[ad_1]

Completely different Job Studies

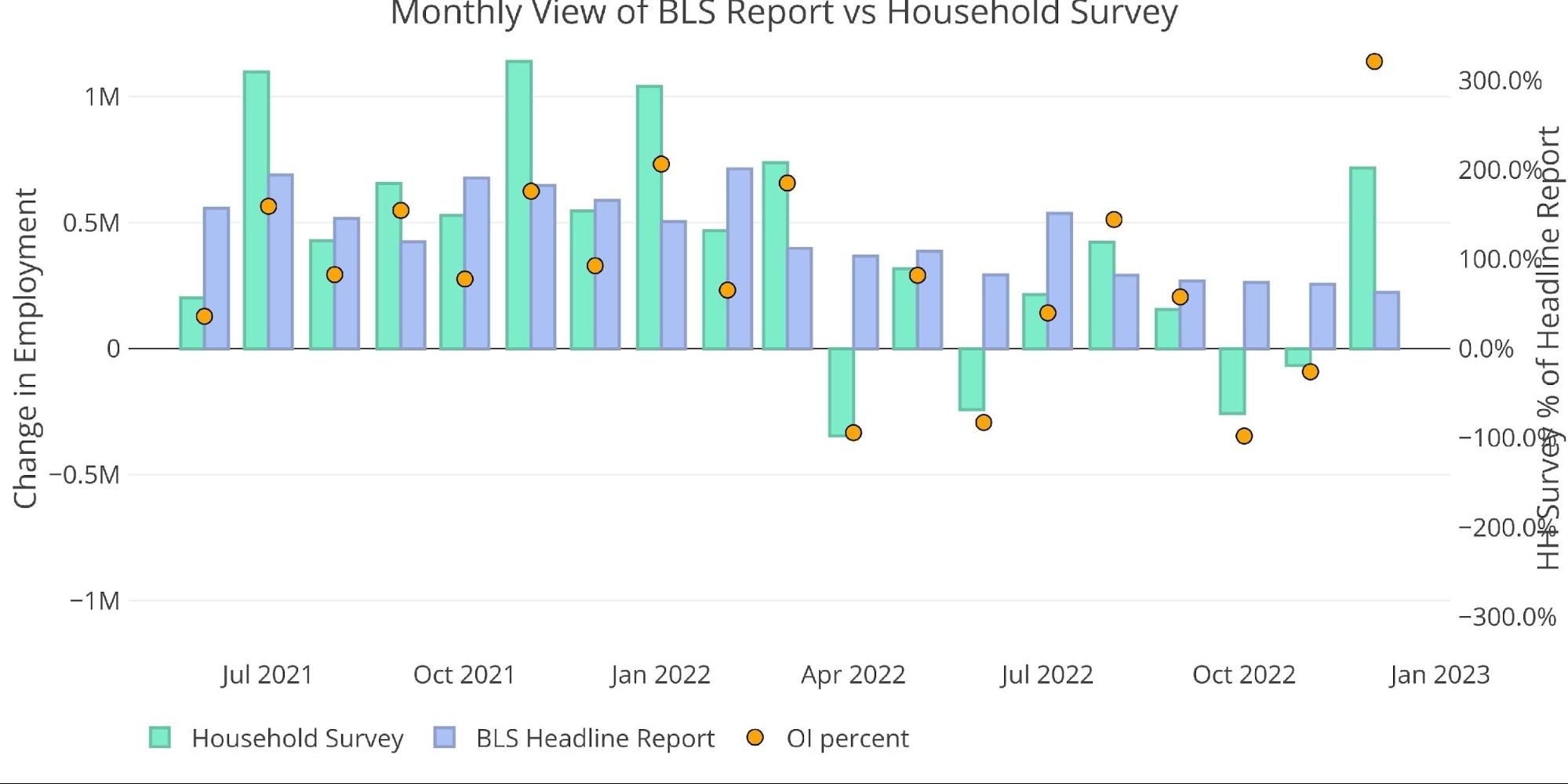

Each month, the BLS releases two job studies. The Headline Report that will get all the eye is the Nonfarm Payroll Report. The second report which will get a lot much less fanfare is the Family Survey. The plot under reveals each studies.

As proven, the Family report had been considerably decrease than the Headline Report going again to April of this yr. December flipped that in an enormous manner with the Family report displaying 3.2x extra jobs than the Headline Report (717k vs 223k).

December was the largest deviation since October 2020. It can’t be defined by vacation hiring as final December noticed the Family survey at 93% of the Headline Report.

