[ad_1]

Updated on May 17th, 2023

For Canadian investors, having exposure to the United States stock market is very important. There are a number of reasons why.

First, the United States is the largest stock market in the world. In order to avoid home country bias and have a globally diversified investment portfolio, exposure to American stocks is required.

Second, there are certain sectors that are underrepresented in the Canadian stock market. Examples include healthcare, technology, and consumer staples. Interestingly, these sectors are among the strongest in the U.S. market.

To invest in stocks from the United States, Canadian investors need to understand how this will impact their tax bills.

This article will discuss the tax implications for Canadians that invest in U.S. stocks, including examples of dividend- and non-dividend-paying stocks held in both taxable accounts and nontaxable accounts.

Table of Contents

While we recommend reading this article in its entirety, you can skip to a particular section of this article using the table of contents below:

Capital Gains Tax

There are two types of investing taxes that Canadian investors will pay if they are investing outside of a tax-free retirement account. The first is capital gains tax, which will be discussed first.

A capital gain occurs when a security is sold for more than its purchase price. Conversely, a capital loss comes from selling a security for less than it was purchased for.

Canadian investors are forced to pay capital gains tax on 50% of their realized capital gains. The tax rate for these transactions is identical to the individual’s marginal tax rate.

Marginal tax rates are composed of a federal component (which is paid in the same amount by all Canadians) and a provincial component (which varies depending on which province you live in).

According to the Canada Revenue Agency, current federal tax rates by tax bracket are:

15% on the first $50,197 of taxable income, +

20.5% on the next $50,195 of taxable income (on the portion of taxable income over $50,197 up to $100,392), +

26% on the next $55,233 of taxable income (on the portion of taxable income over $100,392 up to $155,625), +

29.38% on the next $66,083 of taxable income (on the portion of taxable income over $155,625 up to $221,708), +

33% of taxable income over $221,708.

As mentioned, provincial tax rates vary by province. Examples in this article will use Ontario’s tax rates, as it is Canada’s most highly-populated province. Ontario tax rates by tax bracket are shown below:

5.05% on the first $46,226 of taxable income, +

9.15% on the next $46,228, +

11.16% on the next $57,546, +

12.16% on the next $70,000, +

13.16% on the amount over $220,000

So how do capital gains taxes vary for holders of U.S. stocks?

Fortunately, the capital gains tax paid on investments in U.S. stocks is identical to the capital gains paid on Canadian securities. The only minor difference is that capital gains must be expressed in Canadian dollars for the purpose of calculating an investor’s tax liability.

An example can help us understand capital gains tax from U.S. stocks in the context of these Canadian tax brackets. Let’s assume that you are a Canadian investor who has executed the following trades:

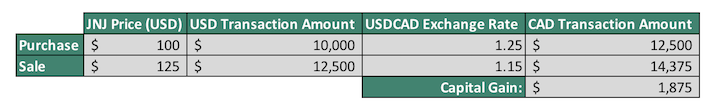

Purchased 100 shares Johnson & Johnson (JNJ) for US$100 at a time when the USD to CAD exchange rate was 1.25

Sold your Johnson & Johnson shares for US$125 at a time when the USD to CAD exchange rate was 1.15

You will pay capital gains on the difference between your purchase price and your sale price, expressed in Canadian dollars. The following table can help us to understand the proper way to calculate the CAD-denominated capital gain.

This is the amount used to calculate capital gains. As mentioned previously, half of this amount would be taxed at the investor’s marginal tax rate. We will assume for simplicity’s sake that the investor is in the highest tax bracket, which is 46.16% for Ontario residents.

The following table breaks down the capital gains tax calculation for this hypothetical investment in Johnson & Johnson (JNJ).

Fortunately, capital gains tax can be avoided entirely if U.S. stocks (or stocks from any other country) are held in Canadian retirement accounts. We discuss the two types of Canadian retirement accounts (TFSAs and RRSPs) in a later section of this article.

For now, we’ll move on to discussing the taxation of dividends paid to Canadian investors from U.S. corporations.

Dividend Tax

Unlike capital gains taxes (which are calculated in the same way for U.S. stocks and Canadian stocks), the taxes that Canadian investors pay on international stock dividends are different than the taxes they pay on domestic dividends.

This is due to a special type of dividend tax called “withholding tax.” Unlike other taxes paid by Canadian investors, these taxes are withheld at source (by the company that pays the dividend) and remitted to their own tax authority – which, for United States companies, is the Internal Revenue Service (IRS).

Dividend withholding taxes meaningfully reduce the income that Canadian investors are able to generate from U.S. stocks. Fortunately, this effect is partially offset by a special tax treaty between the United States and Canada (called the Convention Between Canada and the United States of America). The U.S. withholding tax rate charged to foreign investors on U.S. dividends is normally 30% but is reduced to 15% for Canadians due to this treaty.

