[ad_1]

The Fed has a targeted balance sheet reduction of $95B a month. After reaching and exceeding this target last month, the Fed is back to undershooting.

This should not come as a surprise given the turmoil in the bond market this year and the lack of liquidity.

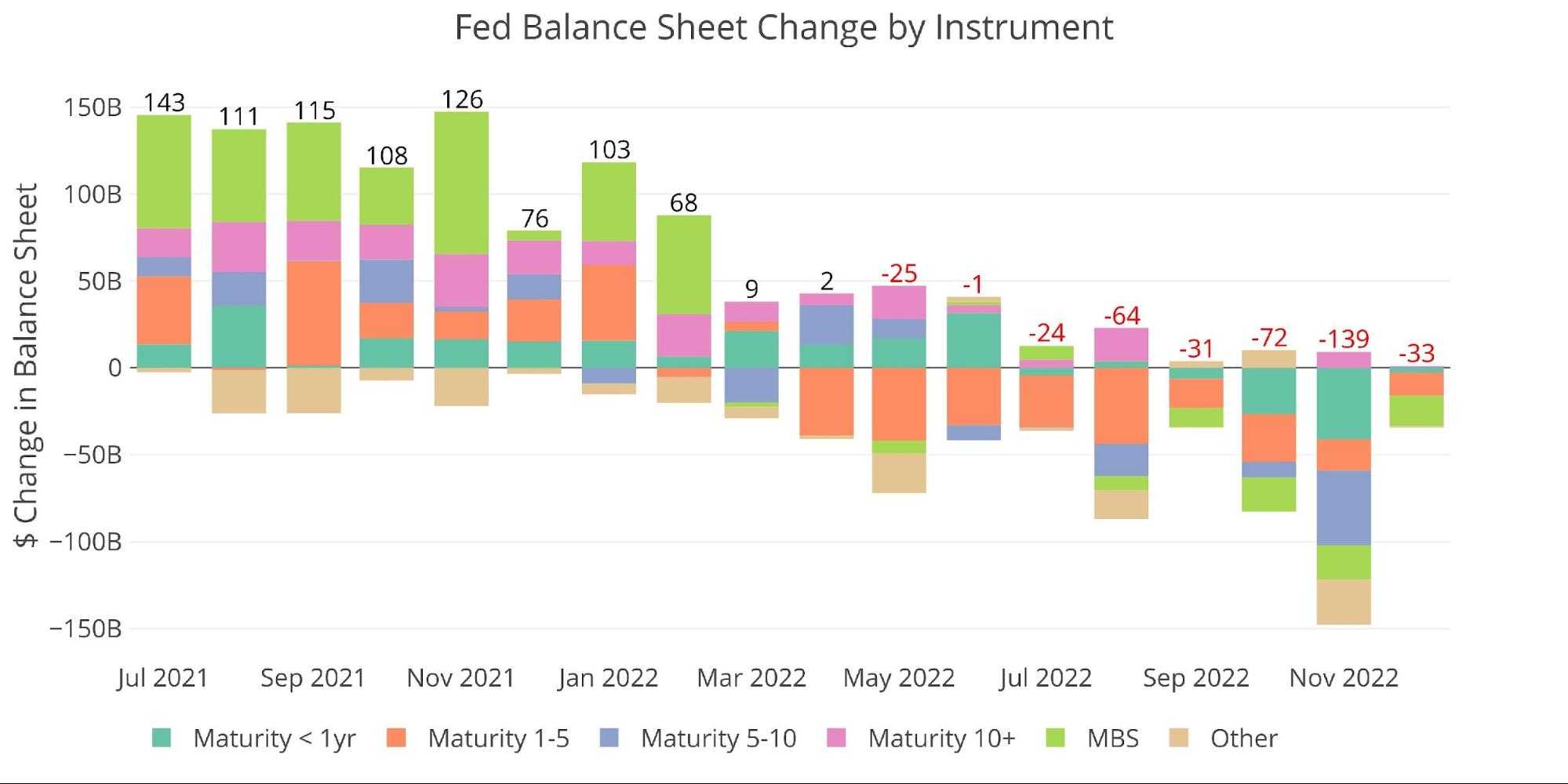

Figure: 1 Monthly Change by Instrument

The table below details the movement for the month:

The Treasury market saw increases on the long end but decreases on the short endThis is a bit surprising as it will only create a larger yield curve inversionMBS fell short again of the $37.5B target by more than 50%The Fed has not come close to hitting the MBS target for a single month so far

The challenge in MBS is more obvious because of the massive change in the mortgage market this year. As interest rates have risen, the housing market has come to a standstill.

