[ad_1]

Trade Ideas Review

Features

Charts

Ease of Use

Scanners

Alerts

Platform Differentiation

Summary

Trade Ideas is a standalone stock scanning tool that offers unique market scanners, advanced analysis tools, and artificial intelligence. Trade Ideas is arguably one of the top scanning tools available on the market right now.

About Trade Ideas

Trade Ideas is an incredibly powerful tool for anyone looking for a nonstop pipeline of trade ideas throughout the trading day. The platform provides tons of built-in scans that find unique trading opportunities in real-time. It’s also flexible enough for users to create their own scanning strategies without ever needing to learn a coding language.

Trade Ideas used to have a reputation for having a steep learning curve, but it’s become much more user-friendly over the years. Now, users can step right into it without too much explanation or take advantage of a one-on-one training session with a Trade Ideas coach. There are also a ton of videos and tutorials to help you get started with the platform.

So, what does Trade Ideas offer, and can it improve your trading? Let’s take a closer look at this platform in our Trade Ideas review.

Trade Ideas History

Formed in 2002, Trade Ideas has evolved from being just a market scanner into a full-fledged idea generation platform. It serves more than 50,000 traders across 19 countries and monitors the US and Canadian equity markets. The platform leverages artificial intelligence to identify what strategies work in the current market and generate ideas that best fit predictive outcomes.

Trade Ideas has a live community chatroom with moderators and a bustling community of active traders. Co-founder Dan Mirkin is an active day trader who regularly posts trades on Twitter and understands the needs of traders.

Unlike a lot of other scanners that tie up massive resources scanning on the user’s computer, Trade Ideas handles all the processing at its data centers and then pushes the filtered stock ideas to the end-user. This is an efficient and streamlined model that results in quicker and more accurate scans. It’s really impressive how fast Trade Ideas can crunch data about thousands of stocks on a typical laptop.

Trade Ideas is being actively developed and regularly rolls out new features. We did our initial Trade Ideas review back in 2019 and have updated it multiple times since.

How Much Does Trade Ideas Cost?

Trade Ideas pricing is straightforward. Subscriptions are $84 per month (or $999 for a prepaid year) for the Standard plan or $167 per month (or $1,999 for a prepaid year) for the Premium package.

The Standard plan comes with all the basic scanning tools, including the Channel bar and built-in indicators that can be customized with your preferred settings. They also include charts, alerts, and top lists. All real-time data is included as well.

The Premium plan includes everything you get with the Standard package as well as:

Entry/Exit Signals

AI Trading Tools

Strategy Backtesting

Autotrading with Brokerage Plus

EXCLUSIVE DISCOUNT

Save $340 on Trade Ideas

Use code DTR15 for 15% off Any Subscription

Trade Ideas Platform Features

Trade Ideas is packed with powerful features and traders should expect a bit of a learning curve when you first open the platform. That said, there are plenty of support resources and tutorials if you need help getting acclimated to the software. Most experienced traders should be able to start figuring things out within an hour or two.

So, let’s get to it.

We are going to take a look at some of the most powerful features in the Trade Ideas platform, including:

Charting

Scanners

Brokerage Plus

Channels

Racing

AI Trading

And more

Platforms

Let’s start by discussing the software itself.

Trade Ideas offers desktop and web platforms. The desktop platform is Windows-only, but the web-based platform can be used on any operating system in any browser. Mac users can run the platform using a Windows virtual environment tool like BootCamp or Parallels.

The software itself is fast and reliable. As we noted above, Trade Ideas processes data in the cloud and then pushes the results to users. This saves your computer from being overloaded.

For the sake of our review, we will be focusing on the desktop platform, as that is what most traders will use. It is also the more powerful option of the two platforms. While the web-based platform is convenient, most active traders will prefer the power and efficiency of the desktop platform.

Channels

Trade Ideas Channels are one of the unique features that allow traders to dive right into this platform with minimal setup.

