[ad_1]

Printed on December thirty first, 2022 by Nikolaos Sismanis

Dividend Aristocrats comprise an elite group of 65 S&P 500 shares with 25+ years of consecutive dividend will increase. These shares are celebrated amongst dividend development traders, as they’re thought of dependable automobiles for rising one’s earnings in a extra predictable method.

Nevertheless, it’s essential to notice that not all Dividend Aristocrats are created equal. Whereas most shares within the group have a tendency to extend their payouts meaningfully, others achieve this solely marginally as a solution to retain their Dividend Aristocrat standing. In some instances, this can be a manner for a Dividend Aristocrat to protect liquidity or enhance their monetary place earlier than extra noteworthy dividend hikes resume.

That stated, it’s price contemplating whether or not decelerating dividend will increase may very well be a signaling monetary pressure and whether or not it raises the chance of a dividend minimize sooner or later. As such, these Dividend Aristocrats needs to be evaluated twice earlier than making any funding selections.

We’ve compiled a listing of all 65 Dividend Aristocrats, together with related monetary metrics like dividend yield and P/E ratios. You’ll be able to obtain the total checklist of Dividend Aristocrats by clicking on the hyperlink under:

Desk of Contents

Examples of Dividend Cuts Following a Declining Dividend Development Tempo

Whereas it’s not a certain signal of economic pressure, a Dividend Aristocrat slowing its tempo of dividend will increase may very well be an indication that the corporate is going through monetary challenges. This might probably result in a minimize in dividends. Listed below are some such examples which have beforehand occurred:

Pitney Bowes Inc. (PBI)

Pitney Bowes had grown its dividend yearly between 1983 and 2013, boasting 30 years of consecutive annual dividend will increase. In 2013, the corporate was pressured to chop its dividend after monetary misery, ending its multi-decade streak. Right here’s how Pitney Bowes’ dividend development tempo regarded previous to the minimize:

1993 – 1998 DPS CAGR: 14.9%

1998 – 2003 DPS CAGR: 5.9%

2007 – 2012 DPS CAGR: 2.6%

AT&T Inc. (T)

Revenue-oriented traders’ darling AT&T was pressured to chop its dividend by the tip of 2021 after 37 years of consecutive annual dividend will increase. With its indebtedness reaching unsustainable ranges, a dividend minimize was the one manner for the corporate to begin deleveraging meaningfully and pursue recent development initiatives. Right here’s how AT&T’s dividend development tempo regarded previous to the minimize:

2003 – 2008 DPS CAGR: 6.8%

2008 – 2013 DPS CAGR: 2.4%

2016 – 2021 DPS CAGR: 1.5%

Mercury Common Company (MCY)

Small-cap insurer Mercury Common in the end needed to finish its 35-year dividend development streak in 2022 after years of over-distributing its earnings. The corporate’s payout ratio would usually exceed 100%. Right here’s how Mercury Common’s dividend development tempo regarded previous to the minimize:

2002 – 2007 DPS CAGR: 11.6%

2007 – 2012 DPS CAGR: 3.3%

2016 – 2021 DPS CAGR: 0.4%

The 8 Dividend Aristocrats With The Smallest Dividend Will increase

Moreover AT&T’s unlucky minimize, Dividend Aristocrats continued to develop their dividends at slightly passable charges. The typical dividend hike in 2022 by all 64 Dividend Aristocrats was 6.5%. Notably, 11 Dividend Aristocrats delivered double-digit hikes, whereas 28 Aristocrats grew their dividends by lower than 5% for the yr.

That stated, eight corporations, particularly, grew their dividends by a charge equal to or under 1%. May their decelerating tempo of dividend will increase sign a possible minimize shifting ahead?

#8: Dover Company (DOV)

Years of dividend development: 67

Dividend yield: 1.5%

2005 – 2011 DPS CAGR: 10.7%

2011 – 2016 DPS CAGR: 7.8%

2016 – 2021 DPS CAGR: 3.0%

Newest DPS enhance: 1.0%

Dover Company is a diversified international industrial producer with annual revenues of practically $9 billion. Dover’s 5 reporting segments embrace Engineered Programs, Clear Power & Fueling, Pumps & Course of Options, Imaging & Identification, and Local weather & Sustainability Applied sciences.

The corporate is a Dividend King with greater than six a long time of dividend will increase. In truth, with 2022’s dividend enhance marking 67 consecutive years of dividend development, Dover boasts the second-longest dividend development streak amongst U.S. corporations.

Dover’s earnings-per-share have compounded at 6% yearly over the past decade. Development, in actual fact, accelerated in the latest years, with earnings-per-share development rising at an annual charge of greater than 14% over the previous 5 years. Dover did undergo some setbacks throughout the worst of the COVID-19 pandemic, however the firm shortly rebounded.

