[ad_1]

Breaking Down the Balance Sheet

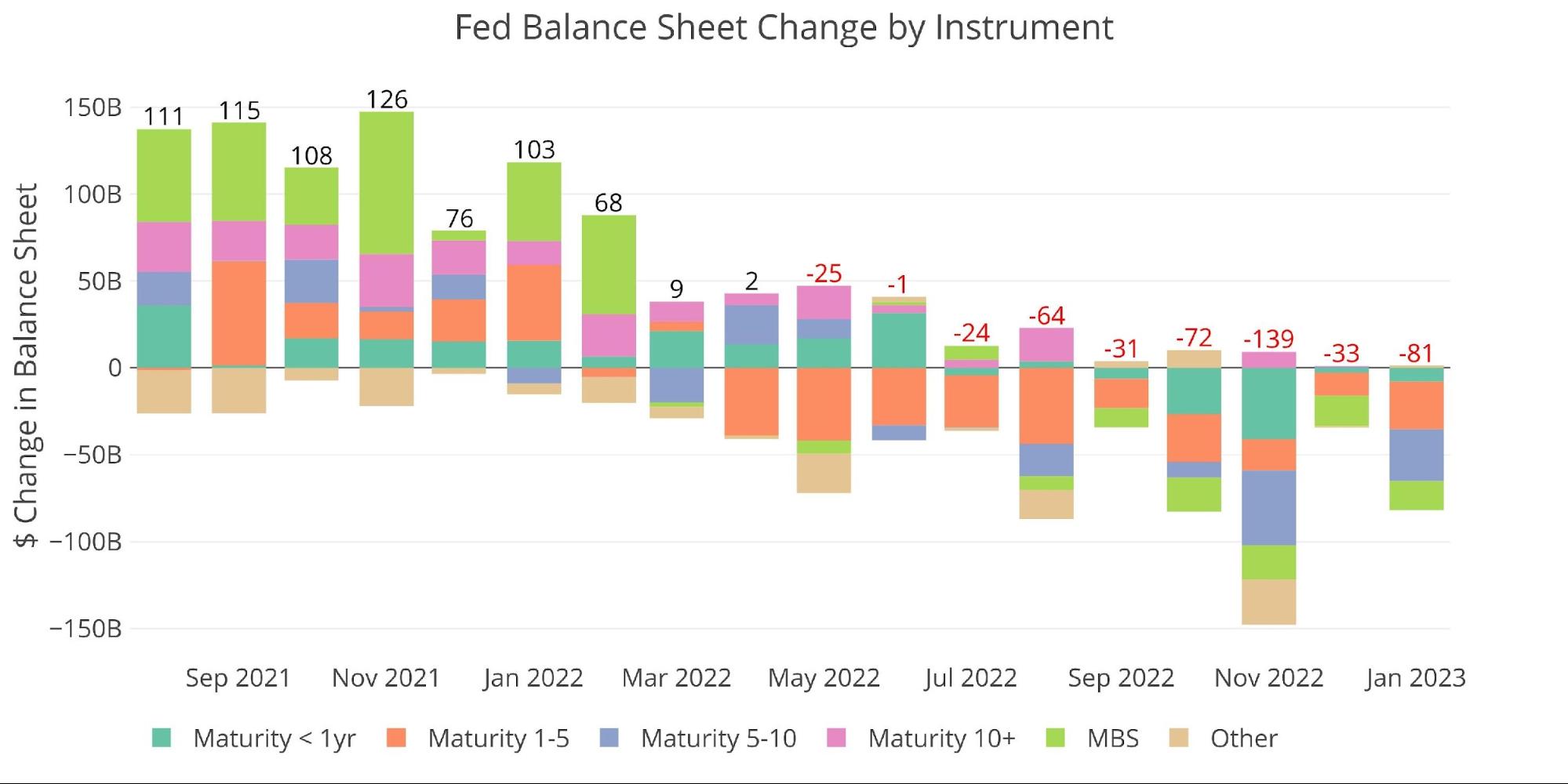

The Fed has a targeted balance sheet reduction of $95B a month. The Fed has failed to meet its target in 7 of the last 8 months with only an $81B reduction in January.

The Fed fell woefully short of meeting their $35B MBS target, seeing only $16.7B (less than 50% of the target). The Treasury target was met.