“Channels” are essentially pre-built scans centered around a theme. For example, there are channels for:

Unusual Volume

Unusual Options

Short Squeezes

Swing Trading Stocks

Pre-Market Movers

After-Hours Movers

And more

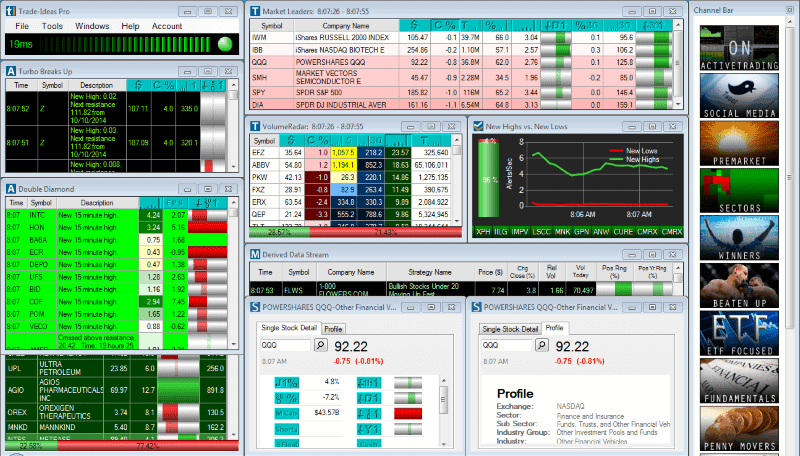

Here’s a look at the channel window:

When you click on one of the channels, you will find the stocks that meet the criteria for the scan of that channel. There are a few convenient scans built in. For example, if you click on the “After Hours” channel, you can find the most volatile stocks, volume leaders, and real-time alerts.

There are plenty of channels to choose from, so new users should explore all of them to see which ones will be most useful for daily trading.

Charts & News

Before we move on to some of the other scanning features, let’s take a quick look at some of the decision support tools that Trade Ideas offers. For most traders, a scan alert is just a starting point. It alerts you to significant price action, and then you can follow up with your own research.

Every Trade Ideas scan is linked to decision support tools. If you double-click on a scan result, you can see the stock charts, fundamentals, news, and more.

Trade Ideas charts have come a long way over the years. When the platform first launched, the charts were very basic. Now, they include most of the advanced features you would expect from a trading platform.

Key features include:

Candlestick Charting

Multiple Timeframes (Minutes, Hours, Days, Weeks, and Months)

Technical Indicators (Moving Averages, RSI, MACD, VWAP, and more)

Annotation Tools

Charts are updated in real-time and include data from pre-market and after-hours trading sessions as well.

You can set up multiple chart windows if you want to use different chart settings or check stocks across multiple timeframes.

Recent news headlines are available from a variety of outlets, including Seeking Alpha, Motley Fool, Benzinga, newswires, and more. Clicking on a news headline will take you out of the platform to read the full article in the browser. Trade Ideas is not a news scanner, but it is convenient to see recent headlines to determine why a stock may be moving.

Strategy Scanners

Trade Ideas has built-in strategies and stock screeners, which are types of pre-configured scans. These can be accessed through the platform’s Alert Window.

You can use the scans as they are, customize them, or build your own from scratch.

These scanners are really the stars of the Trade Ideas software and the reason why so many day traders use Trade Ideas. During our Trade Ideas review, we tested out a few pre-configured Trade Ideas scans and built a few custom scans of our own. The flexibility and power of these scans go way beyond what you can do with a typical stock screener. Trade Ideas enables you to create custom alerts for a variety of different trading strategies. Alerts are color-coded, which makes it easy for day traders to spot the alerts you’re looking for.

You will definitely need to spend some time playing around with the different settings because there are a lot of options. You can set hundreds of different types of alerts. Here are just a few:

You can also filter the scan results even further with criteria like:

Intraday Volume

Change from Close

Relative Volume

Exchange (i.e. NYSE, NASDAQ, etc.)

Custom Watch Lists

As we mentioned, it takes time to set up your scans. It can be helpful to start with a pre-built strategy and customize it to your liking. You have plenty of options to work with. Trade Ideas is incredibly customizable and offers filters and alerts that should suit any trading style.

Once you set up your scanner, results will start showing up in real-time. You can set up multiple scanners to be alerted to different types of moves. The alerts windows are color-coded and include descriptions for the alert type, making it easy to monitor multiple scans at once.

You can also customize the columns in the scan results to include whatever data points are relevant to your trading strategy.

Market Explorer

Market Explorer is one of the newest tools in Trade Ideas. This tool features handmade scans from the team behind Trade Ideas. The scans are unique in that they look for specific setups that may otherwise be difficult to identify with quantitative criteria.

