[ad_1]

sommart

Author’s Note: All funds in Canadian currency unless otherwise noted.

Investment Thesis

BMO’s Equal Weight REITs Index ETF (TSX:ZRE:CA) is a diversified fund providing steady dividend income from a portfolio of S&P/TSX-listed REITs. With an annualized yield of 4.51%, ZRE is one of the highest yielding large REIT fund providers in Canada. While the fund’s high management fee may weigh on returns, ZRE is the best diversified of the large REIT ETFs in Canada.

REITs are one of the few remaining publicly traded income trust structures in Canada. This structure offers current income as well as capital gains potential from stable tangible assets. REITs provide a tax-efficient way of investing in real estate. REITs are exempted from tax on income and gains from the property rental business; instead, these are passed onto unitholders who are taxed on the REIT’s property income when it is distributed.

Fund Strategy and Overview

Established in 2010, ZRE has attracted$651M in funds under management. This BMO fund is unique from other REIT ETFs in Canada in that it uses an equal weight strategy for its 23 holdings. The fund’s goal is to replicate the performance of the Solactive Equal Weight Canada REIT Index after expenses. ZRE trades on the Toronto Stock Exchange with daily average volume of approximately 20,000 units.

The other large REIT ETFs in Canada are Vanguard’s FTSE Canadian Capped REIT Index ETF (TSX:VRE:CA), iShares S&P/TSX Capped REIT ETF (XRE:CA) and CI Canadian REIT ETF (RIT:CA).

ZRE has a management fee of 0.55% and an MER of 0.61%. This is comparable to iShares XRE, but more expensive than Vanguard’s VRE with a 0.38% MER. As RIT tracks the same index as XRE, while charging 20 basis points more in management fees, I will focus on VRE and XRE comparison rather than CI’s RIT.

Solactive Equal Weight Canada REIT Index

This equal weight REIT Index is composed of the major REITs traded on the S&P/TSX. To be included in the index, REITs need to have a market cap of $800M and have an average daily value traded of $1M over the preceding three months. Once added to the index, REITs need to maintain a minimum market cap of $500M and average daily value traded over the preceding of $750K over the preceding three months period.

The composition of the Index is reviewed two times a year on the second Friday in March and September for rebalancing. With 23 constituents allocated at equal weight, each REIT is set to approximately 4.35%. This strategy enables greater exposure to smaller market cap REITs and is more inclusive of REITs with smaller market caps relative to their enterprise values. The downside is that the semi-annual rebalancing can cut short the momentum of individual REITs that are outperforming.

Performance

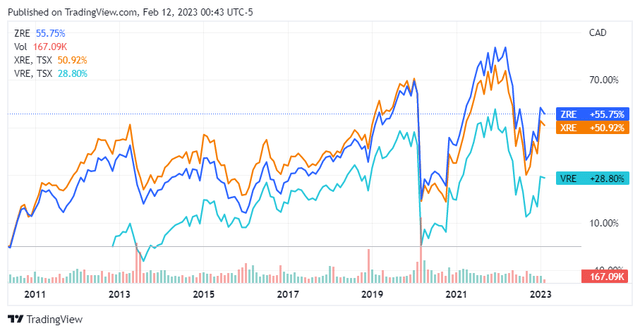

Since inception on May 19, 2010, ZRE has achieved average annual returns of 9.89%, net of fees with dividends reinvested. ZRE has been the best performer in its peer group with a total return slightly ahead of the iShares XRE, and well ahead of the Vanguard VRE.

ZRE Performance (Seeking Alpha)

Source: Seeking Alpha

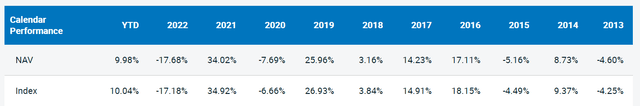

The fund has posted positive NAV returns in six out of the past 10 years. Cumulative performance over the past five and 10 years is 44.62% and 86.75% respectively.

ZRE Calendar Year Performance (‘BMO’)

Source: BMO

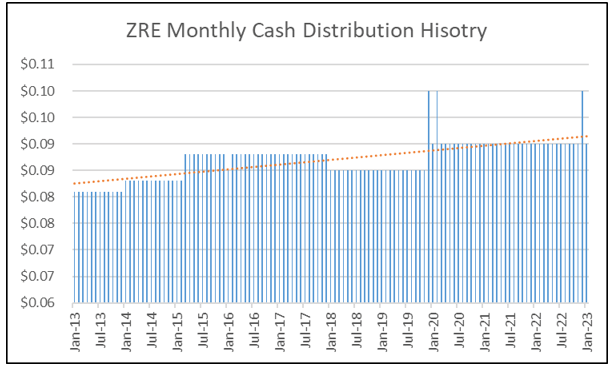

Distribution Yield

ZRE’s monthly cash distributions are currently fixed at $0.09 monthly for an annual distribution of $1.08 per unit. This distribution has been static since 2019 when it was increased from $0.085 monthly. ZRE’s equal weighting formula contributes to the ETF’s higher yield relative to VRE and XRE of 4.2% and 4.4% respectively. This is a result of greater representation of smaller market cap REITs with higher yields and the absence of real estate service firms from the portfolio.

