[ad_1]

Baris-Ozer

Introduction

Following the strongest operating conditions in many years during most of 2022, I suspected Suncor Energy (NYSE:SU) would be leveling up in 2023 with higher shareholder returns that as my previous article discussed, could help by offsetting any recession that may possibly lay ahead. Thankfully this was recently confirmed and thus very excitingly, their shareholders are about to a get 50% pay raise as they reach their interim net debt target as soon as the end of the first quarter of 2023.

Coverage Summary & Ratings

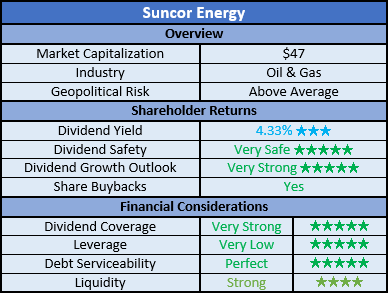

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

Author

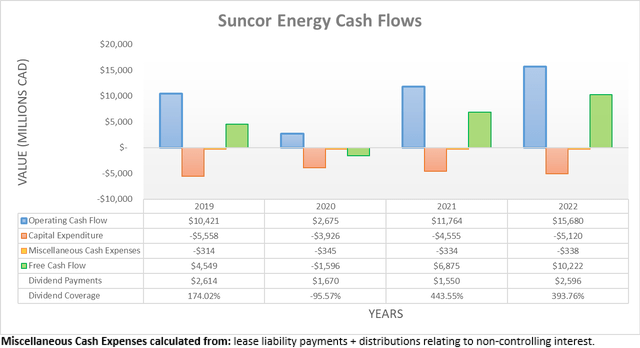

After seeing their cash flow performance weighed down by working capital builds during the first nine months of 2022, this continued into the fourth quarter, albeit to a less significant event. By the time the books finally closed for the year, their operating cash flow landed at C$15.68b and thus a very impressive one-third higher year-on-year versus their previous result of C$11.764b during 2021. Apart from representing a record-setting result, it also marks a more noticeable year-on-year improvement compared to what was observed during the first nine months of 2022.

Author

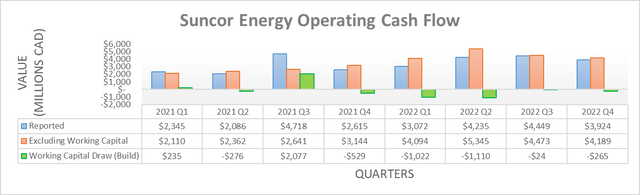

When viewing their operating cash flow on a quarterly basis, it shows they only saw a relatively minor working capital build of C$265m during the fourth quarter of 2022 that barely hindered their reported result of C$3.924b compared to earlier in the year when the first and second quarters saw builds of C$1.022b and C$1.11b, respectively. Whilst oil and gas prices eased during the fourth quarter, it was positive to see their underlying operating cash flow that excludes these working capital movements was still a strong C$4.189b and thus bodes well heading into 2023.

Suncor Energy Fourth Quarter Of 2022 Results Presentation

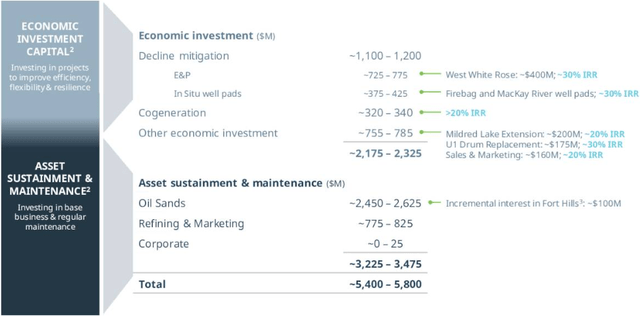

Whilst they cannot provide earnings guidance for 2023 given the inherent volatility of the oil and gas industry, they can still provide guidance for their capital expenditure. In this aspect, they are forecasting spending of C$5.6b at the midpoint, which represents a modest increase year-on-year versus their capital expenditure of C$5.12b during 2022. Despite being higher than previously, this is not too surprising in light of these inflationary times and the fact that booming oil and gas prices are often followed by higher capital expenditure. That said, if oil and gas prices ease even further, it would not be surprising to see their capital expenditure follow in tandem given the nature of their industry and thus, revert back closer to their previous level of C$4.555b during 2021. Very excitingly, they have also provided guidance regarding their shareholder returns that as subsequently discussed, are poised to be pushed higher as they reach their interim net debt target, as per slide four of their fourth quarter of 2022 results presentation.

Author

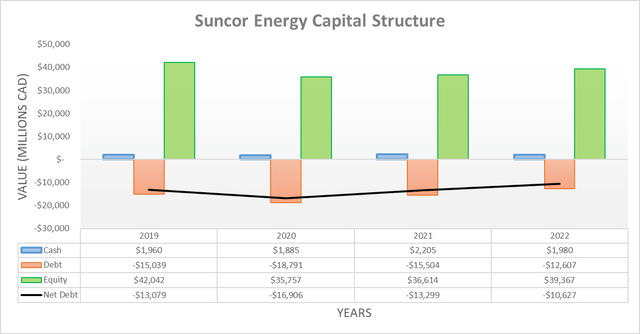

Thanks to their strong cash flow performance during the fourth quarter of 2022, their net debt once again ticked lower, thereby now landing at C$10.627b versus its previous level of C$11.674b following the third quarter. If also including their lease liabilities as practiced by management in regards to their capital allocation strategy, their net debt is now C$13.322b versus C$14.584b across these same two points in time, respectively. Thanks to the latter seeing a similar decrease as the former, it is now even closer to their interim C$12b net debt target, which very excitingly, they expect to cross literally within weeks, as per the commentary from management included below.