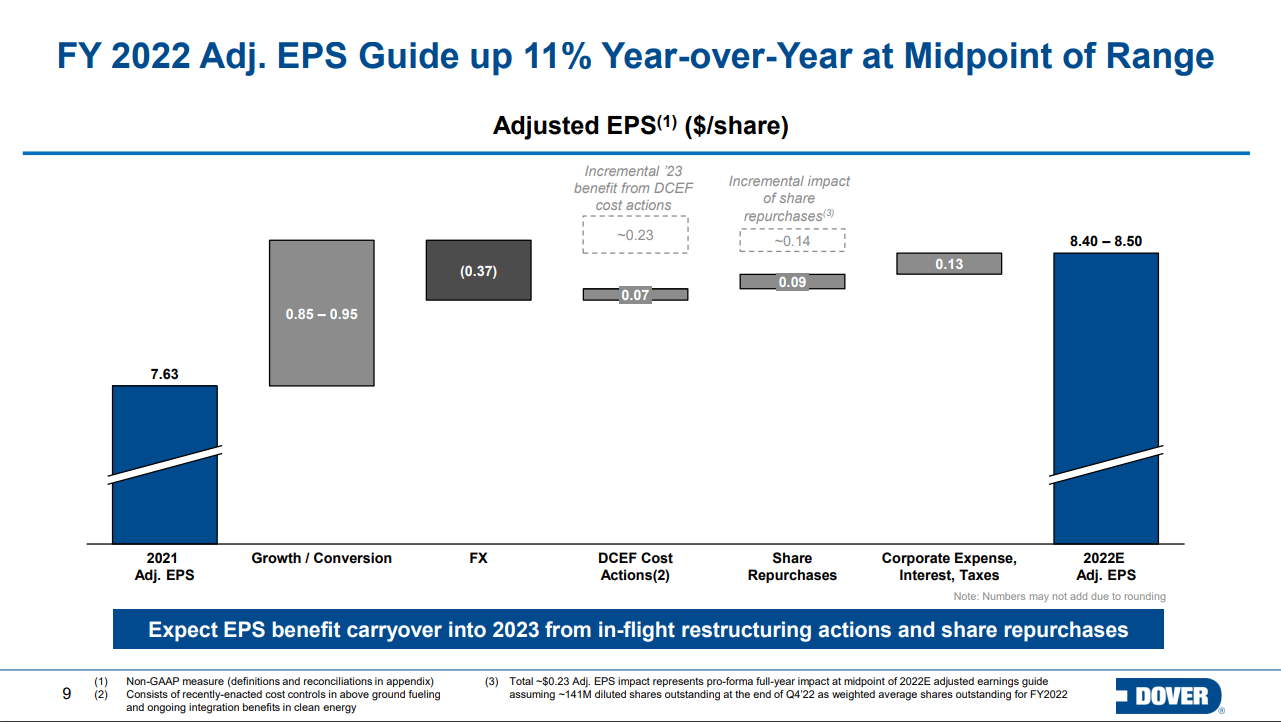

Supply: Investor Presentation

Is Dover Corp More likely to Reduce its Dividend?

Regardless of Dover’s dividend development charge decelerating considerably over the previous few years, we don’t imagine the corporate is headed towards a dividend minimize. Whereas Dover is a cyclical inventory, with its revenues topic to wild fluctuations throughout unfavorable market intervals, the corporate has managed to maintain its earnings at strong ranges and even develop then notably over time. Final yr, the corporate’s web earnings hit a brand new all-time whereas following earnings development surpassing dividend development over the yr, the inventory’s payout ratio stands at a really wholesome 24%

Click on right here to obtain our most up-to-date Certain Evaluation report on Dover Company (preview of web page 1 of three proven under):

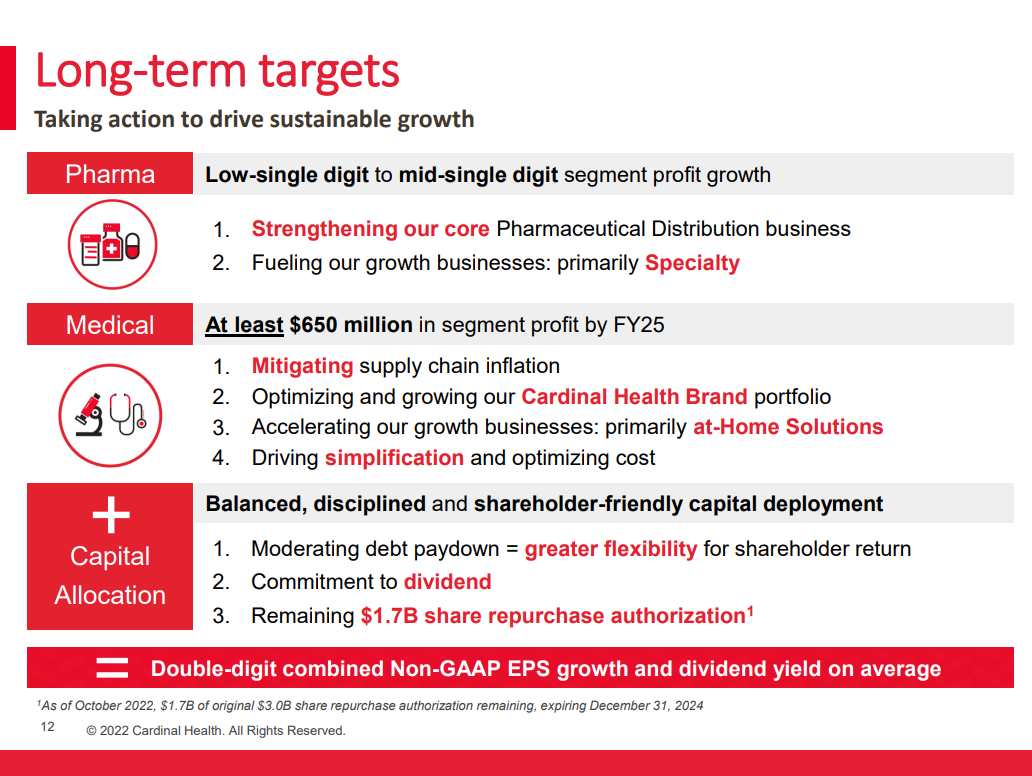

#7 Cardinal Well being, Inc. (CAH)