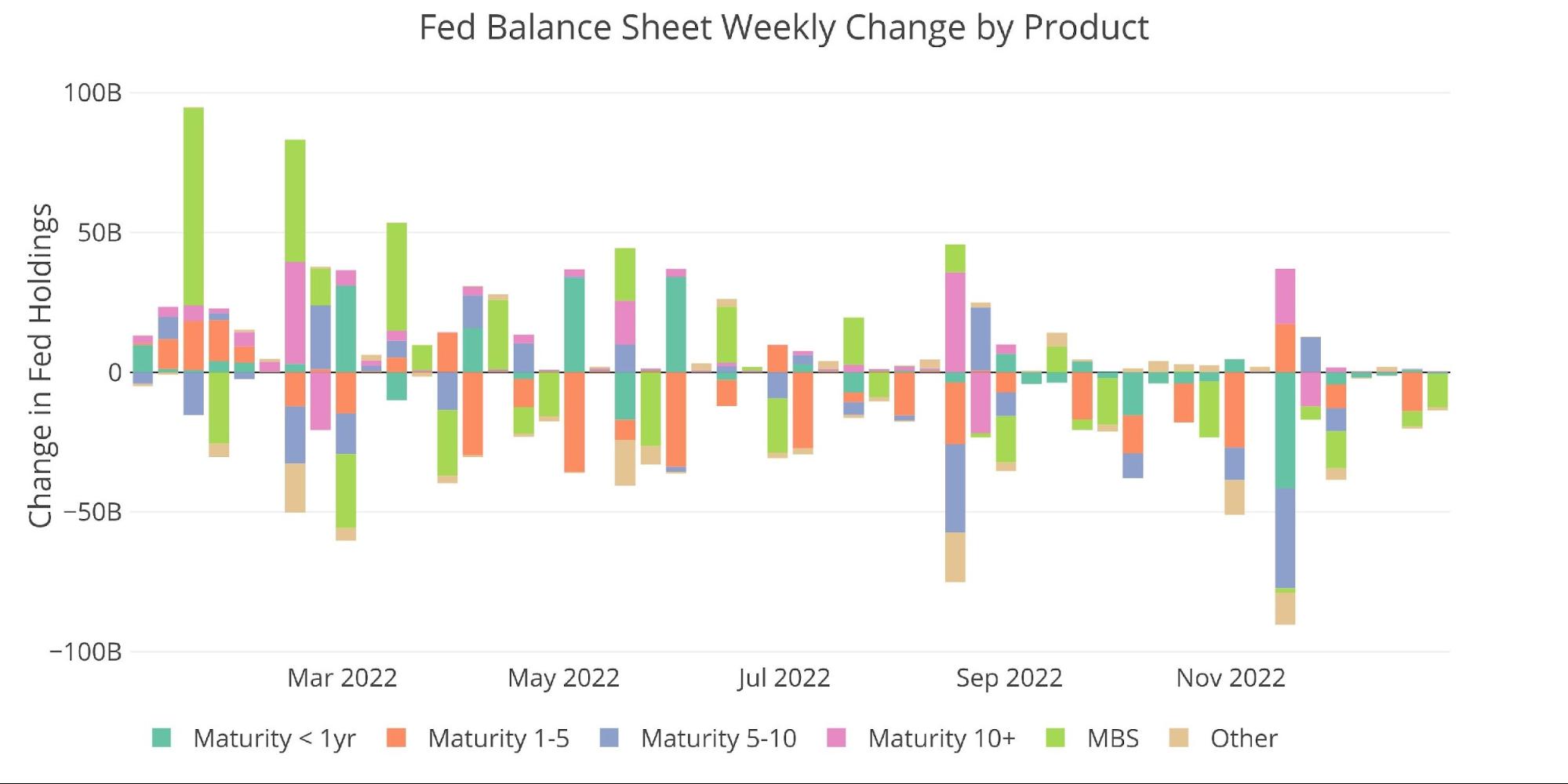

Figure: 2 Balance Sheet Breakdown

Looking at the weekly data shows that activity has been very quiet over the last 4 weeks with little movement in either direction. During December, the busier weeks actually occurred during the holidays with the slow weeks happening in the first two weeks.