Figure: 1 Monthly Change by Instrument

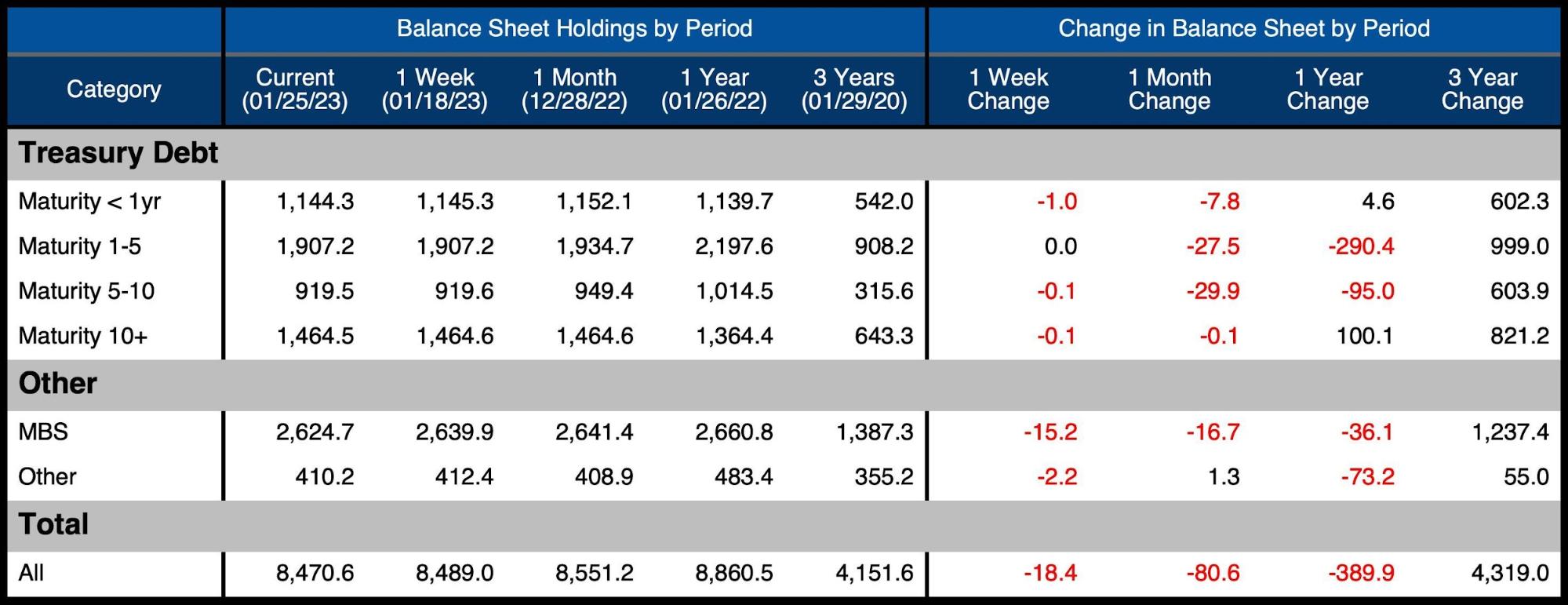

The table below details the movement for the month:

All Treasury securities saw reductions over the month

The focus was in the 1-10 year range which shed $57.5B alone

MBS has missed the target every single month. Before the latest week, MBS reduction had only reached $1.5B in January

Figure: 2 Balance Sheet Breakdown

Looking at the weekly data shows that activity has been very quiet over the last several weeks with little movement in either direction.

Figure: 3 Fed Balance Sheet Weekly Changes

As the Fed continues to miss on the MBS reduction, the overall portfolio allocation of MBS has grown. MBS is up a full percentage point compared to a year ago. 10+ year treasuries have also risen in the last year as well as a percentage of the total portfolio.

