[ad_1]

This text/submit incorporates references to services or products from a number of of our advertisers or companions. We could obtain compensation once you click on on hyperlinks to these services or products

Between inflation and fears of a recession, you’re in all probability taking note of the financial system extra carefully lately.

Between inflation and fears of a recession, you’re in all probability taking note of the financial system extra carefully lately.

The Federal Reserve is on a mission to get record-high inflation underneath management. A method they’re attempting to do that is by rising rates of interest. The logic? Larger rates of interest make borrowing cash costlier.

In idea, that ought to trickle all the way down to the remainder of the financial system. It turns into costlier for companies to entry capital and for normal folks to finance giant purchases, like shopping for a house.

Nevertheless, some economists and enterprise consultants fear that these makes an attempt might backfire. The priority is that as an alternative of simply inflicting disinflation, the Fed might inadvertently ship the financial system right into a state of deflation.

This text will cowl the distinction between deflation and the Fed’s present coverage of disinflation. It’ll additionally dive into what you need to know as an investor to guard your portfolio. However first, let’s begin with the bogeyman in all of the information headlines of the day.

The Brief Model

Inflation is when an excessive amount of cash is circulating across the financial system and never sufficient items being produced

Deflation is when there are too many items and never sufficient cash, resulting in a drop in costs

Disinflation is when inflation begins to chill, both by market forces or authorities motion (like rates of interest hikes)

Whereas disinflation is not one thing to fret about, in and of itself, it might result in deflation

What Is Inflation?

Each inflation and deflation are the outcomes of modifications in provide and demand inside an financial system.

Inflation is the idea that persons are extra more likely to be aware of. It occurs when an excessive amount of cash chases too few items. Presently, we’re in a state of inflation from the COVID-19 pandemic: International manufacturing amenities had been shuttered for a time frame and public well being insurance policies impacted enterprise house owners’ skills to offer items and providers to their clients.

On the similar time, governments all over the world injected new cash into their economies to concurrently stimulate them. This resulted in an excessive amount of cash circulating across the financial system and never sufficient items or providers being produced to maintain up with it.

You’ll be able to see the pricing energy of the U.S. greenback over the course of the previous yr on this graph.

On the grocery aisle, it appears like peanut butter or milk being just a few {dollars} or cents greater than only a few months in the past. However these additional few {dollars} right here and there can shortly add up, whereas salaries keep the identical. That makes it laborious for many individuals to maintain up with beforehand reasonably priced life.

Extra on inflation and what to do about it >>>

What Is Deflation?

Deflation is the other of inflation. It occurs when there’s a discount within the cash provide. Costs of products and providers fall as the availability of cash decreases. Sounds good, proper? However whereas customers have extra shopping for energy within the short-term, it may well additionally result in long-term monetary hardship.

Costs falling sometimes signifies that client spending is down. Shopper spending goes down on account of just a few totally different causes, like financial uncertainty and fewer confidence available in the market, or when different prices (together with debt) go up.

When customers purchase fewer items and providers, companies begin tightening their budgets, extra cautious of placing more cash into their operations. A discount in enterprise operations can set off unemployment. Extra unemployment means much less spending. And if the sample continues, deflation can spiral uncontrolled.

Whereas deflation often interprets into value financial savings for customers within the brief time period, it may well result in a chronic financial contraction in the long run. That is unhealthy information for the financial system general. Deflation is an indication that an financial system is stalling. If not correctly managed, it might flip into critical financial hardship.

That is what the buying energy of the U.S. greenback regarded like between 1929 and 1934 — the interval generally known as the Nice Melancholy.

The Nice Melancholy is an excessive instance of deflation in fashionable historical past. The Roaring ’20s screeched to a halt with a inventory market crash and was instantly adopted by a collection of banking and monetary crises. One oft-cited reason behind the Nice Melancholy was the Fed elevating rates of interest to rein within the rampant hypothesis within the inventory market. This finally despatched share costs plummeting. Throughout this era, almost 1 / 4 of the American workforce discovered themselves with out jobs, and lots of with out properties.

Associated >>> The Greatest Financial Bubbles in Historical past: From Tulips to Crypto

What’s Disinflation?