Figure: 3 Fed Balance Sheet Weekly Changes

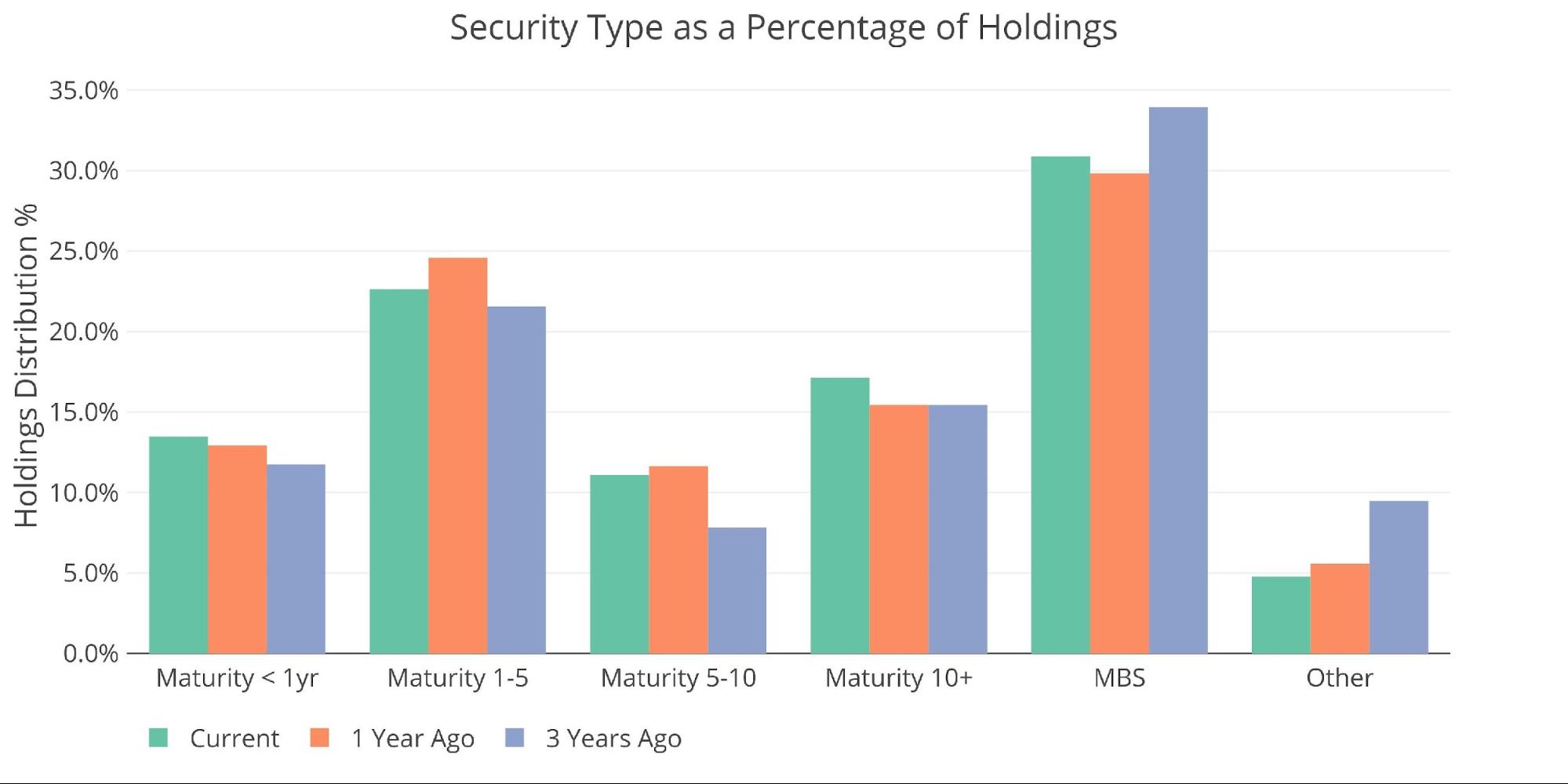

As the Fed continues to miss on the MBS reduction, the overall portfolio allocation of MBS has grown. MBS is up a full percentage point compared to a year ago.

