[ad_1]

jetcityimage

Moving With The Tides

The first time we wrote about discount brokerage behemoth Charles Schwab (NYSE:SCHW), things were… well… not good. The company had been caught up in the turmoil of the regional banking crisis, which, in broad strokes, meant that investors were spooked about the company’s large paper losses in its held to maturity [HTM] bond portfolio associated with the company’s sizable banking operations.

Add to this the fact that Schwab–at the time–engaged in no hedging operations to manage the interest rate risk to its loan portfolio, and it seemed to be a recipe for disaster.

In the months since the crisis hit its peak, the company has engaged in several defensive moves to shore up its balance sheet. It began hedging its interest rate risk and issued $2.5 billion in bonds in May to boost investor confidence.

And yet, as of this writing, the stock is still down more than 20% from its highs and has been more or less treading water since March 2023. All of this begs the question–with the passage of time and the implementation of defensive measures by management, does the stock present a compelling investment opportunity today?

A Question of Great Interest

Financial institutions, for the most part, run a business of spreads–they borrow money (in the form of deposits, asset back securities, bonds, etc) at a certain interest rate and then loan that cash to customers for a (hopefully) higher rate.

This spread, known as net interest income, has become more and more important for Schwab as it has expanded its banking operations.

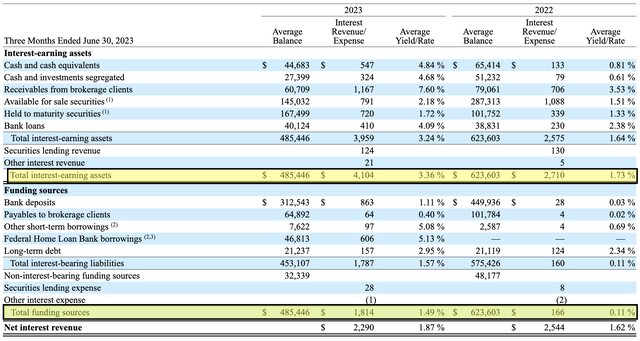

Company Filings With Author Highlights (Company Filings)

The above chart details Schwab’s net interest revenue for the quarter ending June 2023. While it is clear to see from the chart that the cost of funding has risen dramatically (from 0.11% to 1.49%), the overall spread earned by Schwab has widened by 25 basis points, from 1.62% to 1.87%.

Even a casual glance at the chart, however, reveals that Schwab’s largest source of funding comes from bank deposits, which fell from $449 billion in June 2022 to $312 billion in June 2023. A little more troubling is the fact that the company appears to be accelerating the onboarding of expensive sources of funding in the form of short-term and Federal Home Loan Bank borrowings (both of which sport costs higher than Schwab’s total interest earning yield of 3.36%).

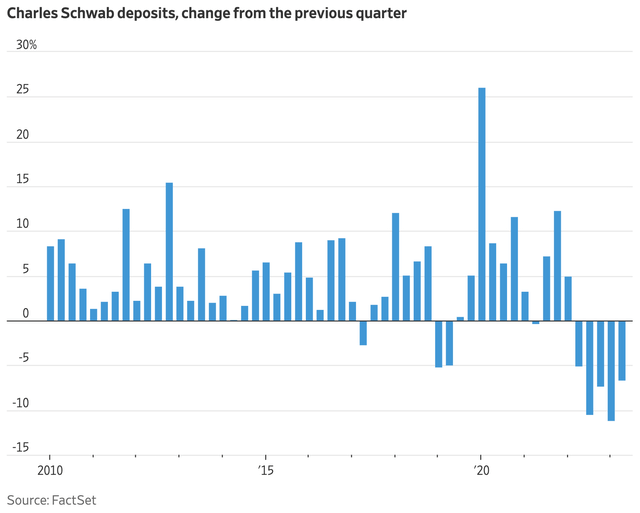

Nonetheless, despite these concerns, the high-cost funding sources represent a small portion of the company’s overall interest bearing liabilities, and there is reason to believe the bleeding of deposits from Schwab’s bank have, it not reversed, at least reached a steady state according to data from the Wall Street Journal.

