[ad_1]

Last year, a major theme in the global gold market was the record gold buying by central banks across the world, with the World Gold Council and its data gatherers (Metals Focus) calculating that central banks had cumulatively purchased a net 1136 tonnes of monetary gold during 2022.

At the outset of 2023, this led the World Gold Council to predict that:

“Looking ahead, we see little reason to doubt that central banks will remain positive towards gold and continue to be net purchasers in 2023.”

This indeed has proven to be the case, for after Q1 2023 drew to a close, the World Gold Council estimated that in the first quarter of 2023, the world’s central banks had again been net buyers of gold to the tune of a combined 228 tonnes. This is the strongest first quarter of central bank gold buying on record.

And the central bank leading the pack in this gold accumulation has been none other than BullionStar’s neighbour, the Monetary Authority of Singapore (MAS), whose headquarters are literally a short 2 kms stroll from BullionStar’s shop and showroom in Singapore’s central business district.

For in the space of 3 months between January and March 2023, Singapore’s central bank has quietly bought an incredible 68.7 tonnes of gold, making Singapore the world’s leading sovereign gold buyer for the first quarter of 2023, even ahead of China.

While the first tranche of Singapore’s gold purchases in January 2023 was covered in a BullionStar article from early March titled “Singapore’s central bank MAS boosts gold reserves to nearly 200 tonnes”, this, as it turns out, was only the beginning, for the Monetary Authority of Singapore kept coming back, adding more gold to its reserves in both February and March 2023.

The Details

In typically discreet fashion, Singapore’s central bank (MAS), does not announce its gold buying via press release or any other method of publicity. MAS merely updates the data on its website in a monthly report called ‘International Reserves and Foreign Currency Liquidity’, which is published on the last day of the month and covers the previous month.

Up until the end of December 2022, MAS had been reporting total gold reserves of 153.8 tonnes (4.94 million ozs). At the end of February, it became apparent from the report that in January 2023, MAS had added a gigantic 44.6 tonnes of gold to its official reserves, thereby increasing Singapore’s gold holdings from 153.8 tonnes to 198.4 tonnes in just one month.

When the ‘International Reserves and Foreign Currency Liquidity’ came out at the end of March, it again showed that MAS had added another 6.79 tonnes of gold in February – thereby boosting Singapore’s gold holdings to over 205 tonnes.

Singapore’s central bank, MAS, bought another 6.79 tonnes of gold during February, and now holds 205.17 tonnes of gold https://t.co/TbXgsjTesz pic.twitter.com/BUbqD4aQrj

— BullionStar (@BullionStar) April 5, 2023

Then when the MAS International Reserves report was published again at the end of April, it showed yet another increase of 17.24 tonnes of gold, bringing Singapore’s gold holdings to a whopping 222.4 tonnes (7.15 million ozs)

BREAKING – Singapore’s central bank (MAS) bought another 17.24 tonnes of during March, bringing its total gold reserve holdings to 222.4 tonnes. MAS has now bought 68.6 tonnes of gold during Q1 2023 https://t.co/TbXgsjTesz

— BullionStar (@BullionStar) April 29, 2023

Singapore’s Gold Reserves – Up 35% in 3 Months

Thus over the course of 3 months from January to March inclusive, MAS has bought a staggering 68.7 tonnes of gold, boosting its gold reserves by a whopping 44.6%. In terms of known central bank gold buyers, this gold accumulation by MAS is the largest gold purchase by any central bank in the world during the first quarter of 2023.