Figure: 4 Total Debt Outstanding

A lost Revenue Source for the Treasury

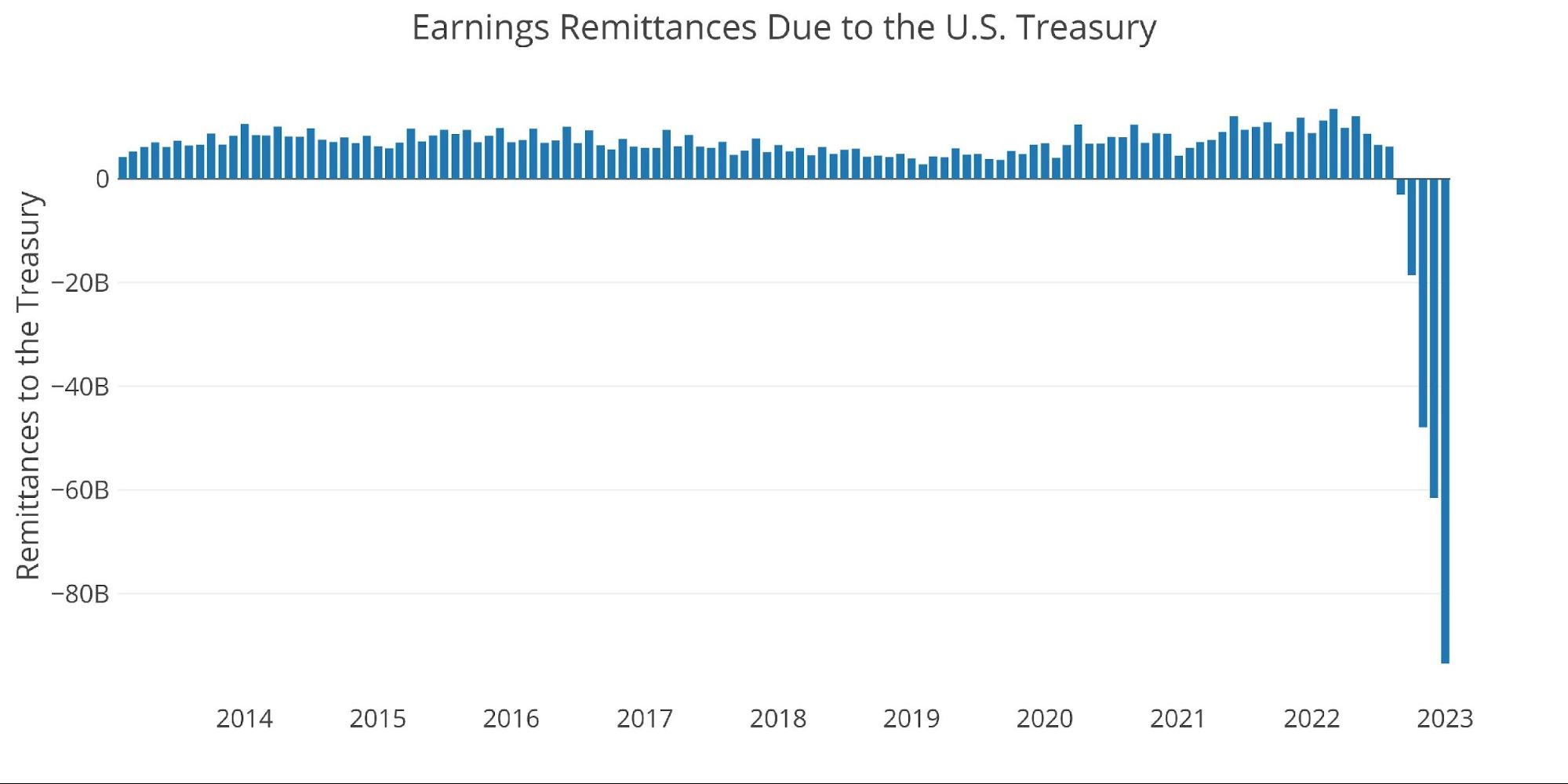

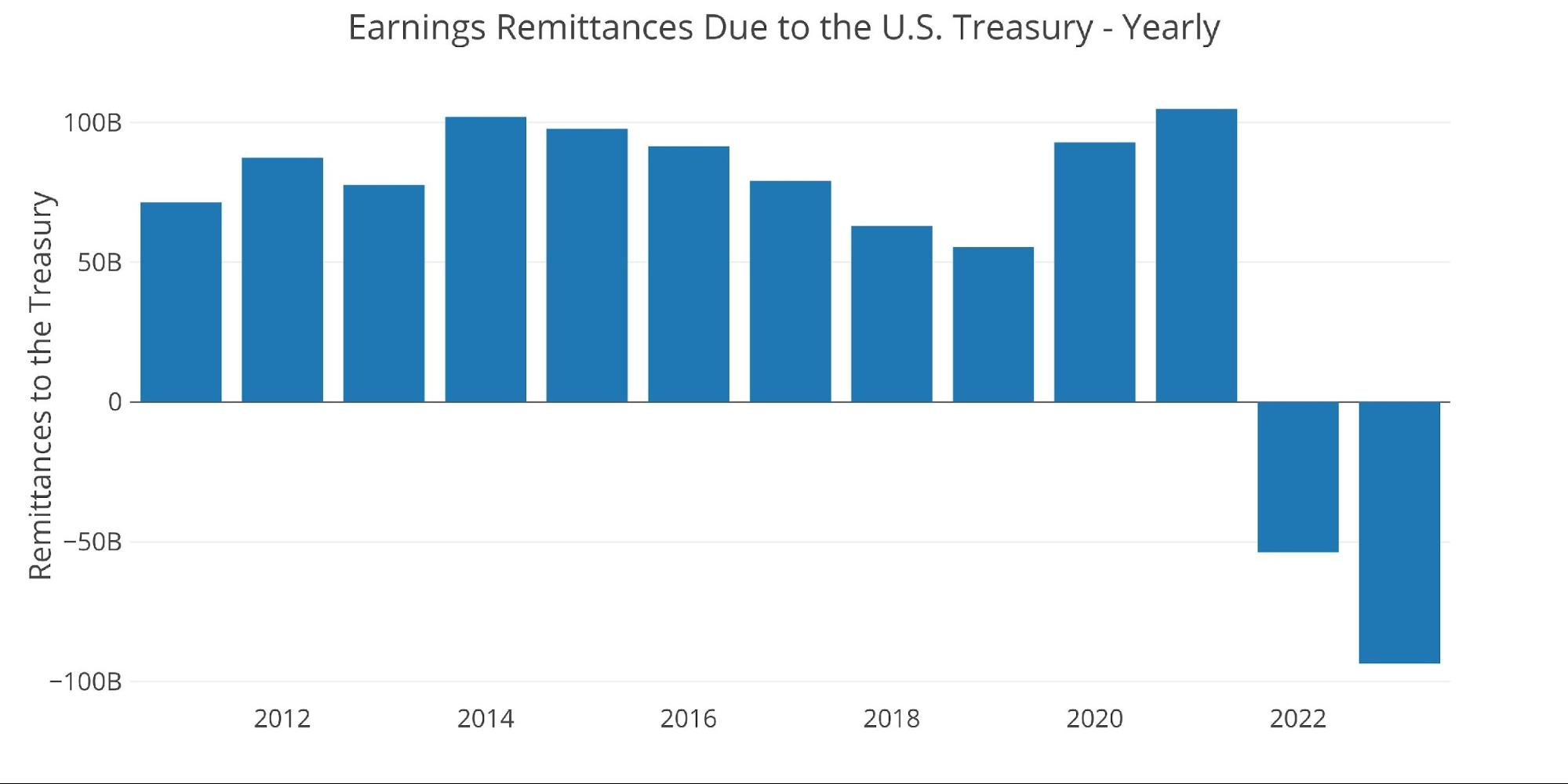

When the Fed makes money, it sends the Treasury a check. This has been quite substantial over the years, totaling $105B in 2021 and $93B in 2020. That time has come to the end. The Fed lost $53B in 2022. Most of the loss came in the last few months.

According to Reuters, the Fed has been warning about this possibility for some time. It should be noted, the Fed will not send the Treasury a bill to cover its losses. Instead, it will book the losses into a deficit account that will be held until the Fed makes enough money to make up for its losses.

Figure: 5 Fed Payments to Treasury

The Fed is set to see massive losses in 2023 that could wipe out all the gains sent to the treasury over the last several years. It may take years to pay back all the losses the Fed is set to see in 2023. This will only hurt the budget deficit further.

