[ad_1]

Spencer Platt

Many investors like to see themselves as rational value seekers who adhere to Warren Buffett’s philosophy of being opportunistic when others are cautious. However, the reality is that investors desire to purchase assets at valuations that reflect extreme market pessimism, while hoping to avoid the actual pessimism that accompanies such conditions. But usually, one cannot have one without the other. With that frame of reference, PayPal’s (NASDAQ:PYPL) recent sell-off is quite interesting: The online payments system provider’s stock dropped about 20% in a few weeks, to a valuation of ∼x10 P/E, despite solid Q1 results and an attractive long term thesis supported by competitive strength, growth and profitability.

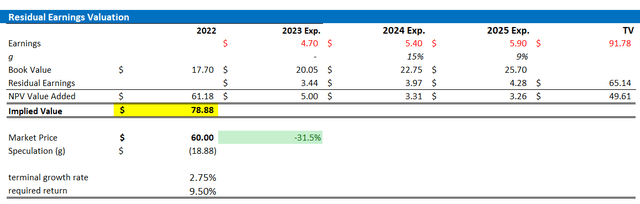

Anchored on my estimates for PYPL’s EPS through 2025, I calculate a fair implied share price of $78.88, implying a valuation gap of about 30% as compared to fundamentals — an undervaluation that I expect to close swiftly.

Q1 Did Not Disappoint Expectations

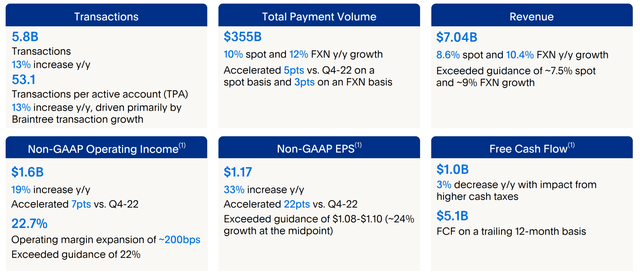

PayPal reported very solid Q1 2023 results, beating analyst consensus estimates with regard to both revenue and earnings. During the period from January to end of March, the online payment service provider generated total revenues of $7.04 billion, up about 10.4% YoY on a FX adjusted basis, and beating analyst consensus at midpoint by about ∼$50 million.

With regard to profitability, PayPal reported an operating margin expansion of about 200 basis points, bringing EBIT profitability to about 22.7% of revenue. Accordingly, first-quarter operating income grew to $1.6 billion, up 19% YoY; Adjusted EPS jumped by 33% YoY, to $1.17, beating consensus estimates by about 10 cents per share.

PayPal closed Q1 with less than $1 billion of net debt, as compared to a TTM operating cash flow of about $5.8 billion.

PayPal Q1 2023 reporting

Despite the solid Q1 earnings, markets punished PYPL stock lower the trading following the earnings report (PYPL stock was down more than 10%). Investors’ concern, arguably, related to the company’s margin guidance, as management lowered the FY23 operating margin estimate by about 25 basis points, to a YoY growth of 100 basis points this year. However, this is a minor negative considering the broad slowdown in e-commerce transaction volume and APP — a headwind that should eventually fade.

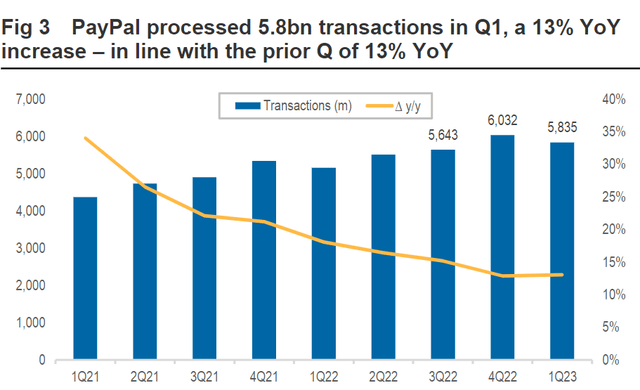

Macquarie equity research pointed out that PayPal’s ecosystem for digital payments continues to grow: In Q1 2023, the processed transaction count stood at 5.8 billion, a 13% YoY increase versus Q1 2022, and a 3.4% increase versus Q3 2022.

Macquarie research

Long-Term Thesis Attractive

PayPal’s long-term investment thesis revolves around its leadership in the digital payments industry, expanding market opportunities in e-commerce and mobile payments, and strong network effects that reinforce its position. All these factors, I argue, persist, despite temporary headwinds relating to a depressed e-commerce environment and a slower than expected margin expansion.

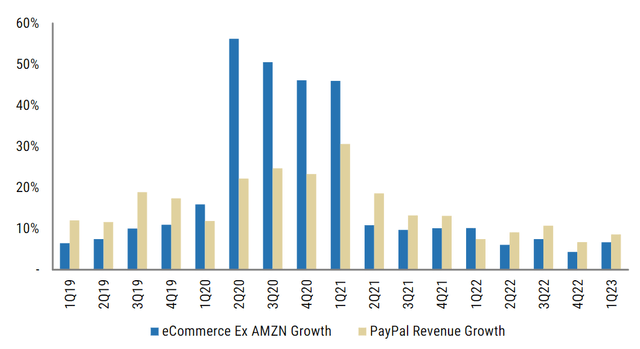

Morgan Stanley’s equity research team mapped PayPal’s revenue growth against the broader e-commerce growth (excl. Amazon) and pointed out that the two metrics have historically been quite strongly correlated. Moreover, the analysis reveals that PayPal has consistently outgrown the benchmark metric.