Determine: 1 Main Report vs Family Survey – Month-to-month

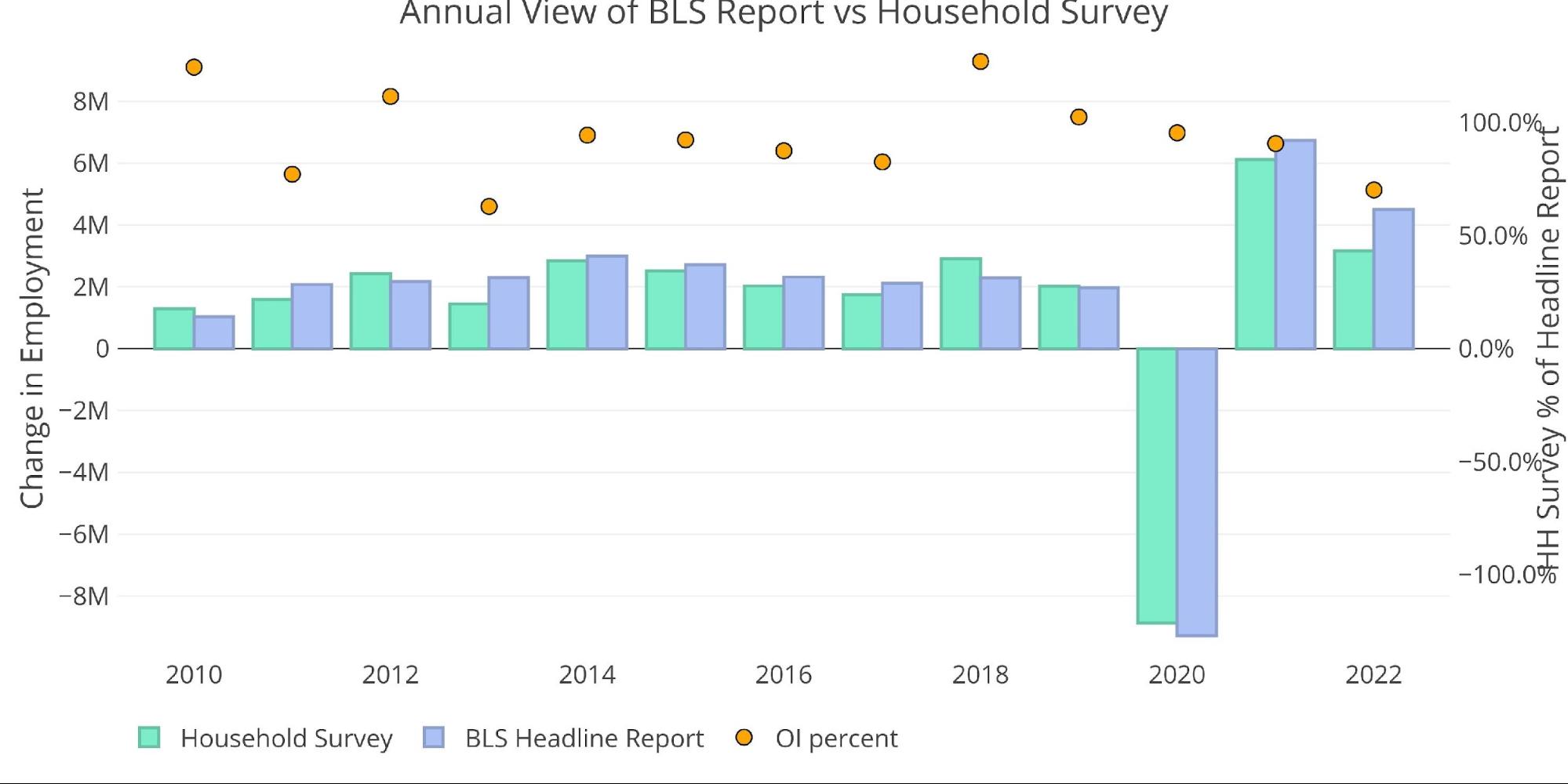

Even with the large deviation in December, 2022 would be the largest miss (70.2%) between the 2 studies since 2013 (63%). Usually, the Family Survey ranges from 85%-120% when in comparison with the Headline Report.