Figure: 6 Fed Payments to Treasury

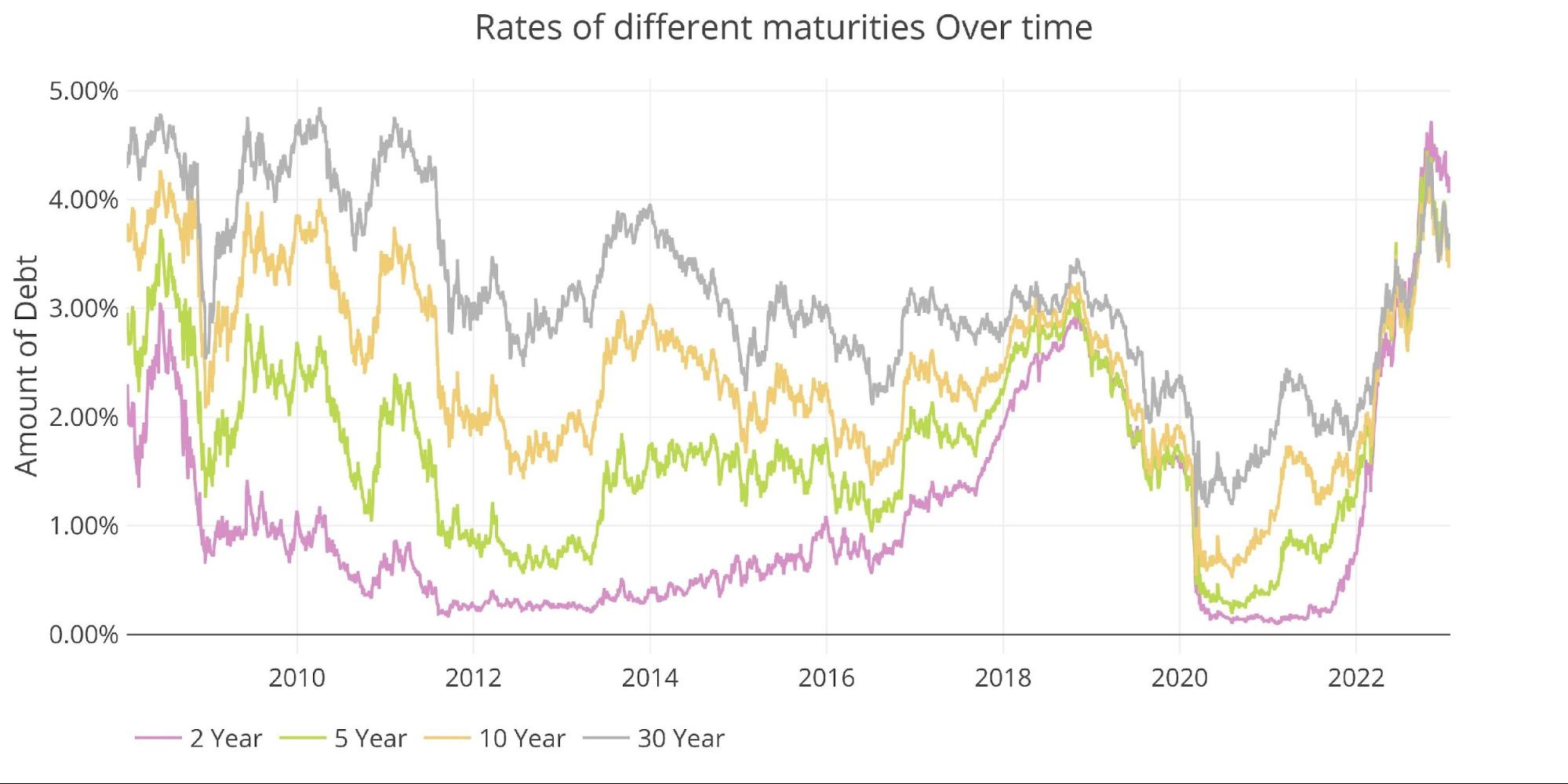

The Fed is losing money because it pays financial firms for keeping assets on the Fed books. As interest rates have risen, the amount it pays out has also risen. It also loses money when it buys bonds at high prices and sells them at low prices, which is what has unfolded with QE and QT. As the chart below shows, interest rates have risen dramatically in recent months.

