[ad_1]

gremlin/E+ via Getty Images

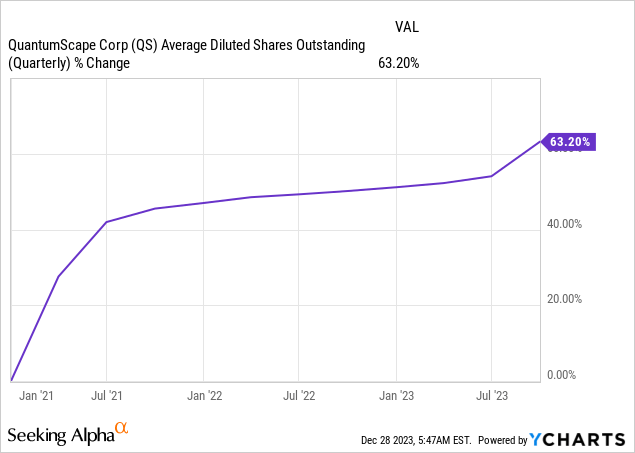

QuantumScape (NYSE:QS) had $1.13 billion in total cash and short-term investments at the end of its fiscal 2023 third quarter. This was set against zero debt and a trailing 12-month free cash burn rate of $354 million. Extrapolating this burn rate would mean the solid-state battery upstart has enough liquidity for at least three years of operations. QS’s abundance of liquidity has come on the back of quite intense shareholder dilution with the company last offering 37,500,000 shares for $300 million in gross proceeds. The company’s diluted weighted-average common shares outstanding at the end of the third quarter was 471,752,000, up 8.7% from a year ago and by 63% over the last three years.

The pace of dilution is staggering and has come at a cost to shareholders with the recent summer equity raise coming after the CEO stated in the second-quarter earnings call that they have enough funds for a cash runway that extends into 2025. Any further funds raised through the company’s at-the-market offering program will essentially extend this runway into 2026 and beyond. Hence, QS has overcome the dreaded liquidity gap, the core stumbling block that has already disrupted the futures of a plethora of speculative companies that rode the SPAC bubble to become publicly traded. The list ranges from collapsed EV bus manufacturer Proterra (OTC:PTRAQ) to EV pick-up truck startup Lordstown Motors (OTC:RIDEQ). QS is up 34% year to date but still trading far below its 2021 peak of $131 per share. The question now is whether the company can repeat is late 2020 ascent on the back of interest rate cuts next year which could see a revival of market appetite for risk.

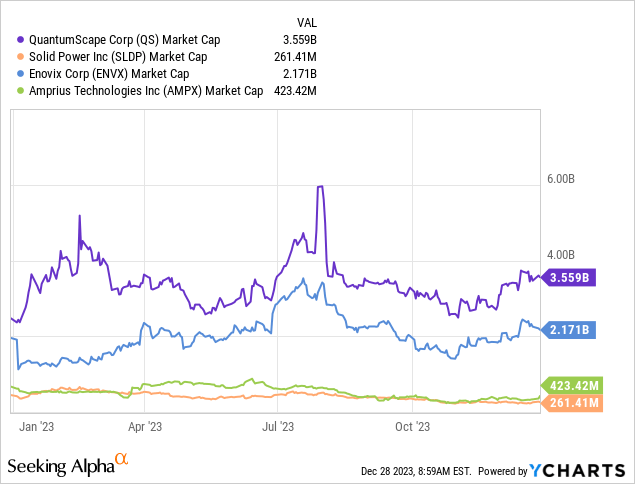

A $3.56 Billion Market Cap For What Exactly?

QS fundamentally represents a play on the much-hyped solid-state battery future of EVs. This is a dream being chased by over 100 entities from startups, universities, and traditional automobile companies. Toyota (TM), BMW (OTCPK:BMWYY), and Nissan (OTCPK:NSANY) are all developing prototype solid-state batteries. They all have different timelines; BMW does not expect to start mainstream commercial mass manufacturing until the end of the decade, Toyota is targeting 2027, and Nissan is targeting 2028 for its first solid-state battery EV. These long-dated plans for solid-state battery start of production reveal chasms about the present; the technology is not yet fully developed and still faces significant technological constraints until economically viable mass manufacture.

