likelihood of failure. If I am correct, the premium valuation at which PLTR currently trades will continue to put pressure on the stock, and new lows could be ahead.

Palantir Stock’s Technical Analysis

From a technical analysis perspective, the situation looks somewhat mixed – at the moment, I do not see any pronounced signs of an obvious unilateral move. There are both bullish and bearish signs. On one hand, the stock is still below its 50-week exponential moving average [EMA], indicating the dominance of the bears in the market – the earnings bounce we saw in mid-February failed to take PLTR out of its long-term bearish trend. The Bollinger Bands’ barriers to growth – as marked by the yellow dots in the chart below – have worked relatively smoothly in recent weeks. If this continues, PLTR is likely to fall further – the next level is $6 per share, which is 24% below yesterday’s close.

TrendSpider, PLTR (weekly), author’s notes

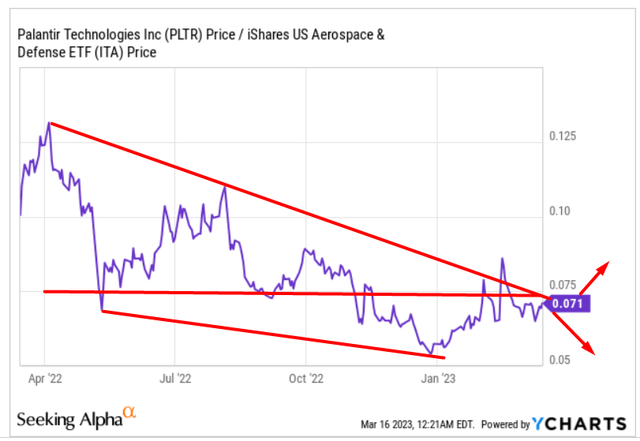

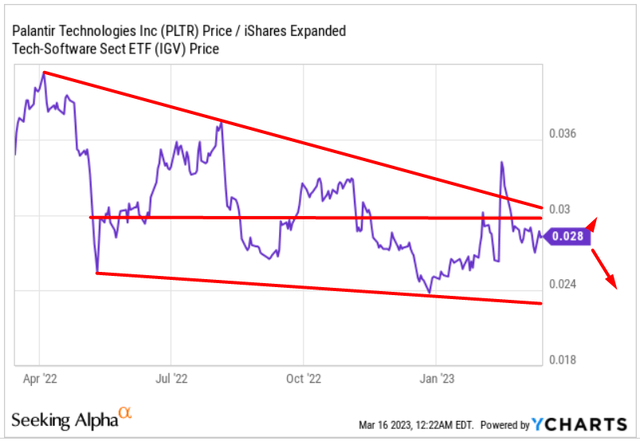

On the other hand, since the end of January, PLTR has shown relative strength concerning the defense sector – iShares U.S. Aerospace & Defense ETF (ITA) – and software stocks – iShares Expanded Tech-Software Sector ETF (IGV). If the positive momentum continues, PLTR may go beyond its usual ratios to these ETFs and most likely show relative strength going forward.

YCharts, author’s notes YCharts, author’s notes

Bottom Line

I cannot help but notice that the company has done quite a bit since my very first sell-rated article came out. The business model has proved that it can survive. But time has shown that this optimism in the eyes of the bulls disappeared as quickly as the growth rates – Palantir at one point underperformed its industry in terms of revenue growth. The multiple contraction came suddenly for all fast-growing companies, and Palantir was punished for reducing its appetite for expansion.

As we wait for the company’s next report, it seems that the market’s expectations for Palantir’s profitability in FY2023 were set too high too quickly. So I would not be encouraged by the positive results of the last quarter of FY2022 – their consequences are already fully priced-in.

With a valuation of 33.37 times the earnings of FY2024, PLTR is still too expensive. Yes, the profitability is already here – but it’s still adjusted for some things bulls do not like to talk about. Given recent events in the banking and VC sectors, I would not be surprised that investor attitudes towards risky assets will not change soon – there will not be a place for multiples to expand, which in itself reduces the chances of “10x returns” that many are now writing about. I’ll stay on the sidelines and continue to cover PLTR stock here on Seeking Alpha – maybe one day I’ll write my first Buy-rated article after all. But not today.

As always, your comments are welcome! Thanks for reading!

[ad_2]