Figure: 4 Total Debt Outstanding

A lost Revenue Source for the Treasury

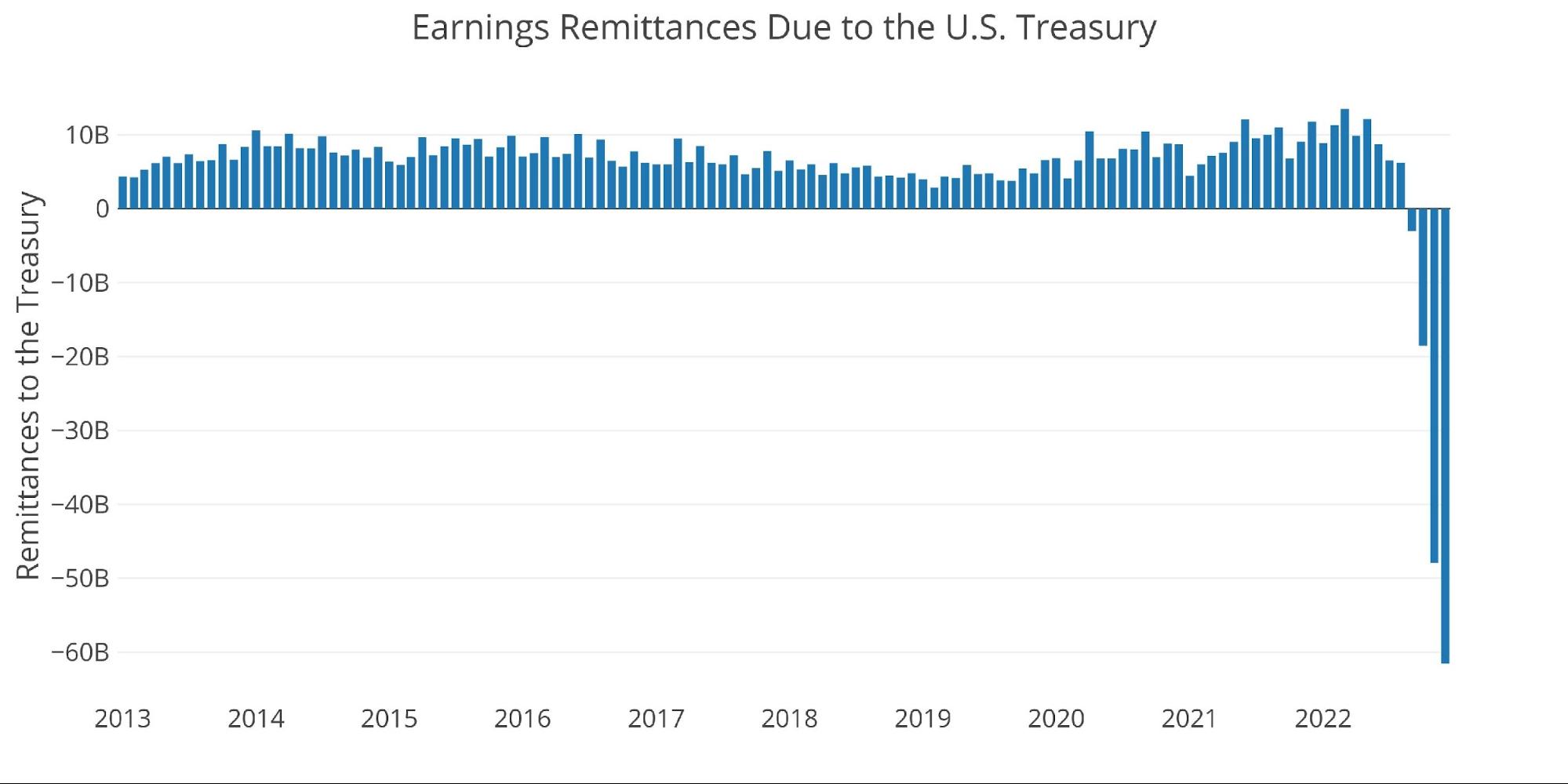

When the Fed makes money, it sends the Treasury a check. This has been quite substantial over the years, totaling $105B in 2021 and $93B in 2020. That time has come to the end, at least for now. The Fed lost $61B in December on the heels of losing $41B in November.

According to Reuters, the Fed has been warning about this possibility for some time. It should be noted, the Fed will not send the Treasury a bill to cover its losses. Instead, it will book the losses into a deficit account that will be held until the Fed makes enough money to make up for its losses.

Making up the losses could be years away, which means the Treasury has just lost a major source of extra revenue. This will only make future Treasury deficits worse.

Figure: 5 Fed Payments to Treasury

When looking at the yearly data, the issue is even more obvious. 2022 is net negative by $53B despite having 8 positive months from Jan-Aug. Based on the current trajectory, 2023 could be negative by over $500B! This would wipe out 6 years of gains!

