[ad_1]

Venturing into any of my home’s storage spaces — the attic crawlspace, the basement utility room, the garage, the shed, spare bedroom closets — gives me heartburn. We’ve accumulated a ton of stuff over the years, and the volume will only increase as our kids get older and demand more toys.

Or we could become monks, sell it all, and put our kids through college with the proceeds. As part of our anti-materialist transformation, we’d no doubt downsize our living space too. Globally, many four-person families can only dream of a roomy, well-insulated two-bed/one-bath bungalow. We could learn to love it.

It would also save us a lot of money. We’d have tens of thousands of dollars left over after selling our current house and putting up the down payment on our smaller new home. Our monthly mortgage payment would likely be smaller as well, and we could shrink it further by making a larger-than-necessary down payment. People downsize

What Downsizing Means for Your Monthly Mortgage Payment

I’ll save you the suspense: We’re not downsizing anytime soon. We love our house and our neighborhood, and besides, we recently locked in a super-low mortgage rate we won’t beat anytime soon. In our market, with rates and home values where they are, it’s likely we’d pay more per month for the sort of house we’d downsize into than our current roomier abode.

Motley Fool Stock Advisor recommendations have an average return of 397%. For $79 (or just $1.52 per week), join more than 1 million members and don’t miss their upcoming stock picks. 30 day money-back guarantee. Sign Up Now

Motley Fool Stock Advisor recommendations have an average return of 397%. For $79 (or just $1.52 per week), join more than 1 million members and don’t miss their upcoming stock picks. 30 day money-back guarantee. Sign Up NowIs Downsizing Worth It? What You Need to Know

But say we did want to downsize into a smaller home. Before moving forward, we’d want to determine how much less (or more) we’d pay toward our monthly housing payment.

This calculation helps us determine whether it makes financial sense to downsize or whether we’re better off staying put. While it doesn’t include all the expenses we could reduce (or not) by downsizing, such as utility bills and routine maintenance costs, it’s by far the biggest piece of the puzzle.

You can do this for your own situation. Instead of the hypothetical values below, plug in your own monthly numbers for:

Principal and interestProperty taxesInsuranceMortgage insurance, if applicableHomeowners association (HOA) dues, if applicable

You’ll also need to make your best guesses as to:

How much your home will sell forHow much equity you’ll convert to cash after paying off your current mortgage and closing costsHow much your new home will cost (its selling price)How much money you’ll put down on your new home, which will determine the size of your new mortgage loan

Each piece of information factors into your new monthly payment and/or your profit from downsizing. For example, all else being equal, a larger down payment means a smaller new mortgage loan and thus a lower monthly payment.

Our Hypothetical Housing Downgrade: Values and Assumptions

Back to our hypothetical housing downgrade. For simplicity’s sake, let’s assume the following:

We’ll sell our old home for $500,000.We’ll net $200,000 on the sale after mortgage payoff and closing costs.We’ll buy our new house for $250,000.The property tax rate is exactly the same: 1% of the home’s value per year, which means $2,500 on the new house, down from $5,000 on the old one.The new home’s property insurance policy costs $1,500 per year, down from $3,000 in our old home.Neither home is part of a homeowners’ association.We won’t pay mortgage insurance on either home.Our old house had a 30-year fixed mortgage at 4% APR.The principal and interest portion of our old house’s monthly payment was $1,909.66.Including real estate taxes and property insurance, our old house’s total monthly mortgage payment was $2,576.33.

How to Calculate Your Mortgage Payment Savings From Downsizing

To compute our new monthly payment, we still need to know:

Down Payment. Since the down payment on the new home depends on the old home’s net sale proceeds and also greatly influences the size of the monthly payment on the new home, I ran three different scenarios: 20% down, 50% down, and 100% down.New Mortgage Rate. Mortgage rates change all the time, so it’s unlikely you’ll get the exact same rate on your new mortgage. This also affects your payment — on equal-sized loans, a higher rate means a higher principal and interest payment, which usually accounts for the majority of the total monthly payment.Total Escrow Costs. The monthly escrow payment covers taxes, insurance, and HOA dues if applicable. Basically, everything except mortgage principal and interest.

Calculating Principal and Interest

For the monthly principal and interest payment, we plug our down payment, home value, interest rate, and loan term into a mortgage payment calculator. Remember, our old house’s monthly principal and interest payment was $1,909.66.

At 30-year fixed and 4% APR, same as our old house, we get the following for our new house:

Calculating Escrow

To calculate the escrow portion, we add the annual tax and insurance bills and divide by 12 to get the monthly rate: (2,500 + 1,500) ÷ 12 = $333.33 per month. Our old home’s escrow payment was $666.67, for a total monthly housing payment of $2,576.33.

