[ad_1]

Phiromya Intawongpan

A Quick Take On Thoughtworks

Thoughtworks Holding, Inc. (NASDAQ:TWKS) provides various IT consulting services to clients worldwide.

I previously wrote about Thoughtworks in September 2023 with a Sell outlook on continued revenue decline amid restructuring efforts.

Management is starting to see reduced pressure on client budgets although sales cycles remain elongated.

While the industry is still facing a difficult environment for discretionary spending by clients and is under pricing pressure, my outlook on Thoughtworks Holding, Inc. stock has improved to Neutral [Hold] on stabilizing revenue and improving employee utilization.

Thoughtworks Overview And Market

Chicago-based Thoughtworks provides consulting and related solutions to enterprises to assist them in evolving and modernizing their IT and digital infrastructures for their business goals.

The firm is led by President and CEO Guo Xiao, who has been with the company since 1999 and has worked in numerous roles within the company and its subsidiaries.

The company’s primary offerings include:

Enterprise modernization

Customer experience

Data and AI

Digital transformation.

TWKS obtains new consulting and integration projects with enterprises via its direct sales & marketing efforts as well as through partner relationships.

Per a 2023 research report by MarketsAndMarkets, the worldwide market for digital transformation strategy consulting was approximately $696 billion in 2023 and is expected to reach $3.14 trillion by 2030.

This represents a forecast CAGR of 24.1% from 2023 to 2030.

The primary reasons for this expected growth are a transition from on-premises, legacy systems to cloud-based environments in public, private or hybrid architectures.

The recent global pandemic has increased demand from organizations to create more capable enterprise IT systems. This has resulted in improved growth prospects for digital transformation consultancies.

However, macroeconomic downturns can hamper growth as clients reduce their discretionary spending and focus on lower-value cost-takeout engagements.

AI-related projects have become a source of growth potential for the IT consulting industry.

Major competitive or other industry participants include:

Globant

EPAM

Slalom

Accenture

Deloitte Digital

McKinsey

BCG

Ideo

Cognizant Technology Solutions

Capgemini

Company in-house development effort.

