[ad_1]

alvarez/E+ via Getty Images

The week, ending Feb. 3, saw Federal Reserve hiking its policy rate by 25 basis points but Chair Jerome Powell warned that the central bank still has “more work to do” to bring down inflation.

The Industrial Select Sector SPDR (XLI) finished the week in the green (+1.69%). XLI was among the eight, out of the 11 S&P 500 sectors, which closed the week with gains. Zim topped the industrial gainers (in our segment) this week but it was earnings that played a major role among the majority of gainers and decliners.

The SPDR S&P 500 Trust ETF (SPY) rose +1.64% for the week, which witnessed ISM Manufacturing fall more than expected in January. ISM services rose more than anticipated while the PMI Manufacturing Index showed a surprise increase in January.

The top five gainers in the industrial sector (stocks with a market cap of over $2B) all gained more than +14% each this week.

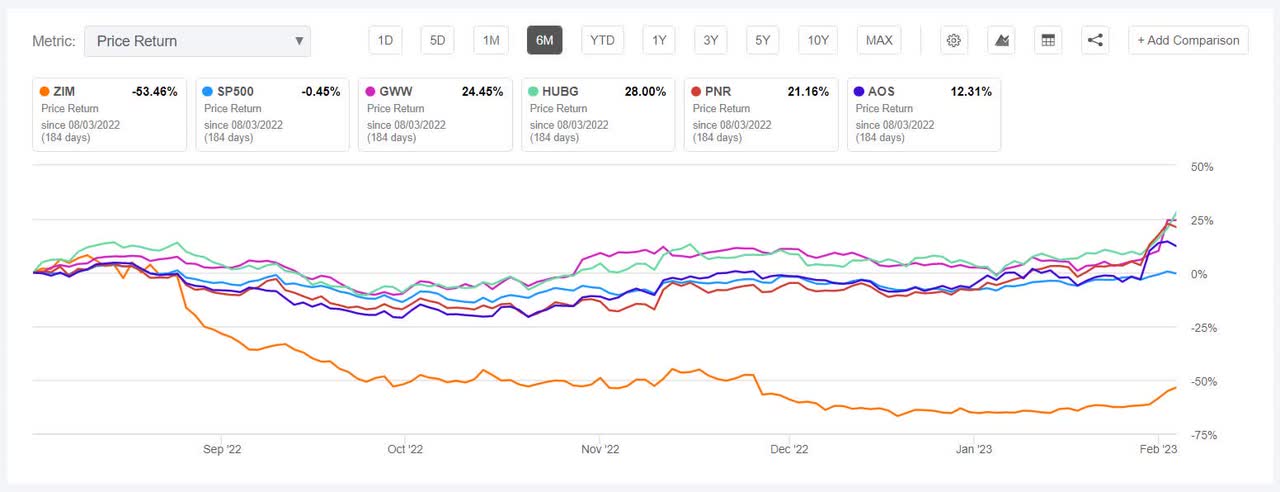

ZIM Integrated Shipping Services (NYSE:ZIM) +22.78%. The Israeli shipping company’s stock rose throughout the week, the most on Thursday (+7.90%). ZIM has an SA Quant Rating — which takes into account factors such as Momentum, Profitability, and Valuation among others — of Hold. The stock had a factor grade of A+ for Profitability but F for Growth. The average Wall Street Analysts’ Rating agrees with a Hold rating of its own, wherein 5 out of 7 analysts see the stock as such.

W.W. Grainger (GWW) +18.19%. The stock surged the most on Feb. 2 +12.96% after the maintenance and repair products distributor forecast ongoing growth for 2023. The company’s Q4 adjusted EPS beat consensus but revenue, though growing Y/Y, narrowly missed out.

The SA Quant Rating on GWW is Hold, with a score of C+ for Momentum but D- for Valuation. The average Wall Street Analysts’ Rating concurs with a Hold rating too, wherein 9 out of 17 analysts view the stock the same.

The chart below shows past 6-month price-return performance of the top five gainers and SP500:

Hub Group (HUBG) +16.58%. The Oak Brook, Ill.-based trucking services provider also gained following its earnings results (Feb. 2 post market) as GAAP EPS beat estimates and the stock rose Friday (+6.05%).

The SA Quant Rating on HUBG is Buy, with a score of B+ for both Profitability and Momentum. The average Wall Street Analysts’ Rating has a Buy rating of its own, wherein 8 out of 18 analysts tag the stock as Strong Buy.