Figure: 6 Fed Payments to Treasury

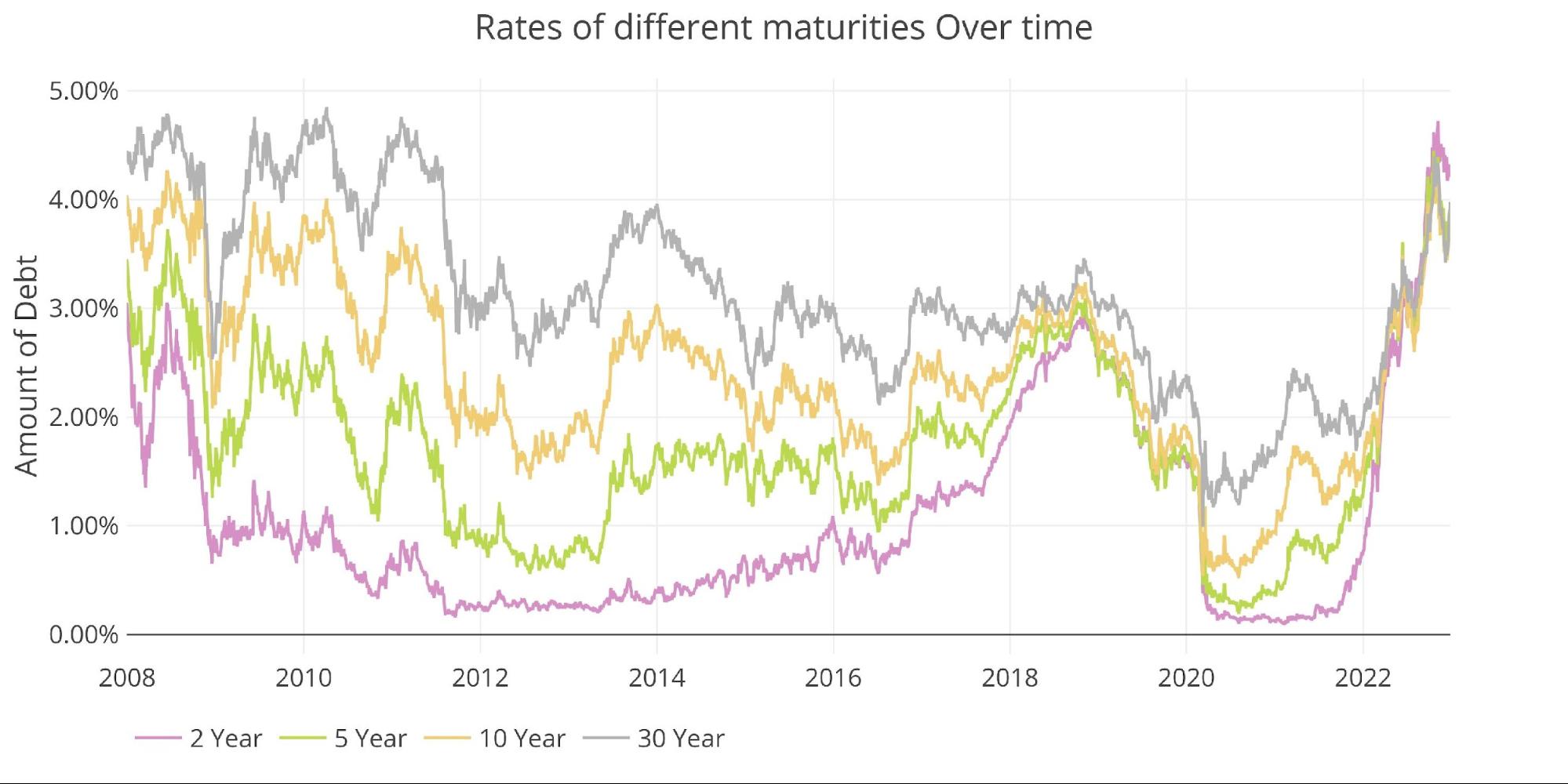

The Fed is losing money because it pays financial firms for keeping assets on the Fed books. As interest rates have risen, the amount it pays out has also risen. It also loses money when it buys bonds at high prices and sells them at low prices, which is what has unfolded with QE and QT. As the chart below shows, interest rates have risen dramatically in recent months, despite the recent pullback.