Thoughtworks’ Recent Financial Trends

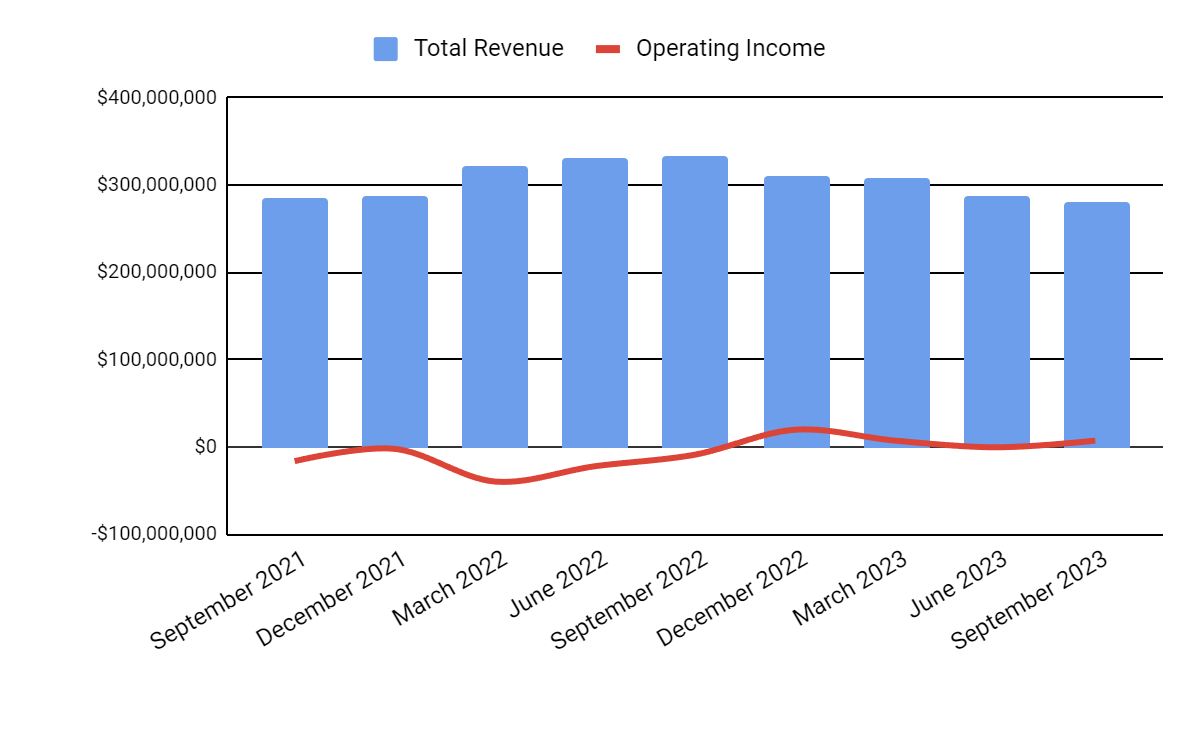

Total revenue by quarter (blue columns) has continued to decline sequentially and year-over-year on softer client demand and longer sales cycles. Operating income by quarter (red line) has varied within a narrow range in recent quarters:

Seeking Alpha

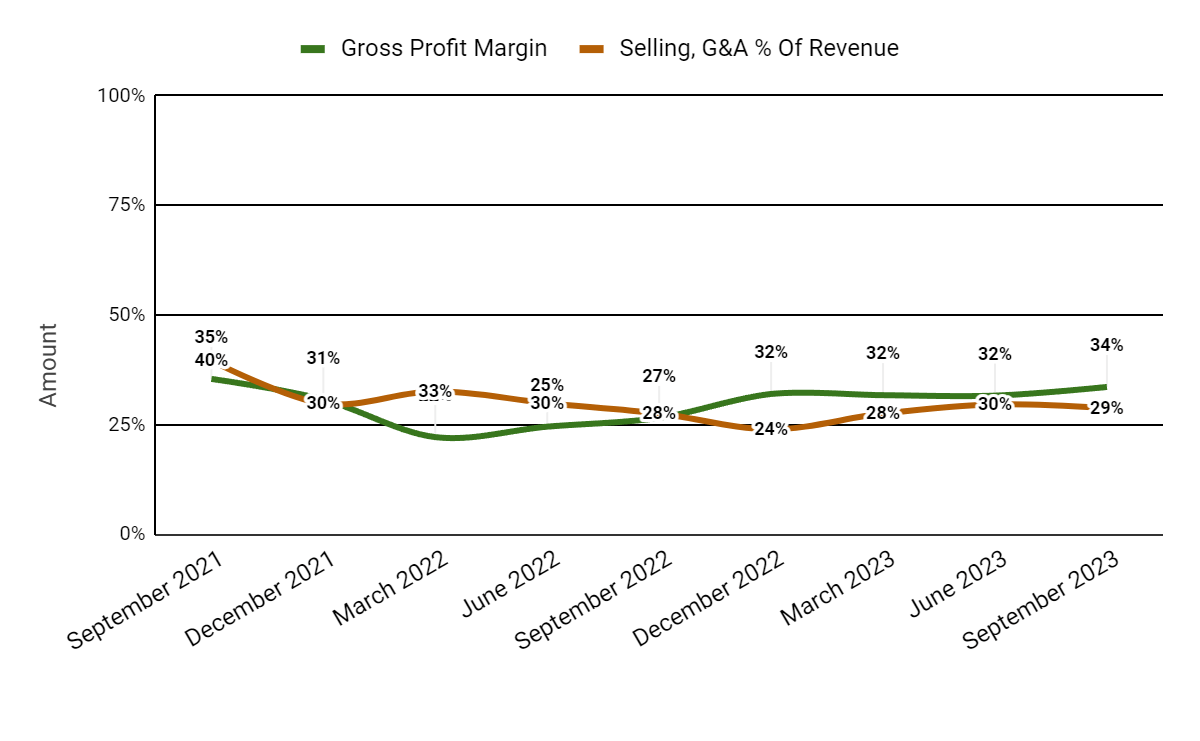

Gross profit margin by quarter (green line) has risen slightly as a result of greater offshoring and higher employee utilization in certain verticals; Selling and G&A expenses as a percentage of total revenue by quarter (amber line) have trended lower in recent quarters due to ongoing restructuring cost savings.