How does this compare to the average withholding tax of countries across the globe?

Even after accounting for the special tax treaty, the U.S. is still an unfavorable market for Canadian investors from the perspective of tax efficiency. According to Blackrock, the weighted average foreign withholding tax on international stock dividends is 12%. Even after accounting for the tax treaty, Canadians still pay a 15% withholding tax — 25% higher than the weighted average dividend withholding tax around the world.

Canadian investors will be happy to hear that this foreign withholding tax is able to be reclaimed come tax time. The Canada Revenue Agency allows you to claim a foreign tax credit for the withholding tax paid on United States dividends. This prevents investors from paying tax twice on their dividend income.

Still, U.S. dividends are not as tax efficient as their Canadian counterparts. The reason why is somewhat complicated and is related to a Canadian taxation principle called the “dividend tax credit.” The dividend tax credit meaningfully reduces the taxes that Canadians pay on dividends, and causes dividend income to be the single most tax-efficient form of income available to Canadians.

According to MoneySense:

When a non-resident invests in U.S stocks or U.S.-listed exchange traded funds (ETFs), the standard withholding tax on dividends is 30%. A Canadian resident is entitled to a lower withholding rate of 15% under a treaty between the two countries if they have filed a form W-8 BEN with the brokerage where they hold the investments.

Our recommendation for Canadian investors looking for exposure to U.S. stocks is to hold their U.S. stocks in retirement accounts, which simultaneously reduces their tax burden and dramatically reduces the tax complexity of their investment portfolios. We discuss dividend taxes in retirement accounts in the next section of this article.

Dividend Tax in Retirement Accounts

The best way for Canadian investors to gain exposure to U.S. stocks is through retirement accounts.

There are two major retirement accounts available for Canadian investors:

Both offer tax-advantaged opportunities for Canadians to deploy their capital into financial assets. With that said, there are important differences as to how each account functions.

The Tax-Free Savings Account (TFSA) allows investors to contribute after-tax income into the account. Investment gains and dividends held within the account are subject to no tax and no tax is incurred upon withdrawal from the account. TFSAs are functionally similar to Roth IRAs in the United States.

The other type of retirement account in Canada is the Registered Retirement Savings Plan (RRSP). These accounts allow Canadian investors to contribute pre-tax income, which is then deducted from their gross income for the purpose of calculating each year’s income tax. Income tax is paid later, upon withdrawals from the RRSP. RRSPs are functionally equivalent to 401(k)s within the United States.

Both of these retirement accounts are very attractive because they allow investors to deploy their capital in a very tax-efficient manner. In general, no tax is paid on both capital gains or dividends so long as the stocks are held within retirement accounts.

Unfortunately, there is one exception to this rule. The withholding tax paid to the IRS on dividends from United States businesses is still paid within TFSAs. For this reason, U.S. stocks should not be held within a TFSA if possible.

Instead, the RRSP is the best place to hold U.S. stocks (not MLPs, REITs, etc.) because the dividend withholding tax is waived. In fact, no tax is paid at all on U.S. stocks held within RRSPs. This means that Canadian investors should hold all dividend-paying U.S. stocks within their RRSPs if they have sufficient contribution room. U.S. stocks that don’t pay dividends should be held in a TFSA. Lastly, Canadian stocks should be held in non-registered accounts to take advantage of the dividend tax credit.

Final Thoughts

This article began by discussing some of the benefits of owning U.S. stocks for Canadian investors before elaborating on the tax consequences of implementing such a strategy. After describing the tax characteristics of U.S. stocks for Canadians, we concluded that the best practices are to:

Hold dividend-paying U.S. stocks within an RRSP

Hold non-dividend-paying U.S. stocks within a TFSA

Hold Canadian stocks in a taxable account — especially dividend-paying Canadian stocks, to take advantage of the dividend tax credit

If you are a Canadian dividend investor and are interested in exploring the U.S. stock market, the following Sure Dividend databases contain some of the most high-quality dividend stocks in our investment universe:

The Dividend Aristocrats: S&P 500 stocks with 25+ years of consecutive dividend increases

The Dividend Achievers: dividend stocks with 10+ years of consecutive dividend increases

The Dividend Kings: considered to be the best-of-the-best when it comes to dividend growth, the Dividend Kings are an elite group of dividend stocks with 50+ years of consecutive dividend increases

Alternatively, you may be looking to tailor a very specific group of dividend stocks to meet certain yield and payout characteristics. If this is indeed the case, you will be interested in the following databases from Sure Dividend:

Another way to approach the U.S. stock market is by constructing your portfolio so that it owns companies in each sector of the stock market. For this reason, Sure Dividend maintains 10 databases of stocks from each sector of the market. you can access these databases below.

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.

[ad_2]