[ad_1]

Justin Sullivan/Getty Images News

While I have previously focused mostly on the regional banking sector to uncover value, top tier bank Wells Fargo (NYSE:WFC) also represents deep value for investors that value investment stability the most. The simple truth is that I focused on the regional banking market chiefly because of large available discounts to book value as well as the presence of very high dividend yields of up to 6%, as in the case of U.S. Bancorp (USB). However, top tier banks also continue to represent deep value, including Wells Fargo which is one of America’s top deposit franchises. Because Wells Fargo is a systemically-important bank that the U.S. government and the Fed are not going to allow to fail, in my opinion, and because WFC continues to trade at a discount to book value, I consider the bank’s shares to be a buy!

Regional banking crisis and impact on Wells Fargo

Wells Fargo, according to the Fed, is the fourth-largest commercial bank by assets in the United States, after JPMorgan Chase (JPM), Bank of America (BAC) and Citigroup (C). Wells Fargo, at the end of the March quarter, had $1.69T in assets on its balance sheet and deposits totaling $1.36T (period-end).

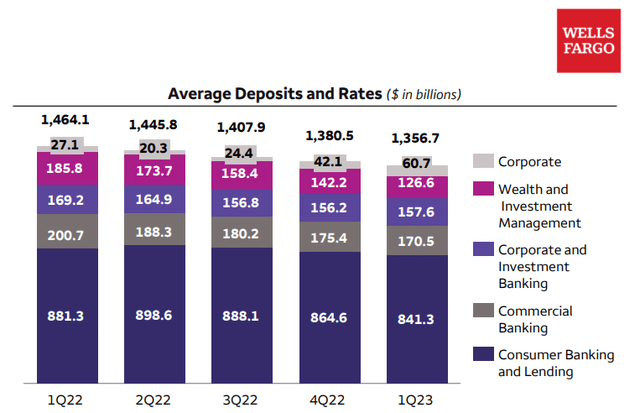

Like most banks, Wells Fargo has been exposed to a declining average deposit balance trend over the last year as the Fed raised interest rates in order to offset high inflation rates. In response to these trends, consumers have pulled down their average deposit balances and invested them elsewhere for higher yields. As a result, Wells Fargo’s average deposit balances declined to $1.36T in the first-quarter, showing a decline of 7.3% year over year. Wells Fargo has not been unusually affected by clients’ cash sorting efforts: Bank of America saw a deposit decline of 7.4% year over year in Q1’23.

Source: Wells Fargo

Why Wells Fargo may offer more investment stability than regional banks

My previous investment focus was on regional banks which have been hit especially hard by the financial crisis in March. Some regional banks, like PacWest Bancorp (PACW), First Republic Bank — which went out of business in May — and Western Alliance Bancorporation (WAL) have seen deposit outflows in the aftermath of the Silicon Valley Bank failure. For investors that are concerned about the fragility of the U.S. financial system, Wells Fargo may be an especially attractive investment at this point.

Top tier banks like Wells Fargo have not suffered deposit outflows due to solvency concerns. They also continue to benefit from an implicit bail-out guarantee in the sense that they are systemically-important banks which the U.S. government and the Fed would unlikely ever allow to fail.

The Fed quickly and efficiently provided U.S. depositary institutions with a deposit backstop guarantee in March through its Bank Term Funding Program. This program made emergency liquidity available to the banking sector, in exchange for the pledging of high quality collateral (such as mortgage-backed securities and U.S. Treasuries).

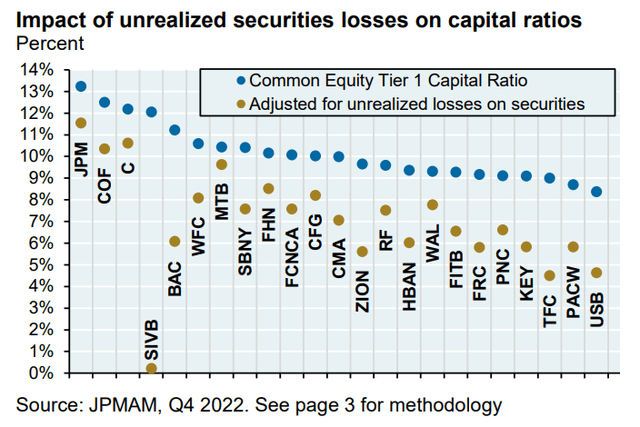

According to JPMorgan Research, Wells Fargo has a very solid balance sheet with a common Equity Tier 1 capital ratio of close to 11% which makes it one of the best capitalized banks in the U.S. Including unrealized losses stemming from Wells Fargo’s investment portfolio, JP Morgan calculated that the adjusted Tier 1 capital ratio would drop to 8%… which would give Wells Fargo a better capital position than most banks, including Bank of America (see chart below). Investors must note, however, that it is unlikely that a top tier bank like Wells Fargo would have to liquidate their securities portfolios and thereby realize investment losses: investments held-to-maturity result merely in unrealized losses and unless a bank is forced to sell them, no loss necessarily has to occur. Additionally, Wells Fargo has a very comfortable liquidity position.

Source: JP Morgan Chase

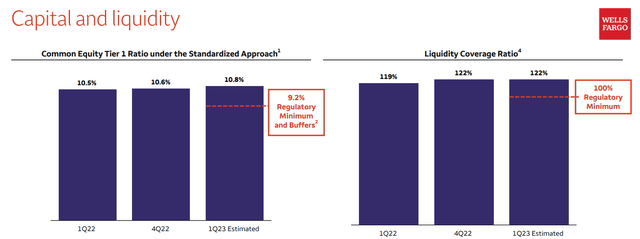

Wells Fargo had a liquidity coverage ratio of 122% at the end of the first-quarter which proved to be stable quarter over quarter as well. Wells Fargo has not seen any major deposit outflows in the first-quarter that were directly related to the regional banking crisis. Since Wells Fargo as a systemically-important bank also has access to the Fed’s emergency liquidity facility as well as the Fed’s discount window, the bank has very low liquidity risks, in my opinion.