Seeking Alpha

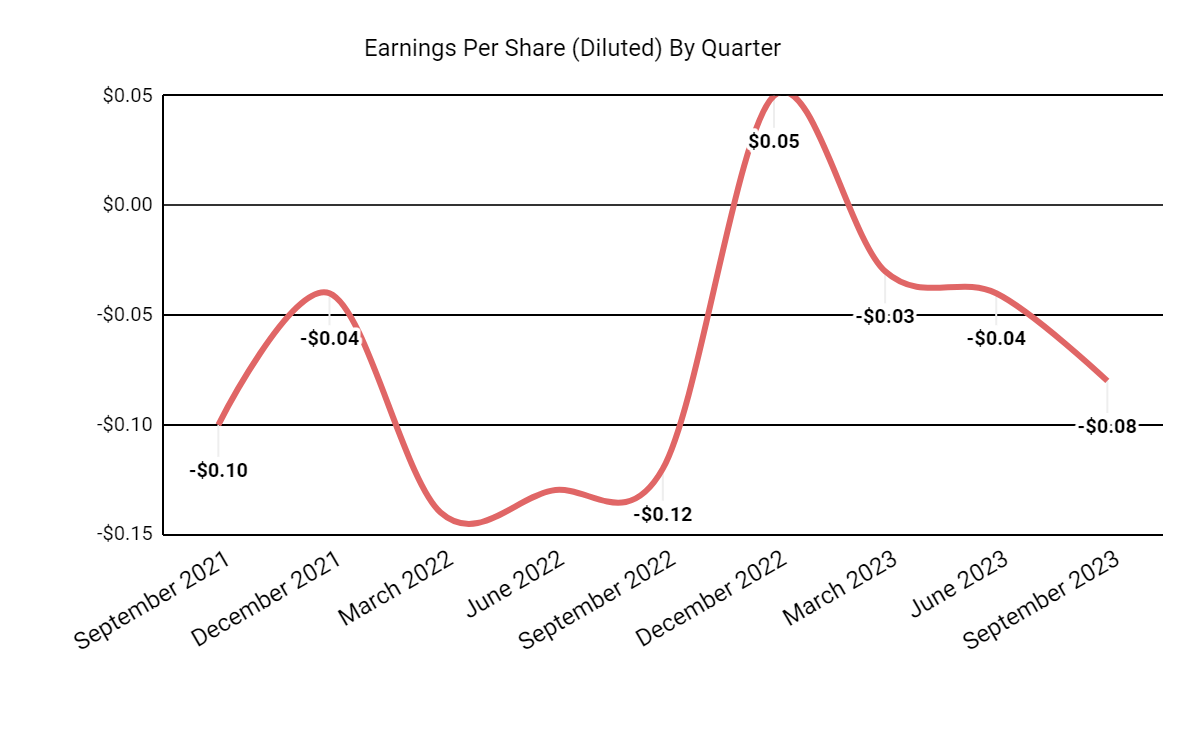

Earnings per share (Diluted) have continued to drop further into negative territory because of reduced topline revenue.

Seeking Alpha

(All data in the above charts is GAAP.)

