[ad_1]

The Web3 space has experienced a resurgence since the turn of the year, with several tokens recovering from the bearish winter in 2022. However, this has done little to spur interest from venture capitalists toward investing in the crypto industry.

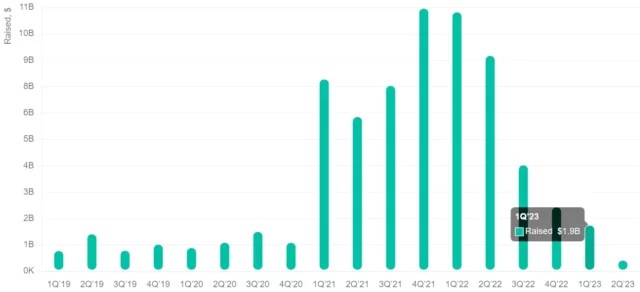

According to a report from Crunchbase, venture funding has plummeted from $9.1 billion in Q1 2022 to $1.7 billion in Q1 2023. This represents an 82% decline from year to year and shows investors are bearish toward investing in web3 projects.

Related Reading: Solana Experiences 3% Rise In 24 Hours – Is A Bullish Trend Imminent?

In context, the $1.7 billion invested in the first quarter of 2023 is the lowest since the fourth quarter of 2020 ($1.1 billion) when Web3 was in its early stages. This decline is linked to developments in the second half of 2022.

Fundraising Decline Linked To Terra Luna And FTX Collapse

To put this into context, the crypto market was experiencing a boom from VC-led funding, which peaked in the fourth quarter of 2021 and continued to the first quarter of 2022. During Q1 2022, VC-backed startups raised more than 20 rounds of more than $100 million.

This included high-profile raises by ConsenSys, Polygon, and FTX, which raised over $400 million in VC funding. The second quarter of 2022 experienced a similar trend, with over $9 billion raised by crypto startups. However, the crash of Luna towards the end of Q2 2022 immediately impacted VC-led funding.

From the chart above, the investments in Q3 dropped by more than 50% to $4 billion, indicating that the crash had led to second thoughts from investors. The subsequent crash of FTX in Q4 appeared to confirm VCs’ fears about investing in a volatile market. This could be why the investment in Q1 hit a low of $1.7 billion.

What This Means For The Future Of Web3

In its study report, Crunchbase notes a drop in the amount invested and a drop in the number of funding rounds. For context, the first quarter of 2022 recorded more than 500 funding rounds compared to 333 this year. In addition, the study reveals that only three financing rounds exceeded $100 million in the past quarter compared to 29 a year ago, a drop of nearly 90%.

However, these events should not be viewed as overly negative. The development in the past year has shown some of the dangers within the crypto ecosystem. It has also helped expose some bad actors like Luna Foundation and FTX, which collapsed despite receiving VC funding.

Related Reading: Trust Wallet Announces $170,000 Loss Due To Security Vulnerability

It is well established that difficult periods typically provide an ecosystem where projects must build solid use cases to survive until the bull market. Therefore it is expected that the Web3 industry will emerge stronger despite the current decline in funding.

The crypto market responded positively in Q1, with the leading coin, Bitcoin, recovering and hitting $30,000 during this period. At the time of writing, Bitcoin is trading at around $27,590, down 9% in the past seven days.

Featured Image from Pixabay, charts from Crunchbase and TradingView

[ad_2]