“Our intent is to pivot to the 75%-25% here towards the end of Q2 — sorry, end of Q1 and as we’re starting to see the debt start to get even closer to those long-term targets that we set out quite a while ago.”

-Suncor Energy Q4 2022 Conference Call.

Right now when writing this article, it is early March 2023 and thus there are only a few weeks left until the end of the quarter at which point, management expects to lift their shareholder returns from 50% of their free cash flow to 75%. In turn, this effectively amounts to a 50% pay raise for shareholders who will see far more of their free cash flow heading into their pockets, relative to their prevailing future free cash flow. As for their circa C$1b Fort Hills acquisition during the first quarter of 2023 that was flagged within my previous analysis, this is now expected to be offset soon after by their upcoming circa C$1.2b divestiture of UK assets and thus it does not impact this timeline, as per the commentary from management included below.

“This is around, as you mentioned, the timing of closing Fort Hills, we had assumed it would be in the beginning of Q2 and much up with alongside of the UK assets in that quarter. There’ll be some noise around that. Obviously, it’s a close Fort Hills earlier, but we expect to move the beginning of Q2 to 75%, 25%.”

-Suncor Energy Q4 2022 Conference Call (previously linked).

Since these two effectively net out against each other, it means their net debt will continue heading lower on the back of their free cash flow. Whilst oil and gas prices have eased thus far into 2023, they can still generate strong free cash flow given their previous results during 2021 that if persistent, also offers desirable value, as outlined within my previous analysis.

Unless we see a return to the booming triple-digit oil prices of 2022, it will likely take around two years to reach their final net debt target of C$9b. To shed the next C$3b of net debt whilst only retaining 25% of their free cash flow will require the company to generate total free cash flow of C$12b, which is realistic across a multi-year timeframe but unlikely to be forthcoming until 2025 or later, barring another oil price boom. That said, the prospect of shareholders getting another pay raise is still enticing, regardless of this likely prolonged wait. Since their capital structure only saw a modest change during the fourth quarter of 2022 and their financial performance remained strong, it would be redundant to reassess their leverage, debt serviceability and liquidity in detail, especially as their outlook for 2023 was the primary focus of this follow-up analysis.

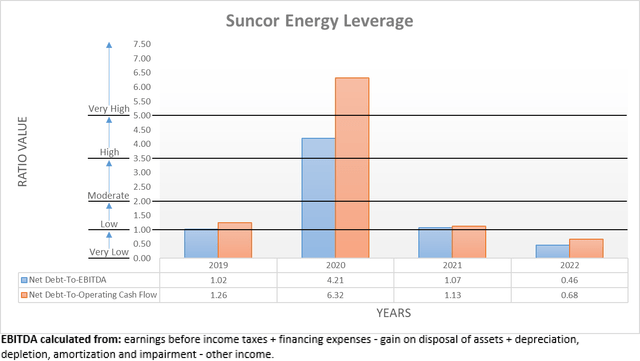

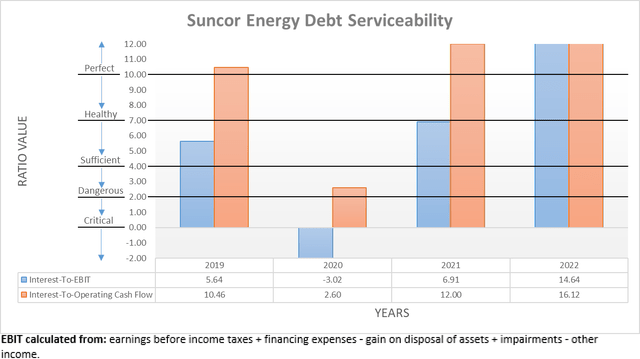

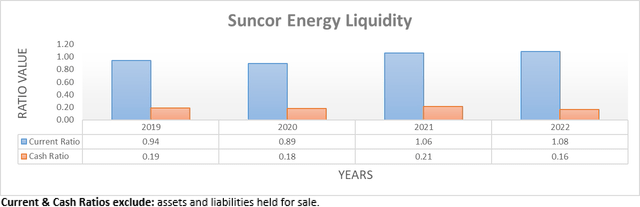

The three relevant graphs are still included below to provide context for any new readers, which shows their leverage is once again very low, quite unsurprisingly. Regardless if looking at their net debt-to-EBITDA of 0.46 or their accompanying net debt-to-operating cash flow of 0.68, they are both well beneath the applicable threshold of 1.00. Concurrently, it is only natural to see perfect debt serviceability with their interest coverage at 14.64 and 16.12 when compared against their EBIT and operating cash flow, respectively. Meanwhile, their massive cash windfall during 2022 ensured their liquidity remained strong with a current ratio of 1.08 and more importantly, a cash ratio of 0.16. If interested in further details regarding these topics, please refer to my previously linked article.

Author Author Author

Conclusion

In mere weeks, the first quarter of 2023 will already be over and whilst the weeks are flying past, very excitingly their shareholders are poised to see a 50% pay raise as their shareholder returns are pushed higher. Regardless of the split between share buybacks and dividends, the former should still help translate into more of the latter in the years ahead. When combined with their similar share price as when conducting my previous analysis that highlighted their desirable value, I believe that maintaining my buy rating for SU stock is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Suncor Energy’s SEC filings, all calculated figures were performed by the author.

[ad_2]