Schwab Deposits (Wall Street Journal)

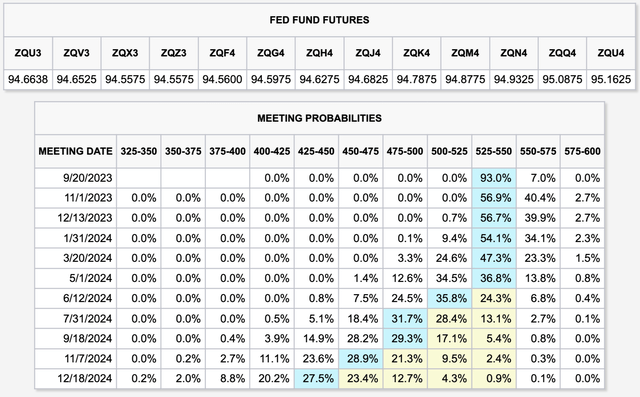

Further, it is likely that the impetus for depositors to flee savings accounts for money market funds or treasury bonds will abate over the next 3-4 quarters, as indicated by the CME’s FedWatch Tool, which accounts for the bets of traders in the forward interest rate market.

FFR Probabilities, accessed 9/8/23 (CME FedWatch)

By the June 24 meeting, the positioning of traders in the market suggests a 60% probability that rates will be between 4.75%-5.25%, with each subsequent meeting bringing a probable decrease in rates.

For Schwab and other financial institutions, this move will likely be an enormous tailwind if it comes to pass as expected, since costs of funding will fall and rates on savings accounts will suddenly be more attractive, especially for holders of money market funds who suddenly notice a diminished return.

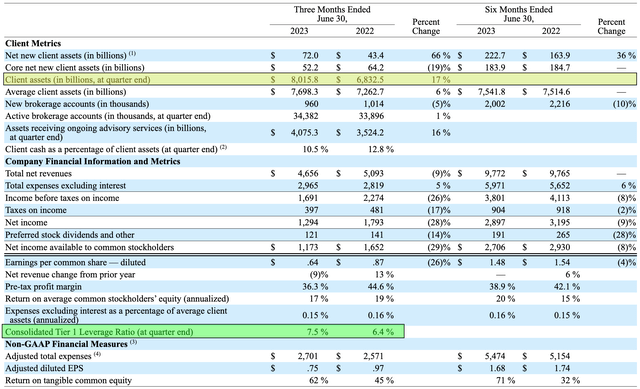

Falling interest rates are also likely to provide a boost to the economy overall, which–if the history of market reactions to falling interest rates is any guide–indicates that the wider stock market will follow suit. This also bodes well for Schwab’s brokerage business which tends to see customer inflows when the market rallies. Schwab’s latest quarter reflected this in part, as the company saw client assets jump year over year by 17%, from $6.8 trillion to $8 trillion (seen below in yellow).

Schwab Metrics With Author Highlights (Company Filings)

Further evidence of the strengthening position of the company is the fact that its Consolidated Tier 1 Leverage Ratio (highlighted in green above) rose by 9 basis points year over year. This metric measures equity against a slew of risk weighted assets and, to put things bluntly, the higher it is, the better.

Given its significant banking assets, valuing Schwab as a total business can be a bit tricky. On a raw forward price-to-earnings basis, the stock is trading below both its five and ten year averages of 18.3x and 21.6x, respectively.

Koyfin

Treading near the bottom of its ten year range may appear to present a value, but we again remind readers that Schwab’s banking assets have significantly grown over the last ten years, making P/E a less useful metric.

The stock trades at 3.9x price to book, which again may seem expensive when compared to other bank stocks, but doesn’t take into account the company’s gargantuan sweep and brokerage operations.

The Bottom Line

For a while in 2023, it was eminently unclear what direction Schwab (or, maybe more accurately, its depositor base) would take. Would assets flee, or stay? If they fled, how big would the flight be? As of this writing today, however, it appears that things have steadied at the financial giant. For those reasons, we revise our rating on the stock upward from Sell to Buy.

Our reasons for this mirror those enunciated by CEO Walt Bettinger on the latest conference call where he made an analogy about fog that often shrouds Treasure Island in San Francisco’s bay area. His analogy, we feel, is a good one, but we also note that fog can cause real damage when ships run aground in it. Today, we think a considerable amount of fog surrounding Schwab’s stock has lifted. When interest rates begin to fall, we think that the stock is likely to resume its upward march. Risks to our thesis include rates remaining higher for longer than currently anticipated, which could prompt a new wave of deposit flight from bank accounts to higher yielding money market funds and bonds, as well as a collapse in the equity market prices which could create an outflow of funds from Schwab’s brokerage business.

[ad_2]