[ad_1]

Delmaine Donson/E+ via Getty Images

Overview

Spotify (NYSE:SPOT) is a great business trading at a market capitalization of $24 billion or a price-to-sales ratio of 1.9. With almost 500 million monthly active users and over 200 million paying customers, Spotify is the music and podcast industry leader, and recently, they started expanding into audiobooks. I believe Spotify could already be profitable today and achieve 20% operating income margins over time.

If I had $24 billion in my bank account and I was offered to purchase the entire company, I would do it. However, one major problem makes Spotify stock uninvestable for me.

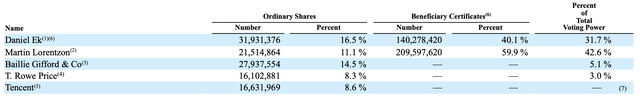

Ownership structure

When Spotify IPO’d in 2018, the founders were granted special voting shares to control the majority of the voting power, with currently only 27.6% ownership in the company.

20-F

Granting the majority of the voting power to the founders is not necessarily bad by itself. It just means that they can run the company however they wish, and the rest of the shareholders cannot influence the management decisions.

Problems

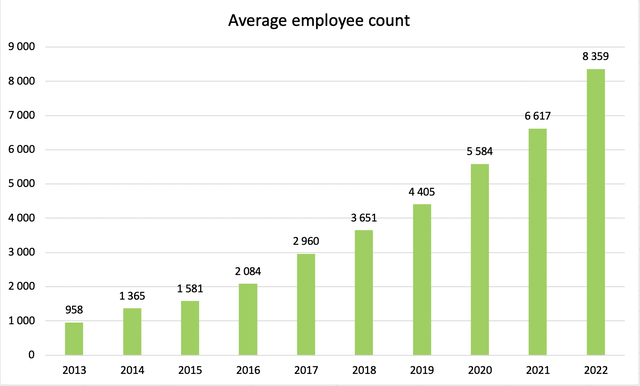

The problem is that Spotify is operating extremely inefficiently and is overstaffed. The employee headcount is increasing rapidly year over year. This business is an app, so why do they need to hire more than 1,000 new employees each year? I remember I could listen to any song I wanted just fine in 2013 when they had less than a thousand employees.

Author’s spreadsheet, sourced 20-Fs post-2016, Statista.com pre-2016.

Recently, there has been a narrative that Spotify is becoming more efficient after laying off 6% of its workforce and streamlining its organizational structure in 2023. While this is a positive step, it may be overstated. The layoffs were necessary due to a 44% (36% constant currency) increase in operating expenses in 2022, which outpaced revenue growth of 18% (12% constant currency). Despite the layoffs, Spotify’s current employee count remains above the 2022 average at around 9,200, which is still 65% higher than in 2020. So, while the layoffs were a step in the right direction, Spotify remains overstaffed.

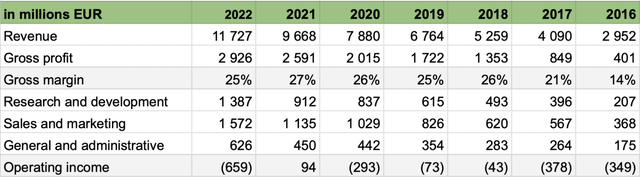

Financials

Even though revenues are up almost 4x from 2016, the operating expenses scaled just as fast as revenues. The entire point of investing in a software business is that revenues can be scaled faster than operating expenses, leading to high profitability. However, Spotify’s income statement looks more like a poorly run car company rather than a software business.

Author’s spreadsheet, sourced from 20-Fs

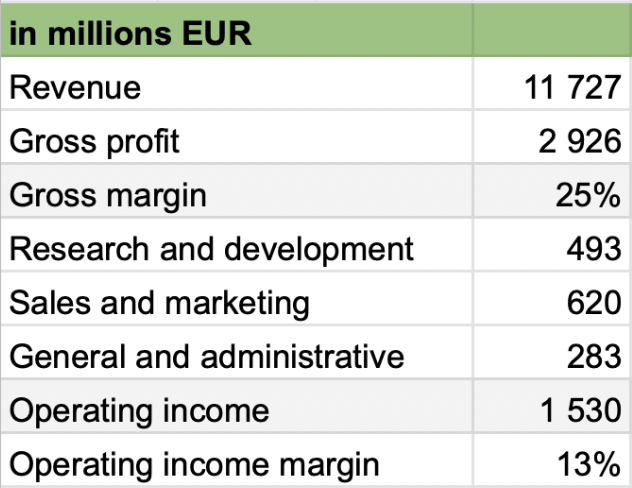

I’m sure Spotify could operate just fine with the 2018 cost structure and still achieve its growth targets. It would already result in 13% operating income margin at the 2022 revenue run rate, and as the revenues and gross margins improve over time, I believe Spotify could achieve 20% operating income margins.