Adding the principal and interest and escrow portions together for our new home, our total monthly payment in each scenario would be:

Does Downsizing Make Sense When Mortgage Rates Go Up?

Unfortunately, mortgage rates are higher than 4% right now, even for well-qualified buyers. They probably won’t return to the 4% range anytime soon. And because even a relatively minor rate jump can significantly increase your principal and interest payment, it’s worth asking whether downsizing continues to make sense — and for how long — as mortgage rates rise.

To find out, let’s see what we get for principal and interest on a 30-year fixed mortgage at 7% APR, about where rates were at the end of 2022:

And with escrow added in:

That 3% change really makes a difference, doesn’t it? It still makes sense for us to downsize at 7% APR, but the higher rate costs us $375.77 per month at 20% down and $234.86 per month at 50% down. Over the life of the loan, we pay an additional $135,277.20 at 20% down and $84,549.60 at 50% down. That’s a lot of money we’d rather put in our kids’ college fund or our own retirement accounts.

One minor bright spot is that the total payment figures are only good for a few months — maybe a year at most, depending on when we move. The principal and interest payment will remain level unless we refinance, but our tax and insurance bills will change (probably upward) at some point every year. That would have happened in the old house too, and because the numbers were higher there, the absolute increase will be smaller in our cozy new home. The longer we stay in the new house, the more we’ll save on taxes and insurance.

Downsizing ROI: Is It Worth It?

Monthly payment change is just one of several financial considerations in downsizing. Smaller homes cost less to furnish, less to heat and cool, and less to maintain. All else being equal, you’ll save more by downsizing than the difference between your old and new housing payments.

That’s not to say it always makes financial sense to downsize. A house is an investment, a valuable asset that can gain or lose value. Depending on the expected return on investment — in this case, the rate at which you build equity through market price appreciation and paying off your mortgage — it might be the best place to park more of your money for the long term.

Where Else Can You Put Your Money?

Or it might not be.

If you have a higher tolerance for risk, maybe a diversified equity portfolio consisting mostly of blue-chip stocks makes more sense.

If your risk tolerance is really high, maybe you go all-in on growth stocks, which have the highest upside potential and the greatest downside risk.

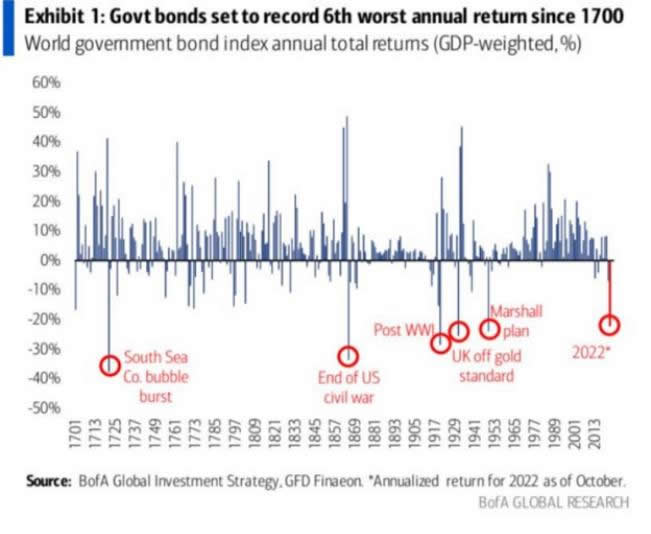

If your risk tolerance is lower but you don’t want all your eggs in the real estate basket, maybe you load up on bonds or CDs.

Alternative Returns: What Could You Get If You Downsized?

Here’s how single-family U.S. real estate has performed against other common investments over the past 5 years:

This is just a snapshot in time. Go back 10 years (2013 to 2022) and stock market returns look better — well above 10% for the S&P 500 and above 15% for the NASDAQ 100. Single-family real estate looks comparatively weaker.

But it’s still useful to think about the opportunity cost of tying up more money in your primary residence. Unless you’re expecting a big inheritance soon or have some other unusually valuable asset at your disposal, the best way to raise cash to invest elsewhere is to sell your home and buy a cheaper one (or rent a cheaper one, but that’s another conversation).

In any case, if you downsize into a new home that you own, you’ll still have exposure to owner-occupied real estate. Just not as much.

Final Word

Downsizing doesn’t make sense for my family right now. We need the living space and the onsite storage, we can afford the monthly payment thanks to a well-timed refinancing, and we like our neighborhood.

But if things go according to plan, I’m pretty sure this won’t be the last house my spouse and I occupy, and it’s likelier than not that the next one will be smaller. Once the kids are grown, we won’t need as much space, and we might want to live in a more happening part of town anyway.

Hopefully, we’ll see ourselves in the younger family we sell to. If not, at least we’ll cash in whatever equity we’ve managed to build over the years and enjoy a lower housing payment moving forward.

[ad_2]