If you have ever tried to scan for a specific chart pattern, you have probably run into this issue. For example, how exactly do you create quantitative scan filters for a chart pattern such as a bull flag or a gap fill?

Market Explorer solves this issue by providing pre-built scans for a variety of setups. Here are just a few:

Bull Flags and Bear Flags

Gap Fills

Gap and Pullback

Strong Stocks Pulling Back

Closing Range Breakouts

Moving Average Crossovers

The results are impressive. For example, here are the results from a closing range breakout scan:

When I pull up the chart for these results, it’s a match.

The ability to scan based on qualitative criteria (i.e. chart patterns) is an exciting feature for Trade Ideas subscribers.

Real-Time Stock Races

Real-time stock races are another recent feature added to Trade Ideas. This is definitely one of the most unique features we have ever seen in a scanning platform.

When we first saw this feature, we thought it was a gimmick. The stock racing window features stocks “racing” (racecar graphics and all).

After testing this feature further, we realized that it actually provides a unique value. The racing feature adds context to a scan. It shows how stocks perform over time relative to a certain metric and to each other.

A stock race can be set up from any top list window. Here’s how it works.

Start by choosing your top list window. Top lists can be set up for a variety of criteria, including:

Daily Gainers

Daily Losers

Volume Leaders

Gappers

And more

Essentially, Top Lists are like the strategy scanners we discussed above, but in more of a “sorted table” format than a “real-time alert” format.

Once you choose your top list, you can set up a stock race and set the criteria for the race. Here are the options:

The main settings for a time-based race include:

Lanes – Number of stocks to race

Minutes – Length of the race

Based On – The metric for winning the race (e.g. volume, % chg)

Sort On – How stocks should be sorted

Replace Cars – Replace stocks in the race

This may seem confusing at first, so let’s put it into basic terms.

Assume it is 10:00AM EST and you are looking at the list of the top gainers for the day. Percentage change isn’t insightful enough because a stock could gap up and then fade. You want to see which stocks are performing best in real-time. So, you set up a 10-minute race to see which stocks perform the best in real-time. This helps you narrow down a list of the 100 top movers down to the 5-10 best intraday opportunities.

There’s no doubt that there is a learning curve when using this feature since the concept itself is brand new. That said, there are a lot of practical applications. In a way, it replaces a screen with dozens of charts. Instead of monitoring performance on charts, you can monitor them with a race and find winning stocks on autopilot.

For example, this after-hours stock race helped us find the most volatile after-hours stocks in real-time.

Since stock races are new, you will need to see if they fit in your trading workflow, but we definitely recommend playing around with them.

Backtesting

So far, we’ve covered the scanning tools available in the Trade Ideas platform. Let’s continue our review by looking at some of the other unique trading tools.

One of the cool things about Trade Ideas is that it brings quant trading features to average traders. We’ll discuss a few of these advanced data tools, starting with backtesting.

Trade Ideas allows users to backtest any strategy. The goal of a backtest is to see how effective it would be to trade the stocks in the scan results.

Remember the custom scans we discussed above? Trade Ideas allows you to test the effectiveness of these scans with an easy-to-use backtesting tool. Simply right-click on the alerts window to pull up the backtesting options.

When you set up a backtest, you enter a few criteria for how you plan to trade the stock and the technology will show you how effective that strategy would be. Settings include:

Entry Time (Based on time of day)

Exit Time (Based on time of day, minutes after entry, or at market close/open)

Risk settings (stop loss and profit target)

Testing timeframe

Once you enter the criteria for your strategy, Trade Ideas will show you effective that strategy would be. Key metrics include:

Average Gain

Average Loss

Buying Power Required

Win Rate

Average Return

And more

The backtesting tool is a convenient way to gauge the effectiveness of a scanner. While it may be difficult to input your exact strategy, you can get close enough to extract meaningful data. For example, if you plan to buy stocks for high-of-day breakouts with a 1:3 risk/reward, you could see how effective that would be over the long run using the backtester.

While we don’t recommend using the backtester for every scan, it can be really useful when testing new scan ideas. The backtester looks at data from the past couple of months to see if a scan is sustainable. This adds a new level of insight to the scan creation process.

