[ad_1]

The Federal Reserve recently surrendered in its inflation fight. But price inflation is nowhere near the 2% target. Why did the Fed raise the white flag prematurely?

One of the major reasons is debt.

The world is buried under record debt levels and the global economy can’t function in a high interest rate environment.

Fed officials know that and it is certainly one of the reasons they don’t want to raise rates any higher and hope to bring them down as soon as possible.

Over a decade of easy money policies incentivized borrowing to “stimulate” the economy. As a result, governments, individuals, and corporations all borrowed to the hilt. That was all well and good when interest rates were hovering around zero, but when central banks had to hike rates to battle the inevitable price inflation, it pulled the rug out from under the borrow-and-spend economy.

Governments around the world are feeling the squeeze as they try to deal with trillions in debt in a rising interest rate environment.

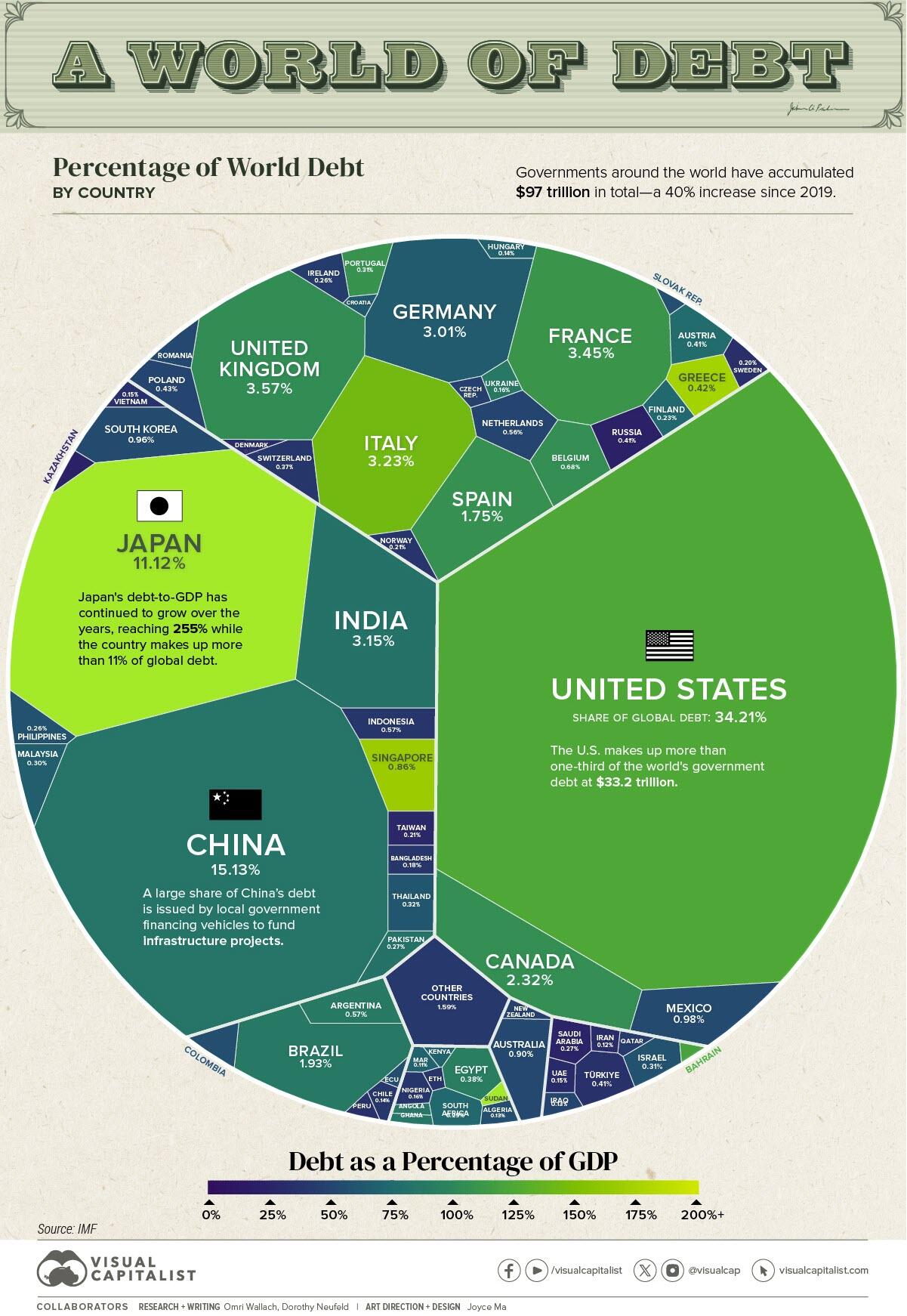

According to projections by the International Monetary Fund (IMF) global government debt will hit $97.1 trillion in 2023. That represents a 40% increase since 2019.

By 2028, the IMF projects that global public debt will exceed 100% of global GDP. The only other time global debt-to-GDP was that high was at the height of the pandemic lockdowns.

Americans like to brag about being number one. Well, when it comes to debt, they’re right.

The US national debt makes up 32.4% of the total global government debt.

According to the IMF, America’s debt-to-GDP ratio stands at 123.3%.

This chart by Visual Capitalist captures the extent of the problem.

THE DEBT SPIRAL

Unless governments dramatically cut spending and/or raise taxes, this debt spiral will only get worse, especially if interest rates remain elevated.

The situation in the United States underscores the problem.

The national debt blew past $33 trillion on Sept. 15. Just 20 days later, it pushed about $33.5 trillion. It is not just a tick below $34 trillion.

Meanwhile, interest expense rose by 23% to $879 billion in fiscal 2023. Net interest, excluding intragovernmental transfers to trust funds, rose by 39% to $659 billion. Both of those numbers broke records.

Rising interest rates drove interest payments to over 35% as a percentage of total tax receipts in fiscal 2023. In other words, the government is already paying more than a third of the taxes it collects on interest expense.

The federal government spent $79.92 billion in interest expense to finance the national debt in November alone. That was more than national defense ($70 billion) and more than Medicare ($79 billion). The only higher spending category was Social Security.

Interest expense is only going to grow.

A lot of the debt currently on the books was financed at very low rates before the Federal Reserve started its hiking cycle. Every month, some of that super-low-yielding paper matures and has to be replaced by bonds yielding much higher rates. The weighted average interest rate on the government’s $26 trillion of outstanding Treasury securities rose to 3.10% in November. That compares with a weighted average rate of 2.22% in November 2022.

The bottom line is interest payments will continue to quickly climb much higher unless rates fall.

Financial analyst Jim Grant doesn’t think that will happen. He thinks we’re at the beginning of a generational bear market in bonds that will keep rates higher for the next several decades — no matter what the Federal Reserve does.

His analysis makes sense. As governments around the world struggle to finance more and more debt, the supply of government bonds in the market grows. That puts upward pressure on interest rates. Even if central banks try to push rates down, it will be a constant tug-o-war with the markets.

That means the only way out of this fiscal death spiral is significant spending cuts.

And we all know that the likelihood of significant government spending cuts is pretty close to zero.

The fuse is on a slow burn but at some point, the debt powder keg will blow. The results won’t be pretty.

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

[ad_2]

Source link