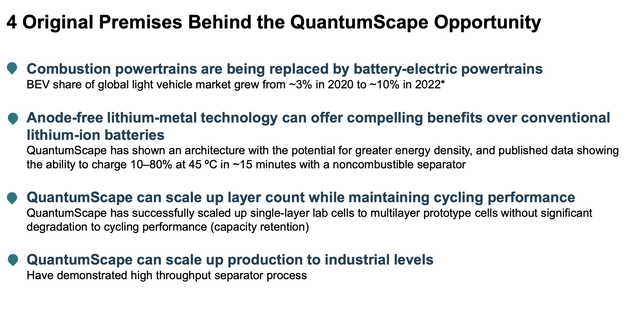

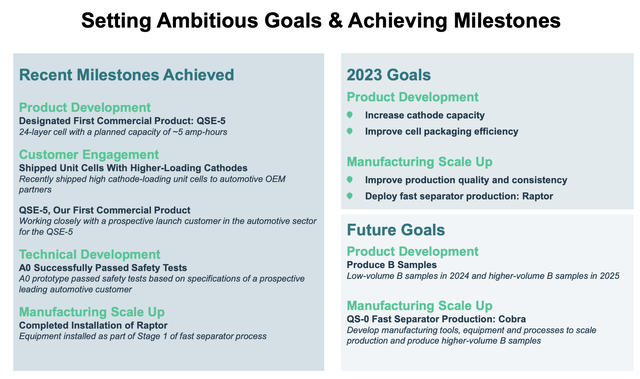

QuantumScape August 2023 Investor Presentation

I last covered the ticker a year ago with a comparison to close peer Solid Power (SLDP). SLDP has since seen its market cap almost get cut in half and is barely above NASDAQ’s minimum listing requirement with QS registering a gain. The market seems to have picked its winner despite both being pre-revenue and still many years away from their stated timelines for commercial production. Batteries that are smaller, lighter, faster, and safer will enable mainstream adoption of EVs and reverse the loss of momentum of recent US EV sales.

