[ad_1]

asbe

Rose’s Earnings Backyard – RIG

Staying inexperienced, good and inexperienced, thanks Mr. Market permitting RIG to be a winner in 2022.

December Efficiency

Most everybody had hopes for a Santa Claus rally which didn’t occur. December was not pleasing and that is what did occur:

(SPY) fell -5.69%

The Dow was down -4%

Nasdaq much more at -9%.

RIG fell -1.84%

The complete yr noticed Dow down -8.8%, S&P – 19.4% and the poor Nasdaq -33.1%. Ouch!

RIG was up 2.83% to outperform SPY by +20.98% to finish the yr.

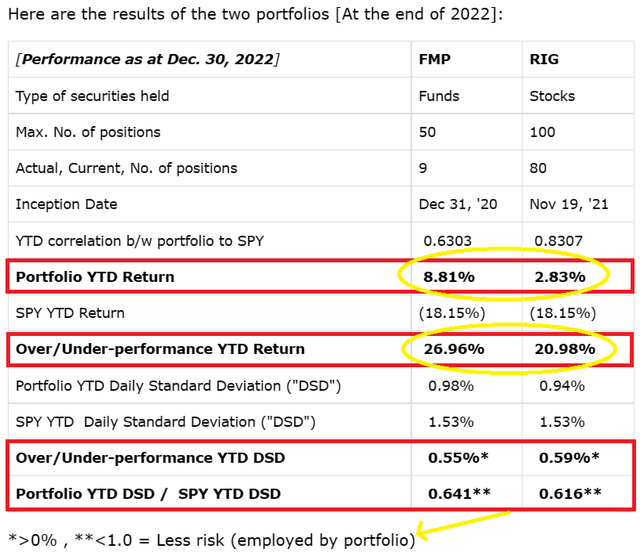

Under you may see the FY 2022 outcomes of Macro Buying and selling Manufacturing unit’s (“MTF”) two (and solely two!) portfolios – Funds Macro Portfolio (“FMP”) and Rose’s Earnings Backyard (“RIG”).

2022 Efficiency FMP and RIG (Macro Buying and selling Manufacturing unit / The Macro Teller)

December Dividend Earnings

The RIG earnings was up 5.5% from December 2021 and for the complete yr up 28.8%. The massive rise was primarily from the delivery shares which aren’t anticipated to supply as massive dividends in 2023.

41 out of 80 corporations/ or ~51% of the portfolio paid; as anticipated together with getting 12 raises. The shares with the elevate have the knowledge in daring within the chart and feedback. Word there are 4 excessive yield corporations that pay month-to-month are famous as such within the feedback too. The two industrial sector delivery shares supply diverse dividend funds which have been decrease and talked about. Regardless that decrease it was not disappointing as they have been nonetheless very excessive funds and welcome.

The chart under makes use of the next abbreviations:

Date Rec’d = Date fee obtained.

Div/sh = Dividend per share paid / obtained.

Yearly $ Div = Present 2022 yearly estimated identified dividend fee.

Div % Yield = dividend yield calculated utilizing the present proven worth and yearly identified dividend.

Curr Worth is for the tip of the day market worth Dec thirty first.

Inventory

2022

div/sh

Yearly

Div%

Different Dividend

Present

Ticker

Title

date

$ Div

Yield

Feedback

Worth

(PFLT)

PennantPark Float

1

0.095

1.14

10.38%

Month-to-month Pay

10.98

(ENB)

Enbridge

1

0.649

2.61

6.68%

Canada exch price

39.1

(V)

Visa

1

0.45

1.8

0.87%

Elevate from .375

207.76

(WEC)

WEC Power

1

0.7275

2.91

3.10%

93.76

(SLRC)

SLR Funding

1

0.1367

1.64

11.79%

Month-to-month Pay

13.91

(CMI)

Cummins

1

1.57

6.28

2.59%

242.29

(MAC)

Macerich

2

0.17

0.6

5.33%

Elevate from .15

11.26

(LYB)

LyondellBasell

5

1.19

4.76

5.73%

excludes spec pay

83.03

(SO)

Southern Co

6

0.68

2.7

3.78%

71.41

(JNJ)

Johnson & Johnson

6

1.13

4.52

2.56%

176.65

(ZIM)

ZIM Built-in Shipg

7

2.95

27.55

160.27%

varies/25% tax

17.19

(AMGN)