Determine: 2 Main Report vs Family Survey – Annual

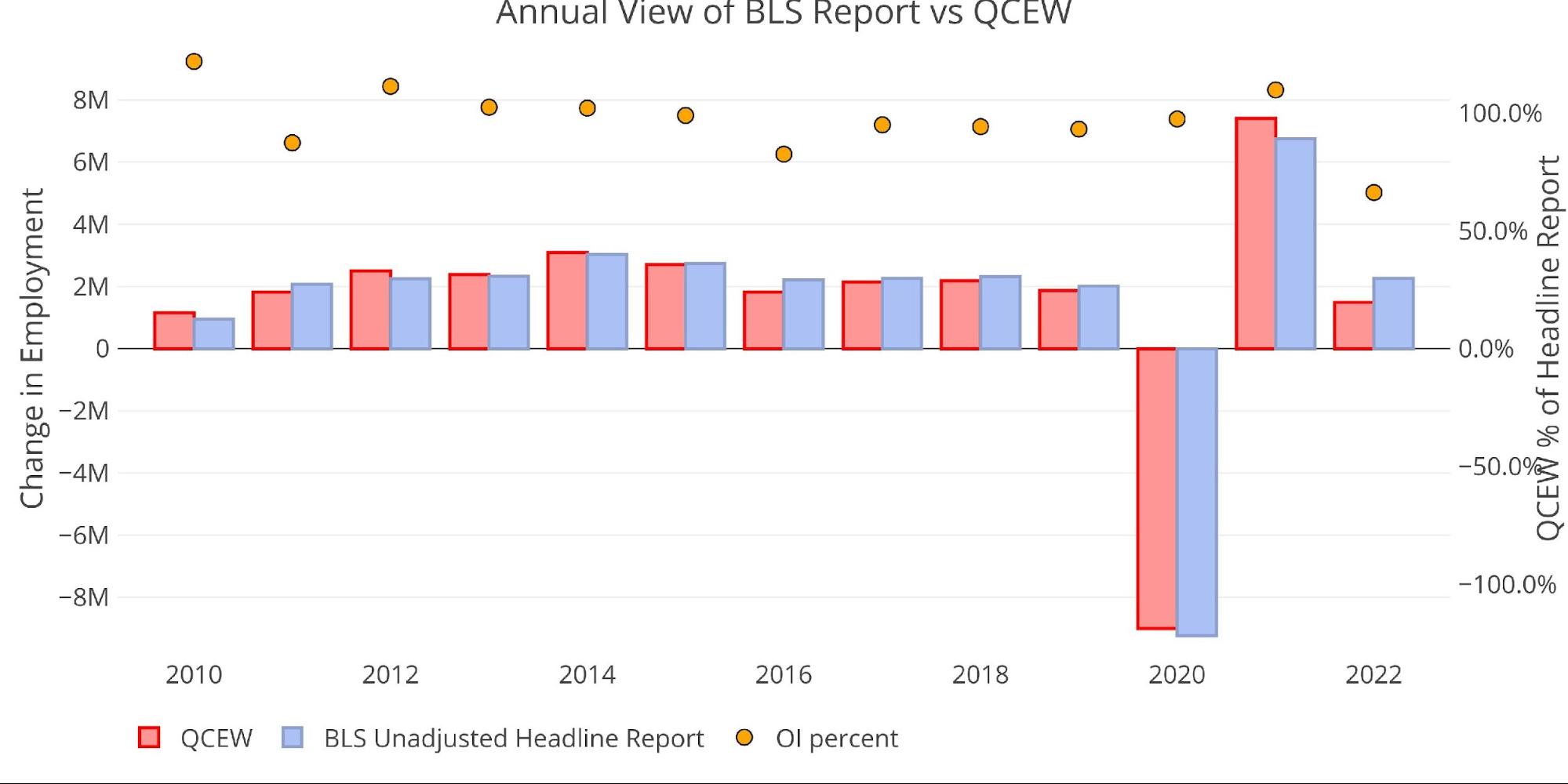

There’s one other report revealed by the BLS referred to as the Quarterly Census of Employment and Wages (QECW) . In accordance with the BLS, it is a much more correct and rigorous report masking 95% of jobs obtainable at a extremely detailed degree. Because of the rigor, the report is launched quarterly on a 7-month lag.

The information proven under is just up to date via June 2022. As might be seen, even on this report, 2022 is displaying the widest deviation of any yr again to 2010. The QECW reveals job development at 66% of the Headline Report. Even when filtering for the primary 6 months of the yr throughout all years (not proven), 2022 is the yr the place the Headline Report is overstating jobs by the biggest quantity.