Years of dividend development: 35

Dividend yield: 2.5%

2005 – 2011 DPS CAGR: 24.3%

2011 – 2016 DPS CAGR: 15.0%

2016 – 2021 DPS CAGR: 3.9%

Newest DPS enhance: 1.0%

Dublin, Ohio-based Cardinal Well being is likely one of the “Massive 3” drug distribution corporations together with McKesson (MKC) and AmerisourceBergen (ABC). Cardinal Well being serves over 24,000 United States pharmacies and greater than 85% of the nation’s hospitals. The corporate has operations in additional than 30 international locations with roughly 46,000 workers.

With 35 years of dividend will increase, the $20.4 billion market cap firm is a member of the Dividend Aristocrats Index.

Between 2011 and 2021, Cardinal Well being grew its earnings-per-share by a mean compound charge of seven.6% per yr, whereas the dividend grew at greater than 9% yearly. Transferring ahead, we don’t anticipate this kind of development, particularly contemplating the slowdown in earnings enchancment in the previous couple of years.

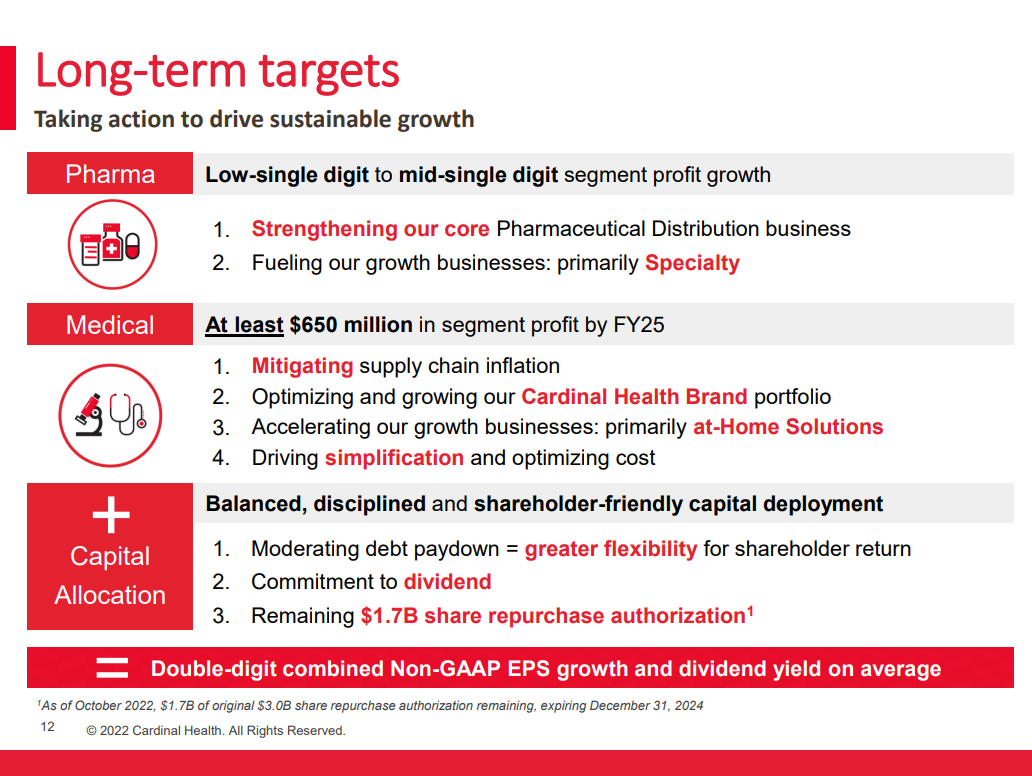

Supply: Investor Presentation

Is Cardinal Well being More likely to Reduce its Dividend?

Certainly, Cardinal Well being’s dividend development tempo has decelerated dramatically over the previous decade, whereas its most up-to-date 1% dividend enhance was actually underwhelming. Nonetheless, we don’t imagine the corporate plans to chop its dividend anytime quickly.

It’s because the corporate’s earnings are prone to stay sturdy as medicine are likely to generate constant gross sales as their important pharmaceutical merchandise. Additional, the corporate’s payout ratio stands at a snug 38%, whereas Cardinal’s total monetary well being has been bettering.

Particularly, Cardinal’s long-term debt has declined from $9.0 billion in 2017 to $4.7 billion as of its most up-to-date Q3 2022 report. Lastly, the corporate is prone to droop its inventory repurchases earlier than touching the dividend, and inventory repurchases have remained robust all year long.

