[ad_1]

Drew Angerer

A Excellent Storm

Snap (NYSE:SNAP) is going through an issue – a number of, truly. We contend that the corporate has gorged itself on stock-based compensation, which has diluted class A shareholders tremendously. This dilution – mixed with the always-nagging downside of Snap’s twin share class construction – and the rising prices of capital are driving institutional buyers away from Snap. We hope to point out that one of the simplest ways ahead for Snap is to focus extra on profitability and cut back dependence on share-based compensation.

Not a Social Media Firm

Snap, previously often known as Snapchat, was based in 2010 and shortly turned a “unicorn” – i.e., a personal firm with too many personal fairness Silicon Valley varieties throwing an excessive amount of cash at it. The corporate was valued primarily based on the funding it took in at over $1 billion. SNAP went public in 2016 and since its founding has been helmed by Evan Spiegel. Snap made headlines when it went public due to its dual-class share construction. In essence, all shares traded publicly (class A shares) wouldn’t have voting rights, whereas the vast majority of the corporate’s class B shares, which retain the voting rights, are majority-held by Spiegel and Snap co-founder Bobby Murphy.

Together with the 2016 rebrand from Snapchat to easily Snap, the corporate’s management sought to alter its picture from being seen as a social media firm to being seen by the general public as a “digicam firm.” Merchandise resembling Spectacles are actually a key focus of the corporate, however its bread and butter stays the social media-esque app that generates primarily all the firm’s income, which is in flip generated nearly totally by advertisers.

The important thing differentiator of Snap to different social media websites is that content material on Snap finally deletes itself. As such, customers do not have to fret about content material hanging round on the web perpetually (though whether or not or not Snap truly deletes consumer publish information is some extent of debate).

Story of the Tape

2022 has not been form to Snap. 12 months so far the inventory has declined greater than 88%, in comparison with the broader market’s decline of 17.9%.

SNAP YTD (Koyfin)

Regardless of this precipitous fall, Snap nonetheless maintains a hefty market cap of over $13 billion. You may also be stunned – primarily based on the chart alone – to study that Snap is on monitor to interrupt income information, with its FY21 revenues coming in at $4.1 billion vs. FY20’s revenues of $2.5 billion. Subsequent yr is projected to be even higher, with the corporate guiding to top-line revenues of $4.6 billion.

Every day energetic consumer (DAU) development for the yr has additionally been stable, posting a 19% year-over-year achieve. The corporate has additionally tightened its belt financially and its efforts have been rewarded – common price per DAU declined by 12% yr over yr. Moreover, Snap introduced that it was planning to deploy $500 million in inventory buybacks, that are anticipated to completely happen in This fall.

So, what provides?

Properly, a few issues. For one, these DAUs do not fork over any cash to Snap for the privilege of utilizing the service. All income comes from advertisers identical to every other social media – oops, I imply digicam – firm, and advertisers are pulling again on their common spends. On the floor, although, it does not sound as if promoting budgets being on the decline ought to trigger a inventory to drop 88%. Actually, we imagine that the core of Snap’s issues stems from a a lot deeper, extra troubling downside.

Dilution in Motion

For all of the hype about A category shareholders being successfully frozen out of constructing any choices about how the corporate is run, a much more sinister motion is being taken by the corporate: extreme quantities of stock-based compensation. A fast take a look at Snap’s money move statements reveals the depth of the issue. In FY21, Snap doled out $1.09 billion in stock-based compensation. In FY20, the corporate paid out $770 million price of stock-based compensation.