Determine: 3 Main Report vs QCEW – Yearly

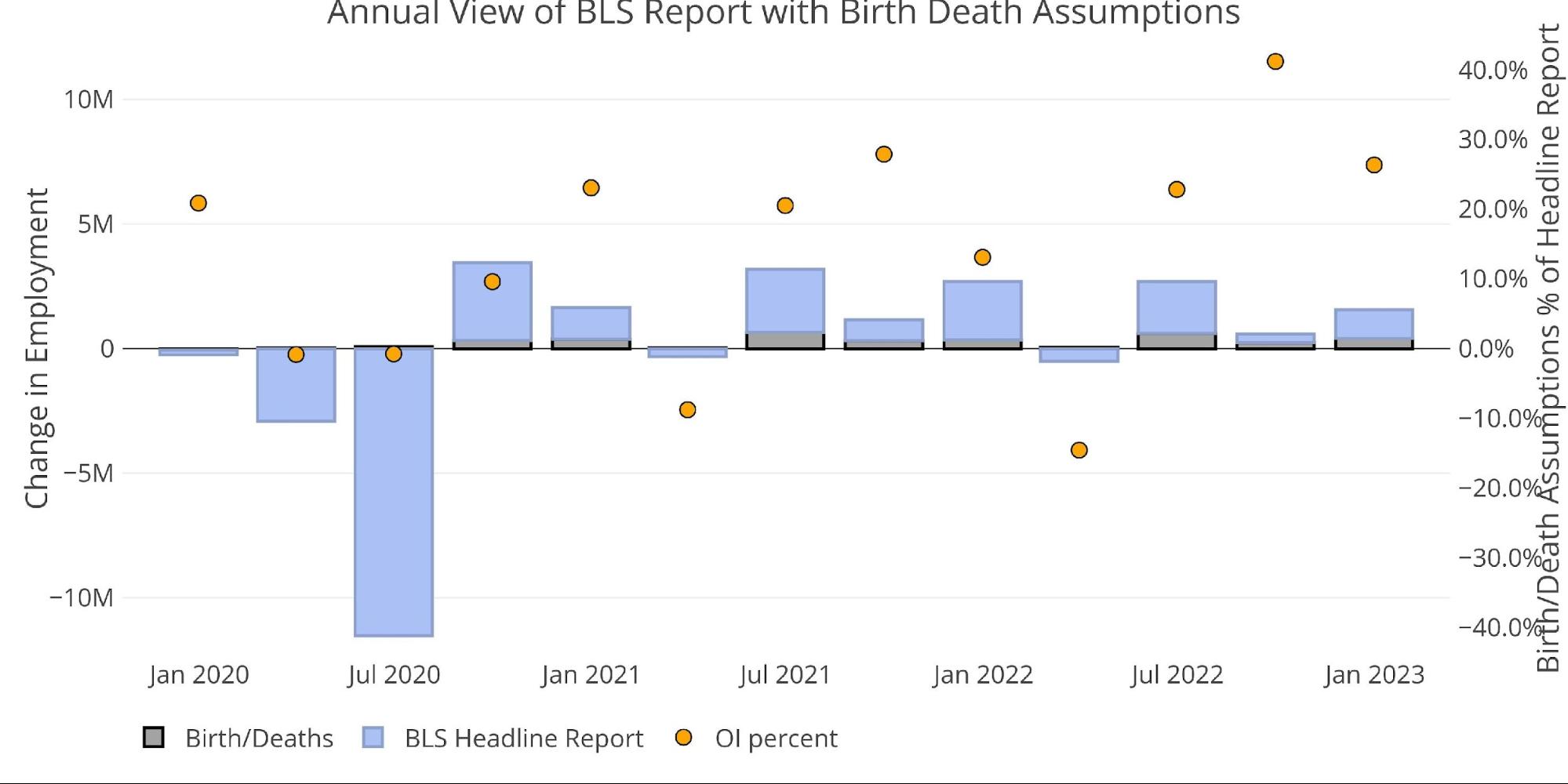

The BLS additionally publishes the information behind their Beginning/Dying assumptions . These are the roles that the BLS assumes primarily based on firms beginning or closing. Whereas the information just isn’t seasonally adjusted, it straight impacts the Headline Report. The chart under reveals the impression of Beginning/Dying jobs on the entire quantity. Whereas this yr represented a modest 30%, up from 20% in 2021, the mixture quantity is price noting.

Earlier than 2021, the Beginning/Dying assumptions had been proper round 1M. In 2021 and 2022, the assumptions surged 30% to over 1.34M in each years. Primarily, 700k jobs over the past 2 years had been resulting from bigger assumptions being made on prime of baseline assumptions.

Determine: 4 Main Unadjusted Report With Beginning Dying Assumptions – Annual

Wanting on the quarterly Beginning/Dying information reveals that 41% of Q3 jobs had been made up of the Beginning/Dying assumptions. This autumn noticed 26.4% of jobs come from the Beginning/Dying assumptions which had been 413k jobs.

Given the recessionary atmosphere, these are very beneficiant assumptions. Contemplating the information from the Family Survey and QECW, makes it very seemingly these assumptions are simply plain flawed.

Determine: 5 Main Unadjusted Report With Beginning Dying Assumptions – Quarterly

Present Developments

Although we simply spent a couple of paragraphs and 5 charts displaying how the BLS Headline Report just isn’t very dependable… that’s what the market takes as gospel. That is additionally what the Fed makes use of in shaping financial coverage, thus it’s nonetheless essential to grasp the information, even when it’s most likely flawed.