Click on right here to obtain our most up-to-date Certain Evaluation report on Cardinal Well being, Inc.(preview of web page 1 of three proven under):

#6 Emerson Electrical Co. (EMR)

Years of dividend development: 66

Dividend yield: 2.2%

2005 – 2011 DPS CAGR: 9.2%

2011 – 2016 DPS CAGR: 6.6%

2016 – 2021 DPS CAGR: 1.2%

Newest DPS enhance: 1.0%

Emerson Electrical was based in Missouri in 1890. Since that point, it has advanced by means of natural development, in addition to strategic acquisitions and divestitures, from a regional producer of electrical motors and followers right into a $56 billion diversified international chief in expertise and engineering.

Its international buyer base and numerous product and repair choices afford it about $20 billion in annual income. The corporate’s very spectacular 66-year dividend enhance streak lands it on the celebrated Dividend Kings checklist.

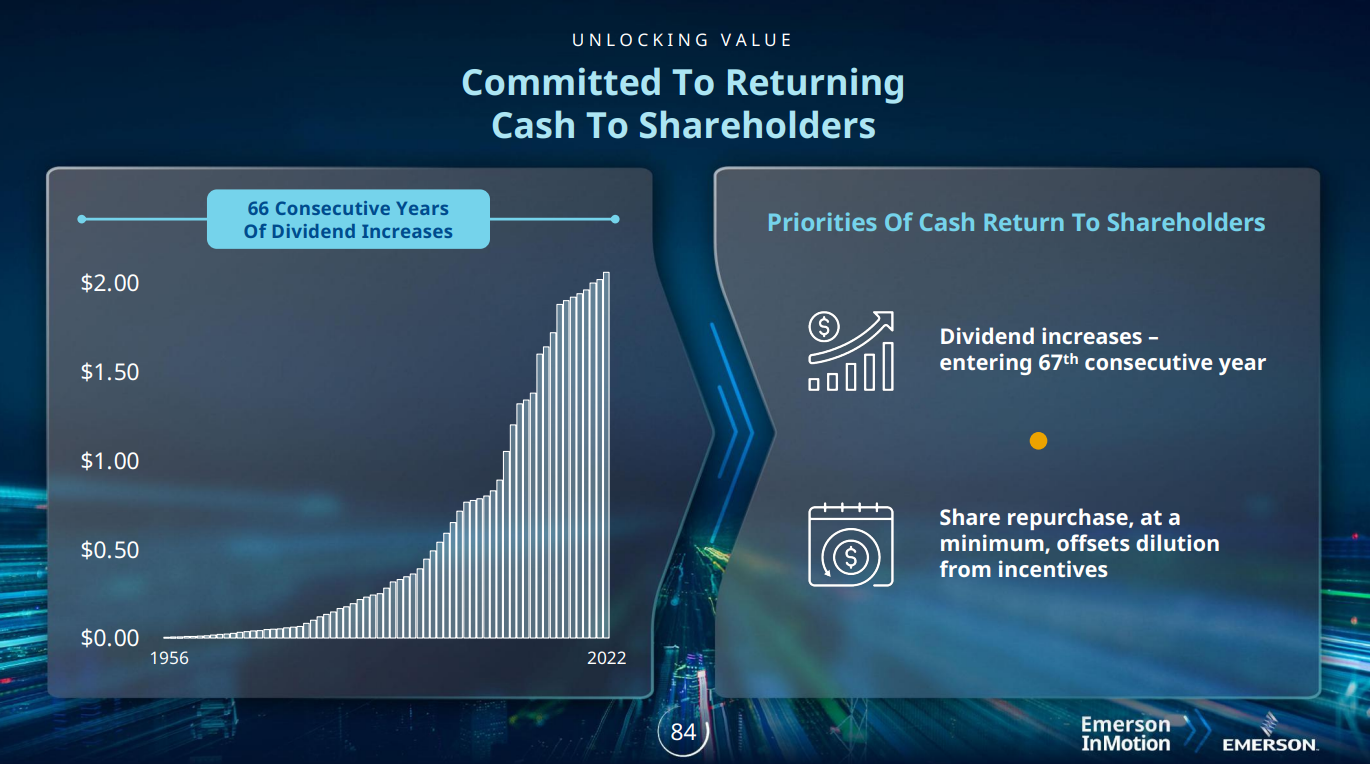

Supply: Investor Presentation

Emerson is present process a big shift in its technique, whereby it’s promoting off legacy items and focusing extra on automation and recurring income. We imagine that low single-digit development in income and a tailwind from the buybacks would be the key drivers of earnings-per-share development within the coming years. The corporate has diminished its share rely by about 37% since 1987.

Nonetheless, we word there may be prone to be important earnings weak spot whereas the transformation performs out, together with a sluggish begin to fiscal 2023.

Is Emerson Electrical More likely to Reduce its Dividend?

Regardless of Emerson Electrical having considerably slowed down the speed at which it grows its dividend, we don’t imagine this to be an indication of a near-term minimize. The dividend is well-covered.

In truth, with earnings-per-share rising at a CAGR of seven.3% over the previous decade, Emerson’s payout ratio has relaxed considerably currently. It stood at 77% in 2016 however has now fallen to 51%. The deceleration in dividend hikes is most definitely a part of Emerson’s transformation plan.

