[ad_1]

Pascal Le Segretain

With Ukraine outbreak of hostilities and the Western sanctions, leaving Russia has become extremely difficult for corporations. Last year, Russia placed a new ban on financial asset sales in retaliation against the US/EU measures. Related to Western banks, they need special permission from the Russian government today, and President Putin “reserves the right to authorize the sale.” This complexity explains why almost all foreign institutions present in Russia have continued to operate in the country. Société Générale is the only exception. As a reminder, the company sold its entire stake in Rosbank and its insurance business, collecting a loss of over €3 billion. Despite these difficulties, the ECB continues to insist on lowering the country’s exposure and reporting the latest words of the ECB Supervisory Board, banks “urge to accelerate their exit from Russia, given the increase in reputational, legal and financial risk.” Looking back to our investment call, in our initiation of coverage called “Time to Enter,” we reported how the French Institute had enough capital buffer to sustain the Russian exit. Since then, Société Générale S.A. (SCGLF, SCGLY) stock price has been broadly flat, but the company’s total return recorded a plus 16% thanks to a tasty dividend, outpacing the S&P 500 index.

Mare Past Analysis

Q2 comment

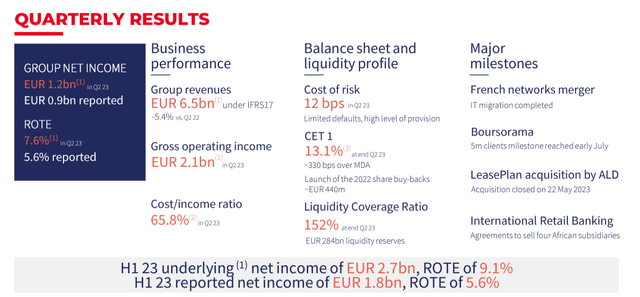

Very briefly, following the H1 results, Société Générale cancels the net loss recorded last year. In Q2, net profits reached €900 million, and cross-checking Wall Street figures, analysts consensus were expecting a net income of €670 million. Q2 beats follow the Q1 positive results. In numbers, the bank reversed the €1.5 billion loss achieved in Q2 2022, which was linked to the Rosbank sale. Aside from that, the company is facing a slowdown in banking activity. Indeed, the net margin fell by 8.9% to around €6.3 billion. On the other hand, profits benefitted from a lower cost of risk (12 basis points). Non-performing loans equal €166 million vs. market expectations of €430 million. Société Générale cost of risk reflects the group’s funding quality on the related loan portfolio. The bank has a safe CET 1 ratio of 13.1% with a Q2 RoTE of 5.6%. Still on the balance sheet measurements, the company’s Liquidity Coverage Ratio was 152% with liquidity reserves for €284 billion.

Société Générale Q2 Financials in a Snap

Source: Société Générale Q2 results presentation

Why are we still positive?

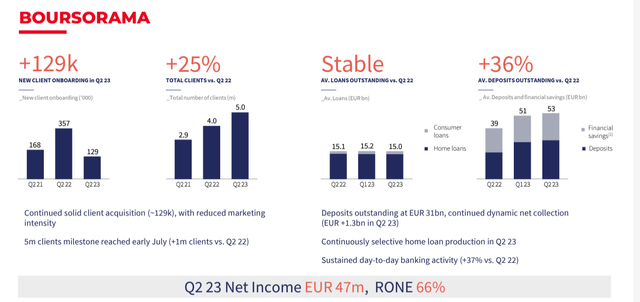

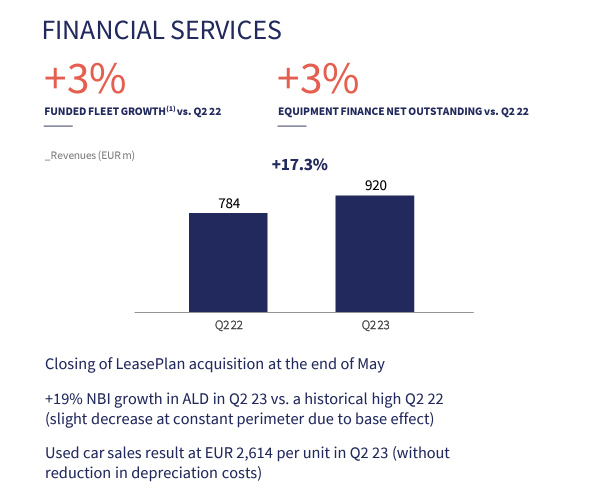

Following our update called: “We Positively View The Buyback,” Société Générale confirmed the buyback program, which is worth around €440 million; Thanks to the Q2 results, the company reaffirmed its 2023 financial objectives and constantly outperformed Wall Street numbers. In addition, we are waiting for the new strategic plan. In detail, the French bank could comment on the medium-term horizon in mid-September. After recent years of difficulties and thanks to a prompt decision to leave Russia, the bank might be in the right spot to close the valuation gap vs. its EU peers; Excluding the French Retail revenues, Boursorama becomes profitable with remarkable top-line growth driven by more clients (Fig 1). In numbers, Boursorama reached five million users with a net result of €47 million in Q2. Concerning the French retail division, the segment was under pressure, but the strong asset quality and the cost savings started to come through; ALD continues to perform with the Leaseplan consolidation (here are the details about our sum-of-the-part upside) – Fig 2. Given the H1 results, we increased our EPS forecast by 1% and 2% in 2023 and 2024, respectively. 2023 was a transition year for the French bank, and we view its asymmetric risk-return profile positively. The imminent catalyst on the CMD also supports this. The company is trading at a P/E of 5.5x (and 4.2x on the 2024 numbers, with a Price to Book value of 0.4x. As a reminder, the bank Price to Book Value historical average was at 0.53x, while other EU banks are trading at 0.8/0.9x (ISP and BNP). Our 2024 RoTE estimate reached 8.7% and, combined with a dividend yield of 8.5%, makes the company a buy. We should also include the ongoing buyback yield, which is around 2% of SocGen’s current market cap;

Looking back, we are aware that Société Générale has not been a profitable investment in the past decade, but moving forward, we see the company’s current valuation as too depressed, given the solid earnings fundamentals. Given our EPS hikes, we increased our valuation from €30 to €32 per share. We believe capital improvement trajectory, higher interest rates, and ALD upside will sustain a re-rating. Given the imminent new strategic update, now we think it is a matter of time.

Boursorama update

Fig 1

ALD Upside

Fig 2

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

[ad_2]