[ad_1]

Georgijevic/E+ via Getty Images

Investment thesis

We think Signet’s (NYSE:SIG) management has both short- and long-term plans and a clear customer profile and well-positioned the company for both competition and macro headwinds. The current valuation for SIG stock is very pessimistic in our view and provides a great risk and return profile for a value investor to enter.

Company profile

“Signet is one of the world’s largest retailers of diamond jewelry. Through a series of acquisitions, the Company owned Kay, Zales, Jared, Diamonds Direct, and JamesAllen.com and operated 2,854 stores and kiosks as of January 29, 2022, which when combined with the Company’s digital capabilities under its Connected Commerce strategy, provides customers the opportunity to use both online and in-store experiences as part of their shopping journey. Signet operates 2506, 94, and 348 locations in US, Canada, and UK, respectively.” – Source: Company

Market projects relatively negative future than management does

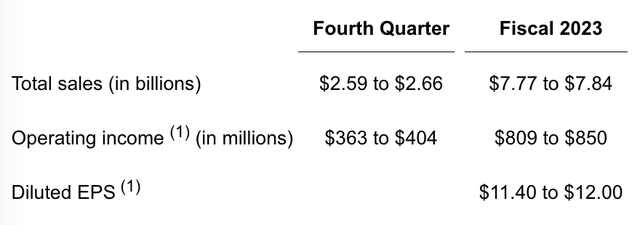

The company provided its FY2023 (ended in Jan 2023) outlook as follows.

Company outlook (Company’s filing )

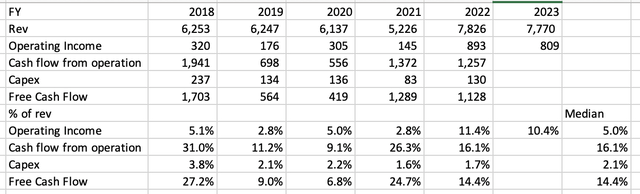

We assume the median of the past five years’ free cash flow margin as our long-term assumption for the company. Additionally, we assume future growth would be limited to just 3%.

Company financials (Company filing)

Along with the following assumptions:

WACC: 18% Terminal growth rate: 3% Net debt:-180 million(Q32023 data) Shares outstanding: 48.1 million (Q32023 data)

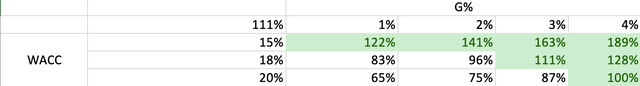

Through the DCF model, we arrived at 7.8 billion equity value ($163.5 per share), which is 111% above the current price.

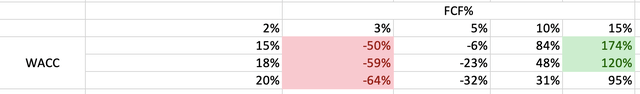

Based on the sensitivity test below, the stock is likely undervalued and offers a great margin of safety as long as the company’s long-term free cash flow margin does not drop below the preceding 5-year low (6.8%) or maintain growth rate above the inflation rate (2%).

Sensitivity analysis for Free cash flow margin and WACC (LEL Investment)

Sensitivity analysis for terminal growth and WACC (LEL Investment)

Catalysts

The company’s priority in this challenging environment, according to its Q3 2023 transcript, are service (such as jewelry repairs) and market share growth. We think the market is uncertain of Signet’s long-term prospects due to factors like growth outlook, the popularity of its service offering, the sector’s long-term outlook, e-commerce competition, and the shift in consumer spending to non-discretionary categories, which we will discuss in the risk sections that follow.

We believe that this upcoming earnings report, which is anticipated to be released around mid-March 2023, will act as a catalyst to revalue the stock once the company shows either (1) margin improvement or (2) continued sales growth.

Risks

Jewelry demand is likely to peak long-term given the decline in the marriage rate

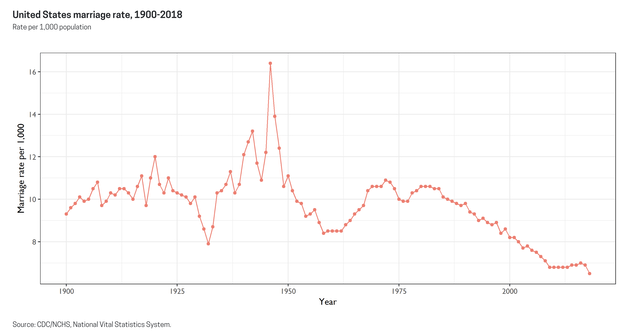

Markets may have a concern about the long-term prospect for the jewelry sector. The following chart shows that the marriage rate has declined to a record low since 1900 per CDC/NCHS data.