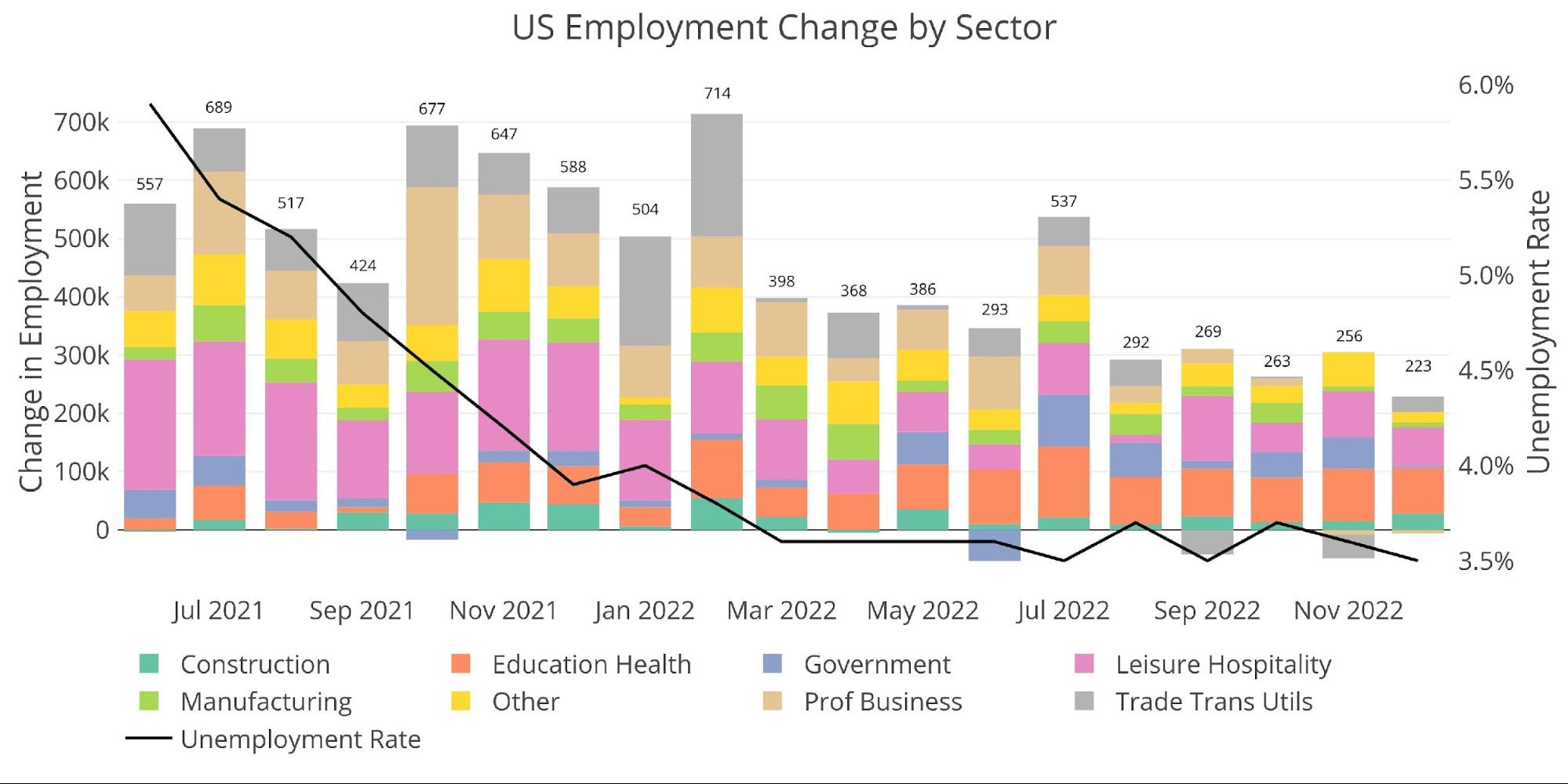

The US Financial system added 223k jobs in December because the Unemployment fee fell to three.5% and the Labor Pressure Participation fee elevated to 62.3% from 62.2%.