Click on right here to obtain our most up-to-date Certain Evaluation report on Emerson Electrical Co. (preview of web page 1 of three proven under):

#5 Federal Realty Funding Belief (FRT)

Years of dividend development: 55

Dividend yield: 4.2%

2005 – 2011 DPS CAGR: 3.8%

2011 – 2016 DPS CAGR: 7.1%

2016 – 2021 DPS CAGR: 2.1%

Newest DPS enhance: 0.9%

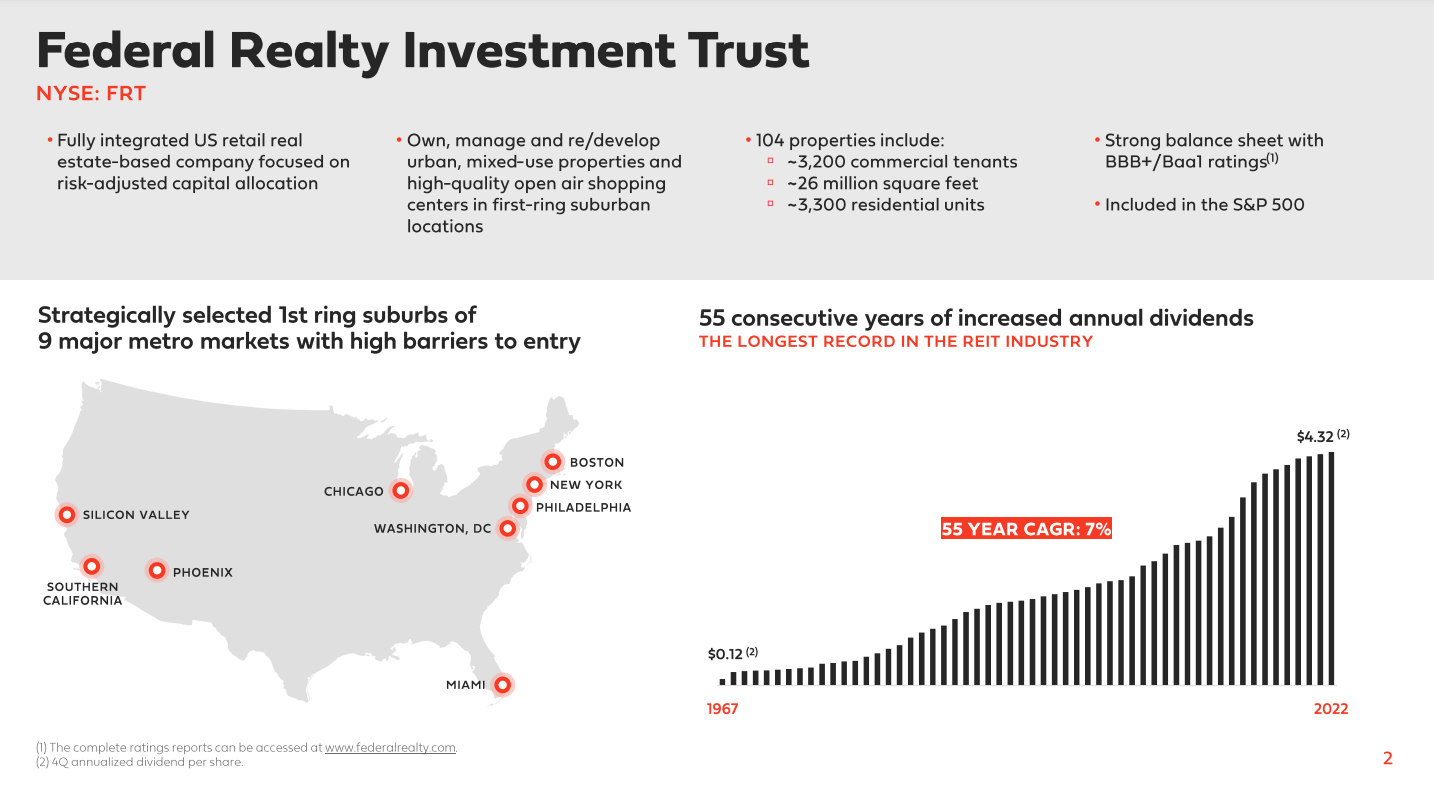

Federal Realty is likely one of the bigger actual property funding trusts (REITs) in the US. The belief was based in 1962 and concentrates on high-income, densely populated coastal markets within the US, permitting it to cost extra per sq. foot than its competitors. Federal Realty trades with a market capitalization of $8.3 billion immediately.

Previous to 2020, Federal Realty’s funds-from-operations had not dipped year-over-year at any level previously decade, a tremendously spectacular feat on condition that the belief operates within the extremely cyclical actual property sector. The corporate’s efficiency has normalized since, and Federal Realty is anticipated to attain near-record earnings in Fiscal 2022.

Transferring ahead, we count on that Federal Realty’s development will likely be comprised of a continuation of upper lease charges on new leases and its spectacular improvement pipeline fueling asset base enlargement. Margins are anticipated to proceed to rise barely because it redevelops items of its portfolio, and same-center income continues to maneuver greater.