Figure: 7 Interest Rates Across Maturities

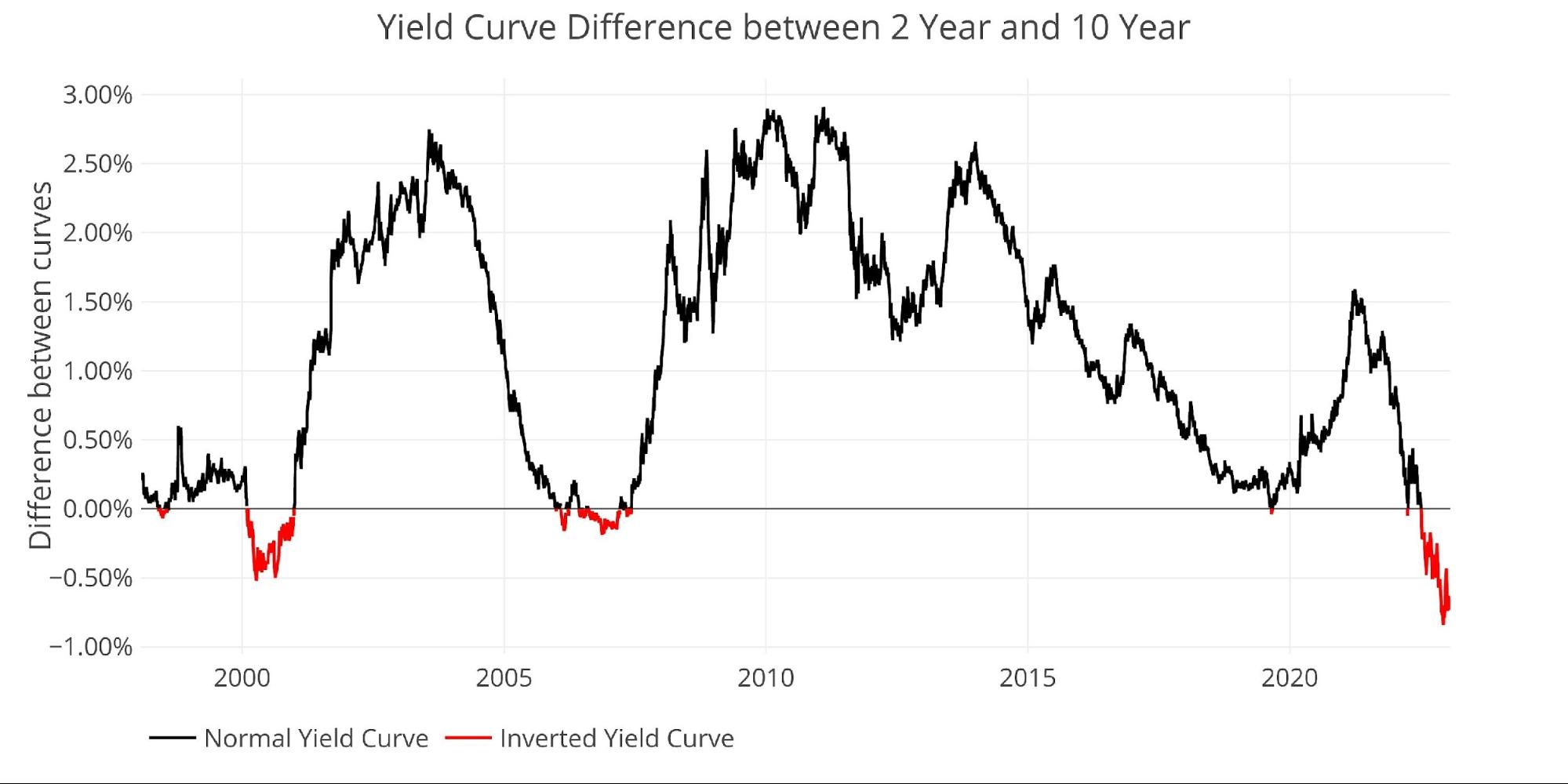

The yield curve remains heavily inverted at -65bps. This is off the lows seen in December but is still deep in negative territory signaling a recession is almost certainly on the horizon.