Determine: 6 Change by sector

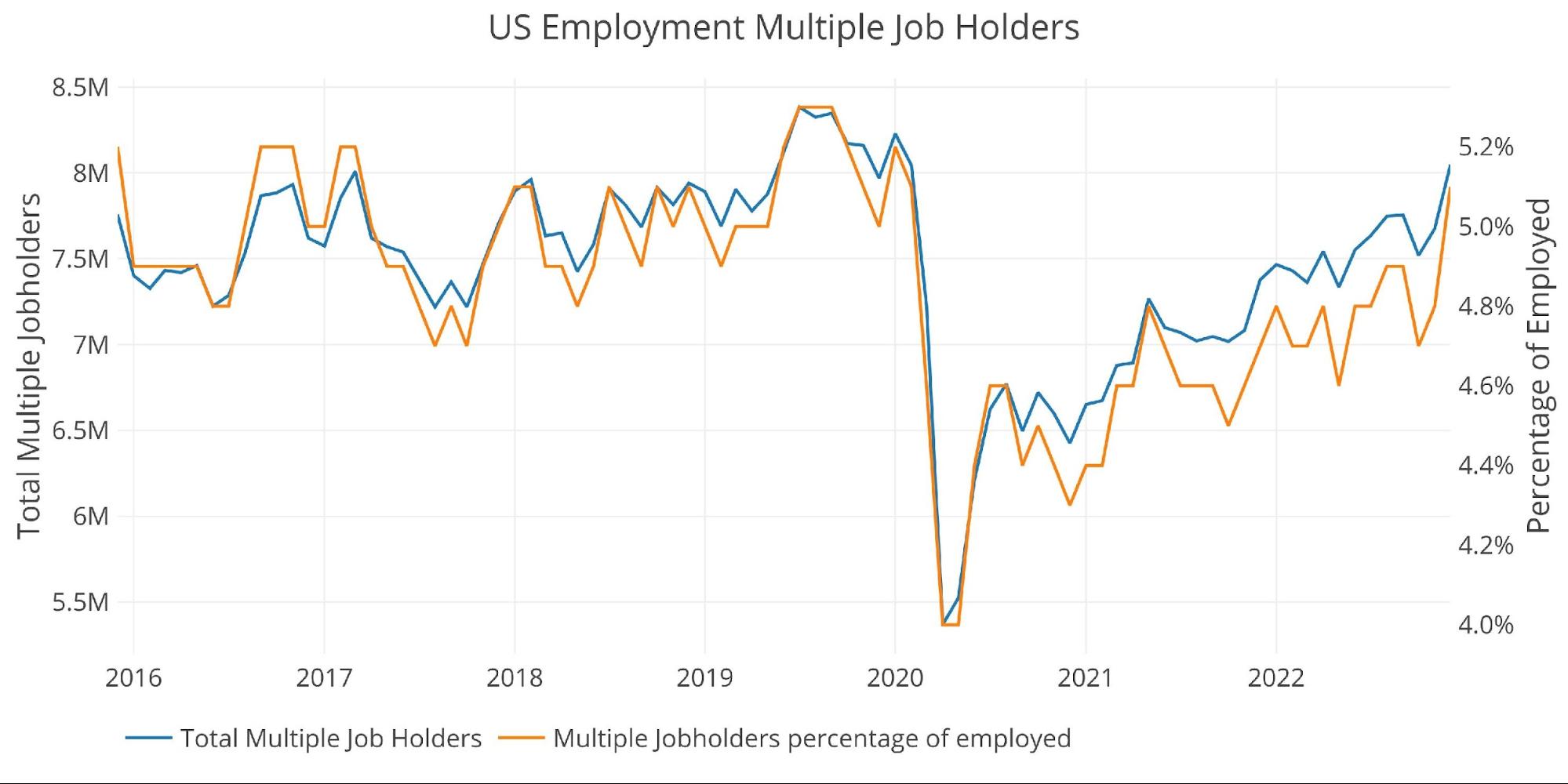

When trying on the information for a number of job holders, we are able to see that the quantity surged from 7.68M to eight.05M. Some fast math reveals that 370k jobs had been straight a results of a number of job holders .

Let’s subtract this from the 223k, carry the 1… oh wait… the roles report would have been -147k if not for 370k second jobs being created! If that isn’t an indication of a wholesome financial system, I don’t know what’s ( sarcasm ).

Determine: 7 A number of Full-Time Workers

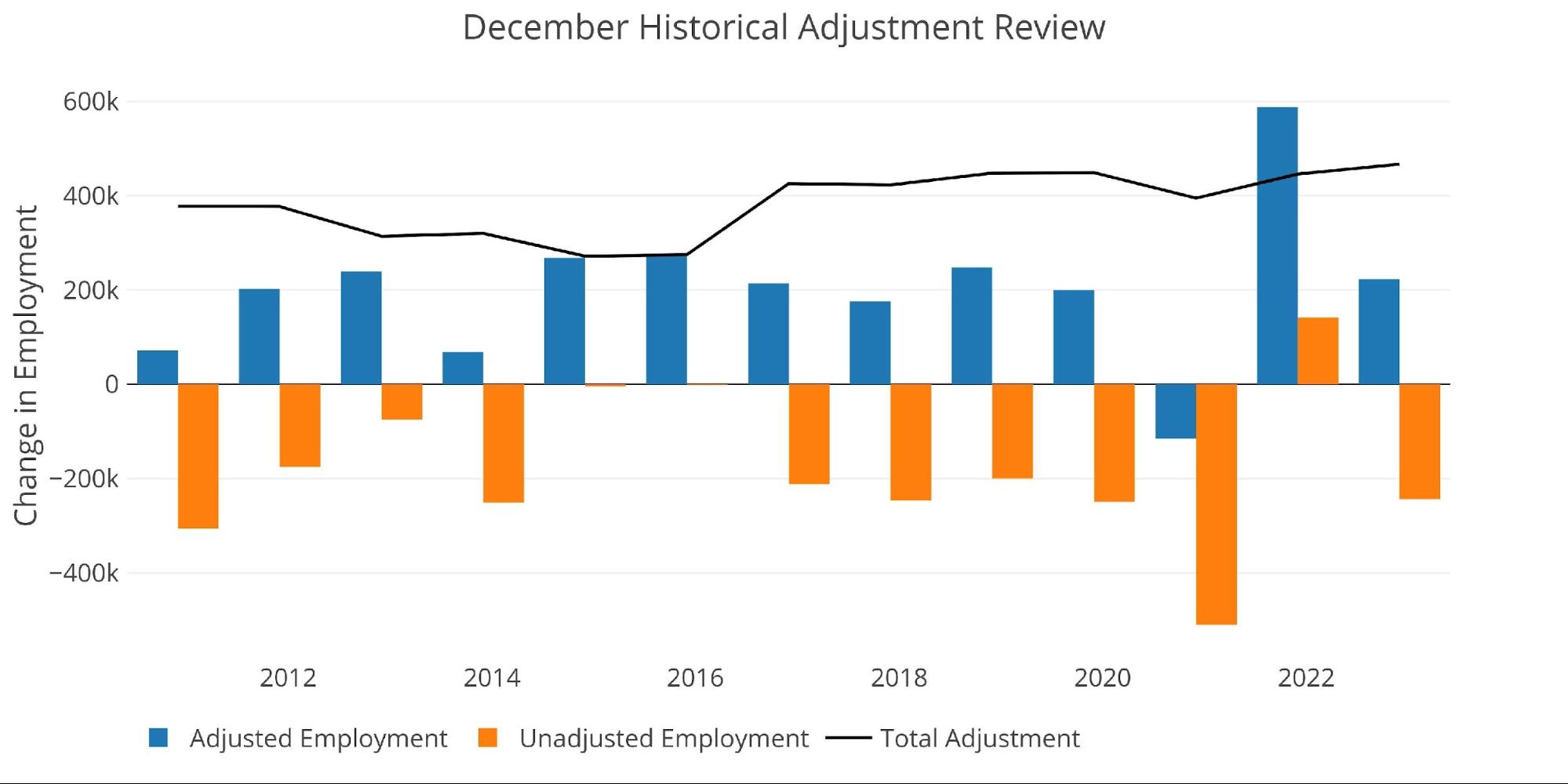

If we poke the report a little bit more durable, we are able to see that the uncooked numbers had been -244k. This implies the uncooked numbers had been adjusted up by 467k. Wanting traditionally, that is the largest December upward adjustment going again to at the very least 2010 .

