[ad_1]

ArLawKa AungTun

Generally one likes silly individuals for his or her folly, higher than clever individuals for his or her knowledge.”― Elizabeth Gaskell

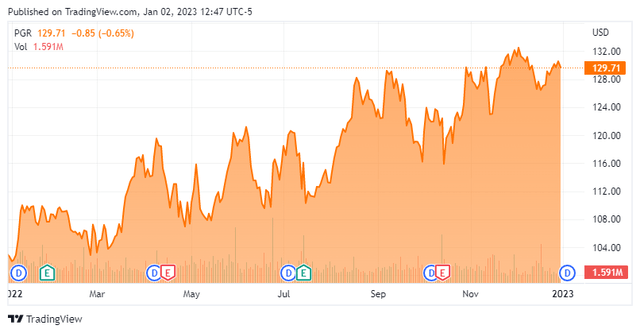

Immediately, we dive into The Progressive Company (NYSE:PGR), an insurance coverage big that was one of many few within the S&P 500 to fare nicely within the markets in 2022. Nevertheless, insiders are promoting shares, valuations appear stretched and the inventory is unloved by the analyst neighborhood in the intervening time. Time to e-book positive factors in these shares or will they proceed to outperform the general market in 2023? An evaluation follows under.

Looking for Alpha

Firm Overview:

The Progressive Company relies simply exterior of Cleveland and the corporate supplies private and industrial auto, private residential and industrial property, common legal responsibility, and different specialty property-casualty insurance coverage merchandise and associated companies in the US. The inventory at present trades slightly below $130 a share and sports activities an approximate market capitalization of $76 billion.

Third Quarter Outcomes:

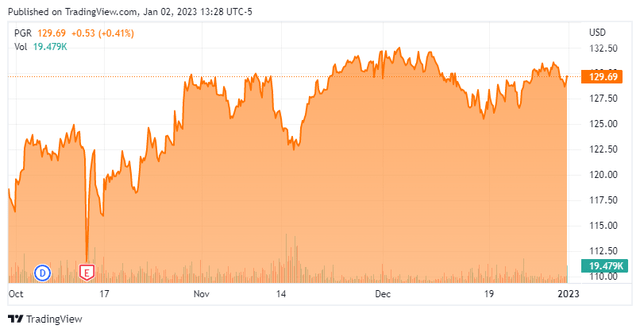

On October thirteenth, the corporate posted third quarter numbers. The corporate earned 20 cents a share on a non-GAAP foundation. Internet premiums written rose over 18% on a year-over-year foundation to simply north of $13 billion at the same time as insurance policies in drive rose only one %. Gross sales have been simply over $350 million shy of consensus estimates.

Analyst Commentary & Steadiness Sheet:

The analyst neighborhood is just not sanguine of the corporate’s prospects in the intervening time. Since third quarter outcomes posted, each Financial institution of America ($143 worth goal) and Jefferies ($147 worth goal) have reiterated Purchase scores. Citigroup ($104 worth goal), Wells Fargo ($100 worth goal) and Barclays ($109 worth goal) have reissued Maintain/Impartial scores on the fairness.

Lower than one % of the excellent float within the shares is at present held brief. Quite a few insiders have been constant and frequent sellers of the shares in 2022. Within the fourth quarter, they disposed of simply north of $12 million value of fairness in combination. The final insider buy of over $20,000 was in 2016 when the shares traded at simply over $30.

The corporate’s funding portfolio is simply north of $50 billion. Progressive has simply over $6 billion in long-term debt, $17 billion in unearned premiums and $30 billion in unpaid claims as of the top of the third quarter. The corporate’s debt to complete capital ratio was a conservative 30.2% as of the top of the quarter.

Verdict:

The present analyst agency consensus has Progressive incomes simply over 4 bucks a share in FY2022 as revenues rise 10% to just about $51 billion. Barely sooner income progress is seen for FY2023 as earnings per share are available round $6.30. It ought to be famous there may be vast variance within the 18 analyst companies which have posted projections ($3.68 to $7.70 a share).

The corporate did me a stable in 2022, offering a a lot decrease auto insurance coverage premium than my longtime service Geico. That stated, I discover that coverage way more enticing than the inventory proper now. The inventory sells for 20 instances ahead earnings and 1.5 instances revenues. Compared, competitor The Allstate Company (ALL) trades for below 15 instances ahead earnings and below .8 instances revenues. Whereas it’s true slower gross sales progress (6% versus 11%) is projected for FY2023 for Allstate, the inventory supplies the next dividend yield (2.51% versus 1.46%).

Insurers ought to profit from increased rates of interest serving to their bond portfolio returns in 2023. Premium will increase as the results of Hurricane Ian must also be a tailwind. Progressive lowered the estimates for its losses from that storm occasion two weeks in the past. Common auto insurance coverage charges have risen 12% YTD on the firm by way of the third quarter, which appear unsustainable. The inventory additionally appears to be topping out in latest months, the analyst neighborhood is hardly constructive on the shares and insiders are frequent sellers of the fairness as nicely.

Looking for Alpha

The underside line is after a greater than 25% return out there in 2022, constructive tailwinds appear totally priced into the inventory as present buying and selling ranges.

The issue is that the individuals with probably the most ridiculous concepts are at all times the people who find themselves most sure of them.” – Invoice Maher

[ad_2]