Amgen

8

1.94

7.76

2.95%

262.64

(XOM)

Exxon Mobil

9

0.91

3.55

3.22%

Elevate from .88

110.3

(TGT)

Goal

10

1.08

4.32

2.90%

149.04

(WBA)

Walgreens BA

12

0.48

1.915

5.13%

37.36

(SBLK)

Star Bulk Carriers

12

1.2

6.5

33.80%

varies: was 1.65

19.23

(DNP)

DNP Choose Inc Fund

12

0.065

0.78

6.93%

Month-to-month Pay

11.25

(CVX)

Chevron

12

1.42

5.68

3.16%

elevate due subsequent

179.49

(PTMN)

Portman Ridge

13

0.67

2.68

11.65%

Elevate from .63

23

(MGEE)

MGE Power

15

0.4075

1.63

2.32%

70.4

(HSY)

Hershey

15

1.036

4.144

1.79%

231.57

(TAP)

Molson Coors Brew

15

0.38

1.52

2.95%

51.52

(HD)

House Depot

15

1.9

7.6

2.41%

elevate due subsequent

315.86

STWD bd

Starwood bond

15

2.375

4.75

4.90%

bond pays 2x/yr

97

(MCD)

McDonald’s

15

1.52

5.66

2.15%

Elevate from 1.38

263.53

(GOLD)

Barrick Gold

15

0.1

0.6

3.49%

17.18

(VTRS)

Viatris

16

0.12

0.48

4.31%

elevate due subsequent

11.13

(DUK)

Duke

16

1.005

4.02

3.90%

102.99

(SHEL)

Shell plc

19

0.5

1.98

3.48%

56.95

(D)

Dominion Power

20

0.6675

2.67

4.35%

elevate due subsequent

61.32

(TRTN)

Triton

22

0.7

2.65

3.85%

Elevate from 0.65

68.78

(NEM)

Newmont Mining

29

0.55

2.2

4.66%

47.2

(UNP)

Union Pacific

29

1.3

5.2

2.51%

207.07

(ARCC)

Ares Capital

29

0.48

1.8

9.75%

Elevate from 0.43

18.47

ARCC/S

Particular Ares Cap

29

0.03

3c Spec =51c complete

(AVGO)

Broadcom

30

4.6

16.9

3.02%

Elevate from 4.1

559.13

(KHC)

Kraft Heinz Co

30

0.4

1.6

3.93%

no change

40.71

(LMT)

Lockheed Martin

23

3

11.4

2.34%

Elevate from 2.80

486.49

(TCPC)

BlackRock TCP Cap

30

0.32

1.2

9.27%

Elevate from 0.30

12.94

(SPG)

Simon Prop Grp

30

1.8

7

5.96%

Elevate from 1.75

117.48

(NMFC)

New Mountain Fin

30

0.32

1.2

9.70%

Elevate from 0.30

12.37

(ARDC)

Ares Dynamic Fund

30

0.1025

1.23

10.61%

Month-to-month Pay

11.59

Click on to enlarge

Raises: 12

Visa (V) – 20% elevate

Monetary tech bank card servicer was based in 1958 and headquartered in San Francisco, CA. S&P credit standing of AA- with 15 years of consecutive rising dividend funds. The low yield should accompany a pleasant massive dividend progress price which occurred.

Macerich (MAC) – 13.3% elevate

Retail REIT / actual property funding belief headquartered in Santa Monica, CA of profitable high quality regional buying malls. No credit standing accessible. That is the primary elevate because it minimize from retail issues throughout covid. This can be a restoration work in progress that can more than likely take just a few extra years.

Exxon (XOM) – 3.4% elevate

Oil and gasoline built-in power firm working in up and down stream and chemical segments. It was based in 1870 and is headquartered in Irving, TX. S&P credit standing of AA- and has 40 years of consecutive rising dividend funds.

Portman Ridge Finance (PTMN) – 6.3% elevate

Enterprise improvement firm, “BDC”, that gives loans of a broad vary to quite a few firm varieties in nearly all sectors. It’s headquartered in New York, NY.

McDonald’s (MCD) – 10.1% elevate

Shopper Staple/cyclical restaurant franchise firm based in 1940 and is headquartered in Chicago, IL. S&P BBB+ credit standing with 47 years of consecutive rising dividend funds.