Figure: 7 Interest Rates Across Maturities

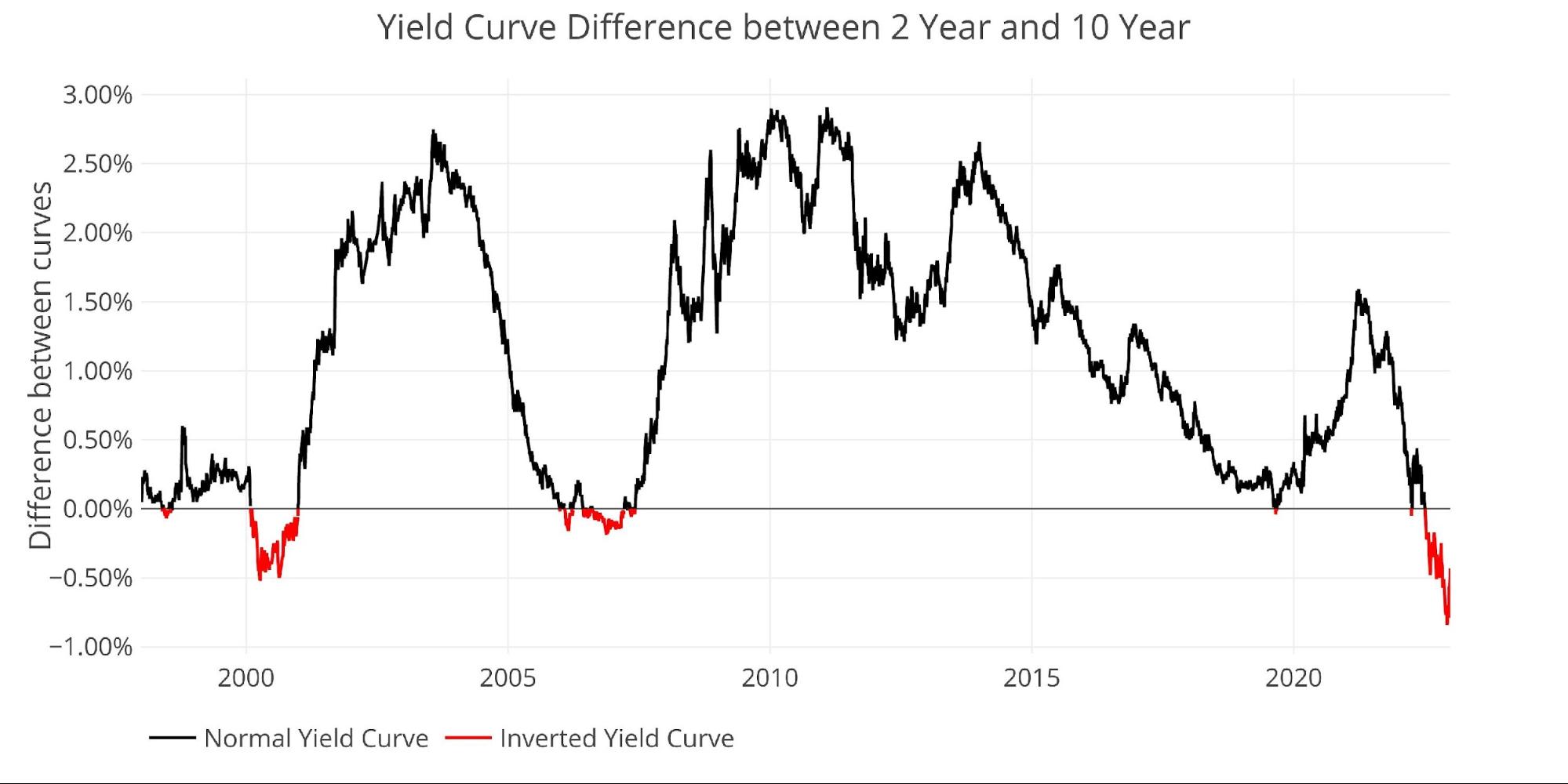

Short-term rates are rising even faster than long-term rates, which has created an inverted yield curve. After bottoming at -84bps on Dec 7, it has since rebounded to only -43bps. It still has a long way to go before it is upward-sloping again.