Federal Realty options the longest dividend development streak amongst REITs, boasting 55 years of successive annual dividend will increase.

Supply: Investor Presentation

Is Federal Realty More likely to Reduce its Dividend?

Federal Realty’s newest dividend enhance of 0.9% was actually disappointing, however we don’t imagine it alerts a possible dividend minimize. The corporate is most definitely simply being conservative within the face of a troublesome actual property atmosphere amid rising rates of interest. Moreover, Federal Realty is anticipated to document near-record FFO/share in Fiscal 2022.

Moreover, it’s not the primary time a marginal dividend enhance has occurred throughout a troublesome market panorama. In 2009, Federal Realty elevated its dividend-per-share by only a cent (1.5%) to a quarterly charge of $0.66 earlier than dividend will increase re-accelerated as quickly as market circumstances normalized.

Federal Realty’s payout ratio stays fairly wholesome as effectively, at present standing under 70%.

Click on right here to obtain our most up-to-date Certain Evaluation report on Federal Realty Funding Belief (preview of web page 1 of three proven under):

#4 Realty Revenue Company (O)

Years of dividend development: 27

Dividend yield: 4.7%

2005 – 2011 DPS CAGR: 3.7%

2011 – 2016 DPS CAGR: 6.7%

2016 – 2021 DPS CAGR: 3.4%

Newest DPS enhance: 0.8%

Realty Revenue is a REIT that has grow to be well-known for its profitable dividend development historical past and month-to-month dividend funds. At the moment, the belief owns greater than 4,000 properties that aren’t a part of a wider retail improvement (resembling a mall) however as an alternative are stand-alone properties. Which means its places are viable for a lot of totally different tenants, together with authorities companies, healthcare companies, and leisure.

Realty Revenue has trademarked itself as “The Month-to-month Dividend Firm”, boasting 628 month-to-month dividends declared and 100 consecutive quarterly will increase.

Supply: Investor Presentation

Realty Revenue generates its development by means of rising rents at current places, by way of contracted lease will increase or by leasing properties to new tenants at greater charges, but in addition by buying new properties. Administration invested about $2.1 billion in new properties in 2020 and one other $6.4 billion in 2021. Realty Revenue expects to extend its investments in worldwide markets throughout the subsequent couple of years.

Is Realty Revenue More likely to Reduce its Dividend?

Just like Federal Realty, Realty Revenue’s newest dividend enhance was below-average as administration is being conservative within the face of a troublesome actual property atmosphere amid rising rates of interest. We don’t imagine that Realty Revenue’s dividend security is threatened for a number of causes.

Firstly, at 76%, its payout ratio is definitely the bottom it has been in over a decade. Secondly, administration continues to develop the dividend a number of occasions a yr (normally quarterly), which additional cements their confidence within the dividend. Lastly, Realty Revenue’s properties are in excessive demand and can possible stay so. The occupancy charge throughout the portfolio is round 99%, and tenants typically report excessive lease protection ratios.

Click on right here to obtain our most up-to-date Certain Evaluation report on Realty Revenue Company (preview of web page 1 of three proven under):

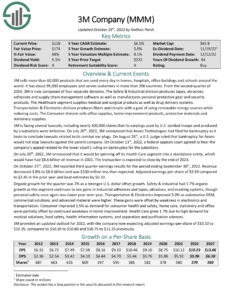

#3 3M Firm (MMM)

Years of dividend development: 64

Dividend yield: 5.0%

2005 – 2011 DPS CAGR: 3.5%

2011 – 2016 DPS CAGR: 15.0%

2016 – 2021 DPS CAGR: 5.9%

Newest DPS enhance: 0.7%

3M sells greater than 60,000 merchandise which are used each day in houses, hospitals, workplace buildings, and faculties all over the world. It has about 95,000 workers and serves clients in additional than 200 international locations. 3M consists of 4 separate divisions.

The Security & Industrial division produces tapes, abrasives, adhesives, and provide chain administration software program, in addition to manufactures private protecting gear and safety merchandise. The Healthcare phase provides medical and surgical merchandise in addition to drug supply programs.

The Transportation & Electronics division produces fibers and circuits with the purpose of utilizing renewable power sources whereas lowering prices. The Client division sells workplace provides, dwelling enchancment merchandise, protecting supplies, and stationery provides.

3M has grown earnings at a charge of 5.4% per yr over the past decade. Easing uncooked materials/logistics/labor inflation and a stabilizing international provide chain atmosphere are prone to be constructive earnings development catalysts in 2023, in line with administration.

Supply: Investor Presentation

Is 3M More likely to Reduce its Dividend?

3M is going through a number of lawsuits, together with practically 300,000 claims that its earplugs utilized by U.S. fight troops and produced by a subsidiary have been faulty. On December twenty second, a U.S. decide blocked 3M from making an attempt to dodge legal responsibility for accidents from its allegedly faulty earplugs by diverting blame to a subsidiary. The continued state of affairs possible explains administration’s resolution to decelerate dividend will increase.

That stated, we imagine that 3M’s dividend ought to stay secure. Whereas dividend development has outpaced earnings development lately, the payout ratio stays under 60%. Additional, the corporate’s diversified portfolio of mission-critical merchandise ought to proceed to generate sturdy money flows no matter non permanent headwinds within the economic system.