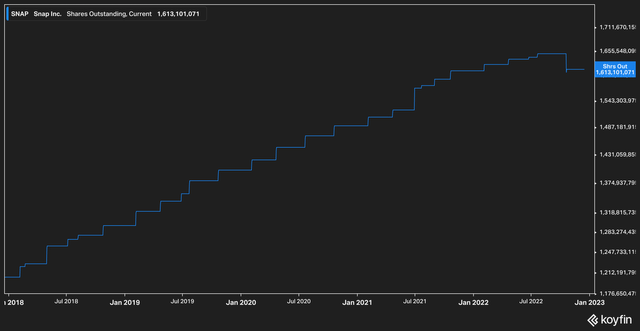

Whereas some are fast to level out that stock-based compensation is a non-cash expense – and they’re right – it does have a dilutive impact, particularly when used to this diploma. Let’s check out Snap’s excellent share rely through the years:

Snap’s 5 yr excellent share rely (Koyfin)

In 2018, the excellent share rely for Snap stood at round 1.1 billion. As of the tip of Q3 2022, the share rely was round 1.65 billion. This 55% enhance represents a direct dilution of every share held by every shareholder of the corporate (therefore, the explanation why Snap has been capable of retain such a big market cap at the same time as the value has fallen). The regular stair-stepping of the blue line up and to the best represents the overall share rely rising by new fairness issuance, but additionally by the exercising of stock-based compensation and choices.

In different phrases, in case you had purchased a share of Snap in 2018 for $1 and the value by no means modified till at this time, your consultant fairness share in 2022 could be price $0.45. Snap has actually taken benefit of shared-based comp through the years, and its shareholders have been left holding the bag. It places into perspective how minimal (hole?) Snap’s current announcement of a $500 million share buyback is – you’ll be able to see it on the chart, the lone motion downward on the chart.

All of that is thrown additional into aid by the truth that Snap has no plans to decelerate its stock-based comp exercise. Projections for the subsequent full yr present the corporate expending $1.2 billion on stock-based compensation – a 20% enhance from this yr.

No Relaxation for the Weary

As an example you’ve got been a Snap shareholder for a few years, and you’ve got watched your proportionate fairness within the firm shrink – after which shrink some extra. No less than we have hit an affordable value level at $8 per share, right? Sadly, in our opinion, the reply isn’t any.

We believed that the closest comparable firm for Snap is Meta (META). Regardless of what their founders need to imagine, each corporations interact in a core, ad-spend dependent, social media enterprise. Each corporations have founders with aspirations far past the bounds of the app retailer. Each corporations have launched costly {hardware} with questionable public reception. Each corporations have skilled precipitous inventory value declines in 2022. And but, just one appears to be considerably pretty valued by the market at this time limit.

Meta’s inventory is presently hovering round $120 per share and trades at a ahead EV/EBITDA a number of of 6.4x. Snap’s ahead EV/EBITDA a number of is 26x. Snap stays costly with a ahead P/E a number of of 31x vs. Meta’s 16.4x.

As a facet word, we put extra inventory within the EV/EBITDA valuation because it takes extra components into consideration than a uncooked P/E a number of, and it higher represents the value a real purchaser of the corporate would consider when evaluating the worth of an organization.

All of this illustrates that Snap is – even at $8 – a really costly inventory. Meta is anticipated to clock $116 billion in gross sales in 2022, whereas Snap is, as talked about earlier, going to usher in lower than $5 billion. Meta contains an ecosystem of corporations – Instagram, WhatsApp, Fb, and the Metaverse (for what that is price) – in comparison with the extra singular app product supplied by Snap, supported by a set of AR glasses.

Given these completely different market positions, we discover it tough to justify Snap buying and selling at any type of premium to Meta. There does not seem like any aggressive benefit, and within the warfare for economies of scale, even essentially the most ardent Snap bulls could be compelled to agree that Meta has the higher hand.

So why, we ask, would anybody pay such a premium for Snap? And moreover, what’s Snap truly price?

Valuation, Snapped

As talked about beforehand, our valuation metric of selection is EV/EBITDA, however it may be fairly tough to divine an applicable value primarily based on this a number of. For that reason, we’ll use each EV/EBITDA and ahead value to earnings (P/E).