Figure: 8 Tracking Yield Curve Inversion

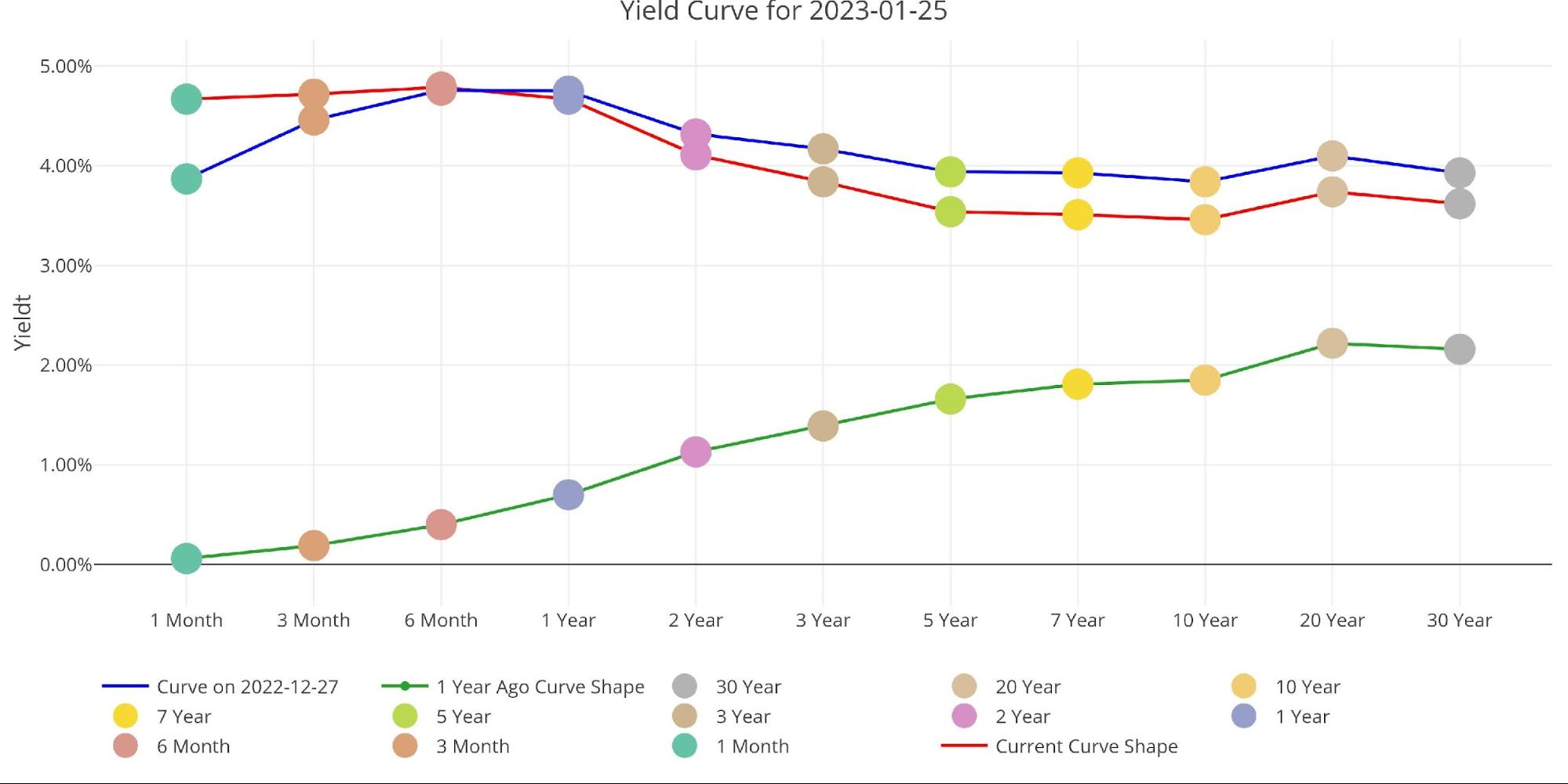

The chart below compares the yield curve at three points in time (current, 1 month ago, and 1 year ago). It’s clear from this view to see that the yield curve has inverted quite a bit in the last month alone. The latest yield curve reflects the most recent hike by the Fed.

Figure: 9 Tracking Yield Curve Inversion

Who Will Fill the Gap?

Bloomberg recently published an article that shows how the typical Treasury buyers have all stepped back from the market. First and foremost, this includes the Fed which has been the biggest buyer in the market for two years. It also includes institutional investors and foreign countries.

As shown below, the international holders have lost interest in the Treasury market. The latest month saw a slight uptick, but this will do little to move the needle. New debt issuance is currently on hold due to the current debt ceiling saga, but it’s only a matter of time before the charade is over and the debt binge starts. Who is going to buy the debt?

Note: data was last published in November

Figure: 10 International Holders

The table below shows how debt holding has changed since 2015 across different borrowers. China is at the lowest level in the 8 years of data shown while Japan has pulled back to the lowest level since 2018.