Click on right here to obtain our most up-to-date Certain Evaluation report on 3M Firm (preview of web page 1 of three proven under):

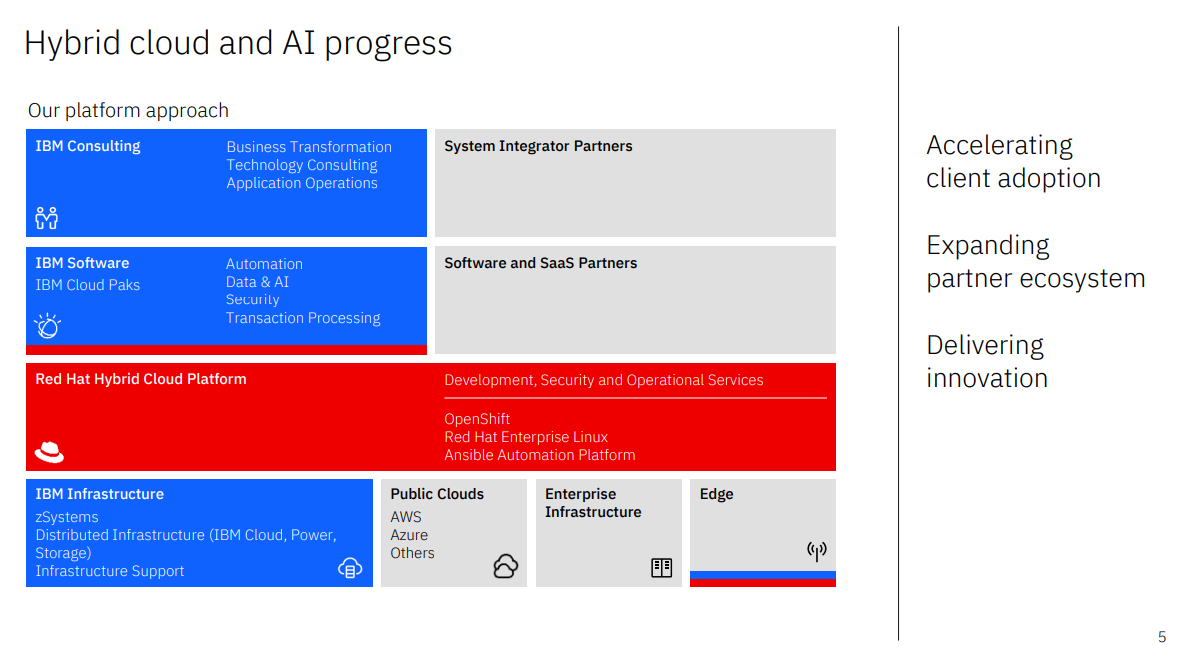

#2 Worldwide Enterprise Machines Company (IBM)

Years of dividend development: 27

Dividend yield: 4.7%

2005 – 2011 DPS CAGR: 21.4%

2011 – 2016 DPS CAGR: 13.7%

2016 – 2021 DPS CAGR: 3.6%

Newest DPS enhance: 0.6%

IBM is a worldwide data expertise firm that gives built-in enterprise options for software program, {hardware}, and companies. IBM’s focus is operating mission-critical programs for big, multi-national clients and governments.

Final yr, IBM spun off Kyndryl, its managed infrastructure enterprise, however it’s nonetheless one of many largest IT companies corporations on the earth. The corporate now has 4 enterprise segments: Software program, Consulting, Infrastructure, and Financing. IBM had annual income of ~$57.4 billion in 2021 (not together with Kyndryl).

IBM’s core operations are worthwhile. However IBM had issue producing development previously a number of years as a result of transition to cloud and SaaS within the IT business and IBM’s late emphasis on this market. Nevertheless, IBM is now specializing in cloud and SaaS and intends to be a significant participant within the hybrid cloud, as illustrated by the Crimson Hat and lots of smaller acquisitions.

Supply: Investor Presentation

Is IBM More likely to Reduce its Dividend?

IBM’s dividend development has slowed down considerably currently. This is smart, contemplating that the corporate is producing the identical free money circulate per share because it did 15 years in the past following years of declining revenues. We wouldn’t kill the potential of a dividend minimize within the medium time period if IBM’s revenues and earnings have been to proceed to say no, because the payout ratio has already climbed to 67%. That stated, constructive catalysts are in place that ought to maintain payouts, together with rising cloud revenues and continued deleveraging.

Click on right here to obtain our most up-to-date Certain Evaluation report on Worldwide Enterprise Machines Company(preview of web page 1 of three proven under):

