[ad_1]

Randy Shropshire/Getty Images Entertainment

Executive Thesis

At the end of FY 2022, Paramount (NASDAQ:PARA) guided for a weak 2023, with peak content spending for their streaming transformation and cyclical ad weakness reducing near term free cash generation. Despite management’s warnings, the market has entered full panic after the MRQ results and dividend cut, selling off all the way to $14/share. Many investors were also likely looking to Warren Buffett to provide some reassurance after the aggressive selloff, and he provided no such consolation at his annual meeting.

I believe the dividend cut to be prudent given the current lack of free cash flow generation combined with the interest rate environment. I also wonder if Buffett’s odd commentary could indicate Paramount is a similar play to his purchase of the Washington Post 50 years ago. The recent selloff appears overdone and comparing Paramount to the Time Warner acquisition in 2018 as well as industry peers suggests a large margin of safety.

Reading Between the Lines on Buffett

If there were a few words I could use to describe Buffett’s values, I would pick partnership, reputation and respect. When he invests in a business he looks at himself as a co-owner and often wants to work with other majority holders to unlock shareholder value. What might be going on behind the scenes at Paramount right now, could be something similar to what happened at The Washington Post 50 years ago. Let me know if this rings any bells.

The market was valuing the Post at $80 million, when Buffett believed it could be sold to buyers for $400 million or more. This being the case, he purchased 10% of the non-controlling B shares outstanding and began conversing with the heiress of the news empire, Katharine Graham. Eventually, he was able to join the board of directors and helped encourage the company to purchase back 40% of its shares outstanding, cut costs, and unlock shareholder value.

Though I don’t envision Buffett joining the Paramount board anytime soon, what has happened in recent years appears to have long term shareholders in mind. First every bear’s favorite doom story, the dividend cut. I think this is one indication that perhaps Shari Redstone is aligning more with long term shareholder value creation, as cutting the dividend puts pressure on the ability of her family’s holding company, National Amusements, to service its debt.

It’s arguable that paying a high dividend makes absolutely no sense to a company with termed out debt and allegedly such a depressed share price relative to its intrinsic value. Retiring debt at a discount or buying back stock would be a much better use of cash, would be more tax efficient, and would increase value realized if any acquisition occurs. Not to mention the much higher costs that would be incurred refinancing debt in the current interest rate environment.

Following the dividend cut, many investors were likely looking to Buffett to provide them with some assurance that Paramount was still a good investment. He provided no such thing, and when asked at his annual meeting, rambled on about how cutting dividends is never a good thing and streaming is a horrible business. I do find his commentary interesting, as holding 15% of the B shares outstanding indicates some degree of confidence in the business. Clearly he is not willing to show his cards yet, and I’m wondering if he sees that there are multiple sharks vying for PARA’s assets, like he saw with the Washington Post so many years ago.

Riding on the coattails of Buffett is no proper way to invest, and any ideas of PARA being an acquisition target is pure speculation. So to supplement this, I decided to take a few approaches to valuation. I first wanted to look at a similar business that was acquired to get a better understanding of private market value, and luckily there was one that was sold to AT&T (T) a few years ago. Let’s take a closer look at the Time Warner deal.

The Time Warner Deal: Paramount’s Margin of Safety?

Time Warner was a pretty similar media conglomerate to what Paramount is now. It had a movie studio, Warner Bros, a premium entertainment service, HBO, and a number of broadcasting channels providing content for all ages, including live sports, news and other entertainment. Bears like to argue that acquiring such a wide reaching company would face antitrust issues, though we have precedent with Time Warner.

This deal shows that companies seeking to acquire streaming/broadcasting assets may not be the obvious ones you’d assume. Other companies may be trying to prevent any more power consolidation into the hands of big tech, and would potentially want to try to create horizontal monopolies of their own with acquisitions of these assets. For example, retail competitors of Amazon (AMZN) may be interested in having a streaming service to entice customers to sign up for their own Amazon Prime-like service. Another telecom might follow in the footsteps of AT&T, thinking they can execute better. Big tech companies may want to acquire Paramount’s assets simply because it means their competitors cannot. The potential acquirers are endless, and if PARA one day decides to sell, there should be no shortage of offers.