Disinflation represents the change within the tempo of inflation. It signifies that inflation has slowed down, nevertheless it has not gone beneath zero. Costs are nonetheless rising — simply not as a lot as they had been beforehand.

In periods of disinflation, there sometimes aren’t many indicators indicating the financial system is in a slowdown. Some disinflation is nice as a result of it permits customers and companies to proceed taking part within the financial system at a traditional tempo.

Disinflation might be attributable to a pure change within the financial system — for instance, a recession— or a deliberate coverage motion, just like the Federal Reserve stepping in to actively deliver down the speed of inflation by tightening the cash provide. It will probably even come about from new efficiencies in expertise and from an oversupply in items.

Traditionally, economies are usually in intervals of inflation reasonably than deflation, so disinflation happens extra generally than deflation. General disinflation shouldn’t be essentially a nasty factor. It represents enterprise as common for normal financial enterprise cycles.

Deflation vs. Disinflation: Which Ought to Buyers Hope For?

Buyers shouldn’t fear about disinflation an excessive amount of. It sometimes signifies that the financial system is wholesome, particularly if it’s the pure results of technological developments or modifications in manufacturing. A decline within the charge of inflation as a consequence of modifications in expertise can recommend that firms are discovering methods to scale and grow to be extra environment friendly.

As an alternative, what buyers ought to be cautious of is a shift from disinflation to deflation. That may sign the onset of antagonistic financial circumstances that may wreak havoc for each customers and companies.