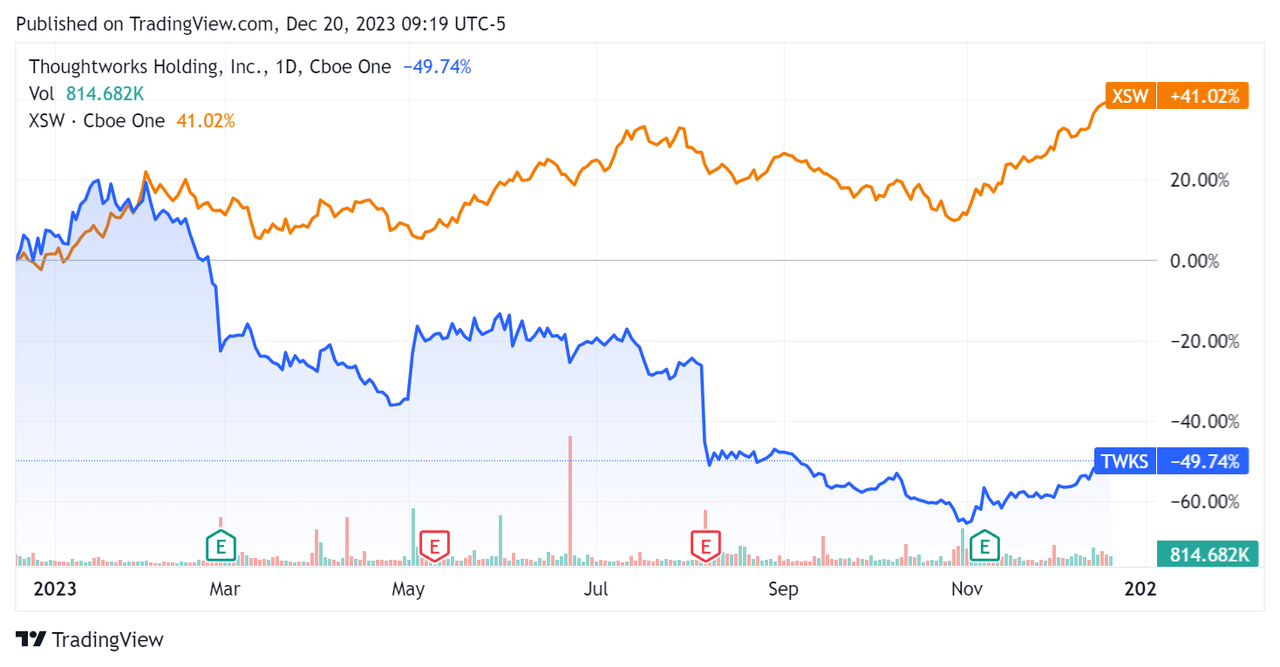

In the past 12 months, TWKS’s stock price has fallen 49.74% vs. that of the SPDR S&P Software & Services ETF’s (XSW) gain of 41.02%, indicating severe underperformance against an industry benchmark:

Seeking Alpha

For balance sheet results, the firm ended the quarter with $87.4 million in cash and equivalents and $294.9 million in total debt, of which $7.2 million was categorized as the current portion due within 12 months.

Over the trailing twelve months, free cash flow was $44.5 million, during which capital expenditures were $11.2 million. The company paid $70.3 million in stock-based compensation in the last four quarters.

Valuation And Other Metrics For Thoughtworks

Below is a table of relevant capitalization and valuation figures for the company:

Measure (Trailing Twelve Months)

Amount

Enterprise Value / Sales

1.5

Enterprise Value / EBITDA

24.1

Price / Sales

1.2

Revenue Growth Rate

-6.9%

Net Income Margin

-2.5%

EBITDA %

6.0%

Market Capitalization

$1,470,000,000

Enterprise Value

$1,720,000,000

Operating Cash Flow

$55,650,000

Earnings Per Share (Fully Diluted)

-$0.10

24 FWD EPS Estimate

$0.22

Free Cash Flow Per Share

$0.14

SA Quant Score

Hold – 2.57

Click to enlarge

(Source – Seeking Alpha.)

Compared to the Seeking Alpha IT Consulting & Other Services industry average EV/EBITDA multiple of 19.2x, the firm is currently being valued by the market at a multiple of 24.1x, a premium to the industry index.

While the firm posted a trailing twelve-month revenue decline of negative (6.9%), the IT Consulting & Other Services index averaged a YoY growth rate of 5.1%.

Commentary On Thoughtworks

In its most recent earnings call (Source – Seeking Alpha), management’s prepared remarks highlighted ‘stability’ in its sales pipeline with reduced client passes and stronger new logo acquisition.

The company is prioritizing investments in sales and marketing and is seeing outbound demand generation produce improved results, generating 51% of net new bookings during Q3.

However, management continues to see longer sales cycles and “programs of work being broken up into smaller deals,” although some clients are reporting reduced budget pressures, with digital transformation remaining a high priority.

Analysts questioned the leadership about its pipeline growth prospects, employee utilization and pricing dynamics.

Management said that it expects to see sequential pipeline growth starting in early 2024.

Leadership also forecasts utilization to continue to trend higher in Q4, adjusted for seasonal factors. The company sees improvements in the verticals of healthcare, automotive and energy.

However, the firm expects continued pricing pressure from clients and competitors into 2024 as client buying behavior remains cautious.

For the quarter’s results, total revenue fell 15.7% year-over-year, while gross profit margin improved by 7.1% due to offshoring and increased utilization.

Selling and G&A expenses as a percentage of revenue increased by 1.2% YoY, and operating income turned positive from the year earlier negative result.

The company’s financial position is moderate, with some liquidity, a greater amount of debt but solid free cash flow.

Looking ahead, 2024 top line revenue is expected to contract by about 1%, according to analyst consensus estimates.

However, compared to the Seeking Alpha IT Consulting and Other Services Index, which is expected to grow revenue by around 6% in the next four quarters, TWKS looks to substantially underperform the index.

However, on an EV/Revenue basis, TWKS is currently valued by the market at only 1.5x compared to the benchmark’s 2.5x average valuation, indicating the potential for being undervalued.

In any event, the firm appears to be seeing signs of revenue stabilization and improvement in certain industry verticals.

Its restructuring continues to make progress, and I see signs of improvement in its employee utilization, gross margin and SG&A expense ratios.

While the industry is still facing a difficult environment for discretionary spending by clients and is under pricing pressure, my outlook on Thoughtworks Holding, Inc. has improved to Neutral [Hold] on stabilizing revenue and improved utilization.

[ad_2]

Source link