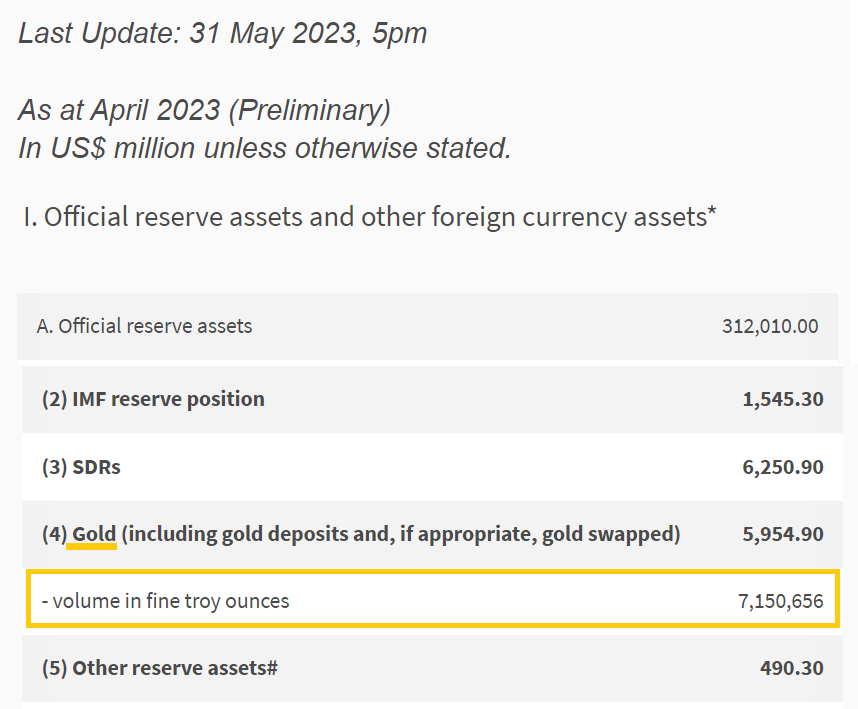

Looking at the latest MAS ‘International Reserves and Foreign Currency Liquidity report published on 31 May and covering up to the end of April 2023, this shows that MAS did not buy any gold during April, as the total gold holding is still listed as being 7,150,656 troy ounces, identical to the end of March.

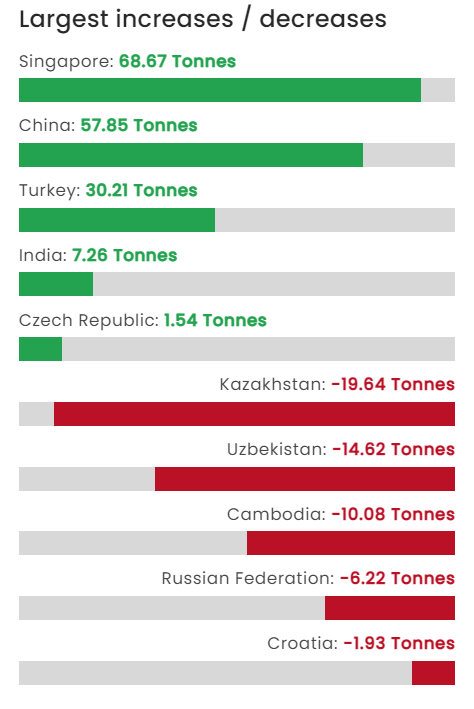

So the 3 month gold buying spree by Singapore’s central bank has come to an end – for now at least. Even so, its a world record for Q1 2023. It even surpasses the announced gold purchases by China for Q1 2023, which came to an accumulated 57.85 tonnes, and which makes China the second largest central bank gold buyer in Q1 2023. In third place is Turkey, which added 30.2 tonnes of gold in Q1. In fourth place is India with a ‘mere’ 7.2 tonnes bought in Q1.

In a similar vein to 2022 where a majority of central bank gold buying was described by the World Gold Council as ‘unreported buying’ (because the purchases were not publicly disclosed by the buyers but are apparently known by Metals Focus to have happened), the Q1 2023 gold buying data from the World Gold Council claims that central banks made ‘net purchases’ of a cumulative 228 tonnes of gold, however the World Gold Council data on ‘reported’ central bank gold buyers and sellers in Q1 2023 sums to 125 tonnes.

This leaves a net 103 tonnes of gold buying by central banks in Q1 that we don’t know who the buyers are as they want to remain anonymous. This however, still leaves Singapore as the largest ‘known’ central bank gold buyer of the first quarter of 2023.

