[ad_1]

Once upon a time, before George Soros became a liberal activist, he was a great trader. That’s where he earned the money to fund his causes.

As a trader, Soros might be most famous for breaking the Bank of England.

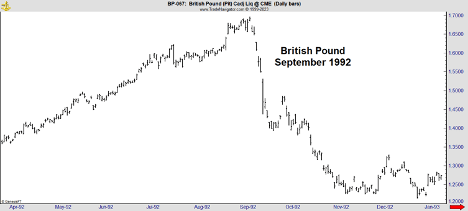

Back in 1992, the United Kingdom was trying to tie its currency to the European Rate Mechanism, a precursor to the euro. The BOE was required to support the price of the pound to be part of the ERM.

Soros believed there were too many economic differences between the U.K. and Europe for that plan to work. His analysis showed the price the BOE was required to defend was too high. He didn’t think England had enough money to do that.

He was so sure of his analysis, he started betting against the pound in the summer of 1992. As the pound rallied, Soros increased the size of his bet. He was short about $10 billion worth of pounds when the Bank of England threw in the towel and allowed the pound to fall.

Soros’ trade worked because he believed markets are stronger than central banks. Today, traders might come to the opposite conclusion.

Since 2009, central banks like the Federal Reserve have been the single biggest factor behind the incredible highs in stock prices.

Both the Fed and the European Central Bank (ECB) pushed interest rates to levels that seemed impossible in 2007. No one thought interest rates could be negative. Yet, the ECB achieved that goal. (The Fed stopped at zero.)

Such low rates virtually demanded investors buy stocks, as bond yields were rarely enough to beat inflation.

Now though, both of those banks are trying to unwind their heavy-handed policies without causing a crash. They may succeed, even if these shifts lead to years-long bears in their respective stock markets.

But the Bank of Japan (BOJ) is in a league of its own…

And because of how it behaved post-2008, it now threatens the entire world economy.

Breaking the Bank of Japan

In 2023, the BOJ pushed real interest rates on 10-year government bonds below 1% and into negative territory five years later.

To do this, like all central banks, the Bank of Japan bought its own government bonds.

Targeting ultralow yields on 10-year bonds is expensive. In the first month of this year, BOJ bought $265 billion of government bonds. That’s about 6% of Japan’s annual GDP. And that was just one month of buying.

The architect of this policy, current BOJ governor Haruhiko Kuroda, steps down in April.

According to The Wall Street Journal, Kazuo Ueda will be his successor. He should be in place for meetings on April 27-28 and June 15-16.

Ueda holds a doctorate in economics from MIT. He was a classmate of former Fed Chairman Ben Bernanke. He and Bernanke shared the same advisor, Dr. Stanley Fischer.

Ueda wrote in the Nikkei newspaper in July 2022 that the BOJ’s policy of targeting negative rates for 10-year yields was a problem. He said speculators could target the bank. And he advised an exit strategy from Japan’s ultra-loose monetary policy.

That tells me he will abandon the policy once he becomes governor.

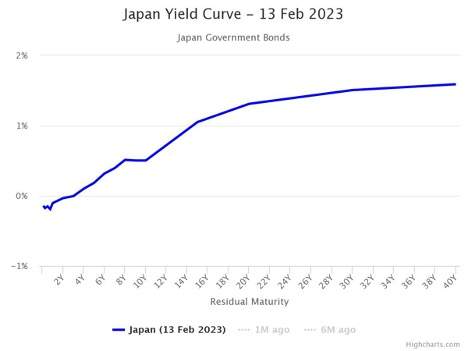

But it won’t be easy. The yield curve for Japanese government bonds shows that rates rise rapidly beyond 10 years.

If Ueda tightens policy quickly, rates will jump. That will cause large losses in bond portfolios. Insurers and pension funds would face a crisis. This happened in the United Kingdom in September during Liz Truss’ short-lived Prime Ministership — the U.K. is now in a deep recession.

If Ueda acts slowly, speculators will attack Japanese financial markets. Funds will bet against Japanese bonds. They’ll also buy yen since the yen should benefit from higher rates.

That’s potentially bad news for exports which account for about 18% of Japan’s economy — almost twice as much as the 10% of economic activity U.S. exports make up.

Any slowdown in exports could threaten growth in Japan and that’s a risk the BOJ can’t accept. Ueda faces a crisis no matter what he does. Japan’s policies have created the perfect storm for global financial markets. As conditions change, fortunes will be made and lost.

Soros is probably too busy being a liberal activist to trade this right now. But we aren’t.

The safest trade for investors in the U.S. is in U.S. stocks. To be clear, I don’t mean buying them.

I mean shorting them.

Japan Heads Us Toward a Global Recession

Japan’s policy shift will create a global liquidity crisis. Hedge funds facing losses in Japan will be forced to sell other assets to cover their margin calls. In times like that, they often sell U.S. Treasurys and stocks. This will push rates up and cause an economic slowdown.

Shorting U.S. stocks is the most readily accessible and potentially most lucrative way to trade this situation, as U.S. markets are the largest and most liquid in the world.

It’s possible Japan will trigger a global recession later this year. The best traders will be focused on short-term opportunities to navigate what could be the most exciting market of our lifetimes.

One such trader is my friend Adam O’Dell. He, like me, is well aware of the systemic risks that global markets face right now. And he’s not sitting idly by. He’s finding ways to profit as it all shakes out.

To be clear, Adam isn’t necessarily recommending his subscribers try breaking the Bank of Japan.

The trade he has in mind is much simpler. And it actually doesn’t even involve shorting.

His method of trading involves limited, measured risk and much higher potential rewards than any short trade would give you.

And if he’s right, participating could result in multiples on your money before the year is out.

Check out the full details of Adam’s trade — which he revealed for the first time earlier this week — right here.

Regards,

Michael CarrEditor, One Trade

Michael CarrEditor, One Trade

[ad_2]