Valuation Based on Time Warner Deal

In FY 2017, Time Warner was earning about $8 billion in EBITDA and it was later acquired by AT&T for $85 billion. AT&T also assumed the net debt of the company, which in the 2017 annual report was about $15.5 billion. This puts the total enterprise value at around $100 billion, for a EV/EBITDA of approximately 12.5 for the deal.

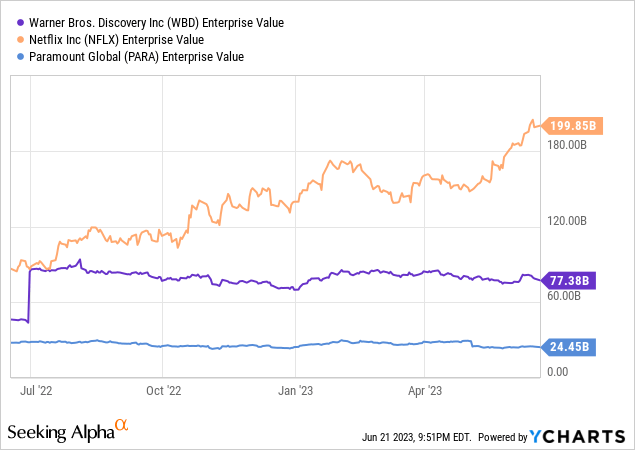

So how does Paramount compare here? Of course, EBITDA is severely depressed this year due to peak streaming spending and ad market weakness. Let’s be conservative and assume the more recent poor EBITDA performance of around $3 billion is a good estimate for long term performance. Taking the Time Warner acquisition multiple of 12.5, this would put the value of PARA at about $37.5 billion. With net debt at around $14 billion, this would leave 23.5 billion for the equity holders, or a fair value estimate of around $36/share. I believe this to be a conservative estimate, and any asset sales, debt pay-downs, and future EBITDA growth after peak content spending should revise this fair value up significantly.

Valuation Comparison to Peers

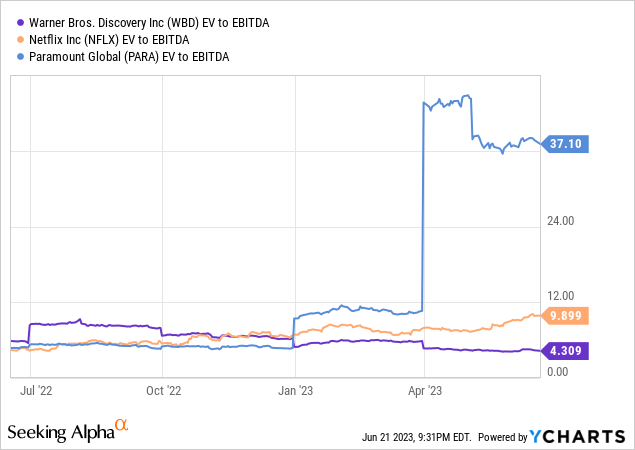

When looking at EV/EBITDA relative to industry peers such as Netflix (NFLX) and Warner Bros. Discovery (WBD), PARA appears to be overvalued. It is worth noting, that PARA EBITDA has been severely impacted by management’s focus on growing the streaming business into a formidable opponent to industry juggernauts.

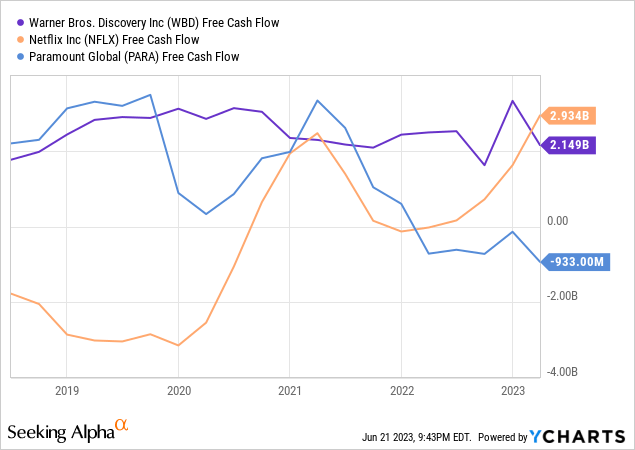

EBITDA though may not be a very accurate barometer of how profitable a business is, particularly in media. It replaces cash content costs with content amortization estimates. When looked at from a free cash perspective, Paramount’s position looks much more favorable at least prior to recent growth initiatives. PARA’s free cash generation was close to industry peers on average, at around $2 billion.