Determine: 8 YoY Adjusted vs Non-Adjusted

Breaking Down the Adjusted Numbers

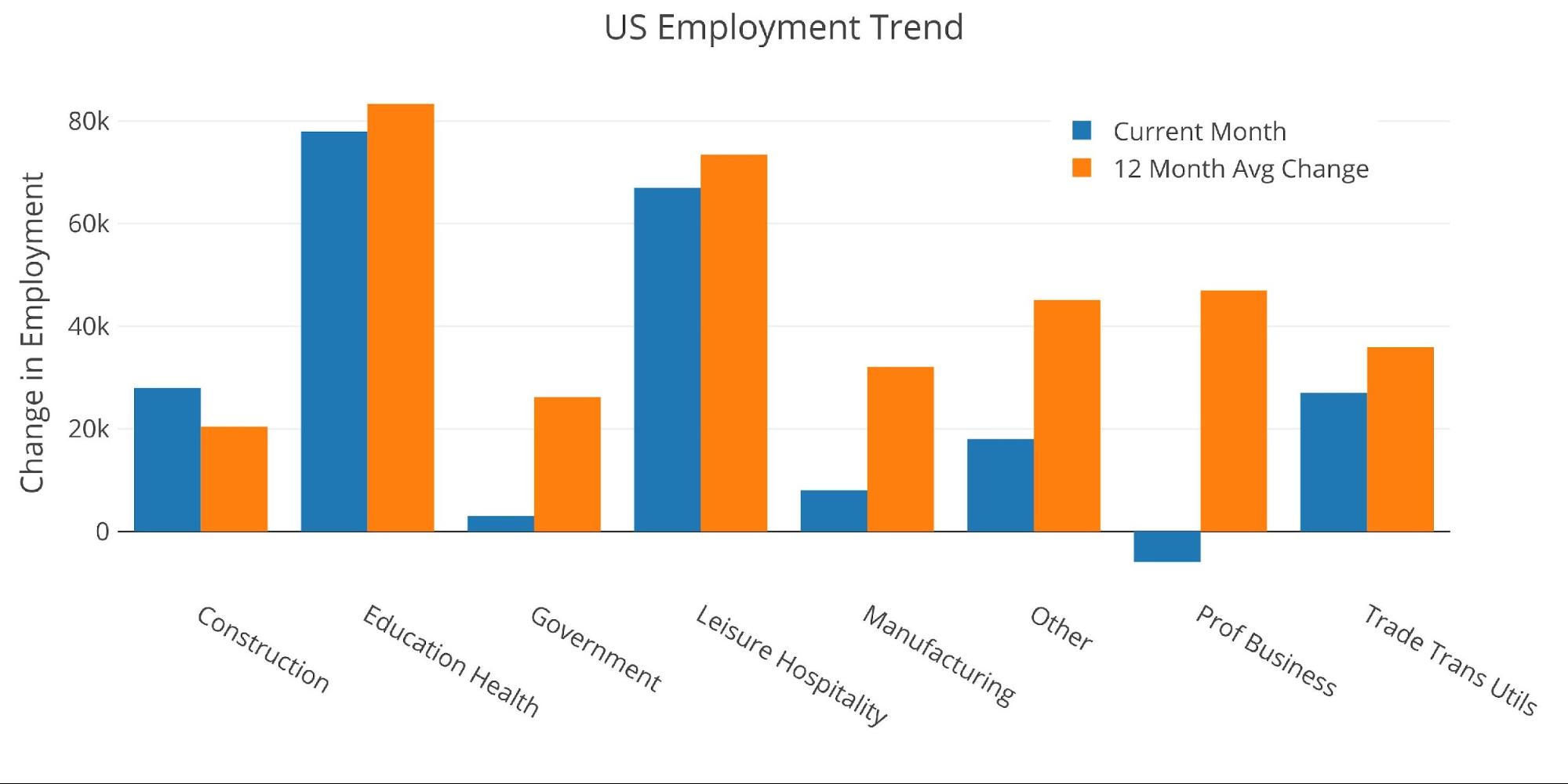

Even with the large adjustment up, the roles report was nonetheless weak. 7 of the 8 traits got here in under the 12-month common.