Figure: 11 Average Weekly Change in the Balance Sheet

Historical Perspective

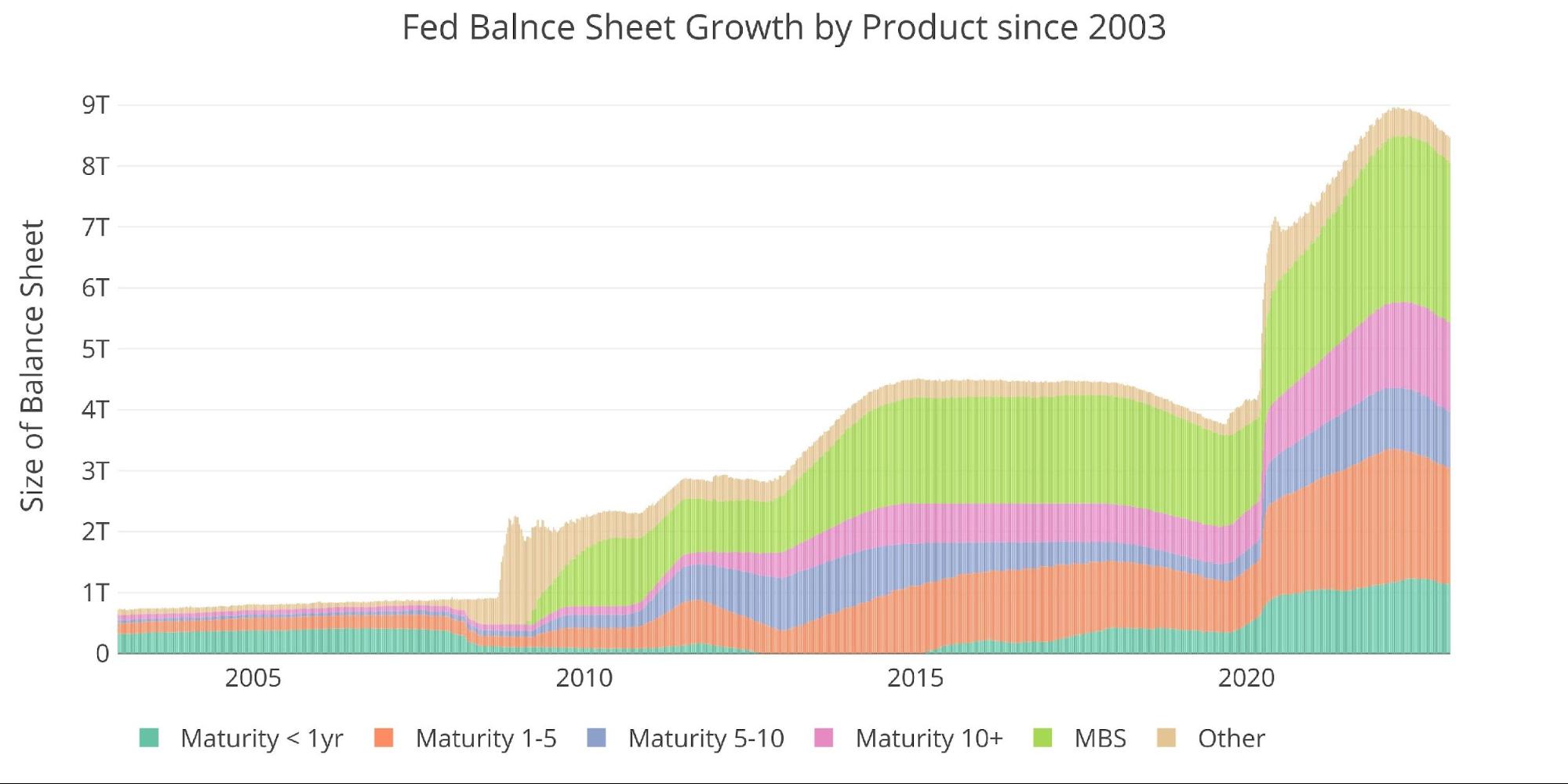

The final plot below takes a larger view of the balance sheet. It is clear to see how the usage of the balance sheet has changed since the Global Financial Crisis.

The last balance sheet reduction lasted almost two years in 2017-2019 but was smaller in magnitude. Even though the current reduction continues to miss target, there is still enough tightening to shrink the money supply. The Fed will likely not get two years into their reduction on this go-around. It only took about 12 months for the Fed to trigger the panic in Q4 2018. The panic this time around will be far worse.

Figure: 12 Historical Fed Balance Sheet

What it means for Gold and Silver

The Fed continues with its tightening cycle, seemingly oblivious to the major risks in the market. As job losses continue to mount, eventually the Fed will realize the damage it’s causing is much greater than a soft landing. Perhaps it knows this, which could explain why it continues to fall short of target every month for balance sheet reduction.

In either case, everything is fine up until the moment it isn’t. When that moment happens, the Fed will move fast and furious. Gold and silver are clearly anticipating this possibility. Both metals are due to cool some after the recent run-up, but this is likely just a stopping point before gold reaches new all-time highs in 2023.

The market sees it coming. When it becomes obvious, it will likely be too late to load up on precious metals. Even though the market sees the pivot, it is missing the bigger picture. The market is pricing in a modest pivot sometime later this year. When that pivot is sooner and stronger than anyone anticipates, expect a massive rally in precious metals.

Data Source: https://fred.stlouisfed.org/series/WALCL and https://fred.stlouisfed.org/release/tables?rid=20&eid=840849#snid=840941

Data Updated: Weekly, Thursday at 4:30 PM Eastern

Last Updated: Jan 25, 2023

Interactive charts and graphs can always be found on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/USDebt/

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

[ad_2]