Morgan Stanley Equity Research

Referencing the chart above, investors should consider that YoY growth for e-commerce (excl. Amazon) in FY 2023 is estimated at only 3%, before rebounding to about 9% YoY growth in FY 2024, according to Morgan Stanley’s projections. If MS’ FY 2024 projections and modelled historical relationships hold, then one may reasonably assume that PayPal’s YoY revenue growth in FY 2024 will rebound to low double-digit expansion rates.

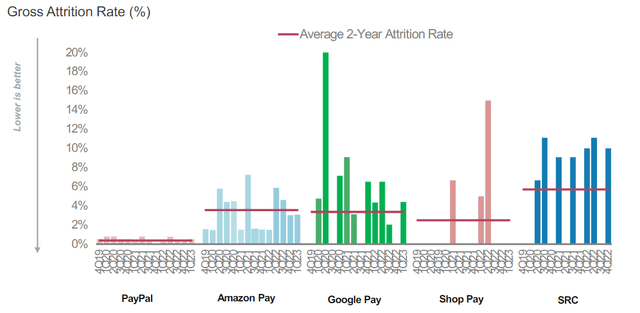

Investors should also consider that PayPal’s growth and earnings outlook beyond FY 2023 continues to be protected by strong moat, supported by network affects. To prove the point, Morgan Stanley mapped PayPal’s gross attrition rate versus peers, and highlighted that PayPal’s gross attrition is very low, generally >1%, while attrition for Amazon pay is around 2-6% and attrition for Google pay around 3-10%. For context: Attrition refers to the measurement of total customer contraction during a quarter, expressed as a percentage of the previous quarter’s count of merchants accepting the digital wallet.

Morgan Stanley Equity Research

Residual Earnings Valuation

To estimate a company’s intrinsic worth, I am a great fan of applying the residual earnings model, which anchors on the idea that a valuation should equal a business’ discounted future earnings after capital charge. As per the CFA Institute:

Conceptually, residual income is net income less a charge (deduction) for common shareholders’ opportunity cost in generating net income. It is the residual or remaining income after considering the costs of all of a company’s capital.

With regard to my PayPal stock valuation model, I make the following assumptions:

To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise. That said, EPS are estimated at $4.7, $5.4 and $5.9, for 2023, 2024 and 2025 respectively. To estimate the cost of capital, I use the WACC framework. I model a three-year regression against the S&P 500 to find the stock’s beta. For the risk-free rate, I used the U.S. 10-year treasury yield as of May 25th, 2023. My calculation indicates an estimated fair required cost of equity of about 9.5%. For the terminal growth rate, I apply a 2.75 percentage estimate, which is in line with global estimated nominal GDP growth and reflects growth conservatism for an asset likely PayPal, in my opinion.

Based on the above assumptions, my calculation returns a base-case target price for PYPL of $78.88/share, implying about 30% upside.

Company Financials; Author’s EPS Estimates; Author’s Calculation

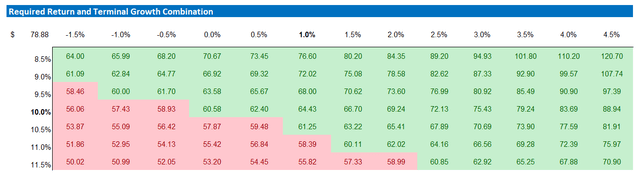

I understand that investors might have different assumptions with regards to PYPL’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Company Financials; Author’s EPS Estimates; Author’s Calculation

Conclusion

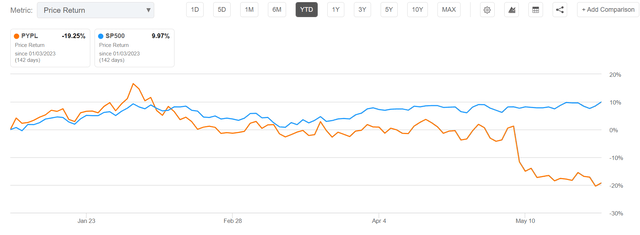

PayPal shareholders are having a tough time: Since the start of the year, PYPL shares are down about 19%, as compared to a gain of close to 10% for the S&P 500 (SP500). And as compared to PYPL’s all time valuation high in Q3 2021, shares are down more than 80%!

Seeking Alpha

However, as I see it, PayPal’s fundamentals do not support any reason for concern — PayPal continues to defend leadership in the digital payments industry, and enjoys a favorable growth outlook anchored on expanding market opportunities in e-commerce and mobile payments. Accordingly, a change in sentiment has likely been the major driver of PayPal’s most recent share price depreciation. And in my opinion, positive sentiment may return quickly once the e-commerce market returns to ∼9% YoY growth in 2024, likely prompting a fast and aggressive repricing. Anchored on my EPS estimates through 2025, I calculate a fair implied share price for PayPal equal to $78.88; it’s a ‘Buy’.

[ad_2]