For example, a scan may perform well today if the broader market is bullish, but that doesn’t mean it will be effective in the long run. Backtesting allows you to time-test your scanning strategies for effectiveness.

Artificial Intelligence (AI) – Holly

Trade Ideas makes use of AI in a way that we haven’t seen from any other trading software. Holly is an AI engine that implements 35 long and short strategies to find strategies that have a historical success rate of 60% and 2:1 profit factor to trade.’Holly is an AI engine that implements 35 long and short strategies to find strategies that have a historical success rate of 60% and 2:1 profit factor to trade.

The AI engine actively stalks the market to execute these trades, complete with entries, exits, the reason for exits, and type of strategy executed. The results are updated in real-time so users can piggyback on the trades or just watch and see how they play out. You can analyze the entry and exit points to see how the artificial intelligence engine works, or you can simply analyze the trades to see which stocks hit Holly’s radar.

Trades are reviewed in an end-of-day video blog from Trade Idea’s Live Trading Room recap. Overnight, Holly will run more than one million simulated trades using more than 45 different strategies to generate the most viable strategies to utilize the next morning. Holly provides a morning watchlist of the preferred strategies and stocks she will trade for the day. You can monitor these in the AI Strategies window. Holly outperformed the S&P 500 index five-fold with a 52% return versus 10% in 2016.

Order Entry/Compatible Brokers

Trade Ideas integrates with E*Trade and Interactive Brokers for in-platform order entry and automated trading.

Training

All new subscribers have the option to schedule a free one-on-one training session with a Trade Ideas staff member. We recommend taking advantage of this after spending a few hours playing around in the software on your own.

In addition, Trade Ideas has a ton of educational videos available on its YouTube channel along with tutorials on the website. The platform has a learning curve, but it’s not too hard to figure out once you dive into it. Users can read through the definitions of each type of strategy to get an idea of what’s under the hood fairly quickly.

Trade Ideas Brokerage Plus

Trade Ideas released Brokerage Plus in early 2019 as part of the company’s initiative to bring AI-powered trading to retail traders. This feature was not included in our initial Trade Ideas review, but we were so excited about it that we came back for an update.

EXCLUSIVE DISCOUNT

Save $340 on Trade Ideas

Use code DTR15 for 15% off Any Subscription

Brokerage Plus was initially launched as an add-on feature priced at $1,100. It is now included with a Trade Ideas Premium subscription

Brokerage Plus allows traders to create, test, and automate day trading strategies. While many trading platforms offer backtesting, this is the first time we’ve seen full automation in an easy-to-use platform for retail traders. Of course, automating your trading strategy is not simple, but Brokerage Plus can get you started.

Here’s how it works:

Step 1: Connect to Your Broker

Brokerage Plus connects directly to your brokerage account, which allows you to place real trades based on your automated strategy. Currently, Brokerage Plus only connects to Interactive Brokers, but the company plans to create more integrations in the coming year.

Step 2: Create Your Scan

The first step towards automating your strategy is creating a scan. This scan will be used to find the stocks that will be traded using your strategy in the next step. You can use the built-in Trade Ideas scanners or build a custom scan within the platform.

Step 3: Build Your Strategy

Brokerage Plus aims to bridge the gap between scanning for stocks and day trading.

Stick with us here, as the process isn’t simple. But it’s important to understand before you consider auto-trading.

If you’re familiar with backtesting, you know that you can create a scan, define your entry/exit criteria, and backtest the profitability of your strategy. For example, you could create a scan for stocks breaking above their 52-week highs, define hypothetical entries of 100 shares at the breakout price, and set your exit price to 5% above the entry point. A backtest would test the profitability of this strategy using historical data. The results may show that this strategy yields a 5% profit 70% of the time and a 2% loss 30% of the time. This results in net profitability of 2.9% ((70% x 5%) – (30% x 2%)).

Traders who use backtesting could run these simulations and choose to trade the strategy manually. Brokerage Plus takes this to the next level by offering automatic trading. You can create an entry/exit strategy using the following criteria:

Long/Short – Choose whether you want to open long or short trades.