Triton (TRTN) – 9.2% elevate

Industrial sector firm for leasing of containers for transportation corporations internationally. S&P BBB- credit standing and has 7 years of consecutive rising dividend funds.

Ares Capital (ARCC) – 18.6% elevate

The elevate consists of the common and particular fee. It’s a enterprise improvement firm “BDC” that gives a broad vary of loans to center market corporations in lots of sectors. S&P BBB- credit standing.

Broadcom (AVGO) – 12.2% elevate

Know-how semiconductor firm included in 2018 and headquartered in San Jose, CA. S&P BBB- credit standing with 12 years of consecutive rising dividend funds.

Lockheed Martin (LMT) – 7.1% elevate

Worldwide safety and aerospace firm working additionally in defensive kind techniques, missiles, and area operations. S&P credit standing of A- and has 19 years of consecutive rising dividend funds.

Blackrock TCP Capital (TCPC) – 1.6% elevate

Enterprise improvement firm, “BDC”, that gives a broad vary of loans to a diverse broad spectrum market preferring people who need an fairness possession stake. The dividend was minimize in 2020 and is now getting a restart upwards with no guarantees. Headquartered in Santa Monica, CA.

Simon Property Group (SPG) – 2.8% elevate

Retail actual property funding firm “REIT” that owns internationally premier buying and leisure property. Headquartered in Indianapolis, IN. Its dividend was minimize in 2020 as a result of covid retail points. That is the third elevate for 2022 which = 9.1% complete enhance from $1.65 to start out the yr. Extra raises are instructed for 2023.

New Mountain Finance (NMFC) – 1.6% elevate

Enterprise improvement firm, “BDC”, that gives a broad vary of loans to a center defensive excessive progress kind market and seeks excessive possession in its portfolio corporations. Headquartered in New York, NY. The dividend was minimize in 2020 and is displaying optimistic indicators for it to rise as soon as once more.

There are 11 corporations with a dividend yield close to or 7% or extra together with the month-to-month payers PFLT, SLRC, DNP, and ARDC. All of them have been dependable with ARDC having raised its fee in August. This month was a pleasant shock as a number of the BDCs did elevate dividends; all the time a giant hoorah when it occurs!

Future Earnings

Future earnings yield is estimated to proceed close to or above ~5% as 2023 begins with the ultimate tally far-off. The yield continues to be fairly good and welcomed even with a rising portfolio worth, delivery shares with unreliable decrease earnings and additional cash. The RIG yield purpose is a minimal of 4% which continues to be being met, however I do admit I want nearer to five%. As soon as the money is utilized it’ll present extra earnings too. I see 2023 as thrilling, attention-grabbing and an funding problem that I’m wanting ahead to and joyful to pursue.

December Transactions

Bought – 2

Kraft Heinz Co.

(KHC) is a client defensive packaged meals firm that merged Kraft with Heinz in 2015. It’s headquartered in Pittsburgh, PA and has a present S&P credit standing of BBB-. It’s paying a 4% good yield when the worth is $40, which appears to be hitting a peak. It examined my endurance for too lengthy and with rates of interest rising and never seeing rising earnings or dividends it turned a drag to maintain within the portfolio. Kraft was a legacy inventory obtained years in the past as a derivative from proudly owning shares of Philip Morris (PM). That is one I just about had excessive hopes for as Warren Buffet owns it. I do know now he isn’t precisely one to repeat for each inventory, and I discover I disagree with a few of his decisions akin to this one, so I gave it the ole heave ho, which suggests “Goodbye!”

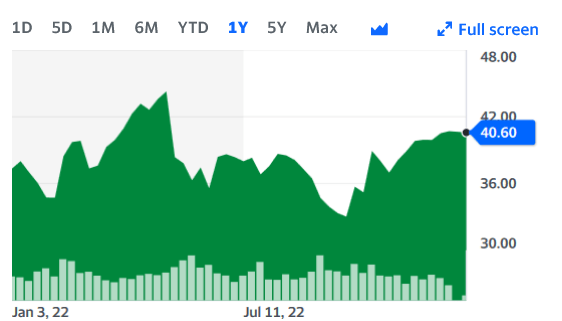

The chart under from Yahoo Finance reveals its worth motion for 2022.