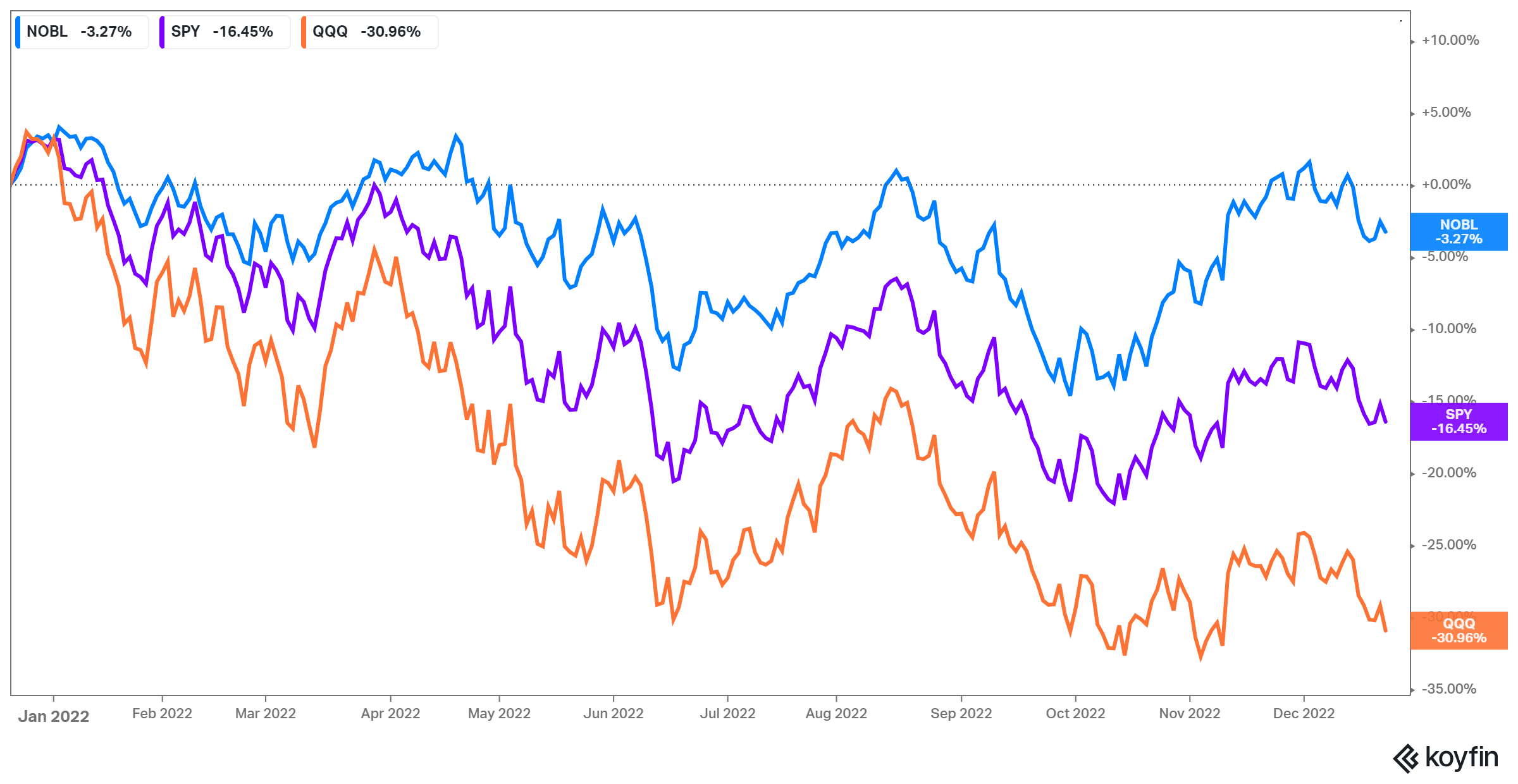

In intervals of disinflation, shares are inclined to carry out effectively. Bonds additionally are inclined to do effectively, particularly when a central financial institution begins decreasing rates of interest reasonably than elevating them. Following intervals of excessive inflation, disinflation can come as a aid, boosting investor confidence.

However in the case of deflation, shares don’t carry out as effectively. This may be the results of occasions triggered by a destructive financial outlook comparable to a recession or social and political unrest.

Buyers ought to take note of financial indicators that point out inflation is cooling too shortly. Whereas disinflation is comparatively regular, an excessive amount of disinflation too shortly can result in deflation. As we have seen up to now, when the financial system enters right into a interval of deflation it may well grow to be harder to get out of it.

Is There a Legit Danger of Deflation in 2023?

It’s too quickly to say whether or not or not deflation will happen in 2023 or within the years forward. With traditionally excessive ranges of inflation within the financial system, nevertheless, some outstanding buyers are frightened.

Potential Fallout From Fed Price Hike

Some enterprise leaders — together with, notably, Cathie Woods and Elon Musk — are involved that continued rate of interest hikes by the Federal Reserve may improve the potential for deflation setting in. As borrowing turns into costlier, companies could search for methods to cut back prices. This traditionally contains layoffs and an increase in unemployment. As increasingly more customers discover themselves out of labor, they’ll grow to be extra more likely to maintain onto cash reasonably than spend it.

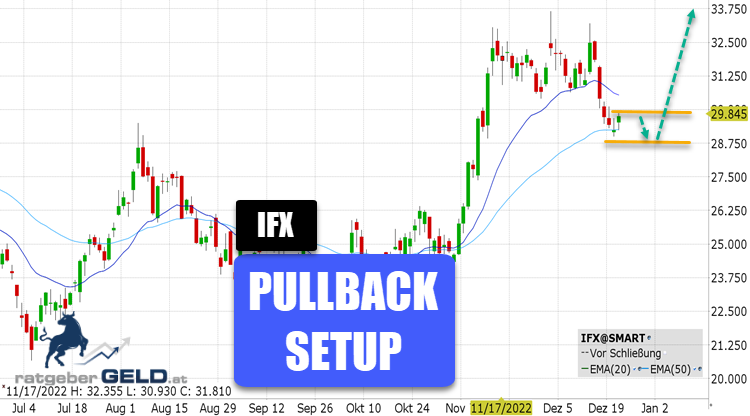

The Fed’s charge hike coverage has the potential for initiating a recession in 2023. Whereas a recession shouldn’t be a assure for deflation, the deflationary spiral that might comply with could be harder to keep away from.