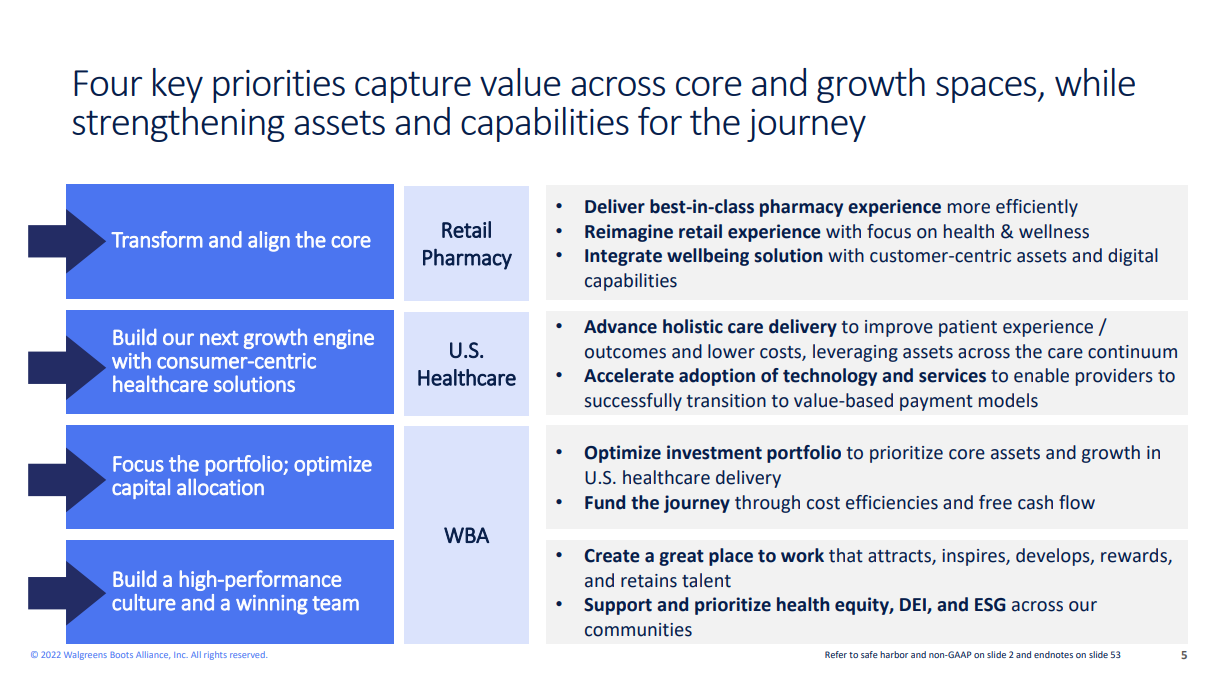

#1 Walgreens Boots Alliance (WBA)

Years of dividend development: 47

Dividend yield: 5.1%

2005 – 2011 DPS CAGR: 22.4%

2011 – 2016 DPS CAGR: 14.7%

2016 – 2021 DPS CAGR: 5.3%

Newest DPS enhance: 0.5%

Walgreens Boots Alliance is the most important retail pharmacy in the US and Europe. The $32.1 billion market cap firm has a presence in additional than 9 international locations by means of its flagship Walgreens enterprise and different enterprise ventures.

Walgreens’ earnings-per-share grew at a CAGR of seven.6% over the previous decade, powered by rising revenues and a declining share rely. This was pushed by a mix of things, together with strong top-line development ($72 billion to $133 billion), a gentle web revenue margin, and a discount within the variety of excellent shares.

Supply: Investor Presentation

Is Walgreens Boots Alliance More likely to Reduce its Dividend?

Walgreens has been rising its dividend by smaller and smaller quantities over time. That stated, we don’t imagine its 47-year dividend development is about to come back to an finish anytime quickly. With earnings-per-share rising considerably quicker than the dividend over the previous decade, the inventory’s payout ratio at present stands at 42%, decrease than 44% in 2012. As a result of promoting mandatory drugs and different prescription drugs, we imagine the corporate will proceed producing strong money flows. They need to proceed to guard the dividend and even for additional dividend will increase forward, no matter their development charge.

Click on right here to obtain our most up-to-date Certain Evaluation report on Walgreens Boots Alliance (preview of web page 1 of three proven under):

Closing Ideas

Inspecting an organization’s dividend development charge pattern is usually a useful indicator for traders seeking to assessment its monetary well being and dividend development prospects. A protracted slowdown within the tempo at which dividends are rising might sign that the corporate is experiencing monetary hurdles.

In that case, the corporate might probably be liable to a dividend minimize sooner or later, no matter how spectacular its dividend development streak is. We’ve seen this occur greater than as soon as, with Pitney Bowes Inc. (PBI), AT&T Inc. (T), and Mercury Common Company (MCY) ending their multi-decade dividend development observe information as their financials couldn’t maintain their payouts additional. In all three instances, a dividend minimize was adopted by a steady deceleration in dividend development.

The eight Dividend Aristocrats mentioned on this article all noticed dividend development of lower than or equal to 1% in 2022, and lots of have additionally proven a pattern of slowing dividend development over the long run. Whereas we can not fully kill the potential of a dividend minimize for any of those corporations, we imagine that almost all, if not all of those Dividend Aristocrats, are at present not liable to chopping their dividends.

Whether or not it’s a scientific threat, like rising rates of interest within the case of Federal Realty Belief and Realty Revenue, or a systemic threat, like the continued lawsuit within the case of 3M, the comparatively tiny dividend will increase seen this yr amongst these Dividend Aristocrats can possible be attributed to the warning exercised by their administration groups.

In case you are interested by discovering extra high-quality dividend development shares appropriate for long-term funding, the next Certain Dividend databases will likely be helpful:

The main home inventory market indices are one other strong useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.

[ad_2]