[ad_1]

Over time, Microsoft Company (NASDAQ: MSFT) has always diversified its portfolio, a method that helped it successfully take care of weaknesses in sure areas just like the core PC software program enterprise. The corporate, which has sturdy presence in a lot of the key markets globally, skilled a slowdown final 12 months, primarily as a consequence of inflationary pressures and price escalation.

Purchase It?

The corporate’s shares reached their highest-ever worth greater than a 12 months in the past after making regular positive factors, in among the best profitable streaks the market has witnessed. However then got here the tech selloff, and Microsoft was not spared – this week, MSFT traded on the lowest degree in about two years and nicely under its 52-week common. Similar to the board market, the tech agency confronted a number of challenges prior to now couple of years, however they aren’t particular to the corporate or the trade it represents. In the meantime, the inventory has develop into extra inexpensive after the year-long shedding streak.

Earnings: IBM Q3 revenue beats estimates; income up 6%

If the optimistic outlook on the inventory is any indication, by the tip of 2023 it might rebound to the extent the place it stood six months in the past. It’s unlikely to get cheaper within the foreseeable future. So, now could be the time to speculate on this blue-chip firm that has sturdy fundamentals and nice development alternatives.

Contemplating the inventory’s restoration prospects, the market will likely be intently following Microsoft’s second-quarter earnings report which is anticipated later this month. The diversified enterprise mannequin and wholesome stability sheet, characterised by sturdy money circulate and sustainable debt, add to the inventory’s enchantment.

Street Forward

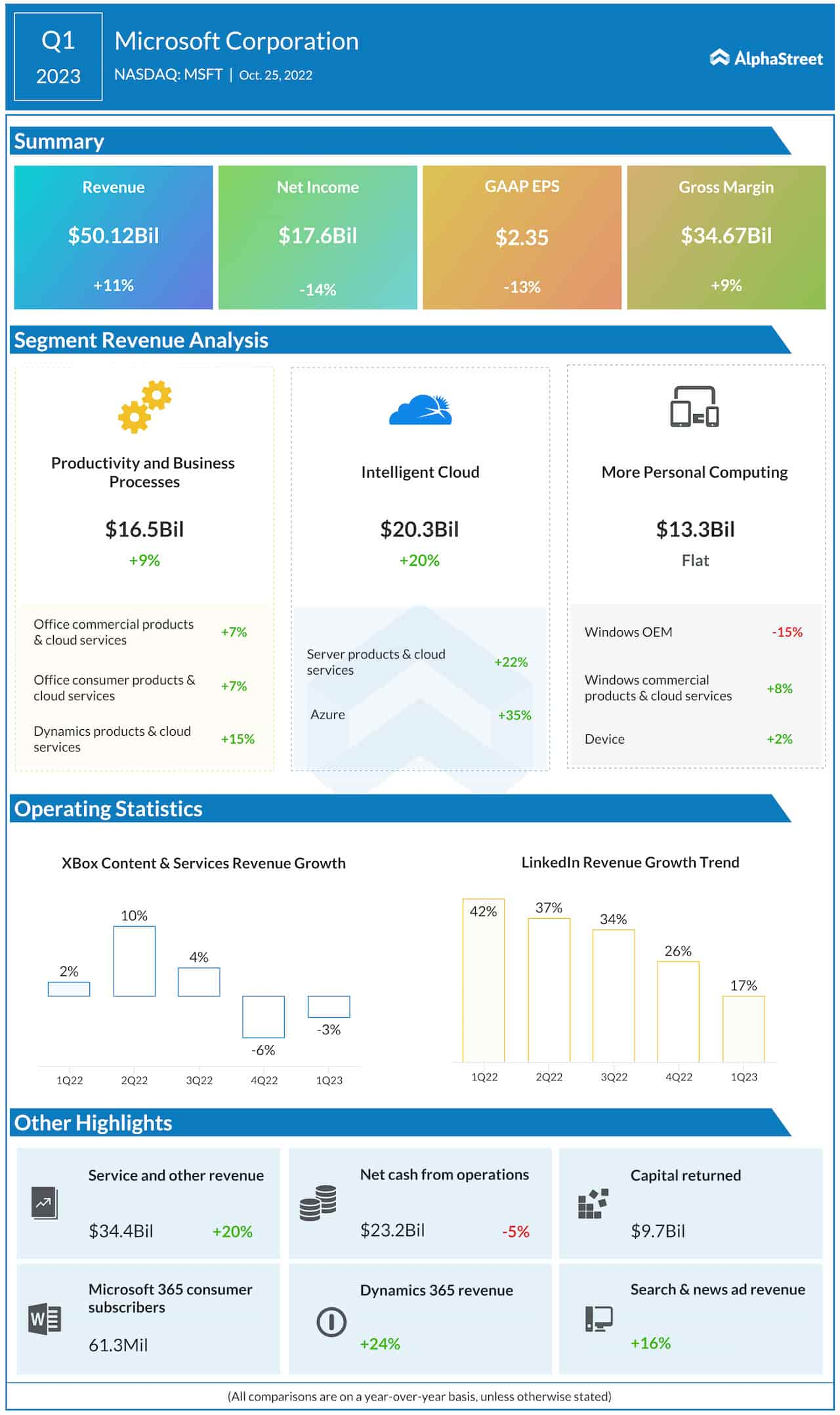

In terms of future development, the corporate is well-positioned to faucet into rising alternatives in areas like cloud computing, digital promoting, and cybersecurity. For example, the Clever Cloud enterprise accounted for round 40% of whole revenues in the newest quarter — Azure is touted because the second-largest cloud supplier on this planet now. Microsoft additionally dominates in enterprise productiveness companies, because of the widespread adoption of merchandise like Microsoft 365.

Microsoft Company Q1 2023 Earnings Name Transcript

“On the whole firm degree, we proceed to count on double-digit income and working earnings development on a continuing forex foundation. Income will likely be pushed by round 20% fixed forex development in our business enterprise, pushed by sturdy demand for our Microsoft Cloud choices. With the excessive margins in our Home windows OEM enterprise and the cyclical nature of the PC market, we take a long-term strategy to investing in our core strategic development areas and preserve these funding ranges no matter PC market situations,” mentioned Microsoft’s CFO Amy Hood on the first-quarter earnings name.

Outcomes Beat

The corporate has a superb observe document of delivering stronger quarterly monetary outcomes than estimated, with revenues rising steadily and crossing the $50-billion mark for the primary time within the final fiscal 12 months. Within the three months that ended September 2022, the highest line moved up 11% year-over-year to $50.1 billion. All of the working segments and sub-divisions, besides Home windows OEM, registered development. Nonetheless, earnings declined by double digits to $2.35 per share, which is especially attributable to the next tax provision.

Microsoft’s inventory had a quite unimpressive begin to the 12 months, struggling losses within the preliminary days. At $222, it traded barely decrease on Friday afternoon.

[ad_2]