ZRE Distribution History (Author)

Data Source: BMO; Graph Source: Author

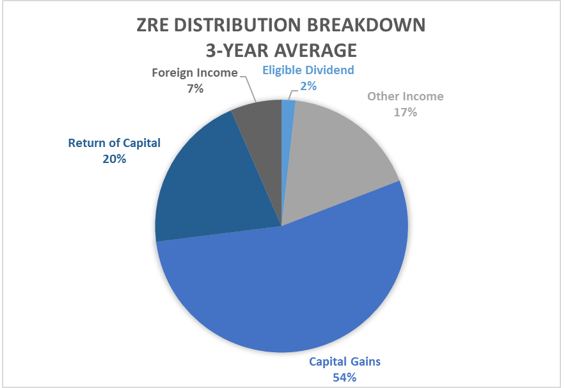

Due to the frequent rebalancing to equal weight allocations, this fund incurs a relatively high level of capital gains. As ZRE’s distributions containing various types of taxable income sources, investors may benefit from holding this within a sheltered account.

ZRE Distribution By Tax Source (Author)

Data Source: BMO; Graph Source: Author

Portfolio Holdings

ZRE is a pure play REIT ETF, in that it only holds income producing publicly listed REITs. Comparable funds such as Vanguard’s VRE also contain real estate services firms that tend to have lower yields. ZRE offers more representation from smaller REITs compared to its peers. The fund’s holdings have an average market cap of $2.4B, compared to XRE and VRE with average market cap of $4.3B.

ZRE has 23 holdings, which is the most among the large REIT ETFs in Canada. The equal weighting formula helps to ensure broader company specific diversification. This is important for an ETF that covers a small sector dominated by a small number of large players. The downside of this formula though is less diversification across REIT sub-sectors.

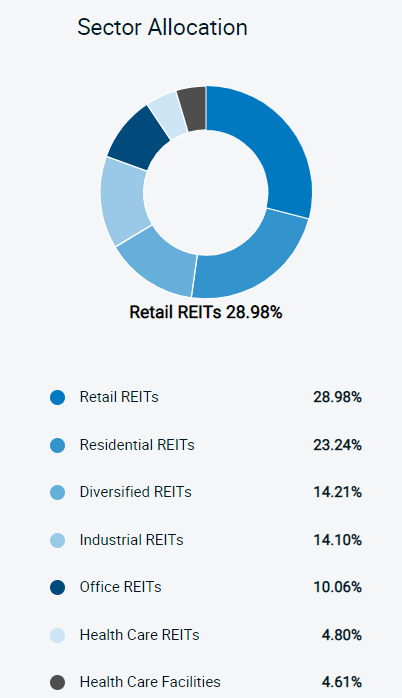

ZRE Sector Allocation (‘BMO’)

Source: BMO

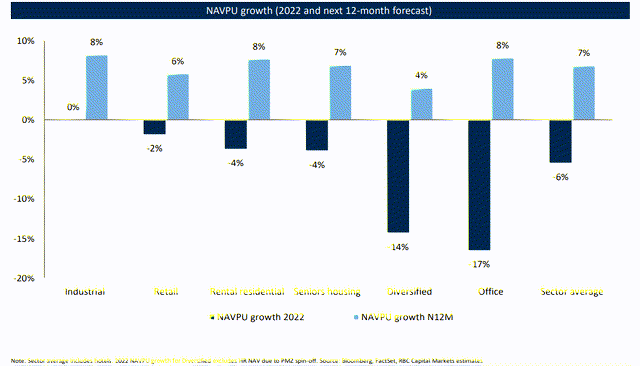

According to a recent REIT forecast report from RBC Capital Markets, office and diversified REITs could see some macro headwinds over the next year based on rising financing rates and tepid demand. BMO’s ZRE has lower exposure to retail REITs than XRE, where retail accounts for 37% of the portfolio. Unfortunately, the sub-sector with the best outlook, industrial, only accounts for 14% of BMO’s ZRE.

REIT Sub Sector Forecast (RBC Capital Markets)

Source: RBC Capital Markets

With constituent companies being equal weighted in the fund, I would argue it is the best diversified fund in its peer group. The top ten holdings for XRE and VRE are over 70% of those funds’ weightings, compared to less than 50% for ZRE. XRE’s top two holdings account for 25% of the portfolio, whereas VRE is a little less at 21%. For ZRE, each constituent is rebalanced to equal 1/23 of the portfolio twice per year, or around 4.3%.

Risk Analysis

There are several risks to consider when investing in publicly traded real estate. While generally considered stable income-producing assets, real estate investment trusts tend to be highly levered. REITs with surplus debt levels could see financing costs escalate as interest rates continue to rise. Across the REIT sector, cap rates are climbing, which can be an indicator of increased risk.

One concern I have with ZRE is the high MER. For income oriented investors seeking stable dividend income, the 0.61% MER erodes a significant portion of the 4.5% dividend yield. This high fee makes alternative investments with comparable yields more attractive. With current interest rates, there are ample options to earn a similar yield with a GIC or other ETFs. In an effort to avoid the MER, some active investors could reasonably replicate the core of XRE or VRE by buying their top ten holdings. This strategy would be harder to replicate with ZRE’s 23 holdings and periodic rebalancing.

ZRE’s equal weigh strategy helps to mitigate company specific risk by limiting the size of any one holding. While this company specific risk is limited through this strategy, ZRE is still concentrated into a handful of real estate sub-sectors including retail, residential and diversified REITs. Lastly, ZRE is not well diversified geographically. While some of these REIT’s have international exposure, many operate solely in Canada.

Investor Takeaways

BMO’s ZRE is a good option for investors seeking a simple, diversified way to gain exposure to the real estate sector and collect steady rental income. Of the large REIT ETFs in Canada, ZRE is the best diversified. It’s equal weight strategy has led to a higher distribution yield and better NAV performance relative to its peers. ZRE’s high fees may be a drag on total returns relative to owning individual REITs. ZRE offers a convenient means of earning passive rental income and upside exposure to real estate investments.

[ad_2]