Entry Time – Choose the market hours when you’d like to run your strategy (e.g. 9:30 AM – 12 PM)

Position Sizing – Choose your position size using a fixed amount of shares or a flat rate (e.g. 1000 shares OR $5,000 position)

Entry Order – Choose what type of order you’d like to use to open a position and enter additional criteria for opening positions (e.g. Open limit order at $0.05 above the last price for 60 seconds following the alert)

Stop Loss – Choose from a variety of filters to create an automatic stop loss (e.g. fixed price, percentage, trailing stop or indicator)

Target – Set your profit target using a variety of filters ((e.g. fixed price, percentage, or indicator)

Timed Exits – You can refine your exit plan further by planning time-based exits (e.g. exit 60 minutes after entry, exit at market close, etc.)

The success of this automation relies heavily on the strategy itself. The idea of making money on autopilot is enticing but shouldn’t be mistaken for easy money. Fortunately, Trade Ideas provides three levels of automation to help you build a winning strategy. It’s generally in a trader’s best interest to move through these levels sequentially.

Manual/Backtesting – This is similar to the backtesting example we discussed above. You can create a strategy, backtest it, and place trades manually.

Semi-Automatic – Semi-automatic is the next step up. Semi-automatic trading allows you to execute automated strategies, but you need to be the one to pull the trigger on the trade. For example, if Stock $XYZ hits the scan, you could manually trigger your “Buy 5000 Shares” strategy.

Fully Automatic – Fully automatic trading is exactly what it sounds like. You create your strategy, and Brokerage Plus will place trades automatically. You still have the option to modify trades (e.g. by tightening a stop order). However, even without your interference, the strategy will execute automatically.

Overall, Brokerage Plus is one of the most exciting innovations for retail traders. We look forward to seeing the evolution of this feature and will report on future updates. This feature could revolutionize the way traders use Trade Ideas and help make it easier for retail traders to automate their strategies.

Platform Differentiators

Trade Ideas is the best stock scanner on the market right now. Other platforms can’t even come close to the type of unique intra-day scans or offer the flexibility of combining scans so easily as Trade Ideas does. Most of the built-in brokerage platform scanners are basic and clunky. Trade Ideas offers an endless variety of pre-built scanners and customization options.

The pre-built scanners are the star of the platform. While many scanners offer customization and a few basic pre-built scans, Trade Ideas offers a suite of well-crafted pre-built scans that allow traders to start using the platform with minimal setup.

Most importantly, Trade-Ideas does all the processing on its servers and pushes the stock candidates to you rather than using your own computer, which ties up resources and slows down performance.

Trade Ideas also offers a web version in case you need to access the platform from a computer where you don’t have the platform installed. The web platform isn’t as powerful as the Windows desktop platform, but there’s definitely value to it.

What Type of Trader is Trade Ideas Best For?

This stock scanner is ideal for intraday traders who trade pre-market, normal market, and post-market hours. Swing traders may also find some good ideas for short-term swings if they set the time frame parameters to longer time frames.

Momentum and chart-based traders will have their hands full with the nonstop flow of ideas. In fact, the biggest problem is not spreading oneself too thin and hopping on too many alerts. This applies to all scanners. It helps to have a solid trading methodology in place and use the scanner as a pure idea generator to consider adopting the ideas that fit your style.

If you are an active momentum trader, Trade Ideas is definitely worth checking out.

Pros

The best real-time strategy-based stock screener on the market

Artificial intelligence integrated strategy trade performance is amazing

Non-stop ideas generated from pre-market through post-market

Free moderated live chatroom provides additional ideas

Lots of training videos and tutorials

Customizable strategies with drag and drop integration and backtesting

Auto-trading availability

Cons

Easy to overtrade too many ideas at once

Charts could use some more indicators

Desktop version is not available for Mac

EXCLUSIVE DISCOUNT

Save $340 on Trade Ideas

Use code DTR15 for 15% off Any Subscription

Trade Ideas Alternatives

Trade Ideas is hard to beat in terms of overall scanning power and quality. But the price and complexity of this platform means it won’t be right for every trader.

If you’re more focused on charting and alerts, and don’t need as many scanning capabilities, you might want to check out TradingView. This is a highly customizable charting platform that offers a script editor to help you build custom trading strategies. It offers a free version, with paid plans starting at only $14.95 per month.

Another option is FinViz, which is simple to use and offers a very wide selection of technical and fundamental metrics for stock scanning. Scan results are updated in real-time throughout the day. There’s a free plan available, but most traders will want to upgrade to FinViz Elite for $39.50 per month.

[ad_2]