[ad_1]

Shares of Snap Inc. (NYSE: SNAP) have been down 1% on Friday. The inventory has dropped 81% this 12 months. The final sentiment across the inventory is pessimistic resulting from issues over macroeconomic headwinds, advert spend slowdown and their impacts on the corporate’s income and earnings. Nevertheless, there’s a slight spot of optimism across the firm’s person progress and engagement traits which stay encouraging.

Headwinds

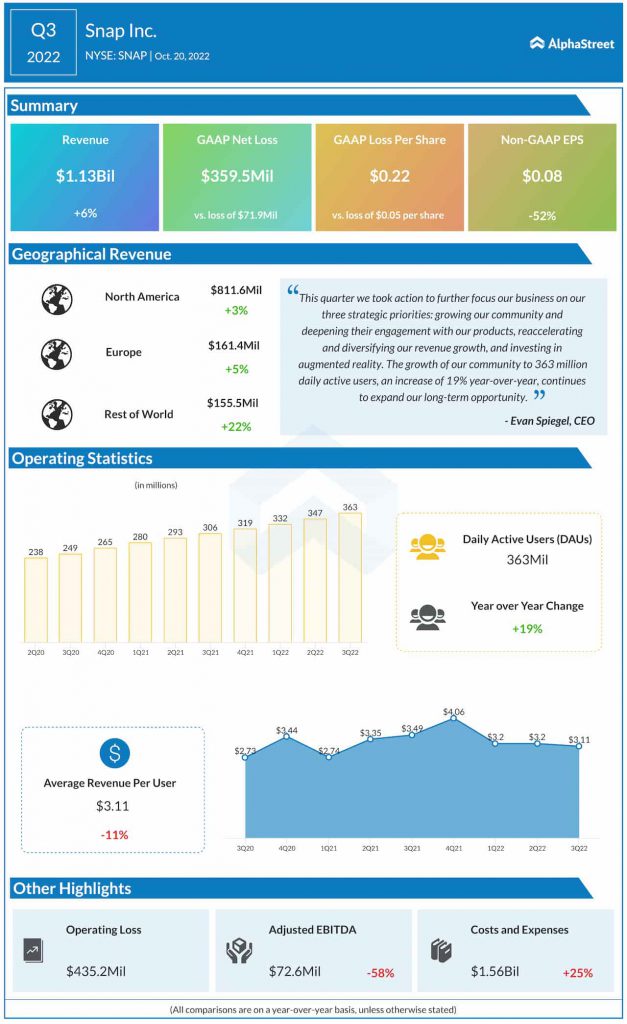

Snap’s income progress has been slowing down and its losses have been widening. For the third quarter of 2022, Snap’s income of $1.13 billion grew solely 6% year-over-year in comparison with the double-digit will increase that have been recorded within the first two quarters of this 12 months.

Whereas the corporate noticed revenues enhance on a YoY foundation throughout all its geographic areas throughout Q3, on a sequential foundation, solely North America recorded a rise. Income from Europe fell 5% whereas income from Remainder of World remained flat sequentially.

Income progress is being impacted by platform coverage adjustments, macroeconomic headwinds and elevated competitors. The corporate can be seeing a slowdown in digital promoting as inflationary pressures power companies to cut back their advert spend. This slowdown in promoting is a significant headwind for corporations like Snap.

Snap expects income progress to decelerate by way of the fourth quarter of 2022 as effectively as a result of This autumn has traditionally been depending on promoting income. Therefore, the corporate anticipates YoY income progress to stay flat in This autumn.

Snap additionally noticed a drop in common income per person (ARPU) in Q3. International ARPU fell 11% YoY and the corporate recorded single-digit decreases in ARPU throughout all its geographic areas through the quarter.

Snap’s widening losses are additionally a priority. Web loss in Q3 widened to $359.5 million from $72 million within the year-ago interval. Loss per share was $0.22 versus $0.05 final 12 months. On an adjusted foundation, the corporate posted earnings of $0.08 per share however this was down 52% from the prior-year quarter.

Tailwinds

Snap has been capable of keep person progress and engagement even on this difficult atmosphere, which is encouraging. In Q3, the corporate’s common each day energetic customers (DAUs) grew 19% YoY to 363 million. On a sequential foundation, DAUs have been up 4%. Through the quarter, DAUs grew each sequentially and YoY throughout all geographic areas as effectively. For the fourth quarter, the corporate expects DAUs to be approx. 375 million, which might mirror a progress of 18% from the year-ago interval.

Snap additionally has important alternative inside its augmented actuality (AR) platform. There are over 250 million folks partaking with AR each day and this supplies the corporate with alternatives to assist companies ship immersive experiences and drive robust outcomes. There’s a variety of digital experiences that may be made doable by way of AR that may assist drive engagement and progress.

Click on right here to learn the complete transcript of Snap’s Q3 2022 earnings convention name

[ad_2]