Pentair (PNR) +15.21%. The water solutions provider’s stock soared on Tuesday (+9.23%) after Q4 adjusted EPS and revenue surpassed analysts estimates. The London-based company has a SA Quant Rating of Hold, while the average Wall Street Analysts’ Rating is Buy.

A. O. Smith (AOS) +14.40%. Q4 results of the water heater products developer exceeded expectations sending the stock surging +13.67% on Tuesday. The SA Quant Rating on AOS and the average Wall Street Analysts’ Rating, both, have a Hold rating.

This week’s top five decliners among industrial stocks (market cap of over $2B) all lost more than -6% each.

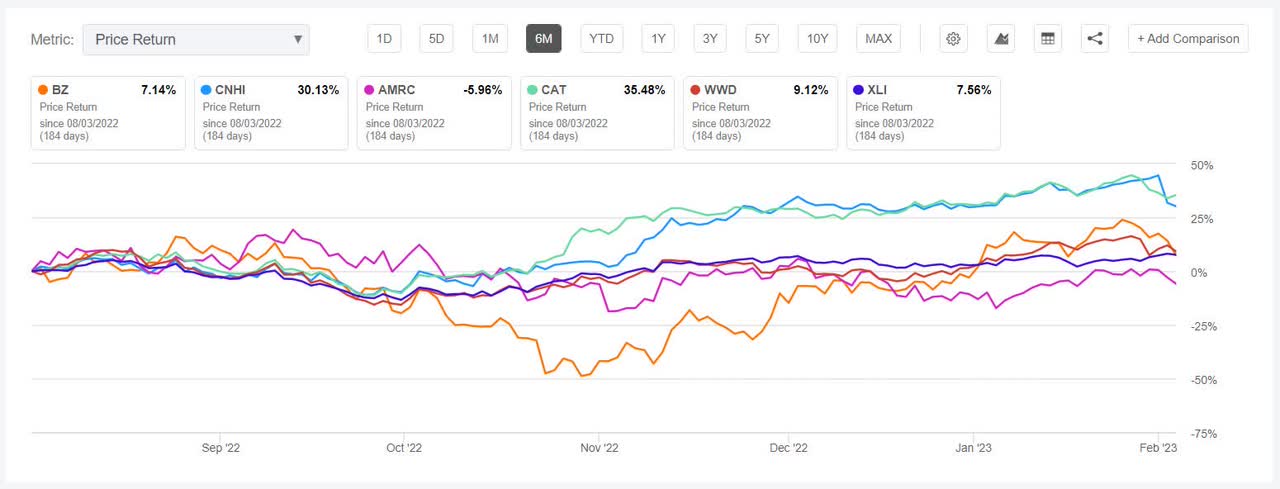

Kanzhun (NASDAQ:BZ) -12.52%. The Beijing-based online recruitment platform’s stock had seen volatility throughout 2022 with considerable ups and downs. This week the stock fell the most on Friday (-6.17%).

The SA Quant Rating on BZ is Hold with B- score for Profitability and a C+ for Growth. The rating is in stark contrast to the average Wall Street Analysts’ Rating of Strong Buy, wherein 9 out of 13 analysts see the stock as such.

CNH Industrial (CNHI) -8.36%. The agricultural and construction vehicles developer’s stock slumped -8.83% on Thursday despite Q4 results beat estimates. The company also noted that it will delist from Euronext Milan.

The SA Quant Rating on CNHI is Strong Buy, with a score of A for Momentum and C for Valuation. The average Wall Street Analysts’ Rating is Buy, wherein 10 out of 18 analysts tag the stock as Strong Buy.

The chart below shows past 6-month price-return performance of the worst five decliners and XLI:

Ameresco (AMRC) -6.84%. The stock dipped most on Thursday (-3.45%). The renewable energy supply solutions provider has an SA Quant Rating of is Hold, with a score of D+ for Profitability but A- for Growth. The average Wall Street Analysts’ Rating differs with a Strong Buy rating, wherein 9 out of 12 analysts see the stock as such.

Caterpillar (CAT) -6.34%. The stock fell -3.52% on Tuesday after the company said its quarterly profit was negatively affected by changes in the value of the U.S. dollar, compared to currencies in other countries. Q4 non-GAAP EPS missed analysts estimates. The SA Quant Rating on CAT is Strong Buy, while the average Wall Street Analysts’ Rating is Buy.

Woodward (WWD) -6.15%. The aerospace products maker’s Q1 revenue beat estimates but non-GAAP EPS missed estimates which made the stock see red on Tuesday (-6.47%). The SA Quant Rating on WWD is Sell, which is in contrast to the average Wall Street Analysts’ rating of Hold.

[ad_2]