Worth Motion KHC for 2022 YF (Yahoo Finance Dec 31, 2022)

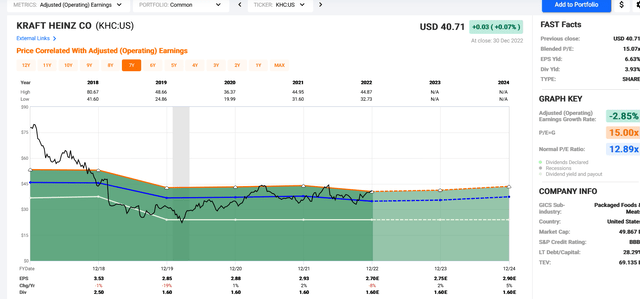

FAST Graph for KHC

The next colours/ traces on the chart characterize the next:

Black line = worth

White line = dividend

Orange line = Graham common of often 15 P/E “worth/earnings” for many shares.

Blue line = Regular P/E

Dashed or dotted traces are estimates solely.

Inexperienced Space represents earnings.

KHC working earnings FG Dec 31, 2022 (FAST Graphs Chuck Carnevale)

Comparatively flat 2% earnings for 2023, a bit extra for 2024, however no anticipated dividend elevate, which isn’t what I would like for a dividend progress portfolio.

Word the conventional P/E proven is 12.89x and it’s promoting at 15.07x.

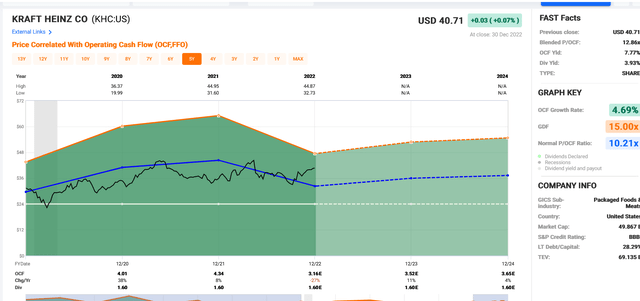

Money Flows

This subsequent chart reveals “OCF” / working money flows, which took an enormous dip in 2022, and won’t get better for a few years. Nonetheless, the flat degree for the dividend does look secure.

FG Money Flows for KHC FAST Graphs (FAST Graph Chuck Carnevale Dec 31, 2022)

Surprisingly, the worth is above the conventional (blue line) P/OCF ratio of 10.18x and sits at 12.74x. Usually for the previous few years the worth travels under the blue line, and for some purpose it now appears overpriced so I bought.

Ontrak, Inc. Most popular – (OTRKP)

This can be a healthcare synthetic intelligence firm that was included in 2003 and is headquartered in Henderson, NV. It lingered properly at a good worth degree and did simply take an terrible flip down rapidly. This funding for some purpose I assumed would flip round, however I used to be completely blind with hope. I did get one fee in Q1, so it was not a complete loss for earnings, however a catastrophe as an funding.

Worth for OTRKP for 2020-2022 (Yahoo Finance Dec 31, 2022)

The optimistic view is that I didn’t have a big quantity, but it surely nonetheless hurts to disclose and even point out this horrible funding. I ought to have minimize and run a very long time earlier than December. I can’t look again, however now you understand my worst funding of 2022. Ouch!

The good information is that RIG is diversified and may and can deal with dangerous funding outcomes, however I hate it when it occurs. I can’t wait this lengthy once more to promote and plan to have a greater exit plan for any funding. There have been no add ons in December, as I’m ready for 2023 to make use of the 12.6% money reserve.

Abstract and Conclusion

The purpose of RIG is at the start earnings with retaining worth crucial too. High quality excessive credit score rated and secure worth line corporations comprise nearly all of the frequent inventory and investments in it.

The Rose portfolio/ RIG continues to outperform SPY by double digits, has a 5% dividend earnings yield together with 12.6% money.

The WTB/ Need To Purchase/ listing is present for all RIG positions with a “Purchase beneath worth” and “Sturdy Purchase” costs, together with desired yield listed. The non-RIG inventory picks even have these worth targets and a few DGR statistics, together with present 52 week excessive and low costs proven that are on steady analysis for buying if not by me, however maybe for subscribers. I get pleasure from watching, evaluating and the hunt for nice shares to personal as an ongoing pursuit for investing happiness.

For extra details about MTF please see the final bullet level initially of the article.

Glad Investing to All!

[ad_2]