When comparing these normalized free cash flow metrics to enterprise value, the discount presented by PARA becomes quite striking. If management is to be trusted the company will be returning to free cash flow positivity in 2024. If it can return to even just $1 billion of free cash flow, the implied multiple at current prices would be an EV/FCF of 24, while at the moment WBD is trading at around 35 and NFLX around 65.

PARA also has been in the news for putting multiple assets up for sale including Simon and Schuster, BET, the CBS NYC headquarters and even Bellator, the company’s MMA division. If billions in asset sales are used to reduce debt, the EV/FCF discount (assuming PARA can return to FCF generation in 2024) relative to peers may become even more pronounced.

A Note on the Writers Strike: Demanding Streamers Make More Money

The main issue that screenwriters are protesting over is the lack of payment that is being made from residuals on streaming content, compared to previous forms of media consumption. I think this highlights the main problem that comes with the streaming transformation, and why it’s not a particularly good business model. Back in the day, it was pretty easy to figure out a compensation structure for writers and actors. Each DVD that gets sold, you get a x% cut which is fair, negotiable and also coming from a cash stream.

Streaming on the other hand, for the most part is a money losing all you can eat consumer buffet. How exactly can that be monetized better? I am not sure, and the entire industry has dug itself into a cash burning hole on this one initially led by everyone’s favorite streaming pioneer, Netflix. To be fair, more recently NFLX has focused on being cash flow positive though has lost money and funded with stock for years. Perhaps this is marking a shift in the golden age of cheap unlimited content for the consumer. For the sake of the employees and the stockholders, hopefully that is the case but I don’t know what the solution is. Perhaps more licensing deals, or perhaps not allowing unlimited streaming on shows forever. WBD has been in the news recently for considering licensing some HBO content to NFLX, so perhaps more of this will occur in the future.

Risks

Low Profitability

The company is burning cash right now and has ensured us that this is only temporary and should return to free cash generation in 2024. Time will tell, but if the company needs to keep spending heavily on content just to remain competitive, shareholder returns will also likely be muted.

Interest Rates

Currently, interest rates are much higher than they were a few years ago, and this could impact the sale price of PARA if investors are looking at it as a potential acquisition target. An EV/EBITDA multiple of 12.5 may not be realistic in this environment, like it was for Time Warner. Additionally, funding with debt is much more expensive in this environment, and it may be difficult to refinance or more costly to drawdown its revolver.

Controlling Shareholder

Shari Redstone has a controlling interest in PARA through National Amusements and may not act in the best interest of shareholders. Her desire to keep the family empire intact may prevent any acquisition talks from moving forward. There are signs that this could be changing though, with increased asset sales, pressure on National Amusement from the dividend cut, as well as the CFO publicly stating being very open to consolidation opportunities.

Warren Buffett

The backing of Warren Buffett is perhaps a great asset to have as he has a history of helping management teams maximize shareholder value. This could also be considered a risk, as if Berkshire Hathaway (BRK.A) (BRK.B) ever sold its position a major PARA selloff would likely occur.

Conclusion

The recent selling pressure appears to have more to do with a knee jerk reaction from the dividend cut rather than informed investor decision making. Management has been transparent even before the MRQ report that this year was going to be a cash burning one as peak streaming investment is realized. With interest rates where they are, it doesn’t make much sense to continue to pay a dividend that is not supported by free cash flow. Instead, cash from asset sales or future operations can be used to pay down debt, or if the macroeconomic picture improves, stock buybacks at historic lows.

If bulls are hoping for PARA to be an eventual acquisition target, this strategy will likely pay dividends as any reduction in debt or shares outstanding will hopefully increase payout. As Time Warner was purchased at an EV/EBITDA of around 12.5, this adds to the margin of safety, assuming that current PARA EBITDA is low relative to actual earnings power. Shareholders can also be consoled by the fact that PARA appears cheap on a normalized EV/FCF basis relative to industry peers. Hopefully, once peak spending on the streaming transformation is completed, PARA can show some strong EBITDA and free cash flow generation in 2024. After the recent pullback in stock price related to the dividend cut, I decided to add to my position.

[ad_2]