Figure: 8 Tracking Yield Curve Inversion

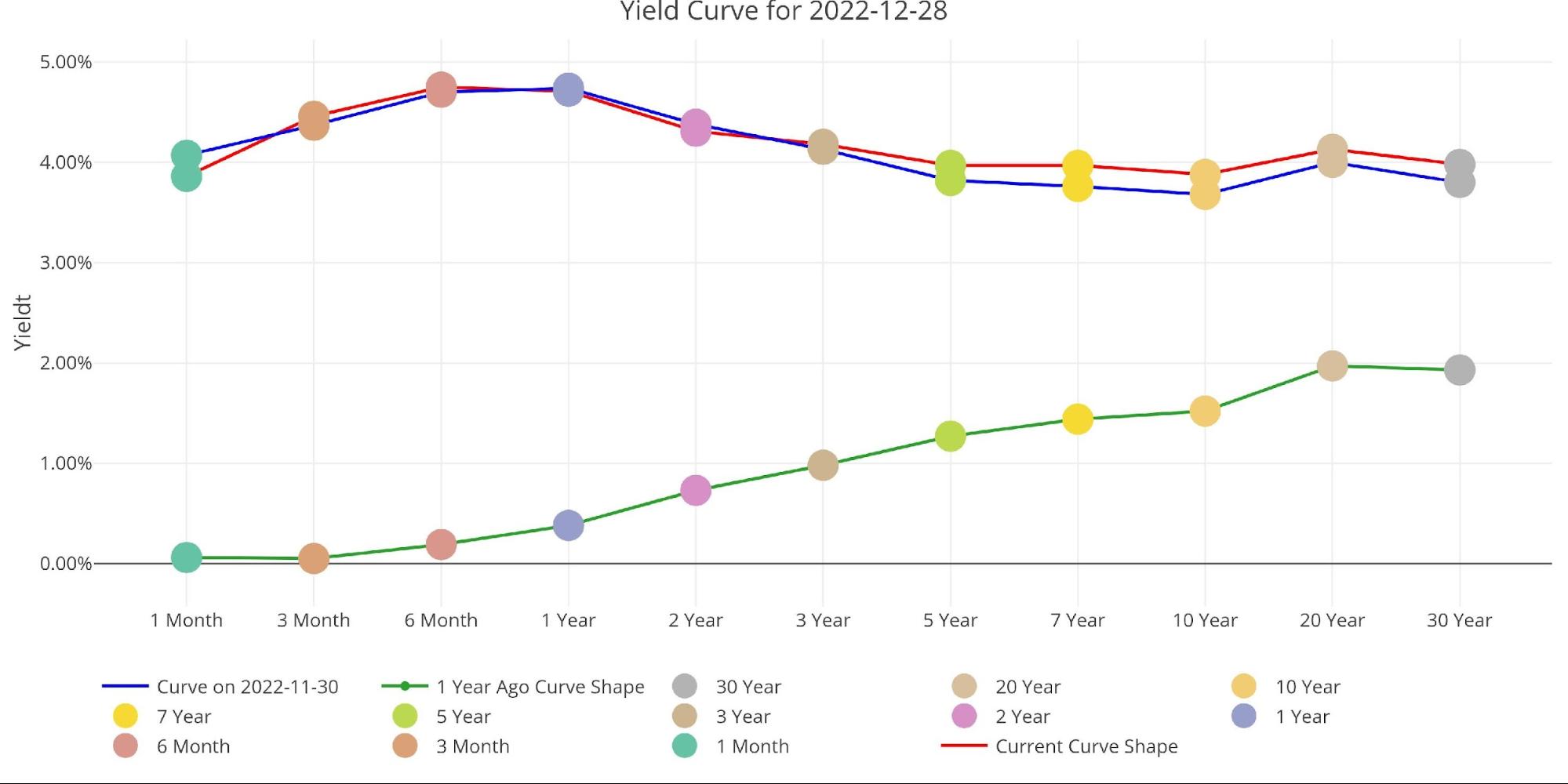

The chart below compares the yield curve at three points in time (current, 1 month ago, and 1 year ago). Over the last month, there has been little change, but compared to 1 year ago, the curve has seen a dramatic change. This was before any rate hikes had started.

Figure: 9 Tracking Yield Curve Inversion

Who Will Fill the Gap?

Bloomberg recently published an article that shows how the typical Treasury buyers have all stepped back from the market. First and foremost, this includes the Fed which has been the biggest buyer in the market for two years. It also includes institutional investors and foreign countries.

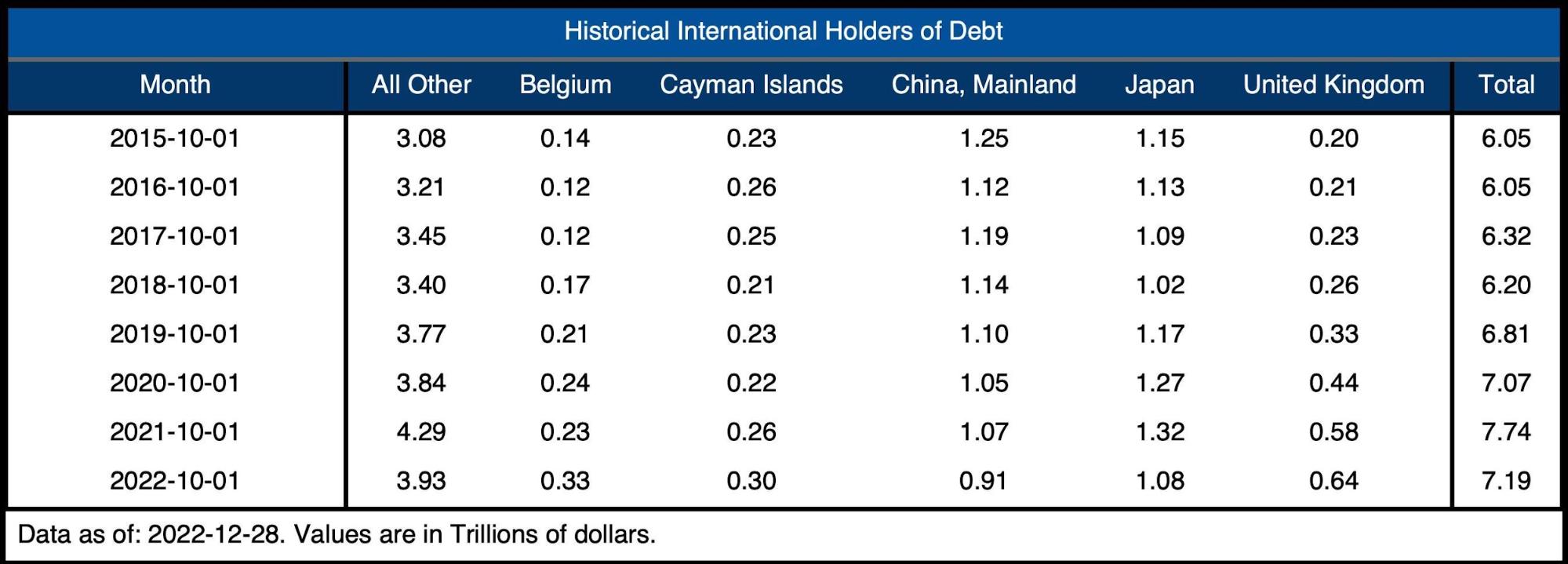

As shown below, the international holders have completely stopped buying and have reduced holdings. Total international holdings are at $7.2T, down from $7.85T less than 1 year ago in November 2021.

Note: data was last published in October

Figure: 10 International Holders

The table below shows how debt holding has changed since 2015 across different borrowers. The net change over the last year is a reduction of $550B! The bigger area of concern though is that China and Japan are down a combined $400B. Behind the Fed, China and Japan had been some of the biggest buyers. Not anymore!