US marriage rate 1900-2018 (CDC/NCHS)

The company states in its mission statement is as follows:

“Signet Jewelers Limited’s purpose is “Inspiring Love” and its mission is to enable all people to “Celebrate Life and Express Love.” The Company’s vision is to be the world’s premier jeweler by engaging customers with superior shopping and ownership experiences, connecting with them seamlessly across channels, earning their trust, and providing superior expertise, value, products, and services to meet their lifetime jewelry needs and desires.”

We think Signet positions itself well in the market. It is a business that markets love and admiration, two things that are consistently in demand and valued in modern society.

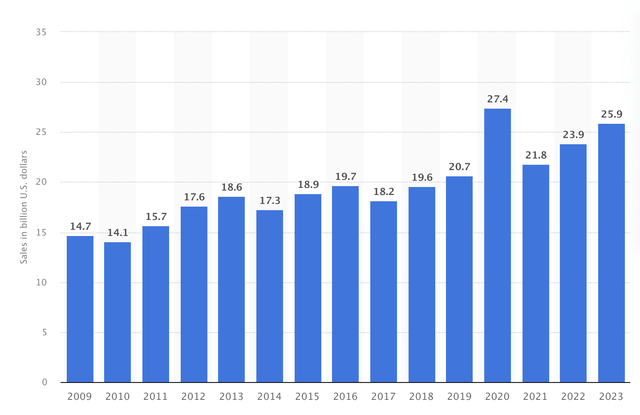

The two sets of sales data listed below back up the company’s proposition. According to Statista, Valentine’s Day sales in the US have increased over the years despite a fall in marriage rates in the US.

US Valentine’s day sales (Statista)

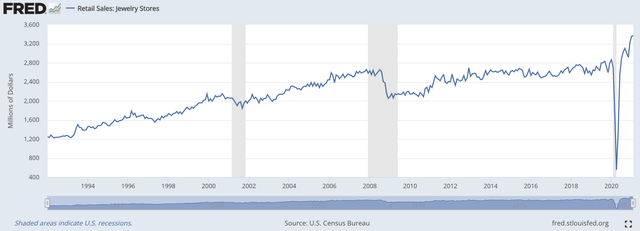

The Fed’s data on jewelry sales also shows a long-term rising trend in the past 30 years.

Retail sales, Jewelry stores (Fed)

Brick and mortar stores likely to lose to e-commerce business

People may now purchase diamonds online and at a lower cost due to the development of synthetic diamond technologies and the relatively low operational cost structure of e-commerce platforms. Thus, it appears that Signet, which runs 2,800 physical stores, face a cost disadvantage compared to an e-commerce pure-play.

The company adopted the omni-channel strategy through acquisition of e-commerce platform as a response to the challengers. The management believes that ordering online and picking up in-stores could differentiate the company from e-commerce pure-plays due to better customer experience. We concur with the company because jewelry is one of the industries where customers prefer to receive items in person and because also when customers need to purchase a gift at the last minute, physical businesses offer convenience.

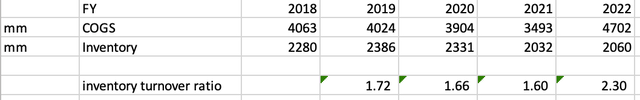

In addition, the company recently reduced its footprint in the low-traffic mall. In FY2022, Signet has successfully increased its inventory turnover ratio to 2.3x from that of 1.7x pre-pandemic.

Signet’s inventory turnover ratio (Company’s filing)

Macro concern for discretionary spending

As inflation persists, there may be concern about spending on discretionary items. However, we think management is well prepared for the headwinds. With the acquisition, they have built a more flexible operating model to defend against the possible volatile market. According to the management, their inventory was down 2% in the quarter, excluding acquisition, and with promotion at the lowest level in recent history. They were also well staffed to defend the labor inflation, and its staff turnover is 17% lower than it was last year.

Also, they mentioned in their Q32023 earnings transcript compared to seasonal fashion such as apparel, jewelry is relatively stable in value and thus makes it less concerning about the excess inventory.

Takeaways

In conclusion, we think Signet’s management has both short and long-term plans and a clear customer profile and well-positioned the company for both competition and macro headwinds. The current valuation is very pessimistic in our view and provides a great risk and return profile for a value investor to enter.

[ad_2]