Determine: 9 Present vs TTM

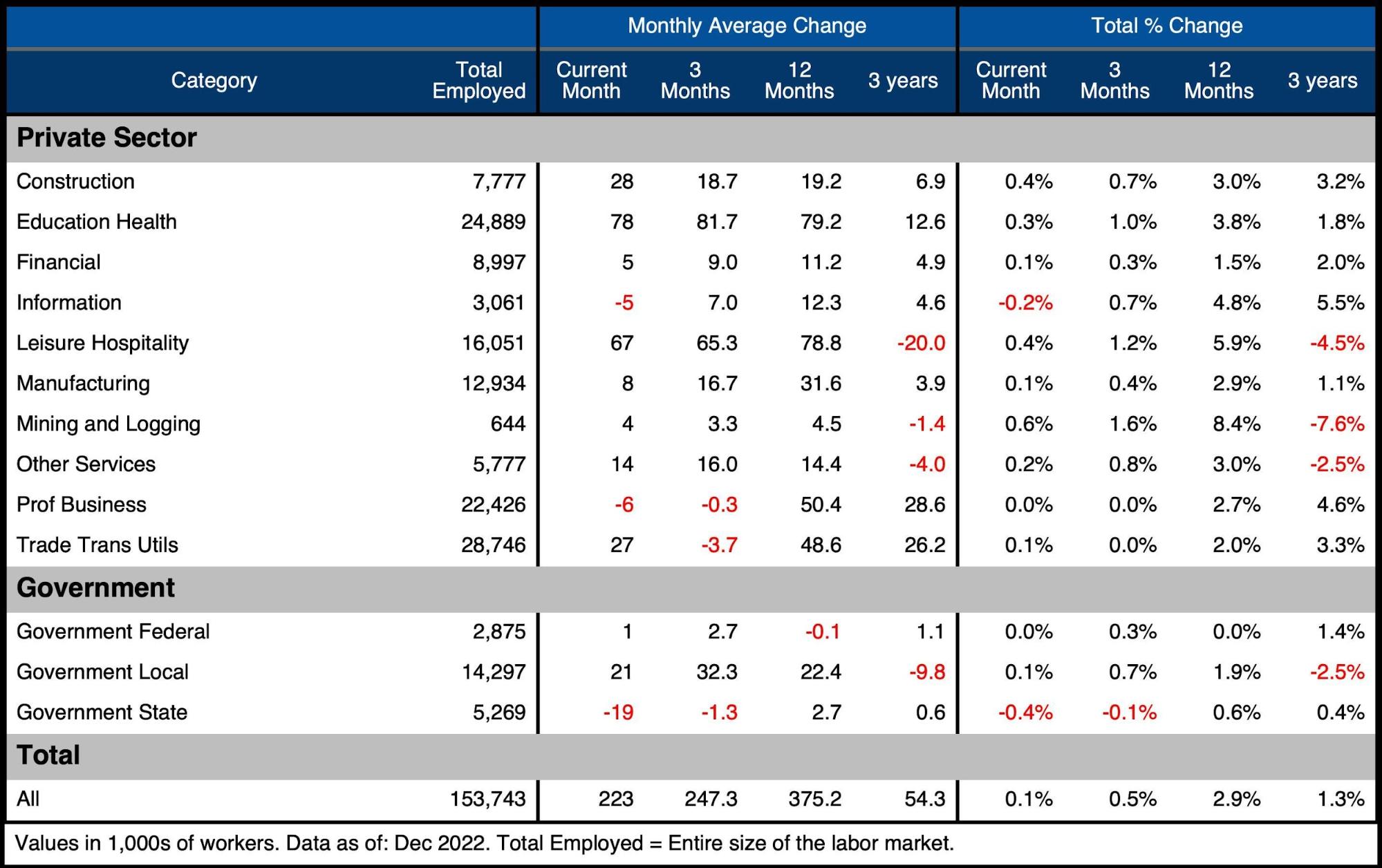

The desk under reveals an in depth breakdown of the numbers.

Key takeaways:

The present month is under the 3-month averageProfessional Enterprise truly shed jobs as did InformationConstruction confirmed a major rebound, surging above 3-month, 12-month, and 3-year traits

Determine: 10 Labor Market Element

What it means for Gold and Silver

As we unpack the labor report, we are able to see that the precise employment scenario is a lot weaker than the Headline Studies have been suggesting. This isn’t a conspiracy; this conclusion might be reached utilizing the numbers supplied by the BLS!

The Family Survey has been weaker, the QECW information has been weaker, we’re seeing document jobs created via assumptions within the Beginning/Dying mannequin, and December simply noticed the biggest adjustment up from non-seasonally adjusted to seasonally adjusted.

The underlying weak point within the information is getting missed by the mainstream and even the Fed. Everybody focuses on the Headline Report. When the weak point is lastly seen by everybody, it is going to be far too late to do something about it. You may wager that the Fed will attempt although with a tough and quick pivot. The gold market appears to already be pricing this in, racing out of the gates to begin the yr and shutting out the week above $1860.

It’s nonetheless not too late to get on the practice earlier than it leaves the station… however that practice is choosing up velocity!

Knowledge Supply: https://fred.stlouisfed.org/sequence/PAYEMS and in addition sequence CIVPART

Knowledge Up to date: Month-to-month on first Friday of the month

Final Up to date: Dec 2022

Interactive charts and graphs can at all times be discovered on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/USDebt/

Name 1-888-GOLD-160 and communicate with a Treasured Metals Specialist right this moment!

[ad_2]