As we shut out the massacre of a yr for fairness markets, Snap’s valuations are staggeringly excessive. Let’s evaluate them, once more, to Meta.

As talked about beforehand, Meta has a ahead P/E of 15.8x, whereas Snap’s is 30.9x. We will contend that Snap’s valuation needs to be lower than Meta’s primarily based on easy profitability – in FY21, Meta generated earnings earlier than taxes (EBT) of $47.2 billion. Snap, in the meantime, produced an EBT lack of $474 million. If one agrees that Meta is competitively priced at these ranges and multiples, it stands to motive that Snap ought to carry decrease valuations.

The analysts estimate of Snap’s per-share earnings in 2023 is $0.36. If we goal a ahead P/E for Snap of 12x, we arrive at a goal value of $4.32, a roughly 50% decline from present buying and selling ranges. Even that is considerably beneficiant, since Snap continues to compensate staff generously with inventory, which we anticipate will dilute the earnings per share at a substantial fee into the longer term. Elevating cash for inventory buybacks can be a proposition with diminishing returns because the Fed continues to boost charges and Snap’s price of capital rises accordingly.

Whereas it is fairly straightforward to govern numbers to estimate P/E ratios, Snap’s EV/EBITDA valuation paints a fairly bleak image as properly. EV/EBITDA is a ratio of what number of years it will take, with EBITDA being generated at fixed ranges, for a purchaser of the corporate to earn again their funding if the corporate was bought for its enterprise worth (market capitalization + debt – money readily available).

Snap has about $4.4 billion in money and money equivalents, a little bit over $4 billion in debt, and a market capitalization of $13.3 billion, which provides us an enterprise worth of $13.1 billion. With a ahead EV/EBITDA of 25.1x (for the sake of comparability, once more, Meta’s a number of is 6.1x), Snap once more seems to be wildly priced. One of the best ways for a corporation to enhance this a number of is to do issues which are immediately constructive for shareholders and the corporate: eradicate debt and enhance EBITDA. Neither of these issues appears to be significantly enticing (eliminating debt) or straightforward (rising EBITDA).

Assuming that Snap does not proceed to dilute shareholders, a value per share of $4.32 would give Snap a market cap of $6.95 billion. If we once more assume a gradual money and debt place, at that time Snap would have an enterprise worth of $7.2 billion. With its adjusted EBITDA analyst forecast of $617 million for the approaching yr, we arrive at a brand new forecast EV/EBITDA of 11.6x – which remains to be fairly costly.

The Backside Line

Provided that the macro atmosphere is deteriorating quickly for Snap with promoting budgets lowering around the globe, and on condition that Snap can be more and more constrained by Apple (AAPL) and Google (GOOG) (GOOGL) on what consumer information it may harvest and supply to mentioned advertisers, Snap is going through severe issues. Along with these exterior components, Snap’s administration continues to make life tough for itself and its shareholders by regularly diluting the inventory.

We imagine that every one of this constitutes one thing of an ideal storm for Snap. Tapping the debt markets for buybacks is not enticing as the price of capital rises. Deploying money for buybacks can be a bit like pouring cash down the drain given the years the corporate has spent inflating the share rely. The one choice, it appears, is for Snap to show its focus instantly to sustainable profitability.

We imagine that $4.32 is an affordable value goal for Snap, regardless that we expect {that a} steady market value may very well be materially decrease than that. With this in thoughts, we imagine that buyers ought to keep away from Snap at the moment – it is extremely overvalued, and buyers have little recourse in opposition to administration in the event that they imagine their choices to be unwise.

For now, we imagine there are higher investments available on the market, and that buyers who give Snap $8 for a share at this value should not be stunned in the event that they’re quickly left with half of their funding. Snap’s core enterprise is not horrible, and it is likely to be price revisiting as soon as the market displays a extra truthful value for shareholders – however that day is not at this time.

[ad_2]

Source link