Figure: 11 Average Weekly Change in the Balance Sheet

Historical Perspective

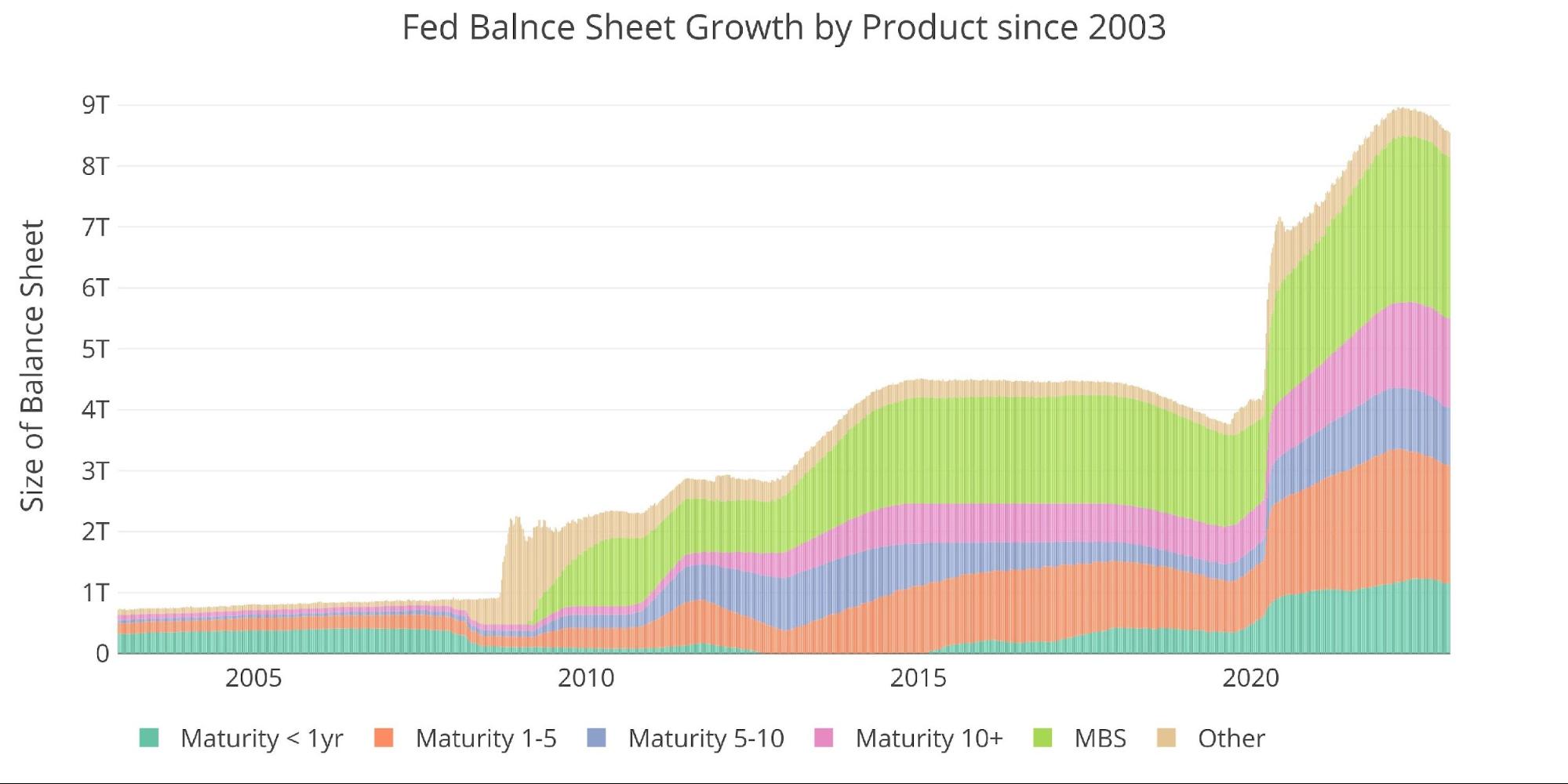

The final plot below takes a larger view of the balance sheet. It is clear to see how the usage of the balance sheet has changed since the Global Financial Crisis. The last balance sheet reduction was two years, going from Sept 2017 to Sept 2019.

The current reduction has only been underway for 9 months, but it seems quite likely that something will break well before the Fed has two years of reductions under its belt.

Figure: 12 Historical Fed Balance Sheet

What it means for Gold and Silver

Things are getting very tricky for the Fed. While they seem content to lose billions of dollars each month, they must realize the impact they are having on the Treasury. Not only has the Treasury lost a major source of funding, but the upward pressure on interest rates is creating havoc due to higher interest expense.

The Fed is struggling to keep QT going because it simply cannot let that much debt mature without having a major impact on the market. With liquidity drying up and a stock market that looks to be on edge, the Fed is getting closer and closer to a major event happening somewhere in the economy.

When something breaks, it is going to break big. At that point, the balance sheet could well exceed $10T in short order. Gold and silver will offer excellent protection given such an event.

Data Source: https://fred.stlouisfed.org/series/WALCL and https://fred.stlouisfed.org/release/tables?rid=20&eid=840849#snid=840941

Data Updated: Weekly, Thursday at 4:30 PM Eastern

Last Updated: Dec 28, 2022

Interactive charts and graphs can always be found on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/USDebt/

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

[ad_2]