Singapore’s gold buying spree comes to an end – for now.

Although Singapore’s central bank didn’t add to its gold reserves during April, it still has the distinction of being the world’s biggest central bank gold buyer in Q1 2023, adding 68.7 tonnes. https://t.co/TbXgsjTesz pic.twitter.com/8rXqefz3sW

— BullionStar (@BullionStar) June 2, 2023

In addition to Q1 2023, you may recall that Singapore’s central bank also bought significant amounts of gold in the two month period from May to June 2021 – specifically 26.35 tonnes of gold (16.4 tonnes in May 2021 and 9.95 tonnes in June 2021). See the BullionStar article here for details.

Those purchases took Singapore’s gold holdings from 127.42 tonnes to 153.76 tonnes. So if you take all of these gold purchases together from May 2021 up to March 2023, Singapore’s central bank has actually added a massive 95 tonnes of gold in less than 2 years, and in the process boosted Singapore’s sovereign gold holdings by a huge 75% from 127.42 to 222.4 tonnes.

Note that the nation state of Singapore (though the precursor of its central bank) bought the first 100 tonnes of its monetary gold in one transaction in 1968. That gold was purchased from the South African government and delivered in Switzerland.

That gold holding remained constant at 100 tonnes until it was at some distant point in the past increased to 127.4 tonnes, probably due in part to gold redistributions that the IMF made to member countries over the period 1977-1979. Singapore’s gold distributions from the IMF were probably delivered at the Bank of England, as Singapore was previously in the Sterling Area currency bloc, and would have had a gold account at the Bank of England.

Which brings us to the possible locations of Singapore’s gold, and the surprising secrecy and stonewalling which MAS has when asked about the locations of Singapore’s gold reserves.

Locations of Singapore’s Gold – MAS Secrecy

Given that Singapore holds the 24th largest sovereign gold reserves in the world with 222.4 tonnes, the reasons why MAS holds gold, and the locations of Singapore’s gold might be of interest to the general public, especially in Singapore.

However, for anyone wanting definitely answers on this, or even any answers at all, you will be sorely disappointed.

As far back as September 2015, I asked Singapore’s central bank (by email) as to where Singapore’s gold was stored.

Question – “Could you confirm if the MAS gold is stored domestically, or stored abroad, and if stored abroad, could you clarify where it is stored, for example at the Bank of England, at the Federal Reserve Bank of New York, etc?”

MAS Answer – “We regret that we are unable to share with you where we store the gold as the information is confidential.” – Corporate Communications Officer

In February 2018 I asked MAS (by email) why it holds gold as a reserve asset. This is a totally reasonable question, and one which many central banks explain in detail on their websites and in presentations. But not MAS.

Question – “For the Monetary Authority of Singapore specifically, would you be able to clarify the main reasons why MAS continues to hold gold as a reserve asset?“

MAS Answer – “As a matter of policy, we do not comment on our reserve composition. Hope you can understand.” – Corporate Communications Officer

No I don’t understand. It’s a totally reasonable question, and not answering it is completely untransparent. Contrast this with the central banks of Poland and Hungary who wrote entire articles explaining why they added gold. See here for Poland, and here for Hungary.

Then a few weeks ago, given Singapore’s huge recent gold purchases over Q1 2023, I again asked MAS a series of questions (by email) about Singapore’s gold and its locations, thinking that maybe MAS was more transparent compared to 2015 and 2018.

Q 1. The Monetary Authority of Singapore (MAS) purchased approximately 68.7 tonnes of gold over January, February and March 2003. This is in addition to the 26 tonnes of gold which MAS bought during May and June 2021.

Overall, in less than 2 years, MAS has bought 95 tonnes of gold, and boosted Singapore’s monetary gold holdings by 75% from 127.4 tonnes to 222.4 tonnes.

Why has MAS been buying more gold for the Official Reserves, especially the purchases in 2023?

Q 2. Does MAS have plans to buy additional monetary gold during the remainder of 2023?