Source: Wells Fargo

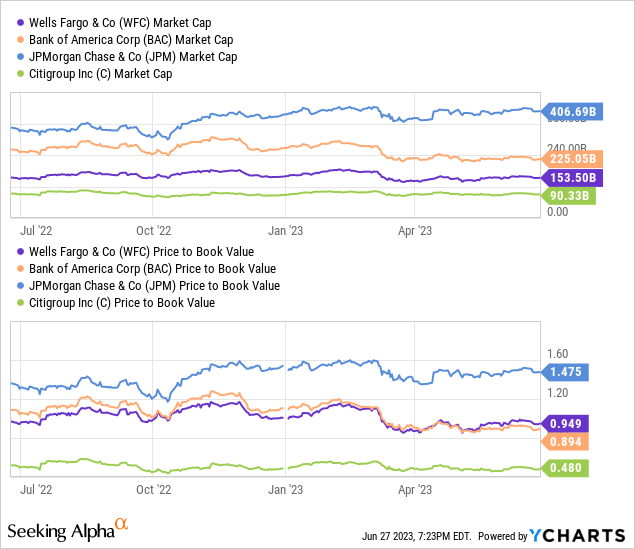

Wells Fargo’s valuation in relation to other top tier banks

Wells Fargo is the fourth-largest U.S. bank by asset size, but the third-largest, ahead of Citigroup, by market valuation. Wells Fargo is currently valued at a price-to-book ratio of 0.95X, implying a 5% discount to book value which makes the bank slightly more expensive than Bank of America. While there are plenty of regional banks, like Truist Financial (TFC), that trade at much larger book value discounts, Wells Fargo’s also has considerable upside potential.

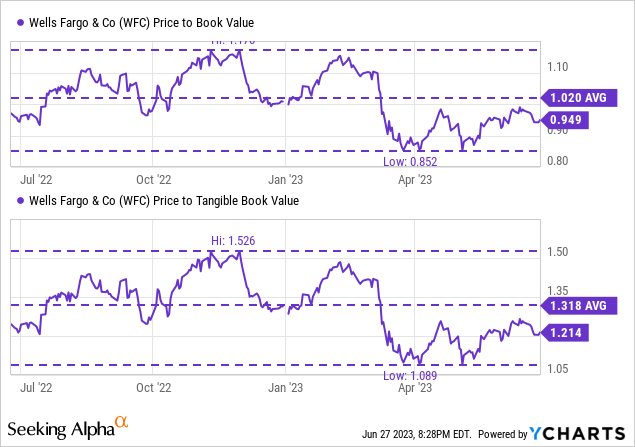

Wells Fargo traded at a price to book value of up 1.17X and at a price-to-tangible-book value of up to 1.53X in the last year. If WFC returns to this upper level of its valuation range then shares of Wells Fargo have 23% upside, based off of P/B, and 26% upside, based off of P/TBV. As catalysts for an upside revaluation I can see two factors: (1) A normalization of banking conditions in the regional bank market that makes investors seek out bank investments again, and (2) Continual rate increases in the fight against inflation that boosts banks’ net interest income/margins.

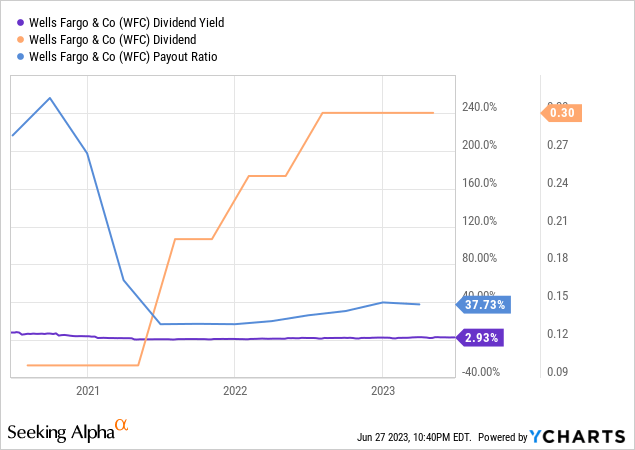

A safe 3% dividend yield

Wells Fargo does not pay as high a yield as U.S. Bancorp does, which currently is about 6%, but investors that prioritize investment stability and safety tend to be willing to accept a much lower yield. Wells Fargo still pays a 2.93% dividend yield which is not too bad, in my opinion. With a payout ratio of less than 40%, I also believe the dividend is safe and will continue to grow going forward.

Risks with Wells Fargo

As opposed to regional banks, which are more at risk of deposit withdrawals at times of heightened fears over the stability of the financial system, the biggest risk for Wells Fargo is the Fed lowering interest rates, in my opinion. Large banks have benefited enormously from rising interest rates (and higher net interest margins) since last year. A new financial crisis may actually benefit Wells Fargo as investors, depositors and savers tend to trust top tier depositary institutions more than regional banks.

Closing thoughts

Wells Fargo offers upside potential as the bank’s shares are still trading below book value. More than anything, Wells Fargo offers investors stability because the bank falls under the protection umbrella of the systemically-important bank label. While Wells Fargo has not suffered as much as some regional banks, the top tier bank still offers upside potential: I see 23-26% upside potential based off of a reset in the bank’s P/B and P/TBV ratios. As the sector moves on from the sector panic in March and the Fed keeps raising rates to quell inflation, Wells Fargo does have 2 upside catalysts as well!

[ad_2]