[ad_1]

Gains for global equities have left many on Wall Street perplexed as stocks — especially high-risk growth names with little or no profits — have rebounded from last year’s punishing selloff, resisting both the pull of more attractive bond yields, and the threat of higher interest rates.

But some Wall Street analysts say they’ve found an explanation that has little to do with inflation and the state of the global economy.

The upshot is this: The Federal Reserve, European Central Bank and Bank of England have advertised that they’re trying to drain the ocean of banking-system liquidity, but on a global scale, liquidity has actually increased in recent months. That’s due in part to factors that are outside the control of policy makers.

A trillion-dollar boost to asset prices

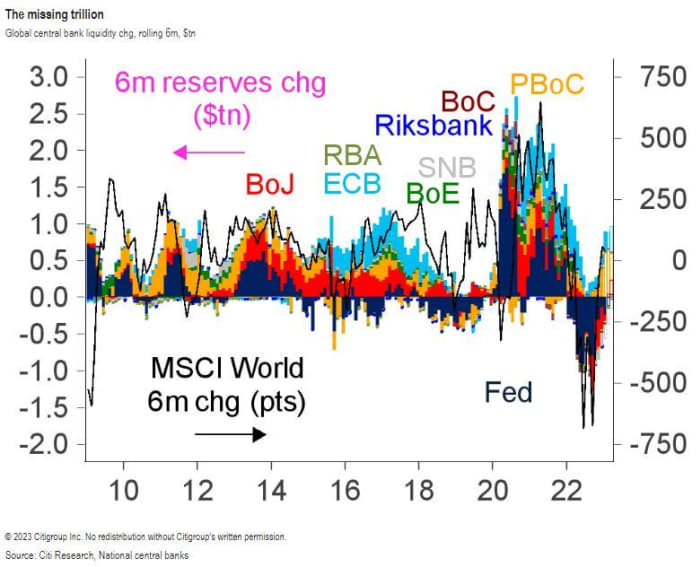

In a research note shared with clients last month, Matt King, a global markets strategist at Citigroup Inc., detailed how the world’s largest central banks had recently injected $1 trillion into the global financial system.

The bulk of this increase, according to King’s analysis, came from the People’s Bank of China, which has bucked the trend of global monetary tightening and instead opted to directly inject liquidity into its banking system, accounting for the largest share of the $1 trillion figure.

“Even as the central banks have told us they’re going to be tightening, it turns out that on at a global level, they’ve just added $1 trillion worth of liquidity over the past three months,” King said.

In his report, King said he was inspired to take a closer look at central-bank balance sheets after concluding that changes in the fundamentals — meaning the outlook for the economic growth and inflation — failed to explain moves across global markets, including a rebound in global equity prices.

When he finally mapped moves in global equities against the shifting tides of global central bank liquidity, he found that they were a near-perfect fit.

The chart below tracks the performance of the MSCI World Index

990100,

+1.41%

against the ebbs and flows of banking-system liquidity. The index has risen 12% since the end of September, according to FactSet data. Around the same time, global central bank liquidity stopped ebbing, and started expanding once more.

CITIGROUP

U.S. bank reserves flat-line

But even the Federal Reserve has contributed to the liquidity deluge in a more passive way, according to King and another London-based strategist, Michael Howell, managing director of CrossBorder Capital, a macro advisory firm.

For more than a year now, the Federal Reserve has been trumpeting its plans to “tighten” liquidity in the U.S. financial system by raising interest rates and reducing its bond holdings by opting not to reinvest the proceeds from maturing bonds.

And while the size of the Fed’s bond holdings has shrunk since last spring by about $500 billion, according to data from the St. Louis Fed, another important component of its balance sheet, U.S. banking system reserves, appears to have flat-lined.

According to the latest weekly update released by the Fed, reserve balances at Federal Reserve banks stood at $3.01 trillion as of Feb 22. That’s a modest increase from $2.9 trillion at the end of September.

“The Fed is supposedly rolling off the balance sheet, but bank reserves are not falling,” Howell said.

This could also be helping to buttress equity prices as the amount of money available for U.S. banks to push into the financial system has expanded, instead of contracting, he said.

Stocks coming off the boil

To be sure, U.S. stocks have come off the boil in recent weeks following a torrid rally that resulted in the Nasdaq Composite

COMP,

+1.97%

rising more than 10% in January for its best start to a year in two decades, according to FactSet data.

That stocks are no longer climbing could be a sign that the liquidity tide is ebbing once again. Whether it will once again come to the market’s rescue remains to be seen.

But it’s certainly possible that ultimately, equity valuations could suffer as a result. According to Howell and his team, it’s possible the Fed may need to hike interest rates more aggressively to compensate for its unwillingness to further cull banking system reserves.

After resisting their pull for a few weeks, U.S. stocks appear to be feeling the effects of higher bond yields. The Nasdaq Composite, S&P 500

SPX,

+1.61%

and Dow Jones Industrial Average

DJIA,

+1.17%

all lost ground in February. They were putting in a mixed performance on Thursday as the yield on the 10-year Treasury note topped 4%. Bond yields move inversely to prices.

See: Key question for stock-market investors: Take profits or sit tight in ‘make or break’ March

[ad_2]