Author’s spreadsheet, sourced from 20-Fs

Unfortunately, this is just my imagination, and there is no indication of the management changing its course to start radical cost-cutting and business streamlining efforts.

By the way, if the management decided to operate at a break-even level while in high-growth mode, I wouldn’t have any objections to that approach. Also, if they can find solid investments with reasonable returns, I encourage them to invest as heavily as possible. However, the problem is when they keep increasing the overall cost structure leading to highly negative long-term ROI.

You might assume there is no way such a massive company with all the brain power and resources would overstaff itself and that all the employees must be essential to the business. Well, recently, Elon Musk took over Twitter and promptly laid off 50% of the company’s 7,500 employees. Since then, the number of employees has continued to decline, with the current count at approximately 2,300, representing a 70% reduction in the workforce. Despite these cuts, Twitter is performing well and has even been introducing new features at a record pace. Unfortunately, when organizations grow in size, they tend to become bogged by bureaucracy, internal politics, non-essential employees, and excessive meetings, leading to a decline in overall productivity.

Future growth opportunities

Spotify has made impressive strides in the podcast industry, rising from a minor player to a dominant market leader in just a few years. The company’s next ambitious goal is to achieve similar success in the audiobook market. Although audiobooks currently represent only 6-7% of the global $140 billion book market, the market share in more mature markets is closer to 50%. As the audiobook market continues to expand, Spotify sees a $70 billion potential market opportunity.

If they capture a significant market share, it could lead to $25 billion in revenue. Audiobooks’ gross margins are expected to be 40% which could lead to 15% net income margins. 15% net income from $25 billion is almost $4 billion in profits. Throw a PE multiple of 20 on top of that, and Spotify’s audiobook business could be valued at $80 billion in the future, or three times more than the current market cap.

It all sounds great, and I hope they are successful. However, it is all speculation so far, and I feel the management is trying to get investors excited with a new growth story instead of focusing on fixing their core business profitability. Firstly, there is no assurance that audiobook gross margins will stay at 40% over the long term after competition increases. Secondly, if the management cannot run the music business efficiently, there isn’t any reason to believe they could manage the audiobook business any better.

Valuation

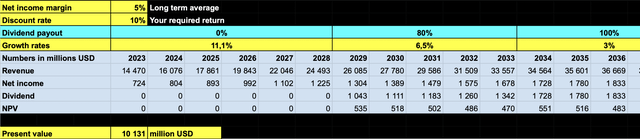

I believe that with the current management, Spotify will reach profitability in a few years, but it will be a low-margin business, and I’m assuming long-term net income margins to be 5%. I used analysts’ consensus estimates on revenue growth with a CAGR of 11.1% over the next 6 years. After that, CAGR slows to 6.5% over the next 5 years and then slowing down to low single digits. I assume no dividend over the first 6 years as it will likely take a few years before Spotify reaches profitability, and they will invest more heavily. For the next 5 years, I used an 80% dividend payout ratio and, after that, a terminal 100% dividend payout ratio. The discount rate is 10%, leading to a net present value of $10 billion or 58% below the current market cap.

Author’s spreadsheet

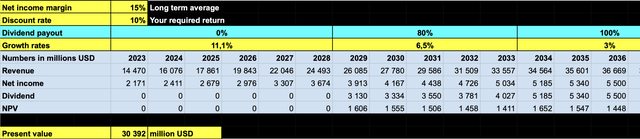

However, if the company was run efficiently, I believe it could achieve 15% long-term net income margins. In that case, the net present value with a 10% discount rate would be $30 billion.

Author’s spreadsheet

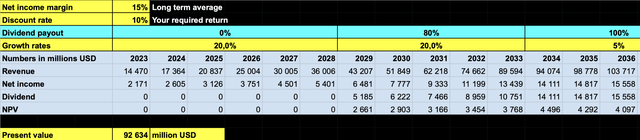

Suppose the management will reach their 20% revenue CAGR target over the next decade and then slow down to 5%. Using 15% net income margins and I get a valuation of $92 billion.

Author’s spreadsheet

Keep in mind that constant currency growth for 2022 was only 12%, and the management’s target relies entirely on the highly ambitious growth plans in the audiobook market.

Conclusion

So there is definitely upside potential, and Spotify is not a stock I would dare to short at this low valuation. However, I have no trust in the management’s ability to control the costs and achieve high profitability levels. When reaching profitability, I believe Spotify will most likely remain a low-margin business, thus not deserving a premium valuation.

[ad_2]