[ad_1]

The S&P 500 (SP500) on Friday advanced 0.75% for the week to close at 4,754.63 points, posting gains in four out of five sessions. Its accompanying SPDR S&P 500 Trust ETF (NYSEARCA:SPY) added 0.92% for the week.

The benchmark index extended its astonishing bull run to eight straight weeks, its longest such streak since early November 2017. Following on from the Federal Reserve’s long-awaited dovish pivot last Wednesday, economic data over the past few days continued to bolster bets for rate cuts and a soft landing.

However, Wall Street’s inexorable rally did show some signs of fatigue this week. On Wednesday, the S&P (SP500) came less than 20 points short of its record closing high, when it abruptly turned lower in afternoon trade and eventually ended deep in the red, suffering its worst day since late September.

The broad decline across the board on Wednesday did not have any specific catalyst. Instead, it was chalked up to a number of reasons such as an expected correction after such a massive runup, a readjustment from overbought levels and trades tied to zero-day options.

The economic calendar during this week pointed to the kind of trends that both the Fed and market participants want to see: moderating inflation amid an economy that is strong but not too strong, supported by a cooling labor market and a favorable direction in the housing market.

Tuesday’s housing starts data showed that U.S. homebuilders were picking up pace following a period of record high mortgage rates, a narrative that was backed up by Wednesday’s higher-than-anticipated existing home sales reading.

Perhaps most significantly, on Thursday the final estimate of U.S. Q3 GDP growth was revised lower, and so was the quarterly core personal consumption expenditures (PCE) price index – the Fed’s favored inflation gauge. Finally, on Friday, the core PCE price index for November rose at a lesser-than-anticipated rate.

With traders going on holiday for the Christmas weekend, the question now is whether Wall Street can extend its rally into the end of 2023. The S&P 500’s (SP500) intraday advance on Friday marked the first step in what is known as a “Santa rally” – an event where stocks make gains on the last five regular trading days of the year and the first two of the new year.

Other notable events this week included a burst of activity in the mergers and acquisitions space. The highlight was arguably Japan’s Nippon Steel (OTCPK:NISTF) (OTCPK:NPSCY) inking a $14.9B deal to buy legacy steelmaker US Steel (X), with The White House calling for “serious scrutiny” of the transaction. Meanwhile, multiple reports said that Synopsys (SNPS), a maker of software used in chip design, was in discussions to acquire engineering software firm Ansys (ANSS).

Additionally, beleaguered luxury retailer Farfetch managed to secure a last-minute rescue after South Korean e-commerce giant Coupang (CPNG) agreed to buy its assets and business and give it a $500M bridge loan.

Quarterly results also grabbed some attention this week. Parcel delivery giant FedEx (FDX) disappointed with its guidance. The company is often seen as a global economic bellwether. Sports footwear and apparel giant Nike (NKE) also provided weak guidance, sending ripples across consumer discretionary stocks. Conversely, chipmaker Micron Technology’s (MU) earnings report was cheered.

Turning to the weekly performance of the S&P 500 (SP500) sectors, all 11 ended in the green, with the exception of Utilities. Communication Services topped the gainers, while Energy came in second. The latter rose on the back of a ~3% climb in WTI crude oil futures (CL1:COM) amid tensions in the Red Sea and Angola’s exit from the Organization of the Petroleum Exporting Countries. See below a breakdown of the performance of the sectors as well as their accompanying SPDR Select Sector ETFs from December 15 close to December 22 close:

#1: Communication Services +4.10%, and the Communication Services Select Sector SPDR Fund (XLC) +2.24%.

#2: Energy +1.66%, and the Energy Select Sector SPDR ETF (XLE) +0.81%.

#3: Materials +1.13%, and the Materials Select Sector SPDR ETF (XLB) +0.50%.

#4: Health Care +1.07%, and the Health Care Select Sector SPDR ETF (XLV) +0.64%.