Q 3. Where is Singapore’s 222.4 tonnes of gold stored? Do you have a percentage breakdown of how much is stored in Singapore and how much is stored abroad? And with which foreign custodians is Singapore’s gold stored, for example, the Bank of England, the Bank for International Settlements (BIS), Swiss National Bank (SNB), and New York Federal Reserve (NYFED)?

Q 4. For many years since 1968, Singapore held 100 tonnes of gold. At some point this increased to 127.4 tonnes of gold, but since the early 2000s, MAS has held 127.4 tonnes of gold (or 4,096,439 fine troy ounces).

In which year (or years) did Singapore’s gold holdings increase from 100 tonnes to 127.4 tonnes? Because the information on this is unclear.

When MAS answered my email, they didn’t answer any of the questions directly at all, and only answered Q1 and Q2 with an obtruse short and general statement. MAS didn’t answer question Q3 about location at all, and didn’t answer Q4 – which remember was merely a question asking about a historical holdings change and date way back in the past.

MAS Answer – “The changes in MAS’ gold holdings, along with any further plans, are taken as part of our ongoing efforts to enhance the resilience of the Official Foreign Reserves (OFR) portfolio such that it remains well-diversified through economic and market conditions.

The change in MAS’ gold holdings does not constitute a large fraction of the overall MAS portfolio.” – MAS’ spokesperson

This generic answer was the same template that was supplied to the StraitsTimes and AsianInvestor when they asked MAS about why it had bought gold during Q1 2023. See here and here.

Western Central Banks less Secretive

When I enquired further as to why MAS hadn’t answered any of my questions, the MAS Spokesman replied:

“We have no additional information to add”.

Why is information about the rationale that a central bank holds gold confidential, when nearly all other major central banks explain in detail why they hold gold – as a store of value, inflation hedge, portfolio diversifier, safe haven etc?

Why is information about the location of a nation’s gold reserves confidential, when nearly all other Western central banks (see below) say exactly where there gold reserves are held?

Doing a quick run through the top 10 countries (and tghe IMF) with the largest gold reserves, nearly all of these countries’ central banks divulge where their soverign monetary gold is held:

The United States discloses its gold storage locations – In US Mint vault facilities in Fort Knox, West Point and Denver.

Germany discloses its gold storage vault locations – At the Bundesbank in Frankfurt, at the NYFED in New York, and at the Bank of England in London.

The four IMF gold despoitories (where IMF gold is held) are the NY Fed in New York, the Bank of England in London, the Banque de France in Paris, and the RBI in Nagpur India.

Italy discloses its gold storage vault locations – The Banca d’Italia in Rome, the NY Fed in New York, the Bank of England in London, and the Swiss National Bank in Berne.

France discloses its gold storage vault locations – 90% of the French gold is in the Banque de France in Paris; the rest (abroad) is probably in the Bank of England in London.

Russian Federation discloses its gold storage vault locations – Moscow and St Petersburg.

China does not discloses its gold storage vault locations (but the PBoC say that the locations are in China)

Switzerland discloses its gold storage vault locations – 70% of the Swiss gold is in Berne Switzerland, 20% at the Bank of England, 10% at the Bank of Canada in Ottawa

Japan does now discloses its gold storage vault locations

India discloses its gold storage vault locations – The Indian gold is stored at the RBI in Nagpur, and also Bank of England and the BIS

Netherlands discloses its gold storage vault locations – in the Netherlands (Zeist), and also at the NY Fed in New York, at the Bank of England in London and at the Bank of Canada in Ottawa.

So within this Top 10 (plus the IMF), only China and Japan do not divulge where their sovereign gold holding are held. Every other country (and all Western nations as well as Russia and India) reveals where its gold is stored. This highlights the secrecy of Singapore’s central bank as being completely unneccessary and out of touch with the thinking of leading central bank gold holders. Maybe in time MAS will reconsider.

In the meantime, Singapore remains as the top central bank gold buyer of Q1 2023. Which central banks will be the top gold buyers during the remaining quarters of 2023. Only time will tell, but watch this space.

[ad_2]