[ad_1]

Day trading can be a stressful way of making money whether you are working independently or as part of an institution.

There are many causes of this stress and depression, including underperformance and a strategy that is not working. This explains why your psychological wellbeing is so important.

In this article, we will look at some of the causes of stress and how to lower its level.

Stress and day trading

Day trading is the practice of buying and selling financial assets like cryptocurrencies, forex, and stocks with the goal of making a profit within the same day. It is a different approach compared to investing, where people buy and hold assets for weeks, months, and years.

When done well, day trading can be a highly profitable undertaking. For example, assume that a stock is trading at $10.25 and you use your $10,000 to buy it. In this case, you will have 975.60 shares.

If the stock rises to just $10.40, your shares will be worth $10,146. Since this movement can happen in minutes, it means that you have just made a $146 profit.

When things are going well, trading can be a highly profitable thing and a person’s mental status will be fine. However, studies show that most day traders are not always profitable. In fact, almost 90% of all people who start trading fail within a few weeks.

The biggest cause of stress and depression is a big loss. In the above example, if the stock suddenly drops to $7, it means that you will have made a loss of more than $3,100. Losing such an amount of money can lead to major psychological issues.

How to identify emotional stress

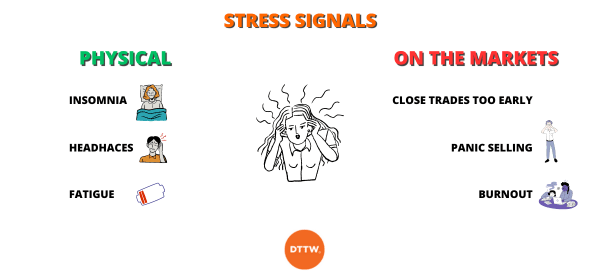

Stress is not always easy to identify. Most people suffering from emotional distress don’t even know the situation they are in. Still, you can look at some psychological signs to tell you whether you are in distress. Some of the physical signs to consider are:

In most cases, when you are going through a difficult phase, you will find it a bit difficult to sleep.

The other sign that you are going through stress is what you do in the market. For example, you will find yourself closing trades so quickly or doing what is known as panic selling. At times, you will find it difficult to execute trades.

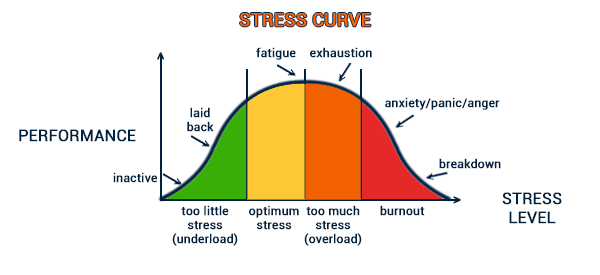

Further, you might go through a burnout, which happens when there is physical and emotional exhaustion. Without any remedy, this situation can move up to depression. Psychologists have identified the stress curve, which is summarized below.

Triggers or causes of stress in day trading

There are several main causes of stress in day trading. Some of the most popular causes of stress in your trading journey are:

Learning difficulties

Learning about day trading can be exhaustive because of the vast amount of materials that you need to cover. In addition to the theory part, there is the practical section, where a person needs to use a demo account.

To many people, this learning process can be highly difficult. At times, you can create a trading strategy that fails to work.

In such a situation, there is a likelihood that you will go through stress, especially when you are passionate about trading.

Trading losses

No trader is 100% perfect. In the past, we have seen some of the best traders in the world lose money. Therefore, as a day trader, you will often lose money.

The challenge comes when there is a long losing streak in the market and when there is an unexpected loss. When this happens, the level of stress can be substantially high.

Volatility or lack of it

The other major cause of stress in day trading is market volatility. Volatility is defined as the rate of change of an asset. Some traders thrive when there is substantial market volatility. Others, such as trend-followers tend to underperform when there is this volatility.

Therefore, the state of the market can lead to stress. For example, if you focus on trend-following, you can go through a stressful period when the market is in a consolidation mode.

Work environment

If you are an employee in a trading floor or investment bank or hedge fund, there is a likelihood that you will go through a stressful period because of the work environment.

This can happen when the company has a toxic work environment or when you are under a lot of pressure to perform.

Related » How to build a better working relationship

When you don’t hit your goal

The other important cause of stress in day trading is when you don’t hit your trading goals. For example, if your goal is to make a 10% return per month, going through a long losing streak can lead to stress, especially when you are a full-time day trader.

Financial management

Finally, there is the issue of financial management. For example, if you use your emergency cash to trade, there is a likelihood that you will be stressed up if you lose the funds.

Stories have been told of people who lost their retirement, health, and education funds through day trading.

How to deal or reduce stress in day trading

There are several strategies that will help you avoid or reduce stress in day trading.

Having a good work and life balance

We recommend that you invest in a good work and life balance. This means that you should have time for both trading and spending time with your family and friends.

You can achieve that by creating a good work routine and ensuring that you create time for them. For example, you can decide to trade during the day and then hang out with your family members in the evening.

Having a good risk/reward ratio

Since losses are inevitable, we recommend a situation where you have a good risk and reward ratio.

For example, you can decide that the maximum loss you are willing to take per trade is 5%. If you have a $50,000 account, it means that the maximum loss per trade will be $2,500.

Always protect your trades

The other strategy is to always protect your trades using a stop-loss and a take-profit.

A stop-loss is a tool that halts a trade when it falls to a certain loss level while a take-profit stops it when it reaches a pre-set profit level. Protecting your trades is a good thing since it will give you peace of mind.

Refine your trading strategy

You should spend some time working on the trading strategy. For example, you should take several months reading about trading and coming up with a good trading approach.

When you do this, there is a likelihood that you will know when to execute trades and protect them.

Other strategies

There are other strategies that you can use to reduce stress when trading, including having a trading journal, having a good trading mindset that realizes losses are possible in the market.

Other approaches are having a mentor, and working as part of a trading floor can help you. Also, we recommend seeking experts when the situation seems to be getting out of hand.

Summary

In this article, we have looked at one of the most important topics in finance and trading. As you have noted, there are many causes of stress and depression in the market. At the same time, there are several remedies that you can use.

External useful resources

How you can benefit from stress management as a trader – Medium

[ad_2]