Learn extra >>> Methods to Make investments for Rising Curiosity Charges | Greatest Shares & Sectors

The Pandemic’s Ongoing Issues

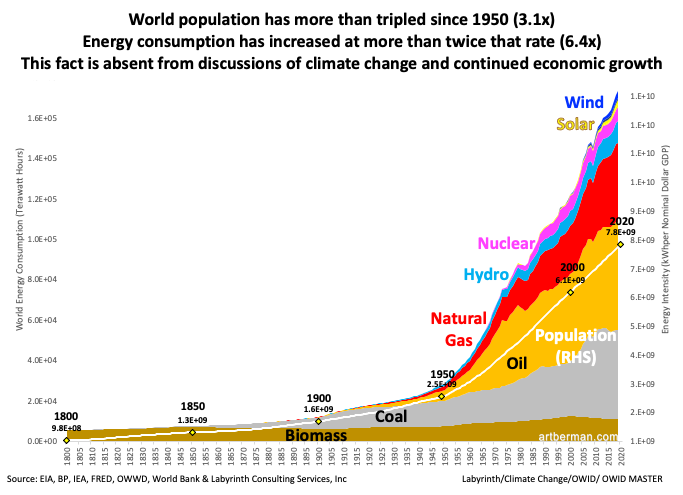

Past the U.S. there’s additionally the concern of the worldwide affect of the financial response to COVID-19. Central banks all over the world are working to disinflate their very own economies. The problem with that is that the worldwide financial system is extra built-in now than ever earlier than.

And amidst every nation working to chill off inflation are different market forces at play: A change within the provide and demand in a single a part of the globe impacts everybody else.

An instance of that is the present microchip scarcity. The pandemic vastly diminished manufacturing of those chips resulting in an enormous shortfall in provide. In the meantime, the transfer in direction of automation and the electrification of automobiles (and hovering gasoline costs) has pushed up world demand in EVs. Companies depending on microchips can discover it tough to offer services and products, limiting progress in sure industries. Sounds fairly inflationary, proper?

Nevertheless, curtailed progress in a single sector — particularly one as ubiquitous as microchips — can set off contagion elsewhere within the financial system, particularly in the case of unemployment.

Customers who discover themselves out of labor in a struggling job market could also be averse to spending cash. The shortage of spending can sign to different companies that client demand is waning, main them to contract their operations. This will increase the probability of broader financial shrinkage which might result in a recession or presumably provoke a deflationary spiral.

Associated >>> What Can Previous Inventory Market Crashes Educate Us?

Methods to Defend Your Portfolio From Deflation?

Whether or not or not the financial system enters right into a interval of deflation in 2023, it’s a good suggestion to diversify your portfolio to hedge towards danger from all sides.

One of the vital well-liked funding automobiles to hedge towards deflation are bonds. Excessive-quality bonds are backed by the federal government and paid out in money. Throughout deflation, money will increase in worth which makes it extra fascinating to carry onto and make investments with.

Learn one author’s take >>> Why I’m Investing in Treasury Bonds As an alternative of the Inventory Market

For buyers preferring holding onto money, a certificates of deposit or cash market account can maintain your funding in a extremely liquid kind whereas producing curiosity that’s increased than a typical checking or financial savings account.

Shares are inclined to carry out poorly in intervals of deflation as a consequence of contractions in capital markets. There are, nevertheless, some sectors that may stand up to monetary uncertainty. Corporations that produce client staples (like meals merchandise or rest room paper) often carry out higher than firms producing discretionary client items (like clothes). These are generally known as defensive shares.

You can even search for high-quality dividend-paying shares. These shares generate revenue, even throughout recessions. REITs, for instance, are tied to actual property and are required to pay dividends to their buyers.

Lastly, in case your portfolio contains debt, comparable to a mortgage on an actual property funding, you may wish to take into account methods to cut back your debt burden. Curiosity on debt retains rising, even when revenue and wages decline. Financial uncertainty throughout a interval of deflation could make any debt you may be carrying way more tough to handle.

The Takeaway

Disinflation isn’t essentially one thing to fret an excessive amount of about. It simply signifies that the tempo of inflation is slowing down. Deflation, then again, is a trigger for concern. The sort of contraction within the financial system might result in monetary catastrophe for customers, companies, and buyers.

No matter whether or not or not deflation occurs on account of the Fed’s present charge hikes, buyers can defend themselves by making ready for the worst-case situation. This implies evaluating your portfolio to see how concentrated it’s in shares, bonds, and money. Transferring some investments into safer devices, like government-backed bonds, may help you hedge towards the affect of deflation within the financial system if it occurs.

Brush up in your financial information with our guides >>>

[ad_2]

Source link