#5: Industrials +0.65%, and the Industrial Select Sector SPDR ETF (XLI) +0.10%.

#6: Consumer Staples +0.63%, and the Consumer Staples Select Sector SPDR ETF (XLP) -0.03%.

#7: Consumer Discretionary +0.51%, and the Consumer Discretionary Select Sector SPDR ETF (XLY) +0.15%.

#8: Financials +0.28%, and the Financial Select Sector SPDR ETF (XLF) -0.03%.

#9: Real Estate +0.25%, and the Real Estate Select Sector SPDR ETF (XLRE) -0.68%.

#10: Information Technology +0.06%, and the Technology Select Sector SPDR ETF (XLK) +0.18%.

#11: Utilities -1.27%, and the Utilities Select Sector SPDR ETF (XLU) -2.11%.

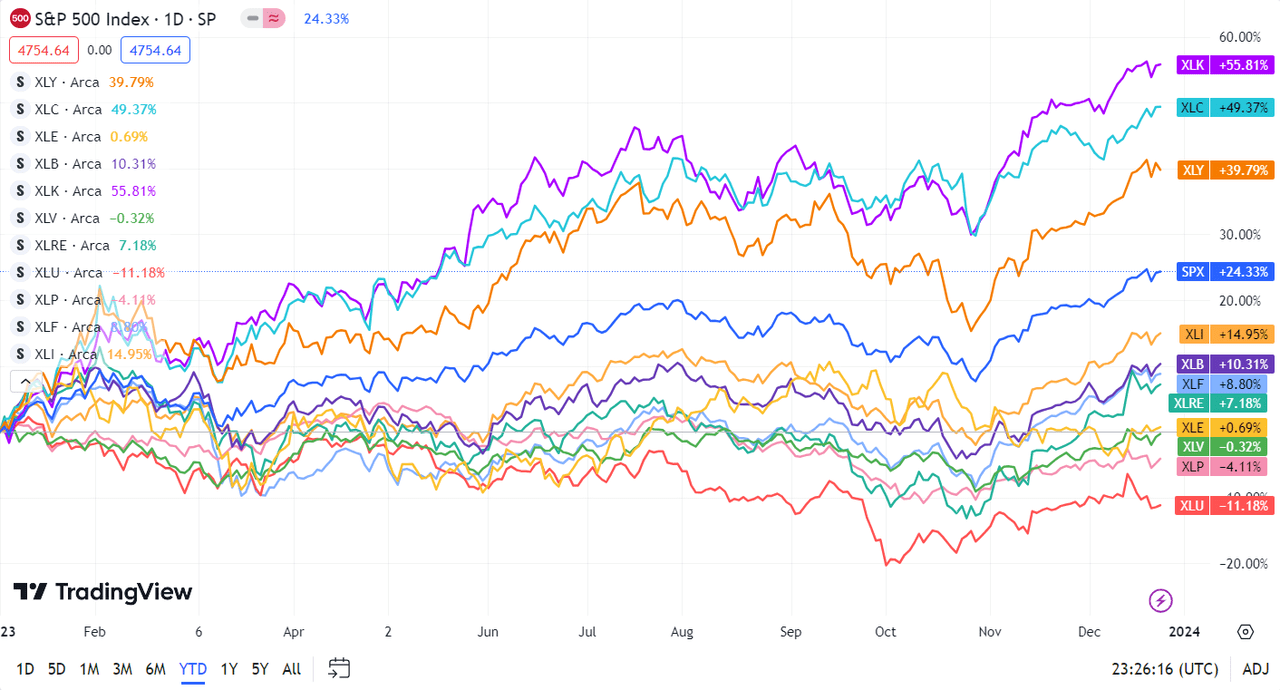

Below is a chart of the 11 sectors’ YTD performance and how they fared against the S&P 500 (SP500). For investors looking into the future of what’s happening, take a look at the Seeking Alpha Catalyst Watch to see next week’s breakdown of actionable events that stand out.

More on the markets

[ad_2]

Source link