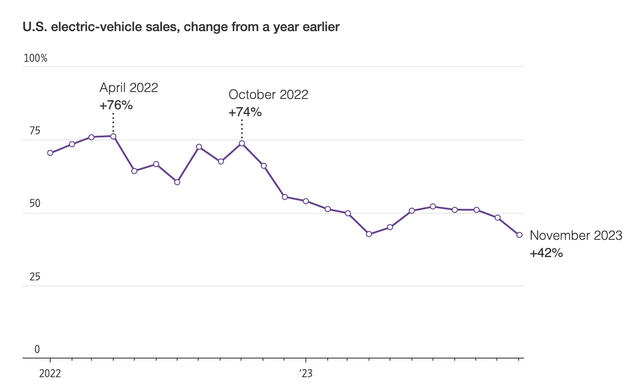

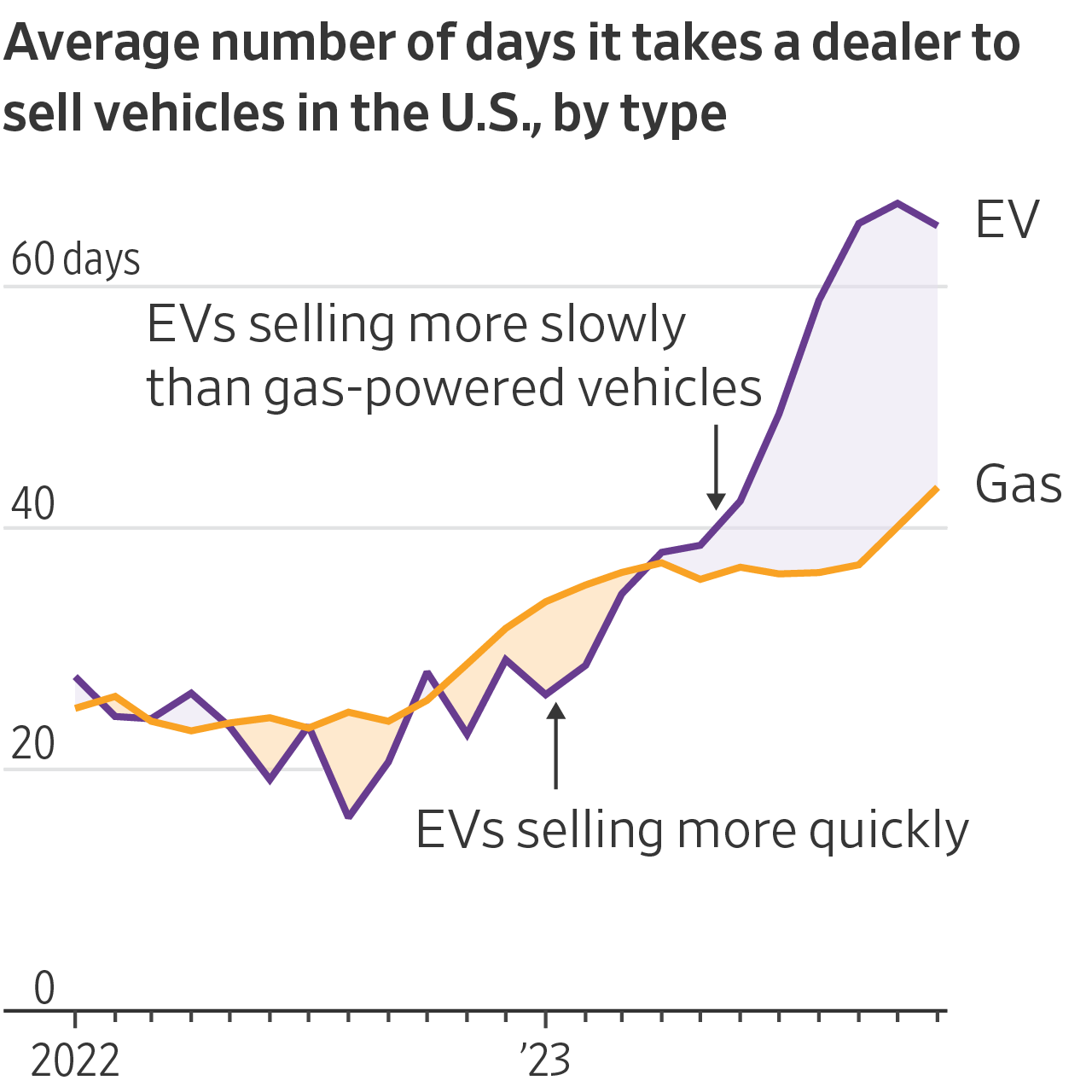

The WSJ

Year-over-year EV sales in November at 42% was a significant deceleration from 74% in October of 2022. Bulls would be right to flag higher interest rates, inflation, and a cost of living crisis as deferring potential sales, but EVs still hold a host of negatives that will continue to act as a barrier to broader mainstream adoption.

The WSJ

This slowdown is further reflected in the average number of days it takes a dealer to sell an EV which has jumped to over 60 days from around 25 days at the start of 2022. This is the promise behind solid-state batteries. US EV sales surpassed one million units in a single year for the first time in November, solid-state batteries could see much more units sold. This milestone followed third-quarter sales of 313,086, a quarterly volume record as the 2022 Inflation Reduction Act looks set to begin handing out $7,500 tax credits from next year to achieve its goal of rendering 50% of all new cars sold in the US fully electric by 2030, around 7 million EV sales a year versus current sales figures.

QuantumScape August 2023 Investor Presentation

Current EVs are slow to charge and have safety issues around fire with some EV owners also flagging problems around longevity and reliability in extreme weather conditions. With all these sticking points essentially solved by solid-state batteries, the potential total addressable market for QS is well north of $100 billion. However, the company is in a space being pursued by a ton of other companies even as management targets an ambitious 2025 for its higher-volume B samples. There is simply no guarantee of QS being successful and its timeline for fully commercial production will be influenced by so many variables that it’s hard to be fully confident about when and if ever it will meet its ambitious goals. Hence, I continue to remain on the sidelines on taking a position in the commons. QS is flush with cash and should survive for years, but the solid-state dream will for the next few years remain promises on earnings calls and cash burn on the financial statement.

[ad_2]

Source link